JIAYUE/iStock via Getty Images

Investment thesis

Shares of Tennant Company (NYSE:TNC) are currently suffering a decline of 26% as the macroeconomic landscape is getting more and more complex. Supply chain issues (specifically parts availability) are having a direct impact on the company’s ability to increase production volumes despite growing demand, which is reflected in a record-high backlog. Also, increased energy and material costs, as well as negative foreign exchange rates, are having a negative impact on the company’s margins, but the management is already making pricing actions and a solar-panel project is about to finish in the EMEA, which should, at least partly, mitigate this impact as long as the headwinds continue to be part of the operating context.

Despite these headwinds, the current issues related to labor shortages and increased production costs (margin pressures) represent a major opportunity for the company as it is heavily investing resources and efforts to deploy its AMR (autonomous mobile robot) technology to other businesses interested in reducing labor costs. Also, Tennant’s business is still pretty much intact despite the current (and likely temporary) headwinds, and debt continues to decline, so I think this is a good opportunity to buy shares of the stock at a reasonable price, and I’ll explain why in this article.

A brief overview of the company

Tennant Company is a globally leading designer, manufacturer, and marketer of mechanized cleaning equipment for industrial and commercial use, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair services, and business solutions such as financing, rental and leasing programs, and machine-to-machine asset management solutions. The company was founded in 1870 and its market cap currently stands at $1.12 billion, employing over 4,000 workers worldwide. It owns globally recognized brands such as Tennant, Nobles, Alfa Uma Empresa Tennant, IRIS, VLX, IPC brands, Gaomei, and Rongen, and its products are sold to over 100 countries.

Tennant Company brands (Tennantco.com)

The company’s products are used in retail establishments, distribution centers, factories and warehouses, public venues such as arenas and stadiums, office buildings, schools and universities, hospitals and clinics, parking lots and streets, and more. It has over 40,000 customers worldwide and also supplies private-label brands, which helps the company capitalize on competition from brands owned by major retail players. The company launched the AMR program in 2019 and made efforts to introduce robotic solutions for cleaning by introducing multi-use robotic solutions for retailers and lithium-ion technology to autonomous mobile robot floor cleaning machines after launching its first industrial robotic floor scrubber for large spaces in 2021. Furthermore, the company signed an agreement to supply Walmart (WMT) with a fleet of robotic floor cleaners in 2019, which demonstrates the quality of its products and ensures a great revenue stream in the years to come from post-sale maintenance services.

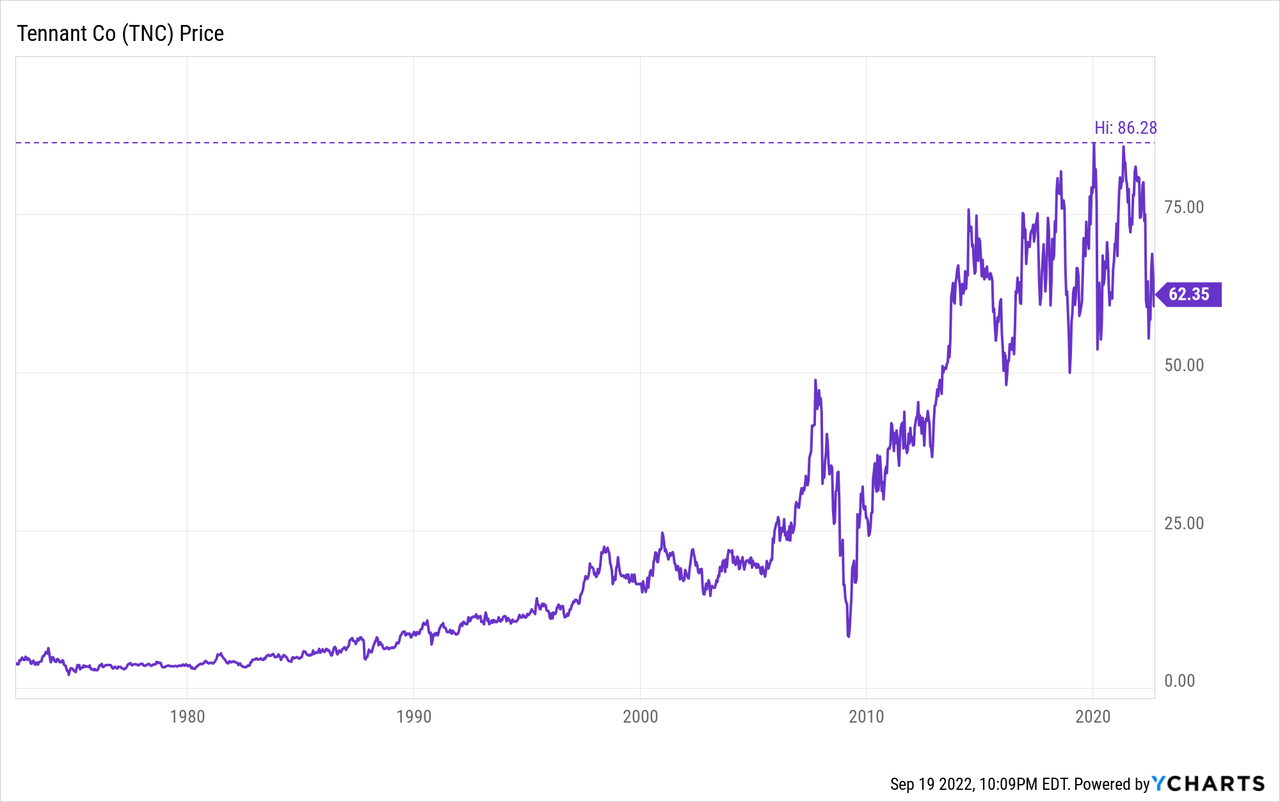

Currently, the share price stands at $62.35, which represents a 26.27% decline from all-time highs of $84.57 on March 18, 2022. This decline can be explained mainly by the following reasons: increasing material costs and declining availability, higher production costs, and negative foreign exchange rates caused a decline in the company’s gross profit margins. Furthermore, the declining availability of materials has made it difficult to increase production at a time when the backlog is increasing significantly.

These are, in short, the main headwinds investors must endure in exchange for the current discount in the share price, in addition to the added risks that the situation will worsen or that there will be a significant economic slowdown due to the complexity of the macroeconomic landscape.

Latest acquisitions and divestitures

In September 2016, the company acquired Dofesa Barrido Mecanizado, Tennant’s largest and long-time Mexico distributor. This acquisition allowed Tennant to provide equipment, parts, and services directly to its distributors and customers in the country more quickly and avoid extra costs.

In April 2017, the company acquired IPC Group, an Italian designer and manufacturer of innovative professional cleaning equipment, tools, and other solutions, for $353 million. IPC Group’s brands include IPC, IPC Foma, IPC Eagle, IPC Gansow, ICA, Vaclensa, Portotecnica, Sirio and Soteco, Ready System, Euromop, and Pulex. This represented a major acquisition and opened a new deleveraging phase in the company’s history as it had to take significant debt to make the purchase.

In January 2019, the company acquired Gaomei Cleaning Equipment Company, a Chinese leader in the development and production of small-to-mid-sized cleaning equipment and solutions for commercial and industrial applications, which increased the company’s geographical diversification as most of Gaomei’s revenues come from China.

In February 2021, the company sold its coatings business, which generated $22.1 million of net sales per year (2.2% of the total) at the time of the sale, to Sherwin-Williams Company (SHW) in order to focus on areas where the company has a higher competitive advantage, that is, the autonomous mobile robot market.

Net sales are currently limited due to lower material availability

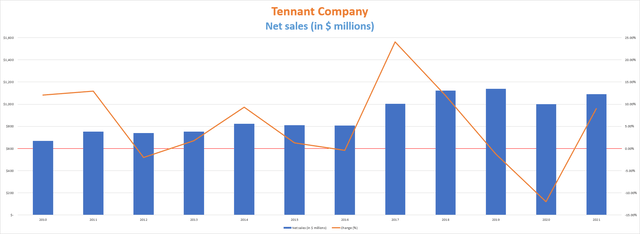

Net sales were negatively affected in 2020 as they declined by 12% year over year as a consequence of mandatory quarantines due to the coronavirus pandemic. After a recovery of 9% in 2021, the war between Russia and Ukraine is now prolonging the headwinds that took place after the reopening of most of the world’s economies and have caused significant increases in energy costs, and although the company has no employees in Russia or Ukraine, it has revenue channels through partners in these countries.

Tennant Company net sales (10-K filings)

Despite these headwinds, during the second quarter of 2022, net sales increased by 0.39% year over year and by 8.56% quarter over quarter boosted by increasing price realization for the company’s products. It is important to note that organic net sales actually grew by 4.4% year over year, but unfavorable foreign exchange had a negative impact of 4%.

Net sales are expected to grow year over year by almost 5% in 2022 and by another 4% by 2023. Backlog increased by 11% quarter over quarter during the second quarter of 2022 and it is already three times larger compared to the same quarter of 2021 due to higher order rates and limited production volumes as a consequence of supply chain issues, but the management prefers not to give exact numbers in this regard. The management expects production difficulties to partially ease during the third and fourth quarters of 2022, which should allow the conversion of part of the increased backlog into net sales. Furthermore, the global cleaning robot market is expected to grow at an astounding CAGR of 22.3% from 2022 to 2030, with which Tennants’ expansion opportunities will be abundant in the foreseeable future.

Also, one of Tennant’s strengths is that it enjoys strong geographic diversification across the globe. Using 2021 as a reference, 60% of net sales are provided by operations located in the Americas, 30% from Europe, the Middle East, and Africa, and 9% from Asia pacific.

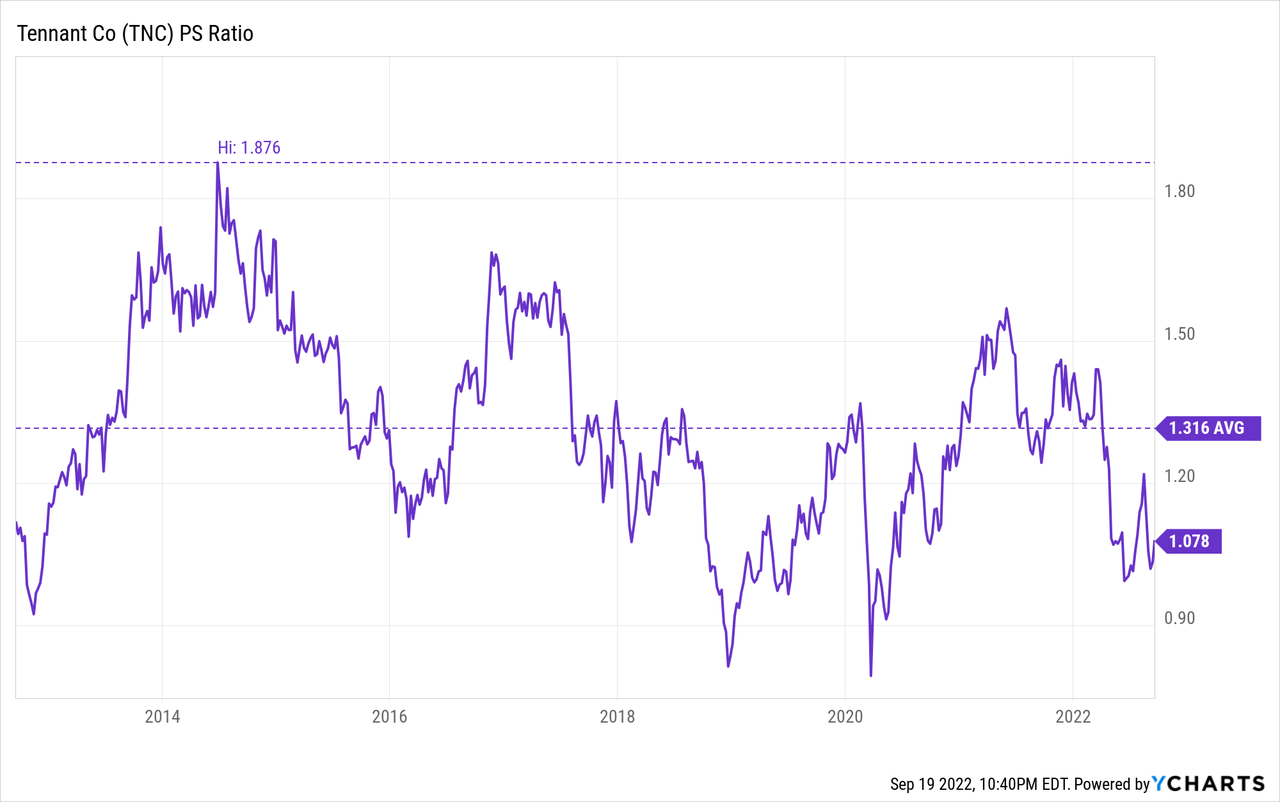

Also, the PS ratio declined by 42.54% in the last decade to 1.078 from the spike of 1.876 reached in 2014 and is 18.09% lower than the average of 1.316. This means the company generates net sales of $0.93 per year for each dollar held in shares by investors.

This drop in the PS ratio shows that investors are not willing to pay as much as they did in most of the last decade for the company’s sales, and this is largely due to the declining ability to convert these sales into actual cash due to the current macroeconomic headwinds. But this pessimism, on the other hand, has opened up an opportunity for more patient investors to buy shares at a reasonable price, which will likely lead to a decent dividend yield on cost in the long run.

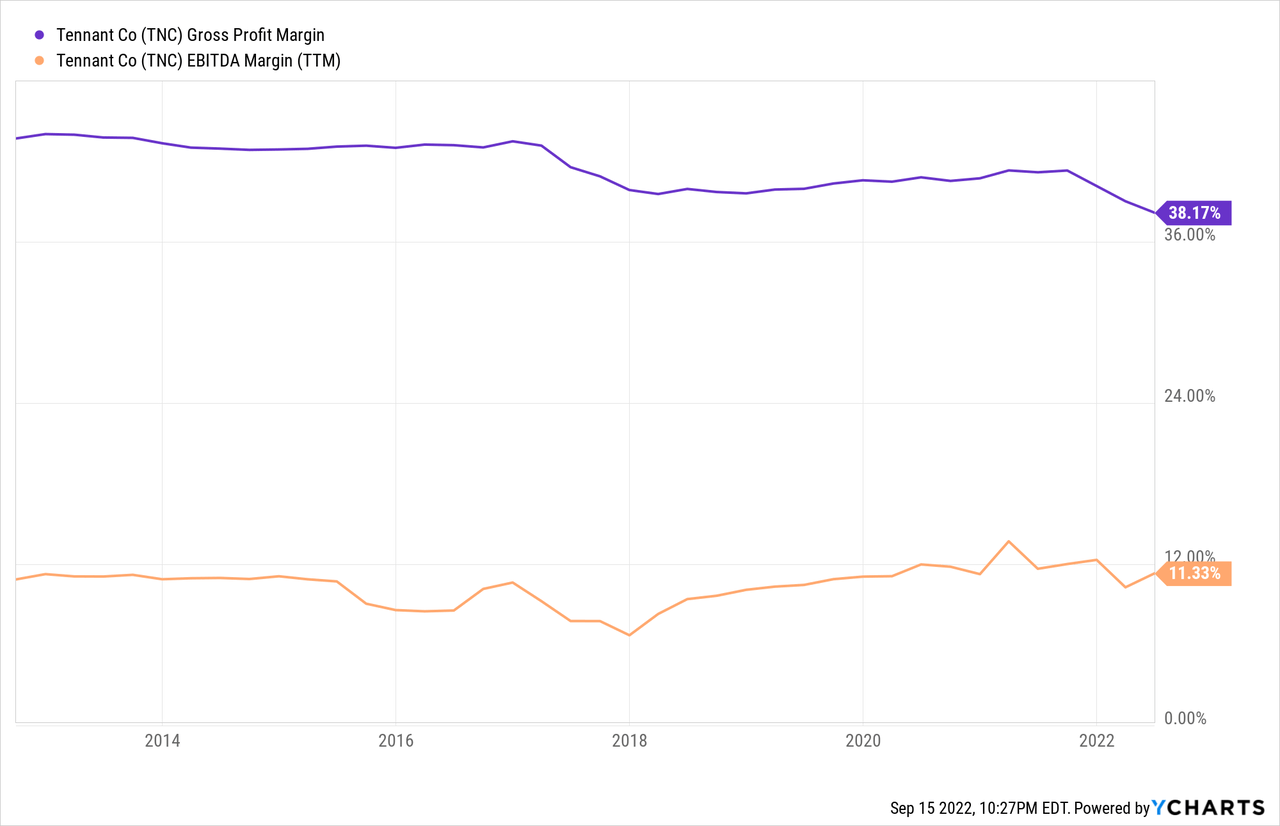

Margins are very decent

The company has very high profit margins that enable strong cash generation. Furthermore, these margins have remained surprisingly stable over the years, including 2021 and the first half of 2022 if we take into account the recent headwinds. Currently, inflationary pressures, decreasing production capacity due to supply chain issues, and negative FOREX are damaging the company’s gross profit margins.

Taking a look at the present, the company’s gross profit margins declined to 37.87% during the second quarter of 2022, but the EBITDA margin was less impacted as it stood at 11.99% boosted by an 8.24% decline in selling and administrative expenses to $79.1 million, and the management expects an EBITDA in the range of $140 to $155 million for the whole 2022, which represents a slight improvement from current trailing twelve months EBITDA of $125.9 million.

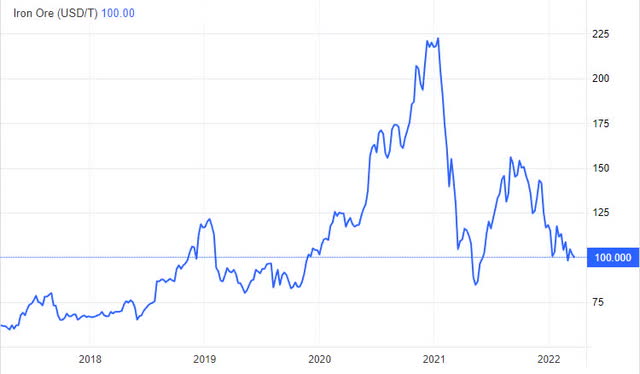

The company’s products are mainly made of steel, metal alloys, and resin, and therefore, profitability is exposed to the prices of said materials and any increase will have a negative impact on the company until prices are updated, something that normally takes time to fully materialize. Iron ore prices seem to be stabilizing at $100 per ton, which should help relax margin pressures to some extent.

Iron ore prices (Tradingeconomics.com/commodity/iron-ore)

Also, while the management keeps reducing discretionary spending, the focus now is on a project of solar panels that will be finished by the end of 2022 to generate electricity in EMEA and thus mitigate increasing energy costs.

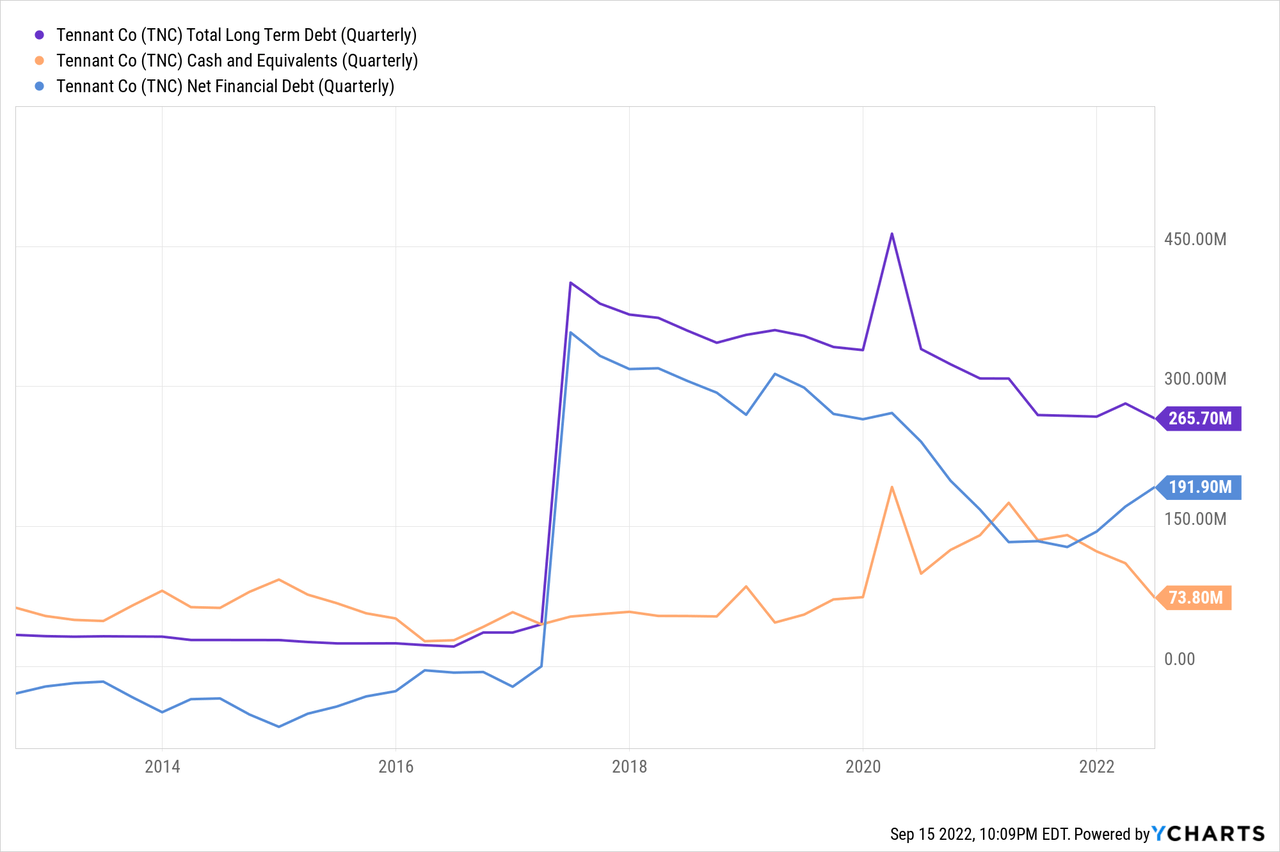

Debt is on the decline

In 2017, long-term debt increased by slightly over $300 million after the acquisition of IPC Group and the company entered a deleveraging phase. Before the acquisition, the company enjoyed a negative net debt as cash on hand was higher than long-term debt.

Despite all the debt incurred for the purchase, the company has managed to decrease it successfully to $265.7 million. Furthermore, it currently holds $73.8 million of cash on hand and has $279.1 million of unused borrowing capacity, so the room for maneuver is enormous.

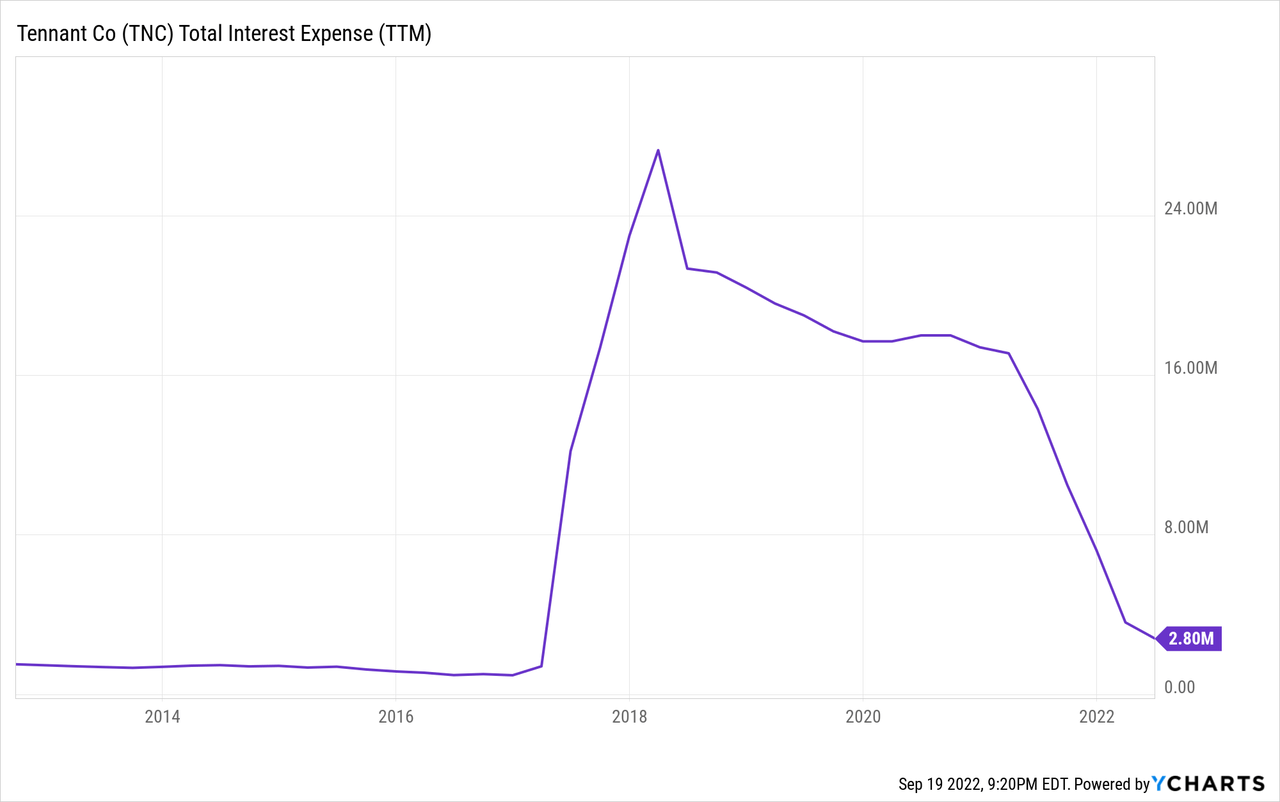

Also, interest expenses declined from over $25 million in 2018 to $2.80 million currently thanks to the refinancing of debt at more favorable rates in the second quarter of 2021 apart from the decreasing debt pile, which is making it possible for the dividend cash payout ratio to remain at a fairly conservative level.

The dividend is safe

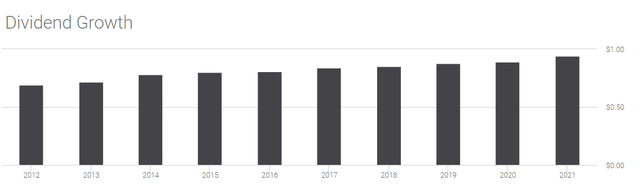

During the past decade, the company has steadily increased its dividend payout by 45%. The last dividend increase took place in October 2021 when it announced a 9% raise in the quarterly payout to $0.25 per share.

Tennant Company’s dividend growth (Seeking Alpha)

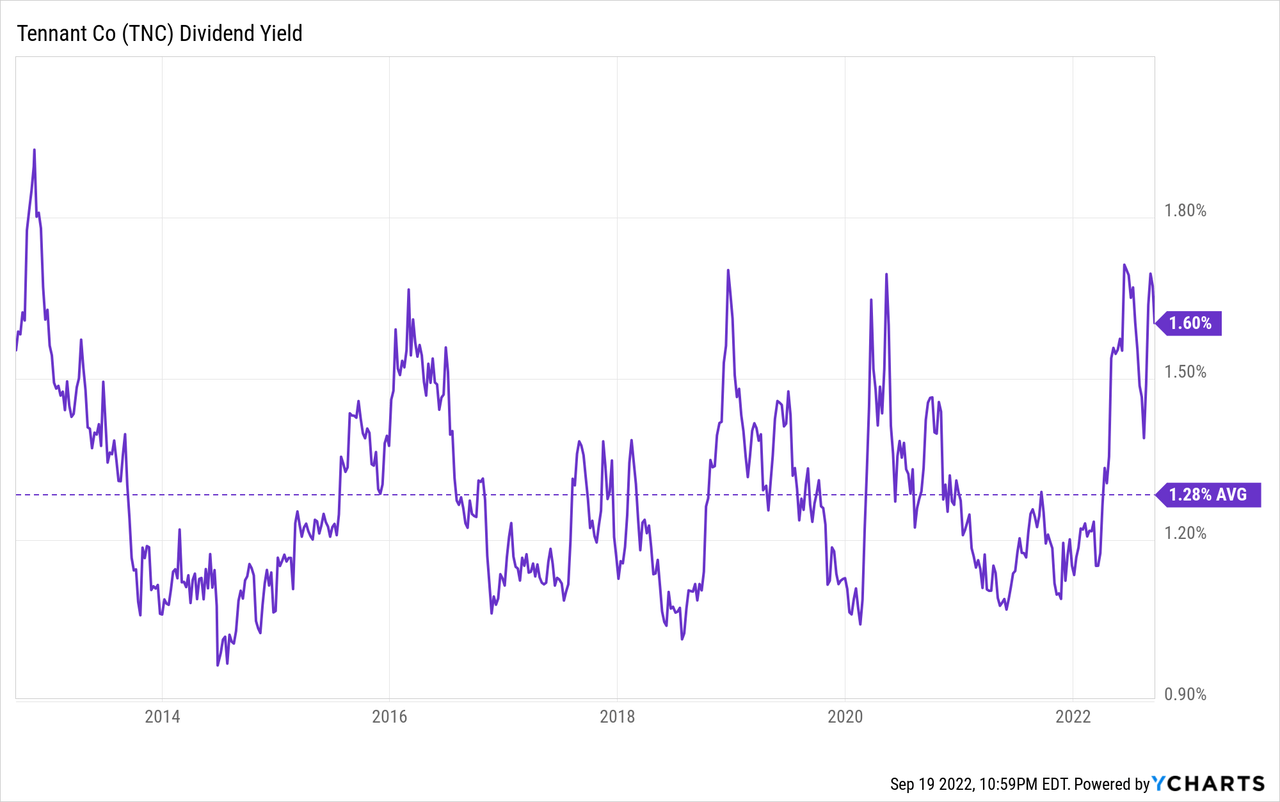

In this sense, the current dividend payout stands at $1 per year, and given the recent decline in the share price, the dividend yield increased to 1.60% from an average of 1.28% during the last decade. The dividend yield is quite low as a result of the conservative use of cash since the management prefers to use the cash generated from operations to expand the business and reduce Tennant’s current debt levels in order to increase the value of the company, which will translate into future stable raises of the dividend without this leading to a worsening of the cash payout ratio.

We should also keep in mind that CapEx is almost ~$30 million per year as the company is constantly launching new products and investing in cost savings initiatives in order to keep margins high and stable. Next, I present a table where I have calculated what percentage of the cash from operations has been used each year to cover interest expenses and the payment of the dividend in order to determine its sustainability over time.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $59.8 | $59.4 | $45.2 | $57.9 | $54.17 | $79.97 | $71.9 | $133.8 | $69.4 |

| Dividends paid (in millions) | $13.2 | $14.5 | $14.5 | $14.3 | $15.0 | $15.3 | $16.0 | $16.3 | $17.5 |

| Interest expense (in millions) | $1.8 | $1.72 | $1.31 | $1.28 | $25.4 | $23.3 | $17.8 | $17.4 | $7.3 |

| Cash payout ratio | 25.07% | 27.31% | 34.96% | 26.90% | 74.48% | 48.37% | 47.01% | 25.19% | 35.73% |

As we can see, the dividend and interest expenses are covered quite comfortably over the years. During the first half of 2022, cash from operations was -$23.6 million, which is a significant decline compared to a positive $37.8 million in the same period of 2021. This decline in cash from operations is attributable to a change in inventories of $44.7 million in the first half of 2022 as the company is preparing to capitalize on the existing backlog, which I believe will be realized almost entirely as ~80% of the total backlog was booked during the first half of 2022. Also, accounts receivable increased by $15.8 million in the same period while accounts payable increased by $14.1 million.

Risks worth mentioning

It is not yet known how (nor when) the end of the current inflationary environment will take place. If inflationary pressures continue over time, the company’s profit margins, and with them its ability to generate the high cash from operations to which we are used to, could continue to decline. On the other hand, if the end of these pressures supposes the beginning of an economic slowdown, the company’s sales could be temporarily reduced since its products are largely destined for the industrial markets.

Also, the company’s cash from operations is not at its best. The company is preparing to deal with the current backlog, which continues to pile up, by increasing its inventories, and solar projects in the EMEA markets, as well as reducing discretionary spending, could ease current profitability issues to some extent, but it is important that the company finally stabilize its margins in order to continue paying down the debt pile.

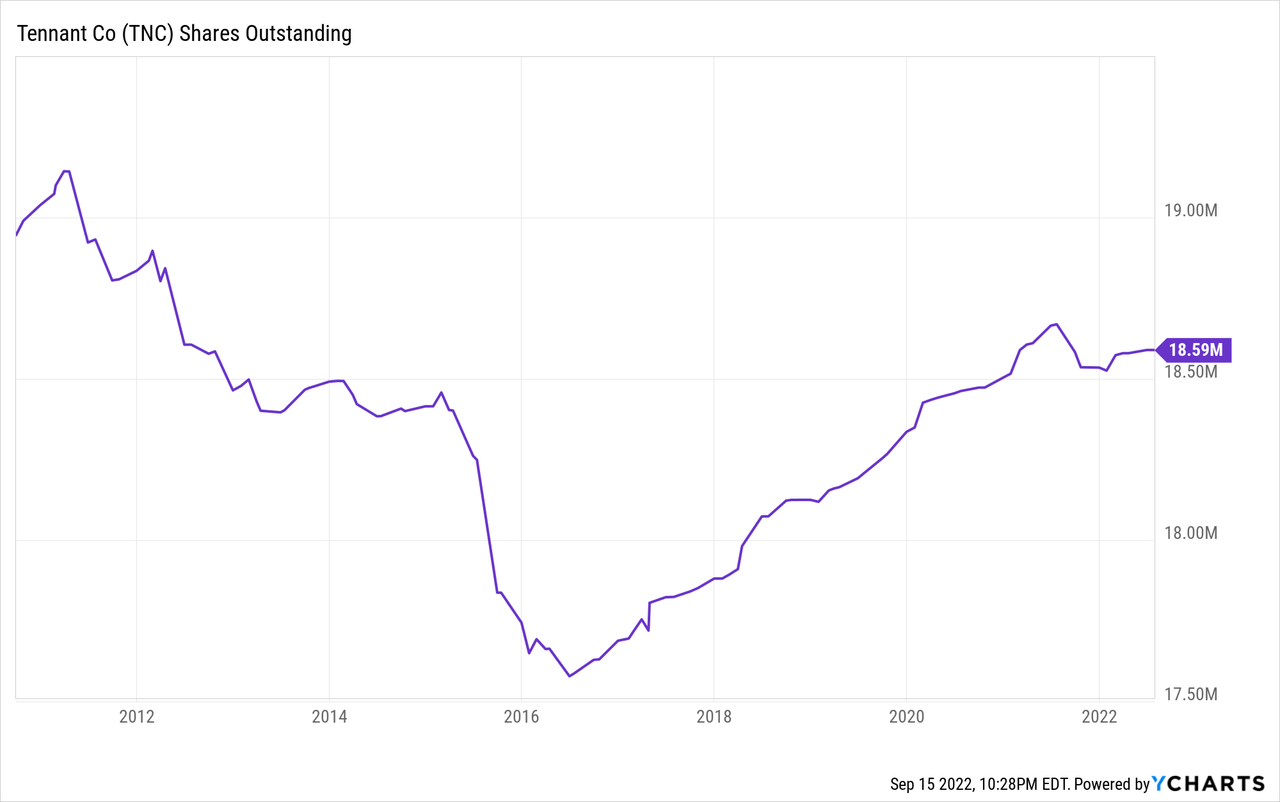

Share dilution is also something that should be periodically monitored as the total number of shares outstanding increased by slightly over 17.50 million to 18.59 million since 2016.

This means that each share of the company represents now a smaller portion of the company, although this has not always been the case since before 2016 the company made great efforts to reduce the number of outstanding shares via buybacks.

Conclusion

I think now is a good time to buy shares of Tennant as it operates in a critical market that is rapidly expanding. Its products represent significant savings in labor costs for customers, and profit margins are very high. Despite current headwinds, I believe that the management is doing what is due to improve the company’s situation by controlling what is in its hands. For the rest, investors will have to wait for current inflationary pressures to relax, for the higher production costs to finally be fully passed on to customers (including the negative foreign exchange), and for material availability issues to come to an end before seeing Tennant shine again.

The company has operated for over 150 years and has been historically a reliable cash cow, and I believe the current decline in the share price represents a good opportunity for long-term dividend investors with sufficient patience since the dividend yield on cost is significantly higher than the average of the last decade.

Be the first to comment