Mario Tama

Investment Overview

Johnson & Johnson (NYSE:JNJ) is the world’s largest healthcare company with a market cap – $434bn at the time of writing – that is >$100bn larger than the next largest U.S. Pharma – Eli Lilly (LLY).

While Lilly’s valuation trades more on the promise of revenues to come – in the form of its Diabetes / Obesity drug Tirzepatide, which analysts expect to become the world’s best-selling drug, and an Alzheimer’s Therapy, Donanemab, expected to win an accelerated approval – Johnson & Johnson is more focused on the here-and-now. The Pharma posted revenues of $93.8bn in FY21 – 3.3x more than Lilly – and expects to deliver revenues of $97.3bn – $98.3bn this year.

That’s more than any other major Pharmaceutical bar Pfizer (PFE) – which expects to deliver revenues of >$100bn this year thanks to a >$50bn contribution from its twin COVID drugs Paxlovid and Comirnaty.

These 2 drugs’ sales will likely fall by at least half in 2023, however, as pandemic pressures ease, likely returning JNJ to the top of the revenue tree, although JNJ itself will shrink in 2023 when the company spins out its Consumer health unit – which made sales of $14.6bn last year – into a new entity, which has been named Kenvue.

Spinouts are all the rage in the Big Pharma sector at present. Pfizer’s UpJohn legacy brands division was spun out and merged with generics player Mylan to form Viatris (VTRS) in November 2020, whilst Merck spun out its Women’s Health and generics / biosimilars divisions into a new entity, Organon (OGN), last year, realizing an $8bn taxation windfall as a result. French Pharma Sanofi (SNY) and British Pharma GSK have also separated out their Consumer Health divisions.

Sometime in the second half of 2023, Johnson & Johnson shareholders will, therefore, receive shares in Kenvue – and many may want to dispose of these shares based on the performance of Viatris and Organon at least, whose share prices are down by 76% and 29%, respectively, since they began trading.

The reality is that the Pharmaceutical industry has become more profitable than the Consumer Health side for Big Pharma, which explains why Eli Lilly shares are worth so much – as its product pipeline is very highly regarded.

Johnson & Johnson has ambitions to grow its own pharmaceuticals division – which earned $52bn of revenues in FY21 – into a $60bn per annum turnover business by 2025, despite the fact its biggest selling product Stelara – indicated for a range of auto-immune conditions including psoriasis and arthritis – will lose its patent protection next year.

JNJ currently pays a dividend of $1.13 per quarter, which translates to current annual yield of 2.74%, and by Big Pharma standards, is a little lower that the average which stands at ~3%. JNJ’s share price performance has been underwhelming over the past 5 years – up just 18%, compared to the S&P’s 42% gain, and rivals such as Merck (MRK) – up 74%, AbbVie (ABBV) – up 55%, and Lilly – up >290%.

Over the past year, JNJ stock has traded flat, whilst the S&P has fallen in value by 19%, which shows that the Pharma is a reliable company to be invested in when economic conditions are uncertain. With that said, across the past 12 months, the share prices of other Pharmaceuticals – Amgen (AMGN), Bristol Myers Squibb (BMY), Lilly and AbbVie, for example – have performed much better.

Nevertheless, as I will show in this post, JNJ’s business is faring reasonably well in the face of headwinds such as high inflation, economic uncertainty, and severely fluctuating exchange rates. The stock price has fallen from a June high of $182 to $165 at the time of writing, a discount of nearly 10%, making this a good time to think about opening a position. The dividend is also supported by a recently launched share buyback program of up to $5bn.

Johnson & Johnson Q3 2022 Earnings Review – Currency, Cash, and Kenvue

In my deep dive note “Johnson & Johnson – Everything an investor needs to know before buying,” I provided an overview of all of JNJ’s business divisions – Consumer Health, the pharmaceutical divisions Immunology, Oncology, Infectious Diseases, Neuroscience, Pulmonary Hypertension, Cardiovascular and Metabolism, and Medical Devices. In this review, I will focus more on the high-level numbers and specific opportunities.

Probably the first thing to note about JNJ’s Q322 results is the impact of currency fluctuations. For example, worldwide sales were $23.8bn, but while operational sales growth was reportedly +8.1% year-on-year, the overall increase was reported as +1.9% owing a negative currency impact of 6.2 points. Sales increased 4.1% in the U.S., whilst sales declined by 0.3% ex-U.S. when factoring in a 12.6 point negative currency impact.

Net earnings were reported as $4.5bn, with diluted earnings per share of $1.68 – up from $1.37 in the prior year – whilst adjusted net earnings and earnings per share (“EPS”) were $6.8bn and $2.55, down by 3% and 2% from the prior year.

On an operational basis, the Consumer Health division revenues of $3.8bn were +4.7% year-on-year, whilst on a reported basis the difference was (0.4)%. Within the Pharmaceutical division, revenues of $13.2bn represented a 9% year-on-year uplift on an operational basis, and 2.6% uplift on a reported basis. This helps to illustrate why JNJ wants to prioritize its Pharmaceutical Division. MedTech performance was also strong, with revenues of $6.78bn, up 8.1% on an operational basis and up 2.1% on a reported basis.

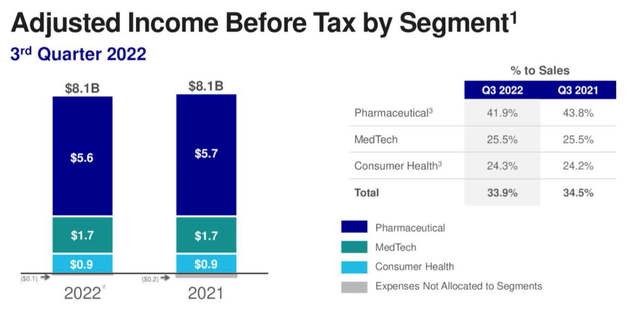

adjusted income breakdown (earnings presentation)

As we can see above, it is the Pharmaceutical division that is driving the most profitability, also, with an astonishingly high margin of >40%.

Stelara’s $9.1bn of revenues earned in 2021 represented 10% of JNJ’s entire revenues – significantly higher than any other product. The next biggest contributors were the atypical antipsychotic Invega Sustenna – $4bn of sales, immunology therapy Remicade – $3.2bn of sales, oncology drugs Darzalex and Imbruvica – $6bn and $4.4bn of sales respectively – and JNJ’s COVID vaccine – $2.4bn of sales.

Given the loss of exclusivity that Stelara faces in 2023, which is likely to impact its sales by -20% per annum at least, as cheaper generic versions of the drug will begin to flood the market, and the fact that Remicade sales are in long-term decline, and that COVID vaccine sales will be drastically lower in 2023, we can see that JNJ has work to do on its Pharmaceutical division if it wants to realize its target of $60bn revenues by 2025.

JNJ announced a number of pipeline and approval milestones on its Q322 earnings call, including approval in Europe for Tecvayli – a bispecific antibody indicated for Multiple Myeloma (“MM”) – a US approval is expected before the end of the year, and will help to bolster JNJ’s presence in this market which has been estimated to grow to a size of $31bn by 2026. The cell therapy Carvykti, developed in tandem with Legend Biotech, is also approved in MM, and pegged for blockbuster (>$1bn per annum at least) sales.

Another bispecific antibody – Rybrevant – is already approved to treat EGFR-mutant non-small cell lung cancer patients, but has taken a step closer to front-line approval, in tandem with the TKI-inhibitor lazertinib – Phase 3 data is expected soon, apparently – NSCLC is one of the largest oncology markets. Meanwhile, Tremfya – a long-term replacement for Stelara, JNJ hopes, continues to grow market share in the psoriasis and Psoriatic Arthritis markets.

Despite these wins and the continuing strength of, e.g., Darzalex and Imbruvica, JNJ admits it needs to invest in M&A as well as R&D in order to grow Pharmaceuticals. The company reported a sizeable $34bn of cash and near-term investment as of Q322.

Admittedly, debt currently stands at $32bn, but JNJ is nowhere near as highly leveraged as, e.g., AbbVie, Eli Lilly, Amgen, whose debt to equity ratios are currently 495%, 195%, and 1,500%, versus JNJ’s 43%. Discussing likely acquisitions, Chief Financial Officer Joe Wolk told analysts during the earning call:

we still hold $34 billion of cash, which positions us extremely well to continue exercising that level of capital allocation around acquisitions or significant collaborations going forward.

So our priorities have not changed. In fact, maybe we’re even a little bit more bullish and eager to do something. But as folks come to know us, we’re not going to do anything haphazardly. We’re not – the aspect of this company that is really enjoyable as being the CFO is we don’t have to do anything out of desperation.

Looking Ahead – JNJ Looks More Than Capable Of Navigating Through A Challenging Economic Downturn

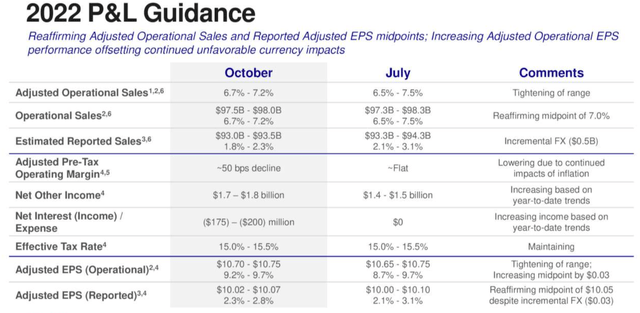

FY22 Guidance (earnings presentation)

As we can see above, JNJ has slightly downgraded FY22 revenue expectations, to reflect 1.8 – 2.3% annual growth, but the adjusted EPS forecast on an operational basis has been increased, to $10.7 – $10.75, which represents a forward price to earnings (“P/E”) ratio of ~15x – well below the Big Pharma sector average.

The company has reaffirmed its target of $60bn pharmaceutical division revenues by 2025 – only Pfizer and AbbVie have a chance of driving higher revenues in that year – and the performance of the MedTech division – which contributed $27bn of revenues overall in 2021 – is expected to continue to be robust. in 2023, the company says it will suffer slightly from the higher inventory costs of 2022 due to inflation, and anticipates a negative currency impact of ~$0.4 – $0.45 on EPS in that year.

In summary, there is good and bad news to digest in relation to JNJ looking ahead.

On the negative side, the patent expiry of Stelara, and inflationary and currency headwinds are the most severe, but I would conclude the good outweighs the bad.

There ought to be label further label expansions for key new drugs, particularly in oncology and autoimmune – JNJ’s 2 largest pharmaceutical divisions, and although the consumer health spinout will likely leave investor holding shares in a new company they may not wish to own, JNJ stock ought to climb once Kenvue shares start trading.

Meanwhile, the company can make some major bolt-on acquisitions and valuations within the biotech sector are exceptionally cheap at the present time thanks to a savage bear market. JNJ is looking to buy at precisely the right time, whilst getting rid of its OTC products divisions at an opportune time also.

Conclusion – JNJ Has Very Solid Credentials and Things May Get Better in 2023

There may be more opportunities within the Big Pharma sector to realize a better return on investment – the sheer size of JNJ makes it hard for the share price to be dynamic – but JNJ stock has strong risk mitigation, pays a nice dividend, and is available at a discount to recent highs.

An interesting strategy may be to think about buying JNJ stock today and holding. When the KenVue spinout happens, I would consider selling any Kenvue shares almost immediately, based on the performance of Merck’s and Pfizer’s spinouts Organon and Viatris, and I would expect to then benefit from a rise in the value of JNJ shares as it focuses substantially more on the more lucrative field of pharmaceuticals.

JNJ may once have been famous for baby powder, shampoo, and Listerine, but in a few years’ time, it may be better known as the world’s biggest driver of prescription drug revenues.

Be the first to comment