gerenme/iStock via Getty Images

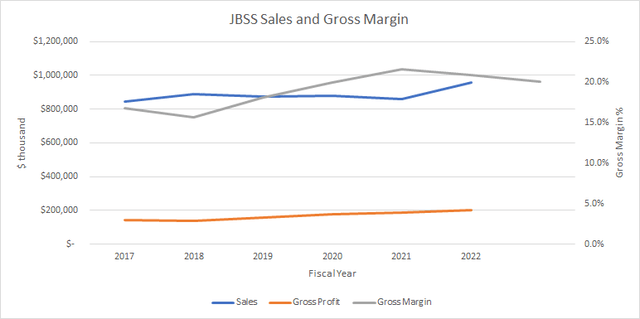

Margins Lower, Still Better Than Pre-2020

Nut distributor John B. Sanfilippo & Son (NASDAQ:JBSS) is not immune to inflation worries and even still experienced some margin pressure in its Fiscal 1Q 2023 results. (The company’s fiscal year starts in July.) However, the company has raised prices enough to generate strong cash flow in the quarter, reversing the recent trend of low cash flow and lower dividend payouts. What I predicted in my article last quarter is playing out.

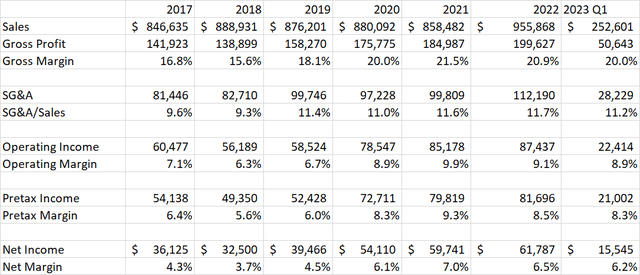

Gross margin in 1Q was 20.0%, down from FY 2022 but even with FY 2020 and better than every year before that.

JBSS increased nut sales volume measured in pounds by 1.8% compared to a year earlier, so the 11.6% increase in dollar sales was not just caused by inflation. In contrast to previous quarters, had a significant volume increase in its branded sales, including 20% in Fisher Recipe Nuts and 15.7% in Orchard Valley Harvest produce/nut mixes. Private brand sales were down slightly this quarter as the company lost business with a grocery customer but gained distribution at a mass merchandising retailer. The commercial distribution channel continued to improve with further recovery in the restaurant business, and the contract packaging channel signed up a new customer.

On the cost side, management noted on the earnings call that freight and commodity acquisition costs have begun to stabilize, which should benefit gross margins. Selling, general, and administrative expenses were up 5.3% from last year, excluding an extraordinary gain on the sale of a facility last year. This is lower than inflation and takes operating margin back to 2020 levels but still better than any prior year.

Cash Flow Recovering

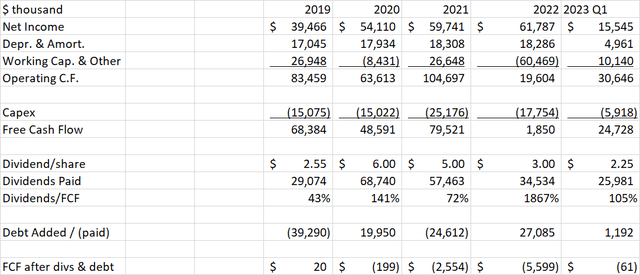

With higher selling prices in place, JBSS is now recovering the cash that went into inventory build last year. The company had operating cash flow of $30.6 million in 1Q 2023, 50% above the full year number for 2022. The company kept debt nearly constant with the end of fiscal 2022. This quarter’s free cash flow basically covered the end-FY 2022 regular dividend of $0.75 and special of $1.50 paid in August.

Two days after the latest earnings release. JBSS announced a special dividend of $1.00 per share with an ex-date of 12/1/2022. This is the first mid-year special dividend since March 2021. This shows management confidence that the company is back in cash generation mode after the inflation spike caused a working capital build last year. Assuming stable prices going forward, the company should be able to pay additional specials. I maintain my earlier forecast of a total dividend payout of $5.25 per share in FY 2023.

Forecast And Valuation

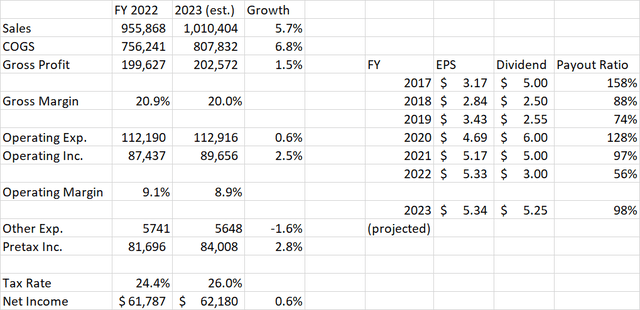

Based on 1Q actual sales of $252.6 million, the company looks capable of achieving $1 billion in sales in FY 2023, just half of its long-term sales goal of $2 billion.

Our long-range plan focuses on growing our nonbranded business across key customers, transforming Fisher, Orchard Valley Harvest and Squirrel Brand into leading brands while increasing distribution and diversifying our portfolio into high-growth snacking segments.

Source: Jeffrey Sanfilippo, CEO (1Q 2023 Earnings Call)

The sales growth estimate for FY 2023 is 5.7% based on annualizing 1Q sales. It would take about 12.5 years to get to $2 billion at this growth rate. Achieving it faster would likely require added capex or M&A activity which would be valuable in the long term but could result in lower special dividend payments.

If we similarly annualize the costs from 1Q, we see that cost of goods, while stabilizing, will still grow more than sales in FY 2023. Operating and other expenses look like they are increasing at a slower rate though. Tax rate looks higher than last year, resulting in almost flat EPS year-on-year. This projection is down slightly from last quarter as cost of goods did not come down as fast as anticipated.

Despite almost no net income growth, JBSS should be able to get back to its historical payout ratio of near 100% of net income now that they are through the inflationary inventory build period.

At a price of $83.12, JBSS has a forward P/E of 15.6. This is slightly higher than last quarter with the share price about 3% higher and the earnings estimate about 1% lower. This valuation is still below the Consumer Staples sector average of 19.9 as reported by Yardeni Research but the gap has closed by 2 P/E multiple points since last quarter.

The Consumer Staples sector typically outperforms in a recession as a defensive sector, but high interest rates make the dividends relatively less attractive compared to bonds. Nevertheless, the projected payout of $5.25 this fiscal year would be a yield of 6.3%. That is still comfortably above treasuries and compensates the investor for the irregular and uncertain payout policy.

Conclusion

JBSS gained slightly since I rated it a buy in my last article, outperforming the S&P by a couple of percent. The stock did not react strongly to either the earnings or special dividend announcements. JBSS currently has no analyst coverage and there were no questions on the last earnings call. The lack of news flow may cause the share price to stagnate, but the valuation remains below larger consumer staples stocks.

The working capital build that reduced the dividend payout in FY 2022 appears to be over and free cash flow was strong in 1Q 2023. The $1.00 special dividend recently declared shows management confidence in the company’s capability to generate cash. JBSS remains a buy for investors who don’t require predictable income but would like a good chance of higher yields over time.

Be the first to comment