- BOJ Likely to Remain Outlier in Tightening Race, Risk of Further Losses for the Yen.

- 145.00 Resistance Seen as the Key.

Starts in:

Live now:

Sep 26

( 13:09 GMT )

Recommended by Zain Vawda

Markets Week Ahead: Event Risk Trading Strategy

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY rallied higher in European trade as we remain within the range of 141.50 to the 145.00 area which provided some much-needed resistance last week. The temporary strength in the Yen was attributed to news that the Bank of Japan conducted a foreign exchange “check”, a move seen as a precursor for formal intervention.

With USD/JPY sitting near 24-year lows following its biggest annual drop on record

and further rate hikes expected from the US Federal Reserve, the signs remain ominous for the Yen. As intervention talk grows, we heard Governor Kuroda state that intervention is on the table and if needed it will be delivered swiftly and without warning. Meanwhile comments this morning from the Japanese Finance Minister Shunichi Suzuki stated that the BOJ will guide policy appropriately considering prices and the health of the economy. He confirmed that reserve funds will be used for essential output and price increases, a hint that further support measures may be introduced rather than a currency intervention.

Source: Bloomberg

FOMC and BOJ MEETINGS and POTENTIAL IMPLICATIONS.

The US Federal Reserve meeting this week should set the stage for the fourth quarter as markets wait with bated breath. The implications of the meeting will be felt across global markets with the Fed leading the tightening cycle while remaining in a better position economically than some of its peers. The meeting this week is expected to see a further 75bp hike delivered, however, most of this hike is priced in, it will be the minutes of the meeting and the speech by Fed Chair Powell which will pique interest.

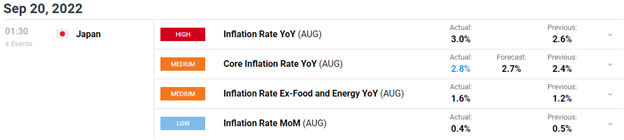

The Bank of Japan (BOJ) on the other hand is unlikely to waver from its policy stance despite a rise in inflation reported today. According to sources familiar with the matter, massive rate hikes would be needed to instill some strength into the Yen but the BOJ remains unconvinced that the current inflation rate warrants such an action. The bank fears the damage to the economy as wage growth continues to lag while inflation is expected to plateau moving forward. With this in mind, it is hard to imagine a bullish BOJ at the minute as I expect policy and rate hikes to remain unchanged for a while.

For all market-moving economic releases and events, see the DailyFX Calendar

As things stand the Fed is likely to be the driving force of any move on USD/JPY this week with the BOJ a supporting cast member if you will. Markets are currently pricing in an 84% probability of a 75bp hike while there remains a 16% probability for a full percentage point. Should the Fed deliver a 75bp hike on Wednesday coupled with bullish forward guidance and a year-end rate higher than 4.25% I expect dollar bulls to take charge and drive USD/JPY higher. Alternatively, should we get a 75bp hike followed by dovish comments and a year-end rate target around the 4.00-4.25% we should see USD/JPY retreat even though this might be short-lived.

How central banks impact FX markets

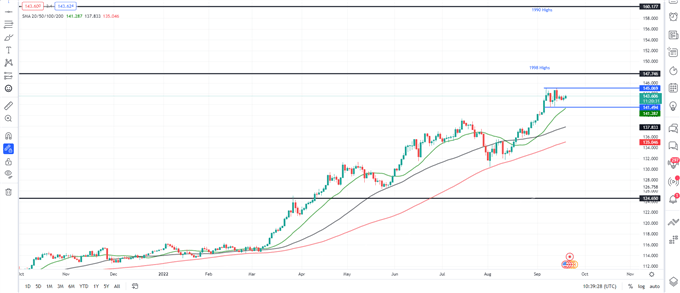

USD/JPY Daily Chart –September 20, 2022

Source: TradingView

From a technical perspective, we can see on the daily timeframe above the talk regarding intervention occurred when the price hovered around the 145.00 area, the higher end of the range. Given the fundamentals driving this pair, assumptions on the technicals alone at this stage is unwise. At the moment the range we are stuck in on a daily timeframe stretches from 141.50 to the 145.00 area, and I expect rangebound price action until the Fed meeting tomorrow. We currently trade above the 20, 50 and 100-SMA with the gradients indicating further upside could be in store. A bullish move post FOMC will need to see us take out the 145.00 level if we are to test the 1998 highs at 147.75 or push toward the key psychological 150.00 level. Alternatively, a surprise of Yen strength could see us test the lower end of the range and then the 140.00 level.

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•143.00

•142.20

•141.50

Resistance Areas

•144.00

•145.00

| Change in | Longs | Shorts | OI |

| Daily | 5% | 2% | 2% |

| Weekly | 28% | -5% | 2% |

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Be the first to comment