Japanese Yen, USD/JPY, Wall Street, Consumer Confidence – Asia Pacific Market Open

Japanese Yen on the Verge of Breakout as Wall Street Stalls?

The anti-risk Japanese Yen slightly rose on Tuesday as equities swung between gains and losses throughout the day. In Europe, the FTSE 100 and DAX 30 closed +1.91% and +1.27% while the Dow Jones and S&P 500 ended -0.13% and -0.52% respectively. The choppy 24 hours meant that volatility in foreign exchange markets was relatively muted.

Recommended by Daniel Dubrovsky

Traits of Successful Traders

Optimism may have been fueled earlier in the session on reports that countries such as Spain and France will be moving towards easing lockdown restrictions amid ebbing coronavirus case growth. Then sentiment faded in the aftermath of the lowest US Conference Board sentiment reading since 2014. The speed at which consumer confidence deteriorated in April was the sharpest drop off on record.

Check out our newly-enhanced economic calendar for comprehensive updates on data worldwide

Leading losses on Wall Street were health care and information technology stocks. In fact, the tech-heavy Nasdaq Composite contracted -1.40% to wrap up the session. Notable selloffs were seen in Amazon and Netflix shares which seem to be showing worrying signs of a top in the making. Amid rising bets of worldwide lockdown easing expectations, cruise ship and airline shares outperformed today.

Wednesday’s Asia Pacific Trading Session

With that in mind, Asia Pacific stocks could be in for a mixed session ahead. S&P 500 futures seem to be brushing aside earnings data from Alphabet as strong ad revenue seemed to push the stock over 8% higher in afterhours trade. The growth-linked Australian Dollar may look past first-quarter local CPI data due to what may be its limited scope to drive RBA monetary policy action at least in the near term. The focus for AUD/USD may rather remain on broader market sentiment.

What are some unique aspects of trading forex?

Japanese Yen Technical Analysis

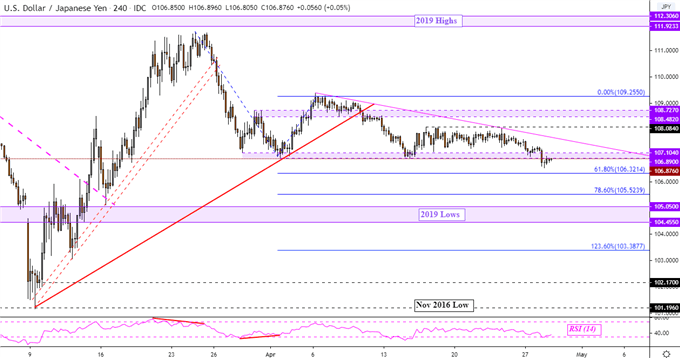

The USD/JPY seems to be on the verge of a technical breakout after almost a month of price consolidation. The pair has taken out key support which is a range between 106.89 to 107.10. Yet follow-through at this point is lacking after there was a cautious bounce to retest former support. A turn lower places the focus on the 61.8% Fibonacci extension at 106.32. On the flip side, upside progress could see the pair retest near term falling resistance from early April – pink line on the 4-hour chart below.

| Change in | Longs | Shorts | OI |

| Daily | -10% | 28% | 7% |

| Weekly | 5% | 26% | 15% |

USD/JPY Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment