Andrew Burton/Getty Images News

Thesis

JD.com, Inc. (NASDAQ:JD) is one of the leading players in the mature Chinese e-commerce market and has seen its revenue increase 13 times since going public in 2014, while the stock price only tripled. The company managed to develop a good moat, yet I only consider them a hold, because of slowing growth and big uncertainties.

Industry

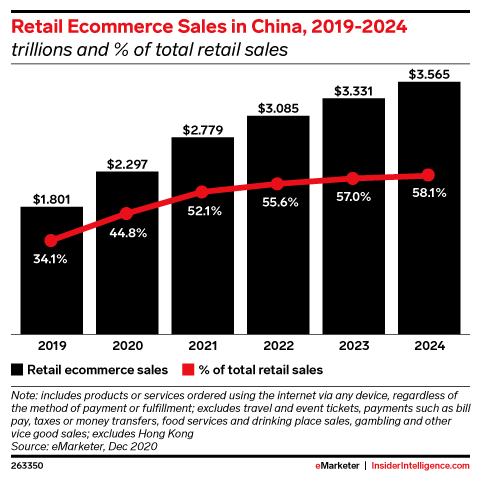

China is one of the largest countries and markets on the planet. With a population of over 1.4 billion people and a total retail market size of around $3 trillion China has the most mature eCommerce market in the world. The pandemic gave eCommerce a big push that sent eCommerce, as a percentage of total retail sales, up to 44.8% in 2020. The eCommerce market share is expected to increase substantially, up to 58.1%, in 2024.

China eCommerce as a percentage of retail sales (eMarketer)

In the table below, we can see the growth rates of the different eCommerce segments in China for different time periods. We can see that Electronics and Fashion are the biggest segments, while Beverages, Food and Media saw the highest growth rates. The pandemic accelerated eCommerce adoption and led to a CAGR of 9.5% during that time period. This effect is now beginning to subside, and the expected 3-year CAGR going forward is back to pre-pandemic rates of around 5%.

|

Period |

CAGR 17-20 | CAGR 20-22 | CAGR 22-25(expected) | Total size in 25 |

|---|---|---|---|---|

| Beauty/Healthcare | 6.9% | 11.4% |

5.7% |

$128b |

| Beverages | 38.5% | 27.3% | 4.6% |

$99b |

| Electronics | -2.1% | 5.2% | 4.2% | $443 |

| Fashion | 4.9% | 8.2% | 5.3% | $362 |

| Food | 38.6% | 38.9% | 7.3% | $111 |

| Furniture | -8.8% | 0% | 7.7% | $138 |

| Media | 20.7% | 13.2% | 2.5% | $80 |

| Toys/Hobby/DIY | 13% | 12.2% | 4.6% | $264 |

| Total eCom growth | 4.1% | 9.5% | 5% | $1626 |

JD is the leader in electronics

One of the early ways JD expanded was by dominating the large Electronics category. Unlike competitors like Alibaba (BABA, OTCPK:BABAF), JD has a very curated catalog of products and actually sells the items themselves. Alibaba on the other hand mainly operates a marketplace but doesn’t own the inventory leading to much higher margins.

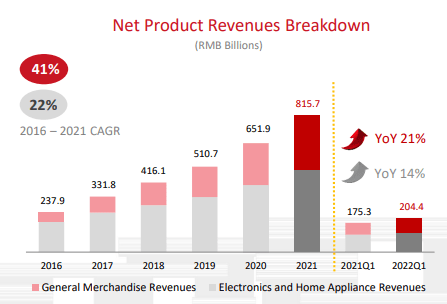

This focus on good quality has been a success, especially in Electronics, where quality matters more than other categories. Even though Electronics has had a slow growth rate in the low to mid-single digits, JD managed to grow revenues at a 22% CAGR. The other segments are lumped together into General Merchandise Revenues, which roughly double the growth rate at an impressive 41% CAGR. We can also see that revenue growth is slowing down, this can be attributed to a generally lower growth rate of eCommerce in general.

JD revenue by segment Q1 22 (Jd investor relations)

Logistics as a moat

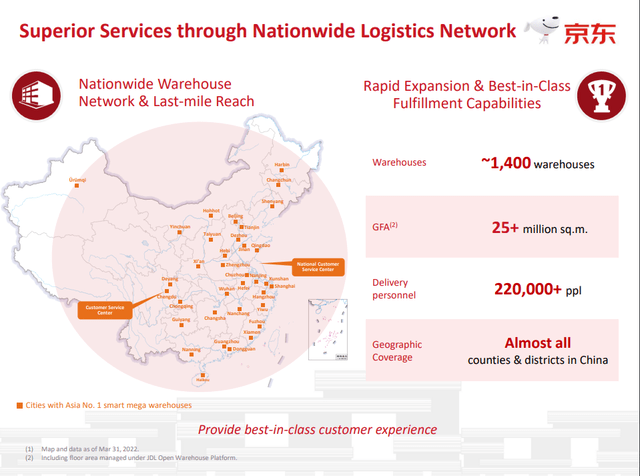

Perhaps the most interesting aspect of JD is its logistics network, which is the leading logistics network in China, enabling fast deliveries into almost all parts of China. While eCommerce will always remain a low-margin business for JD, due to the nature of the business, logistics could provide a higher-margin revenue stream, by offering the services to other companies as well.

JD logistics network (Jd investor relations)

The company is a pioneer in new delivery methods, like drone delivery and autonomous delivery vehicles. The company also has been operating smart factories since 2018, where everything is operated by autonomous robots. Currently, the spun-off logistics subsidiary is still writing losses, but it is not hard to see a potential for a high margin in the future here once they reached scale. The logistics services already account for over 10% of revenues.

JD faces many uncertainties

An investment in JD comes with a lot of uncertainties. I talked about some of the general uncertainties about investing in China in my first Tencent (OTCPK:TCEHY, OTCPK:TCTZF) article last February. Most of these should still be relevant.

The relationship with Tencent

Speaking of Tencent, in last December the company decided to pay out 457 million Class A JD shares, or 14.7% of the company, to shareholders as a special dividend. The total stake Tencent holds now only accounts for 2.3% of JD. This could have an impact on the long-term partnership between the two companies that helped elevate JDs market position by being the preferred partner for all eCommerce businesses Tencent had.

Tencent did state that the divestiture of its stake won’t have an effect on the partnership, but who knows how that will look in a few years. It creates a lot of uncertainty in my opinion because the ability to leverage Tencent’s WeChat ecosystem gives a large advantage over competitors like Alibaba.

Founder Richard Liu stepping down

Richard Liu has followed many other Chinese tech CEOs that stepped down from their CEO position in recent years. He now joins the list of founders from ByteDance, Kuiaishou, Pinduoduo (PDD) and of course Alibaba. The regulatory landscape in China is still one of the biggest uncertainties for the long-term growth of JD and other Chinese tech stocks.

JD is not a bargain

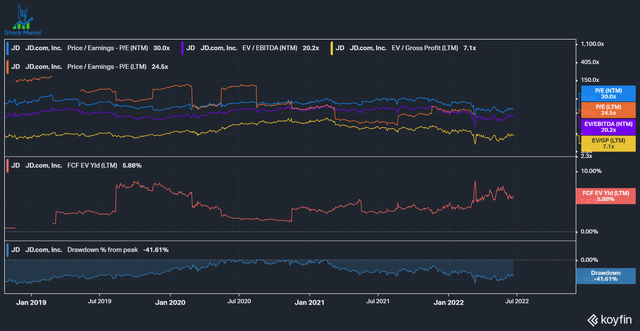

JD has come down around 41% since the Chinese tech stocks peaked in early 2021. Through 2020 the company was quite overvalued at around 50 times forward earnings. Earnings have been relatively flat over the last year and are expected to decline, which is shown in a higher forward (NTM) P/E ratio than the trailing (LTM) P/E ratio. On a Free Cash Flow basis, the company looks a lot better. If the company can start to increase margins again, due to rising efficiencies and scale in its eCommerce and logistics business, then the company could be a decent buy here. We also should keep JD’s stakes in its recent spin-offs in mind:

- 63.6% in JD logistics, worth $8.2 billion (down 55% from ATH)

- 67.2% in JD health, worth $15.4 billion (down 72% from ATH)

Conclusion

JD is an interesting play on the Chinese eCommerce market, but I am not a buyer here. The company could offer a good value proposition, especially through its logistics operations which have great potential. China continues to be a harsh environment that I am not comfortable owning a part off without a massive discount. I do own shares indirectly through my investment in Prosus (OTCPK:PROSY), an opportunity with a large enough margin of safety to accept the Chinese regulatory risk.

Be the first to comment