R.M. Nunes

Thesis

We believe Jefferies Financial Group (NYSE:JEF) is an attractive stock for investors looking for good capital returns in the financial services sector. Jefferies’ management has shown strong commitment to increasing shareholder value through forms of dividend and share buyback programs. In addition, we believe that the company’s stock is fundamentally undervalued based on a dividend-based valuation model and peer group benchmarking. With a strong capital position, Jefferies is a great stock to invest in to reap the benefits of capital return programs during a time of economic uncertainty.

Company Overview

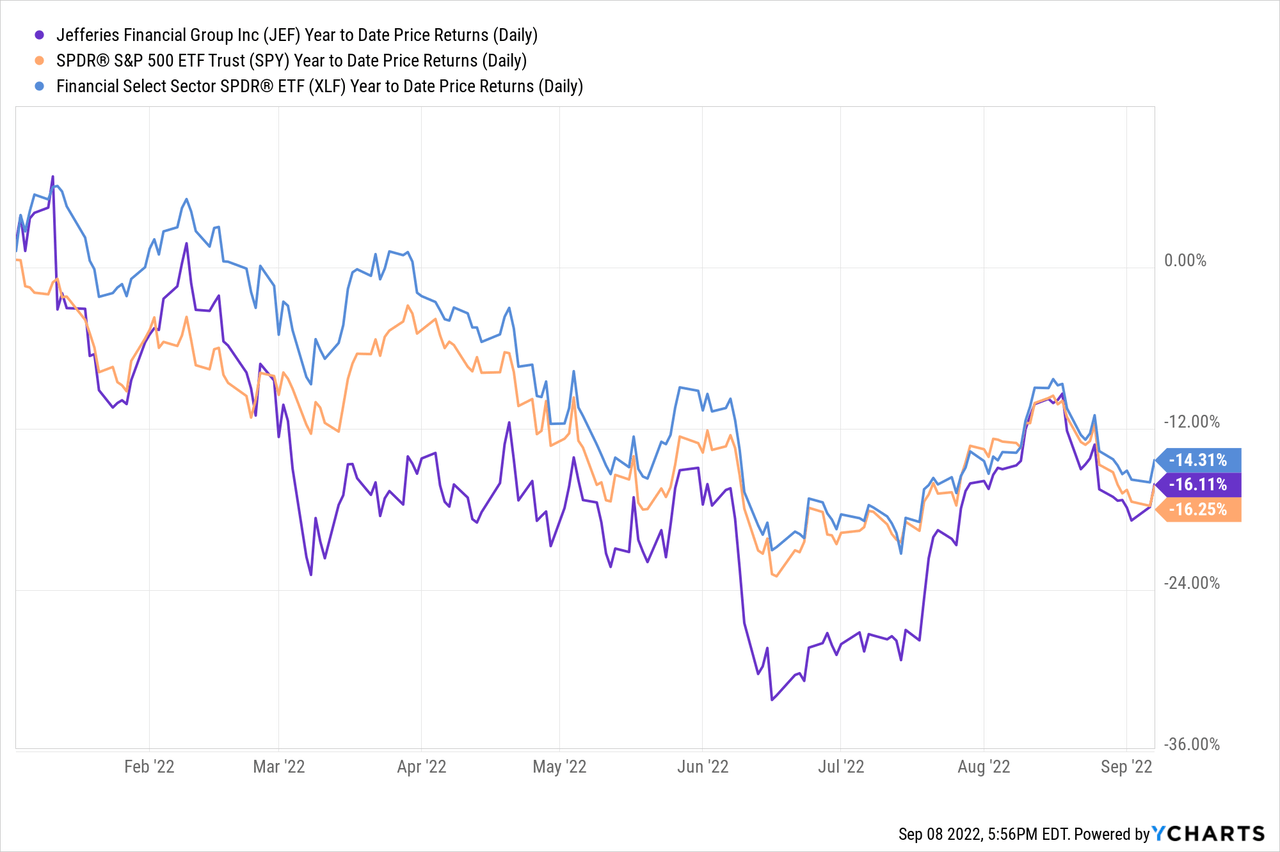

Jefferies Financial Group is a financial services company that provides investment banking services along with asset management. The company has five divisions: investment banking, equities, fixed income, asset management, and wealth management. The company has a current market capitalization of $7.74 billion. Year-to-date, the company’s stock performance has largely tracked the return of S&P 500 and XLF. Jefferies has returned -16.11% compared to S&P 500’s return of -16.25% and XLF’s return of -14.31% since the beginning of the year.

Commitment to Shareholder Value

Dividend Grower

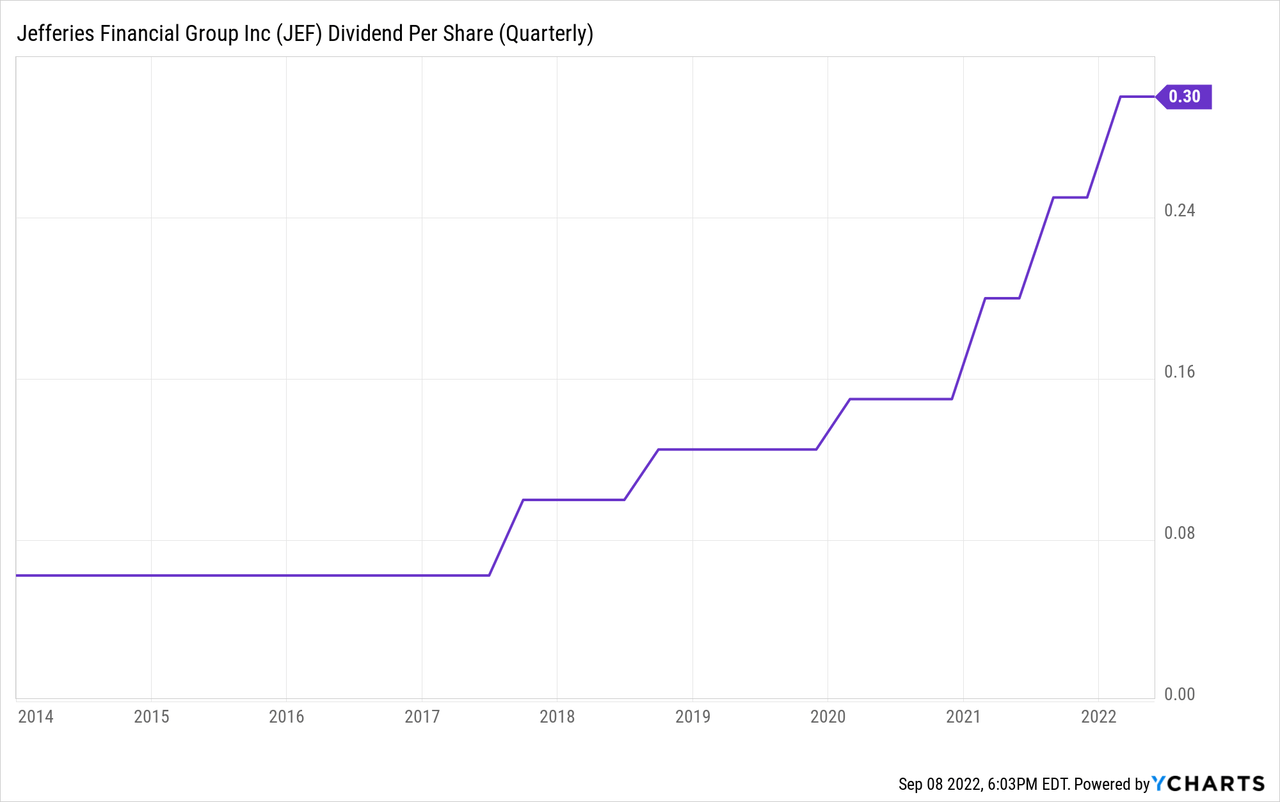

Jefferies provides an excellent dividend growth proposition based on its history of payouts since 2013 and payout ratio. Jefferies currently pays $0.30 per share in quarterly dividend. Once annualized, the company’s dividend yield stands at around 3.76%, which is more than twice S&P 500’s dividend yield of 1.69%. Jefferies has a history of raising dividends since the beginning of 2013. The company paid out $0.0625 per share in quarterly dividend at the beginning of 2013, and that dividend has grown over the last 10 years at a ~17% CAGR. We believe that the current dividend rate is very sustainable due to a payout ratio of ~41%.

Buyback Programs

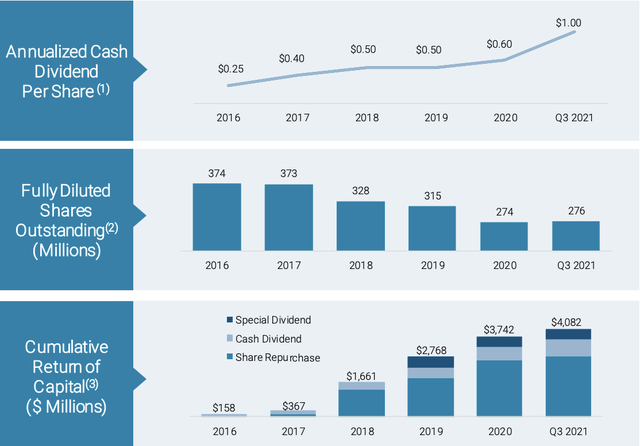

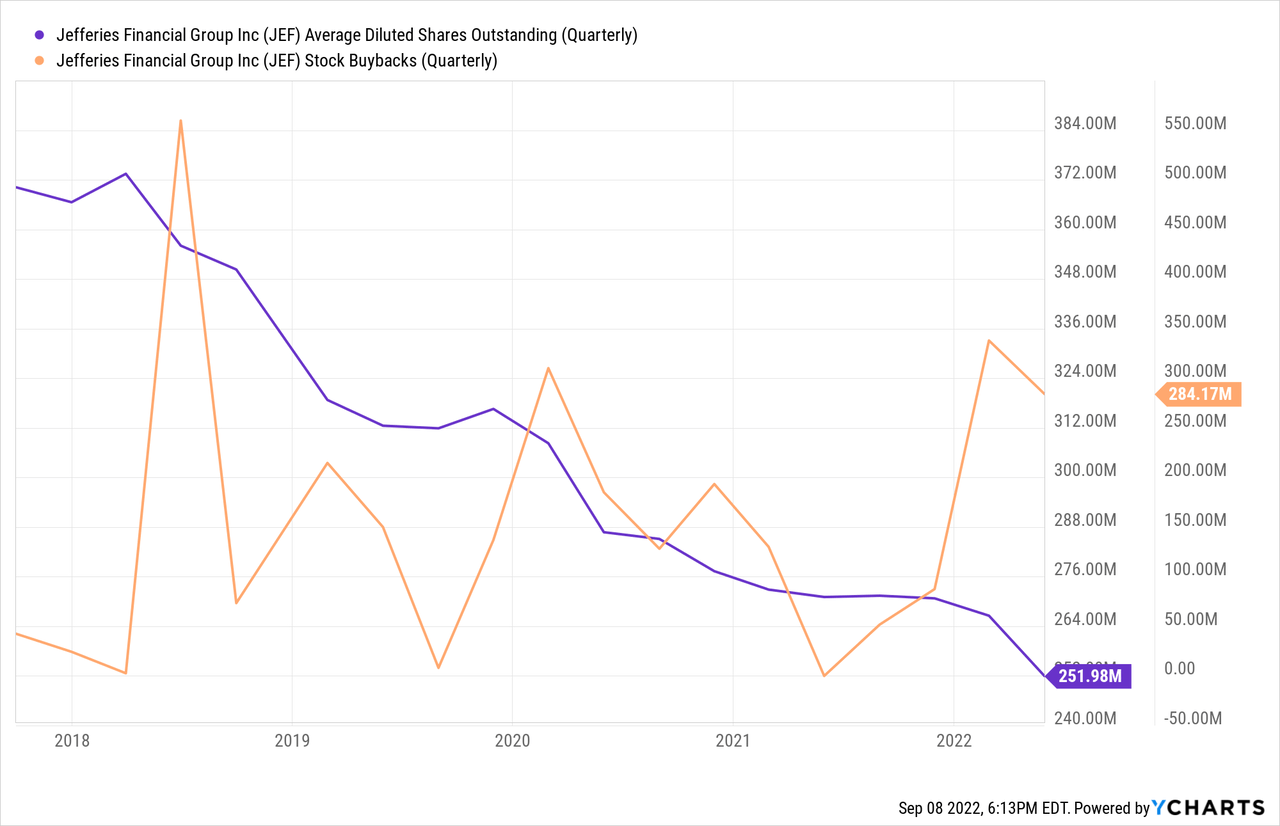

Management has expressed serious commitment to improving shareholder value. The company reports that since 2016 management has returned $4.1 billion to shareholders through the form of cash dividends, special dividends, and share repurchases. That amount is more than half of the current market capitalization, and such a track record makes us confident that management will prioritize shareholder value and returns. As seen below, the company has increasingly relied on share buybacks for capital returns, and as of Q3 2021, share buybacks have made up more than two-thirds of capital distributions. Such large commitment to shareholder buybacks has had a large impact on shareholder value, as the diluted number of shares dropped dramatically from 373 million in 2017 to now 284 million of this last reported quarter. That’s roughly a 25% decrease in the number of shares within a span of five years. We are fans of management’s continued share buybacks, and we believe such policies will help drive shareholder value in the future.

Jefferies 2021 Investor Day Presentation

Valuation

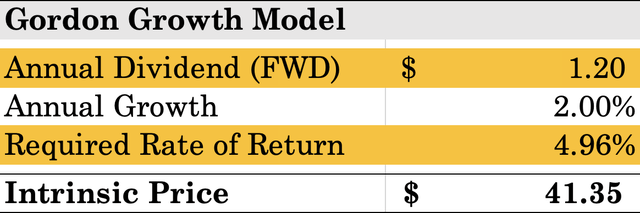

Our valuation model uses a dividend growth-based model based on our analysis of the company’s current dividend payouts and a reasonable growth assumption. Assuming that the dividend grows perpetually at the rate of inflation and using a discount rate of 4.96% based on the Cost of Capital of the Financial Services sector, we find that the intrinsic price per share should be $41.35. Based on this model, this valuation presents a 29.7% potential upside from current levels.

Sweet Minute Capital Valuation Model

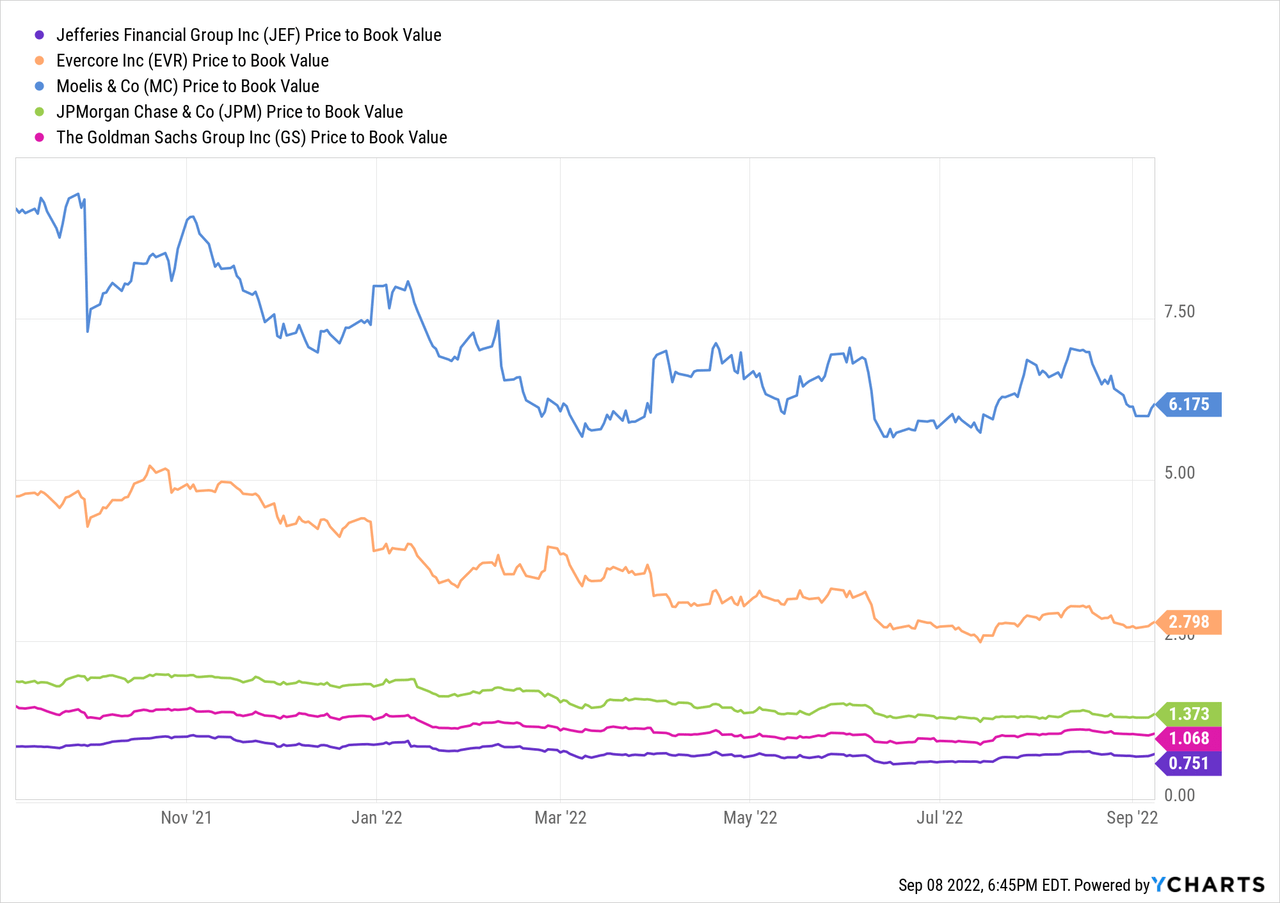

Furthermore, at the current price, the stock is trading 0.75 Price-to-Book value, which we believe is extremely cheap for a stock with strong fundamentals. Even when compared to other bulge bracket banks and boutique banks, Jefferies’ valuation is noticeably low as the only company in the peer group that is trading below 1.0x Price-to-Book value. As a result, we think that Jefferies is undervalued as well compared to peers.

Risks

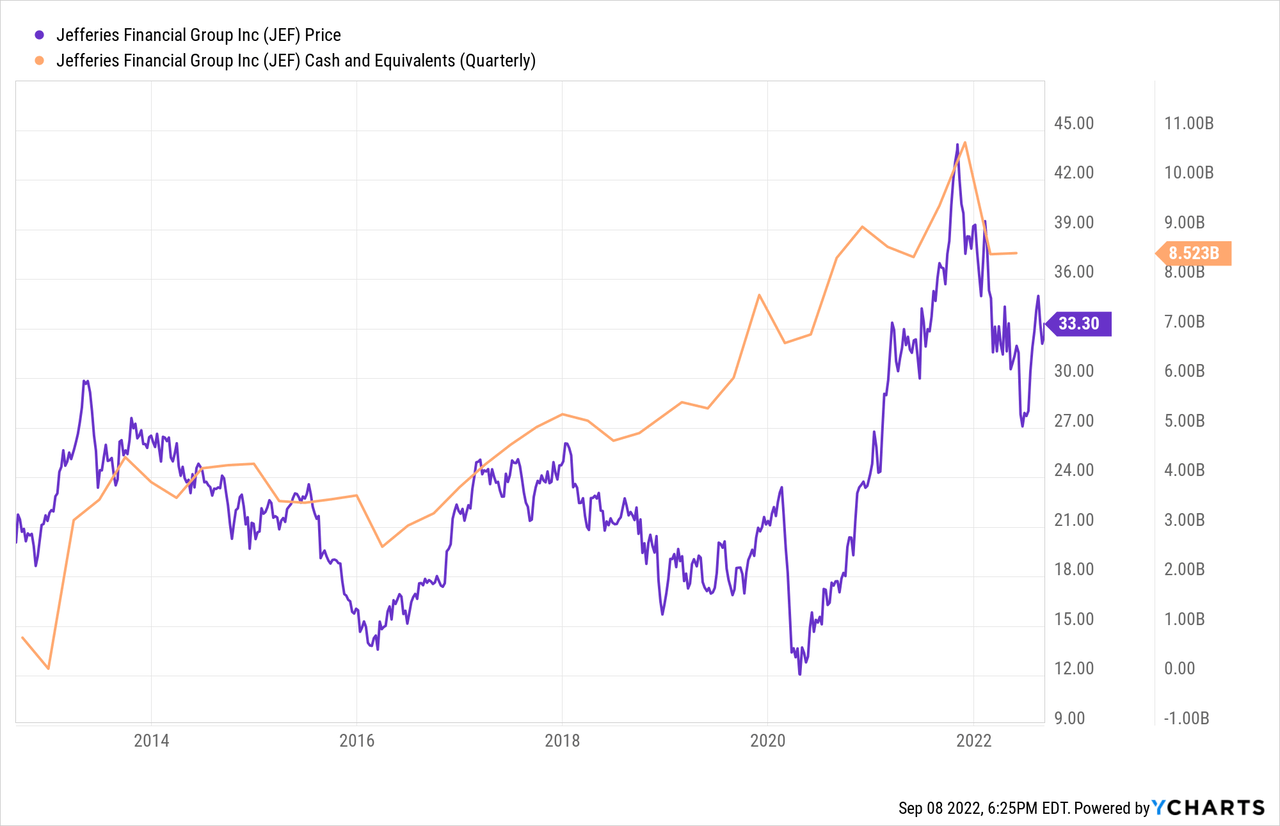

Jefferies faces the same macroeconomic risks that would affect other financial services firms. Rising interest rates and a steep recession would affect the company’s business by reducing investment banking fees and affecting its AUM. However, we believe that there are a few aspects of Jefferies that would help protect its business against poor macroeconomic conditions. First, unlike other boutique investment banks, the company has a diversified line of businesses such as asset management, wealth management, and equity research. We believe that even in a cyclical downturn in investment banking fees, the other business lines would serve as bell-weathers that can bring in consistent income to keep the business afloat. In addition, the liquidity position of Jefferies is solid, as the company has $8.5 billion in cash and cash equivalents and reported a total long-term capital of $14.74 billion. Therefore, it is our view that Jefferies is well-positioned against any worse-than-expected recession scenario.

Conclusion

Jefferies is a great investment for investors looking for a financial services company that is committed to returning capital to investors. Jefferies’ management has iterated its commitment to maximize shareholder returns, and the company has continued to raise dividends and increase share buyback programs to return excess capital to investors. We also believe that the company is well-protected against major macroeconomic risks and makes this company a relatively safe bet during a time of economic uncertainty.

Be the first to comment