Gary Yeowell/DigitalVision via Getty Images

Jacobs Solutions, Inc. (NYSE:J), just renamed from Jacobs Engineering Group, is an engineering and construction firm operating in three segments: Critical Mission Solutions, People and Places Solutions, and PA Consulting. PA Consulting is a UK-headquartered company of which Jacobs acquired 65% in 2021; the remaining 35% is held by employees.

Due to its small dividend, I do not recommend Jacobs to dividend-hunting investors.

Investors should be aware the company’s financial reporting is one quarter and a few days different from traditional financial reporting, so its most recent report for the quarter ending July 1, 2022, was a third quarter report. Its fiscal year will thus end in October 2022.

Jacobs has a history of growing by acquisition. However, the environmental and renewables projects to which it has pinned its organic growth may be displaced in government budgets (especially the US and UK, the company’s primary markets) by more basic spending for hydrocarbon and nuclear energy. While the company has many other levels of expertise–and moreover is bargain-priced relative to its 52-week high–there is no easy line of sight to capital appreciation.

Because Jacobs Solutions pays only a small dividend, the company is also unlikely to interest investors seeking returns, particularly if they can do as well or better by buying Treasuries.

I am changing my recommendation for Jacobs Solutions from “buy” to “hold.”

Macro

Given Jacobs Solutions’ expertise across security, cyber, infrastructure, water, and energy, the macro environment certainly presents many potential opportunities and challenges worldwide, from the severe need for energy in the UK and Europe to replace Russian gas and oil to intelligence solutions in Russia’s attack on Ukraine to repairing Florida infrastructure after the destruction of Hurricane Ian.

Jacobs Solutions is also experienced and positioned to take on renewable and infrastructure projects generated from the recent multi-billion-dollar US infrastructure bill.

However, because of the suddenly-high cost of energy, as well as inflation in the US, UK, and Europe (Jacobs’ markets), it is likely the levels and focus of government spending on infrastructure-and especially renewables and ESG-may drop.

Third Quarter Results for Quarter Ending July 1, 2022

Jacobs Solutions reported $3.8 billion of revenue for the quarter ended July 1, 2022, a 7.0% increase year-over-year. Earnings per share (EPS) from continuing operations was $1.52, compared to $0.82 a year earlier. Adjusted EPS from continuing operations was $1.86/share for the quarter.

During the quarter, Jacobs’ backlog increased $2.7 billion to $28.1 billion, up 10.4% year-over-year. This includes a $3.9 billion ten-year contract to support NASA Johnson engineering, technology, and science strategy.

Cash flow from operations for the quarter was $212 million.

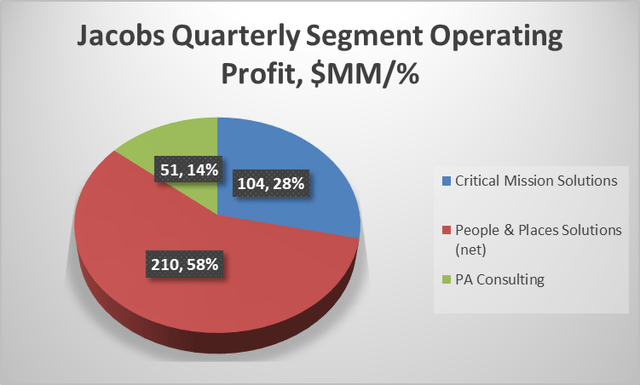

The quarterly operating profit of each segment is shown below.

jacobs.com and Starks Energy Economics, LLC

The company expects fiscal 4Q (that is, the quarter ending in October) adjusted EBITDA of $340-$360 million and adjusted EPS of $1.75-$1.85.

Nine-Month Results and Looking Forward

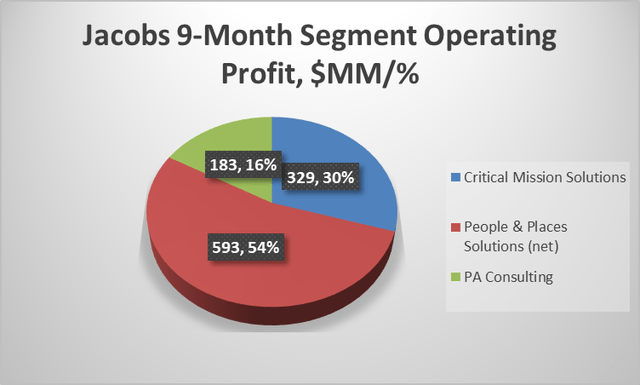

For the first nine months of its fiscal year, Jacobs reported GAAP and adjusted revenues of $11.0 billion, net earnings attributable to Jacobs of $665 million or $5.13/share, and an operating profit margin of 10.3%.

jacobs.com and Starks Energy Economics, LLC

Because of the particularities of government and large-project accounting, revenue recognition takes place as work progresses. For example, in the company’s most recent 10-Q it explains remaining performance obligations:

“The Company’s remaining performance obligations as of July 1, 2022 represent a measure of the total dollar value of work to be performed on contracts awarded and in progress. The Company had approximately $14.4 billion in remaining performance obligations as of July 1, 2022. The Company expects to recognize approximately 53% of our remaining performance obligations into revenue within the next twelve months and the remaining 47% thereafter. Although remaining performance obligations reflect business that is considered to be firm, cancellations, scope adjustments, foreign currency exchange fluctuations or deferrals may occur that impact their volume or the expected timing of their recognition. Remaining performance obligations are adjusted to reflect any known project cancellations, revisions to project scope and cost, foreign currency exchange fluctuations and project deferrals, as appropriate.”

Operations and Strategy

Jacobs Engineering is headquartered in Dallas, Texas. In 2021, nearly 70% of the company’s sales were in the US; another 22% came from Europe.

In the most recent quarter, 74% of the company’s revenues were from technology and consulting, 9% were from project delivery services, and 17% were pass-through revenue.

The “Critical Mission Solutions” (CMS) segment comprises projects in cybersecurity, data analytics, systems and software application integration, engineering, and nuclear.

According to the company, some CMS clients are the US Department of Defense (DoD), the Combatant Commands, the US intelligence community, the US Department of Energy (DoE), UK Ministry of Defense, the UK Nuclear Decommissioning Authority (NDA), as well as private sector customers in the aerospace, automotive, energy and telecom sectors.

The “People & Places Solutions” segment comprises data analytics, artificial intelligence, software development, architecture, and program management. Some of Jacobs’ specialties include designing and building wind tunnels, water systems, and construction projects.

In March 2021, Jacobs paid $1.7 billion for a 65% interest in PA Consulting that it acquired from Carlyle. PA Consulting is a UK-based firm begun during World War II whose expertise is strategy, technology, and innovation.

In the last year Jacobs has added specialized expertise in analysis, intelligence and cyber via acquisitions of

- BlackLynx, a cyber/intel/digital company, for $234 million in November 2021, and

- StreetLight Data, a mobility analytics company, for $190.8 million in February 2022.

Integrating these-especially PA Consulting which did a fair amount of executive hiring during the quarter to the detriment of margins according to the investor call transcript-and earlier acquisitions will take time.

Excluding PA Consulting in the percentages, the company describes its markets as:

- advanced manufacturing (4%)

- cities and places (8%)

- energy and environment (18%)

- health and life sciences (11%)

- infrastructure (transportation, telecommunications, water) (32%)

- national security (16%)

- space (11%).

For example, Jacobs’ space group works with NASA, SpaceX, US Missile Defense, US Space Command, and United Launch Alliance.

Some other specific project examples:

- US data centers

- Thames Tideway tunnel, UK

- small modular (nuclear) reactors

- hydro power stations and wind farms

- Doha south sewage infrastructure.

Jacobs Solutions has many engineering and construction macro-project competitors.

Governance

At October 1, 2022, Institutional Shareholder Services ranked Jacobs Solutions’ overall governance an 8, with sub-scores of audit (7), board (2), shareholder rights (9), and compensation (8). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

ESG rating from Sustainalytics as of August 2022 was “medium” with a total risk score of 22 (34th percentile). Component parts are environmental risk 5.3, social 11.5, and governance 5.6.

Controversy level is 3 on a scale of 0-5, with 5 as the worst. Product involvement behind these rankings for Jacobs includes “controversial weapons” and “military contracting.”

On September 15, 2022, shorted shares were 1.6% of floated shares. Insiders own a small 0.87% of outstanding stock.

The company’s beta is somewhat below the market average at 0.85: its stock moves in the same direction as the overall market but less sharply.

The company’s largest institutional holders are Capital Research (14.1%), Vanguard (10.7%), State Street (6.2%), and PrimeCap (5.0%). Some institutional fund holdings represent index fund investments that match the overall market.

Jacobs recently announced Bob Pragada, the company’s president and chief operating officer, will become CEO January 24, 2023, the date of the annual shareholder meeting. Current CEO Steve Demetriou will continue as executive chair of Jacobs’ board of directors.

While not quantified, there is sometimes a “new-CEO discount,” as investors wait to see how a new executive handles the very considerable challenges of the position, particularly in a volatile macro environment.

Jacobs Solutions Financial Highlights

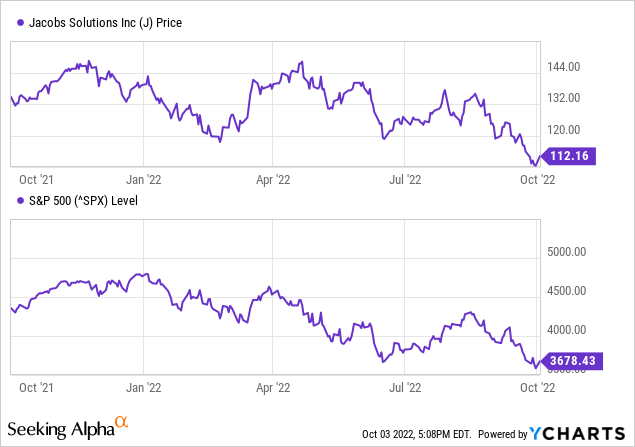

Closing price on October 3, 2022, was $112.17/share, 75% of the 52-week high of $150.32. The closing price is also 72% of a one-year target price of $155.80/share, or said another way, Jacobs’ stock price has a 39% upside to the one-year target.

This price gives a market capitalization of $14.3 billion; enterprise value is $17.1 billion.

Trailing twelve-month EPS is $3.57/share for a trailing price/earnings ratio of 31. The average of analysts’ estimated EPS for 2022 is $6.95 for a forward P/E ratio of 16.1.

Trailing twelve-month (TTM) return on assets is 5.2%; return on equity is 8.1%.

TTM operating cash flow is $400 million and levered free cash flow is $809 million.

The dividend of $0.92/share yields a small 0.8% at the current stock price.

As of July 1, 2022, the company had balance-sheet liabilities of $8.7 billion including $3.2 billion of current liabilities and $3.5 billion of long-term debt. Assets of $14.7 billion gave the company a liability-to-asset ratio of 59%.

The charts below show Jacobs’ one-year stock price history compared to the S&P 500.

Jacobs Engineering has a very good average analyst rating from eighteen analysts of 1.7, or “buy” leaning to “strong buy.”

Seeking Alpha News recently noted the company’s stock price had hit a 19-month low, along with other industrial stocks. Be aware that recently the company has had 17 downward EPS revisions from analysts and no upward ones.

Notes On Valuation And Risk

Jacobs’ market value per share is 2.4 times its book value, indicating positive investor sentiment.

US and UK inflation could further increase labor, materials, operations, and financing costs.

Because the company, like many in its sector, operates worldwide with a variety of governmental entities, it has more varied political risk than a domestic-only company.

In both the UK and likely the US, changes from recent and forthcoming elections may result in changes in government spending priorities. The UK is also contending with severe shortages and much increased costs for energy throughout its economy.

The evolution of the Russia-Ukraine war may also change spending requirements of the US, UK, and European countries’ governments.

Recommendations

I do not recommend Jacobs Engineering Group to dividend investors because of its small (0.8%) dividend.

While the just-passed US infrastructure bill contains a large allocation for infrastructure and renewable projects, given high levels of inflation and the recession, as well as the upcoming mid-term elections, there is no guarantee US government spending on renewables and infrastructure will continue at the current pace nor that Jacobs will get a large share of it; this is simply the nature of government contracting.

For macro reasons (the fall of the stock market, infrastructure and renewables spending may have peaked), as well as potential the “new-CEO discount,” Jacobs Solutions’ stock price is low (75%) relative to its 52-week top. The company operates somewhat as an aggregator of smaller contractors-efficiently integrating the expertise of the people from those various companies may present issues.

Capital appreciation investors may well experience upside at Jacobs’ current stock lows; however, due to its nature as a government contractor, the uncertainties of the business do not offer a clear line of sight to increasing profitability other than by acquisition.

Yet acquisitions, like Jacobs’ acquisition of a 65% interest in PA Consulting, is no panacea, as today’s UK government spending limitations demonstrate.

Particularly in an environment in which investors need to see larger planned returns of capital, I am changing my rating on Jacobs Solutions from “buy” to “hold.”

jacobs.com

Be the first to comment