PhoThoughts/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 4th.

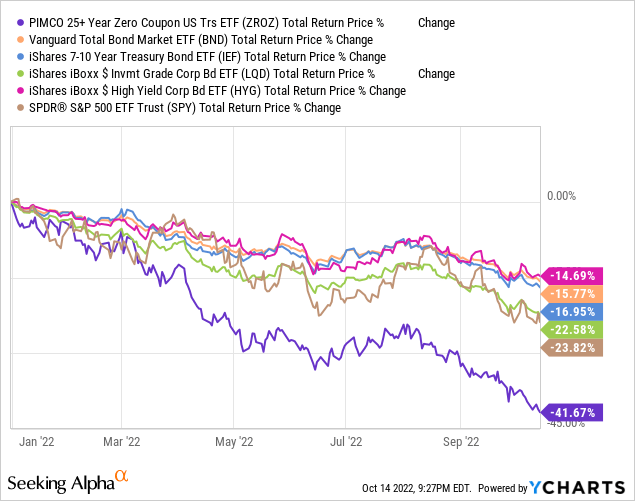

Looking through bond fund screeners, the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (NYSEARCA:ZROZ) caught my eye. ZROZ has been the worst-performing bond fund of the year, excluding leveraged funds and the like, with losses of over 40% YTD. Thought to do an article explaining just why the fund has performed so disastrously YTD, so bond investors know how to avoid similar losses in the future.

ZROZ invests in long-term zero coupon treasury strips. These securities have some of the highest duration and interest rate risk in bond markets, and so have fared particularly badly as rates rise. Their excessive duration is due to focusing on long-term bonds, which take a long time to mature / be replaced with higher-yielding alternatives. Focusing on zero coupon long-term bonds boosts duration and interest rate risk further, as these bonds pay no interest at all until maturity, and so investors don’t receive any cash flows which can be reinvested in higher-yielding securities as rates rise. Investors wishing to avoid disastrous losses if rates continue to increase should therefore avoid bond funds with long duration, those focusing on long-term bonds and / or zero coupon bonds.

ZROZ – Basics

- Sponsor: PIMCO

- Underlying Index: The BofA Merrill Lynch Long Treasury Principal STRIPS IndexSM

- Dividend Yield: 2.75%

- Expense Ratio: 0.15%

- Total Returns CAGR 10Y: 0.53%

ZROZ – Overview

ZROZ invests in long-term zero coupon treasury STRIPS, with remaining maturities of at least 25 years. ZROZ’s holdings make no coupon or interest rate payments throughout their tenure, and so tend to trade with deeply discounted prices, leading to strong capital gains at maturity.

Let’s have a closer look at a specific treasury STRIP to see how this works. All figures below are as of October 4th 2022, when this article was originally written. Figures have not materially changed since.

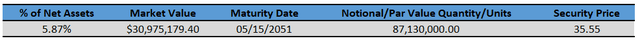

ZROZ’s largest holding was as follows.

ZROZ

The bond above works as follows.

ZROZ loaned $31 million (market value) to the U.S. government. At maturity, in May 2051, the government will pay ZROZ $87 million (notional/par value) back. There are no interest rate or coupon payments, only a massive payment at maturity. The payment at maturity is significantly greater than the amount loaned, as compensation for the lack of interest rate or coupon payments.

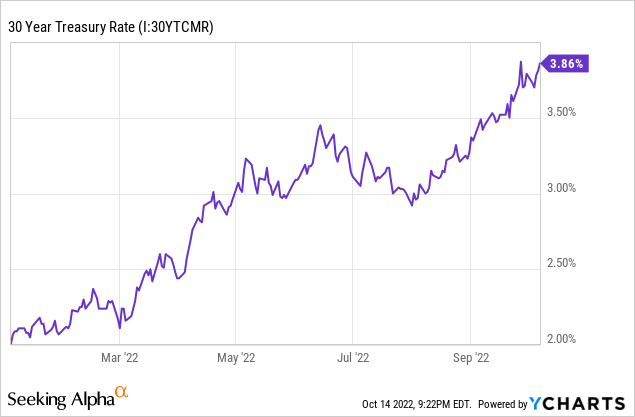

By my calculations, said bond has an IRR of 3.6%, very similar to the 30-year treasury rate, which has extremely similar maturity.

ZROZ has more or less the same characteristics as most treasury funds.

ZROZ’s investments are all treasuries, backed by the full faith and credit of the United States Federal Government, the strongest, most credit-worthy institution in the world. Treasuries are the safest investment asset in the world, and carry effectively no credit risk. ZROZ will almost certainly receive their money back once its bonds mature, barring an unprecedented U.S. default.

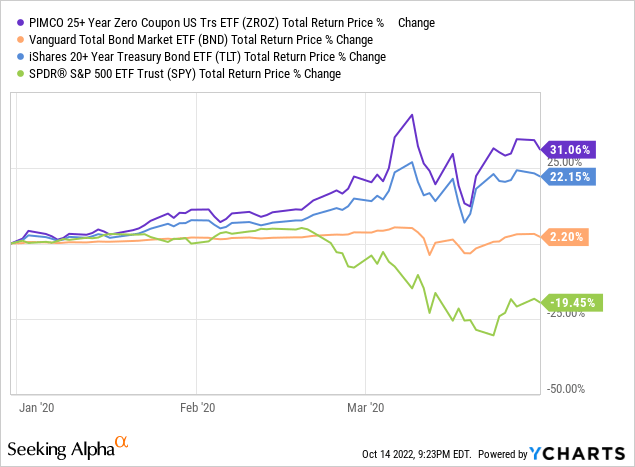

ZROZ’s treasury holdings tend to outperform during downturns and recessions, due to a flight to quality effect, and due to Federal Reserve policy. In simple terms, investors flock to the safest assets during (most) recessions, and that means treasuries. As an example, ZROZ saw gains of 31% during 1Q2020, the onset of the coronavirus pandemic. The fund significantly outperformed equities and bonds, even outperformed relative to long-term treasuries.

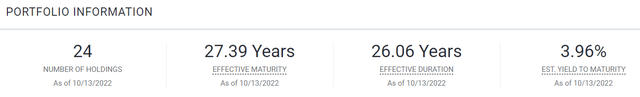

ZROZ’s investments all have relatively low expected returns, due to focusing on assets with very low credit risk. ZROZ sports an average yield to maturity, a measure of long-term expected returns for bonds, of 3.96%. Expect returns of the same moving forward.

ZROZ

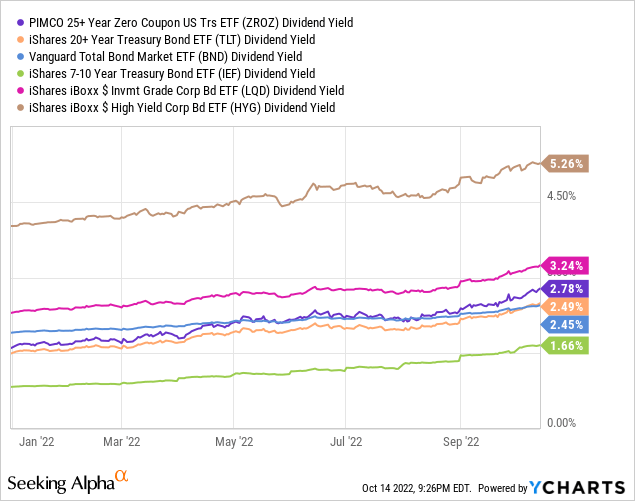

Even though ZROZ’s holdings themselves do not pay interest, the fund does, with a 2.75% dividend yield. These dividends are likely due to the accounting and regulatory treatment of zero coupon bonds, and do not change the fact that the fund’s holdings themselves generate no interest rate or coupon payments.

ZROZ’s dividend yield is about average for a bond fund. On the other hand, from what I’ve seen, it is a bit higher than expected, as the fund has been quicker in growing its dividends as rates rise. ZROZ’s peers might see higher dividend yields in the future, although much will depend on how interest rates continue to evolve, and in how these ETFs react to rising rates.

Let’s summarize the above.

ZROZ’s holdings have extremely low credit risk, tend to outperform during downturns and recessions, have average dividend yields, but below-average long-term expected returns.

The above is, I think, pretty self-explanatory. Less so is ZROZ’s disastrous results these past few months, with the fund significantly underperforming relative to its peers YTD.

The above has to do with the fund’s excessive duration and interest rate risk. Let’s have a look.

ZROZ – Duration Analysis

Interest rates and bond prices are inversely correlated: higher interest rates mean lower bond prices, and vice versa.

The process / explanation of the above is quite simple.

Higher interest rates means higher yields for newly issued bonds. Older bonds retain their original, lower rates.

When interest rates increase, investors sell their older, lower-yielding bonds to buy newer, higher-yielding bonds. Selling pressure leads to lower prices for these older, lower-yielding bonds, and to capital losses for bond investors.

Although the vast majority of bonds see losses when rates rise, some see higher, others lower, losses than average.

Short-term bonds see below-average losses when rates rise, because these bonds mature quickly, and so can be quickly replaced for higher-yielding, newer issues without experiencing significant losses / opportunity costs. It is simply not a big deal to hold a relatively low-yielding security for a year or two, so losses are relatively small. The opposite is true for long-term bonds, which see above-average losses when interest rates increase.

Bonds with large coupon / principal payments also see below-average losses when interest rates rise, as these payments can be (quickly) re-invested in higher-yielding securities. The opposite is true for bonds with no coupon payments, which see above-average losses when interest rates increase.

ZROZ focuses on long-term zero coupon treasuries, more or less the worst possible combination for a rising rates environment. Significant losses and underperformance was almost certain to happen if rates rose, and did these occur, as expected.

It is possible to estimate the interest rate sensitivity of a bond. Duration is a measure of said sensitivity, measuring the impact on a 1% change in interest rates on the bond’s price. Bonds with longer maturities have higher durations, as well as those with low / no interest rate or coupon payments.

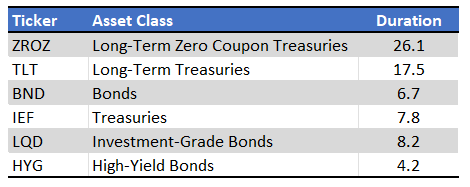

ZROZ focuses on long-term zero coupon treasuries, which boosts duration to a massive 26 years. ZROZ’s duration is incredibly high on an absolute level, and significantly higher than that of its peers.

ZROZ

ZROZ’s significant duration means the fund sees outsized price movements from even small increases in interest rates. As the fund’s duration is significantly higher than that of its peers, the fund should underperform when interest rates increase, as has been the case YTD.

ZROZ’s significant duration exposes investors to the possibility of greater losses if rates continue to increase. Although I’m not certain that this will be the case, the risk and possibility of significant losses seems excessively high. As such, I would not be investing in the fund at the present time.

Bond investors wishing to avoid the possibility of significant losses if rates rise should avoid funds with long duration, and focus on funds with low duration. The iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) is one such fund, with a duration of just 2.6 years, and a fully-covered, growing, 5.5% dividend yield.

Conclusion

ZROZ’s sky-high duration has led to significant losses and underperformance YTD, as the Federal Reserve hikes rates to combat inflation. The fund’s duration could lead to further significant losses moving forward, an important risk and negative for the fund and its shareholders. As such, I would not be investing in the fund at the present time.

Be the first to comment