yuelan/iStock Editorial via Getty Images

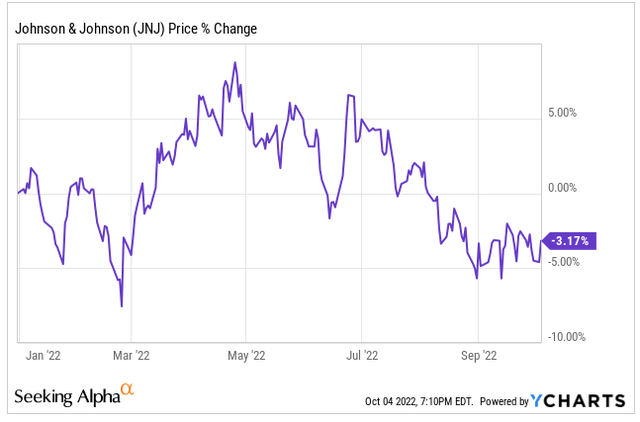

Johnson & Johnson (NYSE:JNJ) is a healthcare juggernaut that needs no introduction. On the year, shares of JNJ are down slightly at -3%, which is still outpacing the S&P 500 by a wide margin.

We just completed the worst one-month performance in the stock market since March 2020 and the worst September performance since 2002.

October is off to a better start, but the market headwinds are quite clear, which could prove to add further pressure and instability to US markets.

Inflation remains high and the Federal Reserve is set on attacking it from all angles, including aggressive rate hikes and quantitative tightening.

A Consistent Dividend Grower

Johnson & Johnson is not only a Dividend Aristocrat (25+ consecutive years of dividend growth), but they take things to another level and are on the prestigious Dividend Kings list, which means they have increased their dividend for 50+ consecutive years.

Here are the company’s current dividend stats:

- Dividend per share: $4.52

- Dividend Yield: 2.8%

- Payout Ratio: 55%

- 5yr Dividend Growth Rate: 6%

- Consecutive Years of Dividend Growth: 60 years

In April of this year, the JNJ board increased the quarterly dividend by 6.6%, which eclipsed the 60th consecutive year of dividend growth. If that does not scream consistency, I do not know what does.

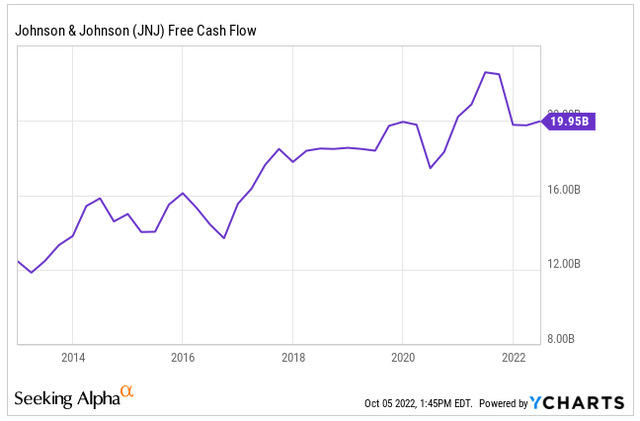

One way to determine if a company is executing well is to look at the company’s free cash flow growth. This is also a great way to determine the safety of a dividend, considering that dividends are paid out of free cash flow.

Over the past decade, you can see how the company’s free cash flow has continued to climb higher to nearly $20 billion.

On a per share basis, JNJ has an FCF per share of $7.47. Comparing this to the annual dividend of $4.52, you can see that JNJ has an FCF payout ratio of 60%, suggesting the dividend is plenty safe at the moment.

Consumer Health Spinoff A Plus For Shareholders

In late 2021, JNJ announced plans to spin off its consumer health segment with the idea of it creating shareholder value. This will allow for enhanced operational performance by allowing more focus on the individual segments, as they have all grown into massive companies able to stand on their own.

Once the spinoff is completed, the new consumer health company will be named Kenvue.

The consumer health segment has many household names such as Tylenol, Neutrogena, Listerine, and Band-Aid, which generate sales in more than 100 countries.

In May of this year, Johnson & Johnson named Thibaut Mongon as the CEO of Kenvue. Currently, Thibaut is the consumer health segment leader within JNJ right now.

This spinoff will allow JNJ to put more into developing new drugs and push their faster-growing pharmaceutical and medical devices segments.

JNJ is just another company that has recently completed or announced plans for a spinoff of one of its segments. 3M (MMM) and GlaxoSmithKline (GSK) also announced planned spinoffs recently.

A Stable Company At A Great Price

JNJ has long been known for their stability, which is one reason they are found in many dividend investors’ portfolios. It does not matter if you are retired or not, JNJ is a great company and investment to have for long-term stability. The company has been able to weather the storm through many different economic backdrops and they always seem to come out on top.

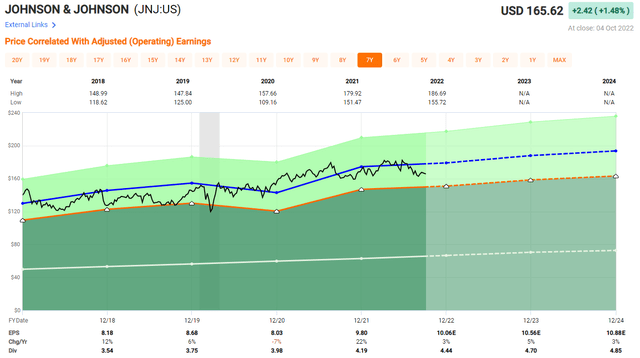

Analysts are currently looking for 2023 EPS to come in around $10.56, which would represent a 5% increase over 2022.

On a forward-looking basis, shares of JNJ currently trade at a multiple of 15.7x. Over the past 5 years, shares of JNJ have traded closer to a multiple of 17.8x, indicating shares are trading at a slight discount right now.

Risks To The Company

Johnson & Johnson has been able to withstand a lot over its long history, but it is important to understand the current risks to the business.

The first risk that always comes to mind with JNJ is legal exposure. We saw the business go through its talc issue over the years, which I believe is one reason they want to spin off the consumer healthcare segment. By completing the spinoff, future legal issues related to that segment will no longer impact the pharmaceutical and medical device segments’ growth.

With the spinoff expected to go through in 2023, the consistent stability that the consumer health segment brought, will no longer be around. This could add more volatility and pressure, even though JNJ has a strong pipeline of future drugs, but much like AbbVie (ABBV) now, they will need some of those newer drugs to hit.

Investor Takeaway

JNJ is a great company trading at a solid valuation right now. Whether the economy is going through a recession or growing, JNJ can provide stability to any portfolio.

The company pays a reliable dividend that has been growing for over 60 years and still has plenty of room for growth, albeit at a slower pace, moving forward.

JNJ will look very different after the spinoff, but the pharmaceutical and medical device segments have a lot of growth left in them and a lot of shareholder value could be unlocked with more focus and less legal issues stemming from the consumer health segment weighing on total company results.

Would love to hear your thoughts on the spinoff below in the comment section.

Be the first to comment