Bet_Noire

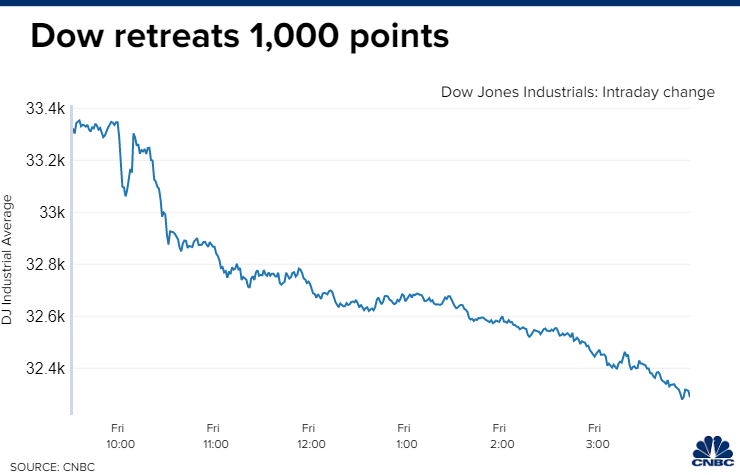

Last week’s highly anticipated speech from Chairman Powell led to a major sell-off in stocks on Friday, which carried into yesterday’s trading day. The Dow lost more than 1,000 points, while the Nasdaq Composite and S&P 500 both shed more than 3%. Interest rates rose across the curve with 2-year Treasury yields hitting their highs for the year and 10-year yields climbing back above 3%. As a result, the dollar soared to a fresh 20-year high. Monday brought more losses but less volatility on a very light news day. What was the catalyst in Powell’s Jackson Hole speech to send risk asset prices reeling? In my view, nothing at all. Jackson Hole was a great excuse for a much needed pullback from technical resistance after a huge two-month run up from the June bear-market lows.

Finviz

There was nothing new in the relatively succinct delivery from the Chairman, who asserted that short-term rates may need to stay high for some time in order to bring the inflation rate back to target. Powell did not commit to a specific size of rate increase in September, other than to say that an “unusually large” increase could be appropriate, but that it would depend on the incoming data between now and then. He insisted that the Fed will remain data dependent. Perhaps an overzealous consensus was expecting him to reference a “pivot” in policy at some point next year, but that’s absurd when we are just starting to see the deflationary impacts of policy tightening.

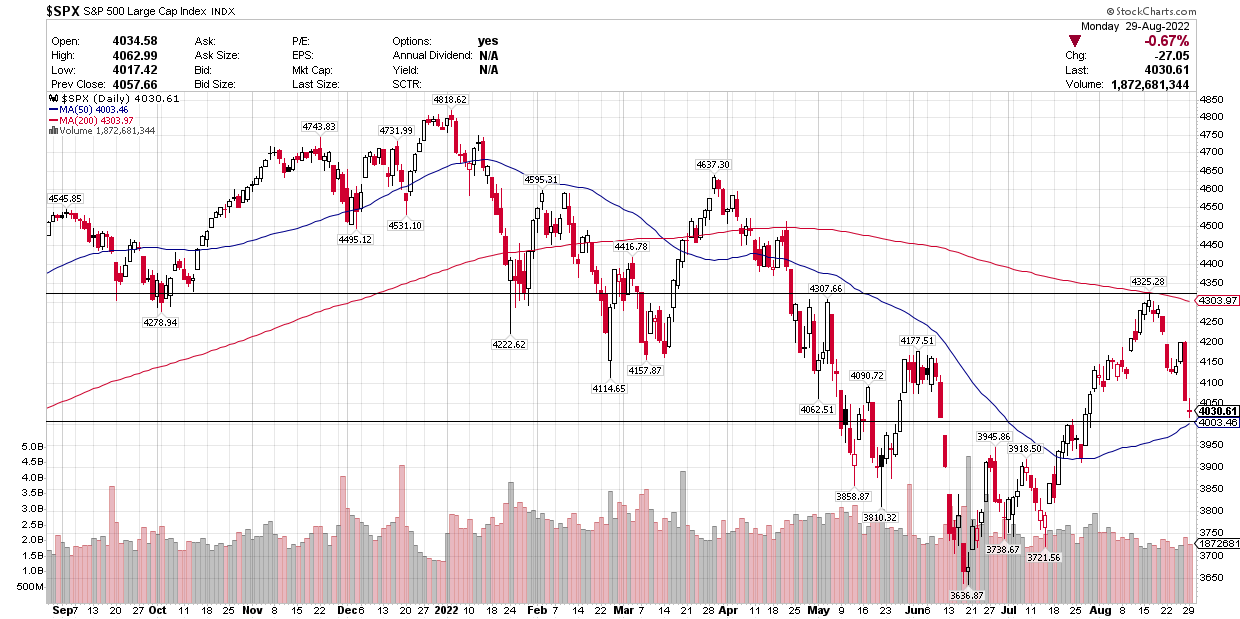

CNBC

Furthermore, the rekindling of animal spirits that was starting to show up in meme stocks, as well as the speed, breadth, and size of the rally in the stock market from the bear-market lows, surely encouraged Powell to lean against further speculation. Several Fed President’s had already started to jawbone the market lower in the days leading up to the speech. Therefore, the pullback that ensued after the S&P 500 ran into significant overhead resistance at its 200-day moving average came as no surprise. What is surprising is how quickly we fell to near-term support at the 50-day moving average, which was my target.

Stockcharts

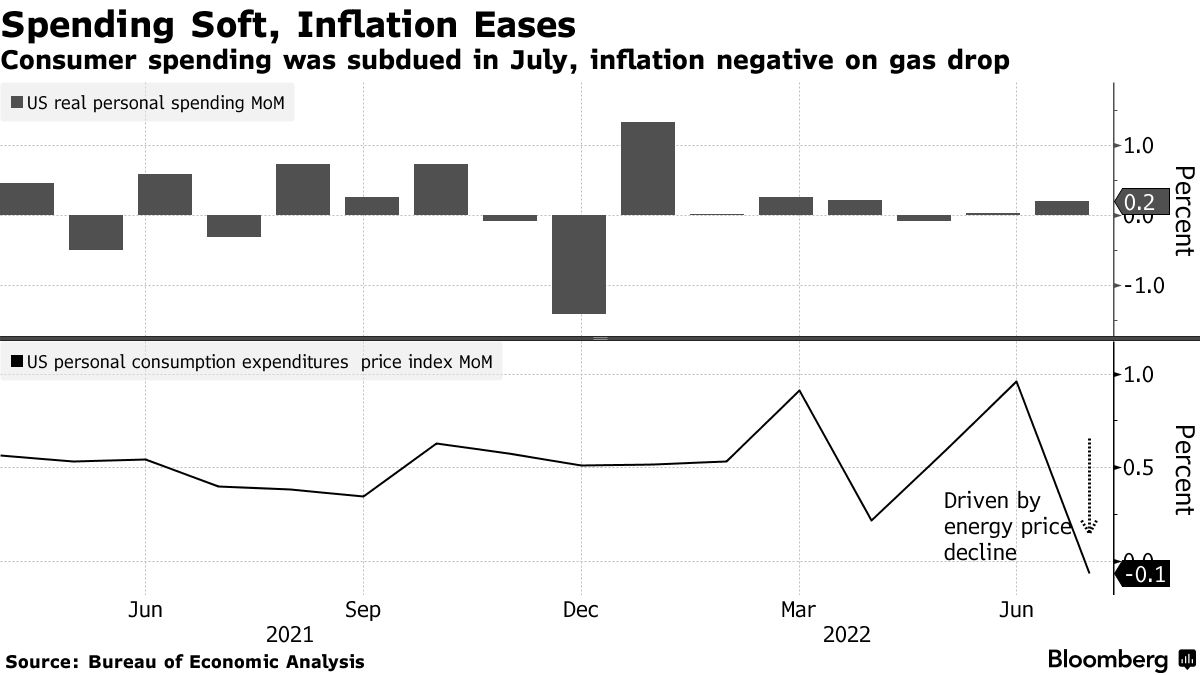

Investors were so panicked by Powell’s stern tone that they ignored another step in the right direction on the inflation front. The Fed’s preferred method of measuring inflation fell for the first time since the start of the pandemic in 2020. The personal consumption expenditures price index (PCE) fell 0.1% last month to an annualized 6.3%, while the core rate excluding food and energy decelerated to 4.6%. Meanwhile, consumer spending rose by an inflation-adjusted 0.2%.

Bloomberg

All of these numbers were spun negatively by the consensus. The rate of inflation fell, but not by much, and it isn’t close to the Fed’s target of 2%. Consumer spending didn’t rise as much as the 0.4% expected, which suggests that the economy could contract again in the third quarter. I think this is ridiculous. Both sets of figures reflect forward progress.

We want to see demand in the economy, which is fueled by consumer spending, slow to a snail’s pace. That is what will help bring down the rate of price increases. At the same time, we don’t want to see demand contract to the point that it results in a recession. I say that July’s 0.2% increase was just about right.

The rate of inflation is not going to fall to 2% overnight. It is the rate of change in the number and its direction that matters most to the Fed and markets. Both are moving in the right direction with a significant lag to tightening monetary policy conditions, as expected. The Fed has no clue how much it will have to tighten moving forward to meet its target inflation rate, which is why it can’t possibly suggest when it might “pivot” on policy. Chairman Powell learned this lesson one year ago.

During his Jackson Hole speech last summer, he indicated that policy was well positioned. That policy was a near-zero Fed funds rate. Today the rate is 2.25%. Therefore, when he said on Friday that interest rates are likely to stay higher for longer, I am ignoring him. All he is doing is halting the loosening of financial conditions that resulted from the rally in risk assets over the past two months, which is a smart move. Otherwise, he will focus on the incoming data with the understanding that the final rate hike will come well in advance of the inflation rate falling to the Fed’s target of approximately 2%. This is because monetary policy works with a lag. I still see short-term rates peaking before year end at 3-3.25%.

Friday’s jobs report and the next Consumer Price Index report for the month of August will be critical to the data-dependent Fed’s next policy rate decision. I expect to see some softening in the labor market and more progress on bringing down the rate of inflation. Both should result in a 50-basis-point rate increase by the Fed at its September meeting and support the major market indexes well above their bear-market lows.

Be the first to comment