ablokhin

J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) is one of the largest surface transportation, delivery, and logistic companies in North America who operates in five business segments: Intermodal (“JBI”); Dedicated Contract Services (“DCS”); Integrated Capacity Solutions (“ICS”); Final Mile Services (“FMS”); and Truckload (“JBT”).

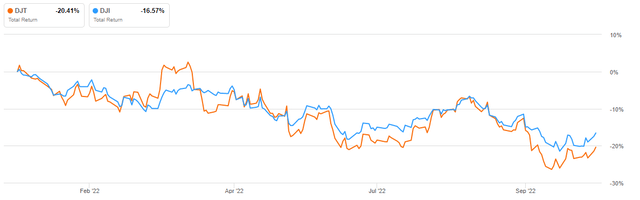

The company is a freight bellwether that is a component of the Dow Jones Transportation Average (“DJT”), a predictive index that is sometimes used to assess the direction of the economy based on its performance against the standard Dow 30 (“DJIA”). Historically, declines in transportation stocks are indicative of lower demand for goods, materials, and travel. Divergence between these two indexes, therefore, would be suggestive of a change in economic conditions ahead.

YTD, the DJT has lagged the DJIA by about 385 basis points (“bps”), with more of a divergence in recent months due to FedEx Corp.’s (FDX) 20% decline in September following their warning in package deliveries.

Seeking Alpha – YTD Returns Of The DJT Index Versus The DJIA

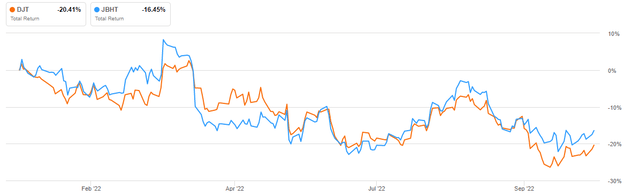

JBHT, however, has held up better compared to the DJT and has essentially performed in-line with the DJIA on a YTD basis.

Seeking Alpha – YTD Returns Of JBHT Compared To The DJT Index

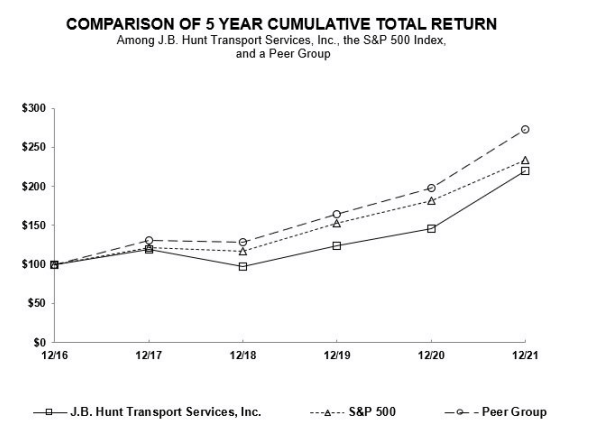

But over the past five years prior to 2022, JBHT has lagged both their peer group, which includes rail and other trucking companies, and the broader S&P 500 Index, though this performance gap has narrowed in recent periods.

2021 Form 10-K – 5-Yr Total Returns Of JBHT Compared To Their Peer Group And The Broader S&P 500 Index

Presently, shares are trading off their 52-week lows at a forward multiple of earnings of 17.4x. And following their Q3FY22 earnings release, the stock was boosted higher by about 3% in the after-hours session after posting results that came in ahead of estimates.

The company is a leader in the intermodal freight market and has a strong dedicated transportation service offering with a strong financial track record. However, while it may be a strong core portfolio holding for many, clouds ahead warrant an increased level of caution.

JBHT Q3FY22 Earnings Recap

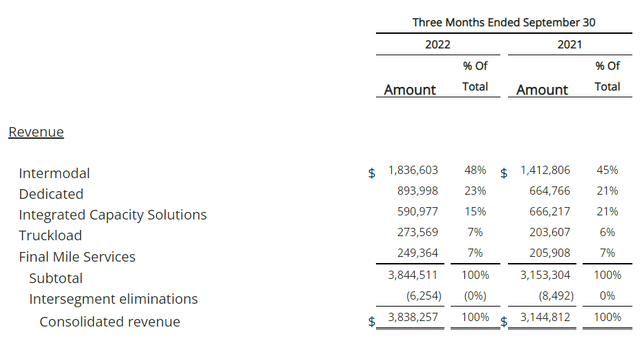

JBHT reported total consolidated revenues of +$3.8B in Q3FY22. This was up 22% compared to the same period last year and 12% when excluding fuel surcharge revenue. The JBI and DCS segments, who collectively account for approximately 70% of total revenues, were the primary drivers of the YOY increase, with revenue per load up 17% in the JBI segment and average revenue producing trucks up 18% in DCS.

Q3FY22 Earnings Release – Total Quarterly Revenues By Operating Segment

Consolidated operating income also came in higher, up over 30% YOY and 2.6% sequentially, with margins holding strong at about 9.4%, which is over 100bps greater than last year due to higher customer rate and cost recovery efforts and volume specific to their DCS, JBI, and JBT segments. These gains were partially offset by higher transportation and labor recruitment costs, as well as network inefficiencies driven by rail velocity challenges, particularly in September during the rail labor talks.

In the individual business units, strength was highlighted by their JBI, DCS, and JBT segments, who each posted revenue and operating income growth of over 30%. The FMS unit complemented these gains with 20% revenue growth of their own.

ICS, however, weighed on results with reported declines in both revenues and operating income due to lower volumes and revenue per load in their transactional business. Despite the declines, gross profit margins in this segment increased to 14.3% in the current period from 12% prior, resulting in an overall 5.9% YOY increase in gross profit.

At period end, the balance sheet remained well capitalized with net debt still below target leverage levels of 1.0x trailing 12 months EBITDA and a liquidity position that includes +$84M in cash and equivalents and availability on their +$750M revolving credit facility. Net CapEx is also up to +$1.0B YTD, though management does expect to fall short of their +$1.5B plan for the year.

Post-Earnings Insights

JBHT continues to post strong top line results in a challenging operating market. This is being led by their two largest segments, JBI and DCS, who are both producing strong gains in revenue per load and average revenue producing trucks, respectively.

While the rail labor talks in September impacted intermodal volumes, it did not leave any lasting repercussions other than a negative 2% volume impact during the month. Velocity in October has since rebounded from the weaker levels in the month prior.

While labor developments have been positive, recruiting and retention continues to be performed at elevated cost, which is impacting overall margins. Furthermore, a newly proposed rule that would make it easier to reclassify workers out of the independent contractor category could significantly impact JBHT due to the negative implications for their payroll-related costs and liabilities.

In addition, equipment availability for growth and replacement continues to be constrained. This is resulting in additional maintenance costs on older assets over those that are already being incurred on their newer fleet, which has experienced about six straight quarters of growth and is running well above their long-term guidance of 1,000 to 1,200 trucks per year.

Unavailability of equipment is perhaps one reason management is not expecting to hit their CapEx target for the year. The shortfall in CapEx could also be a sign of moderation in the months ahead. Already, management has warned of a dampened holiday shipping season, noting that the peak season doesn’t appear to be much of an event this year.

With inventory stacking up at retailers, measures of shipping demand are declining and freight rates are falling, particularly in truck spot rates. This is resulting in a pullback in capacity, as evidenced in the company’s brokerage business, which was down 11% in the third quarter on an 8% decline in volume. Noted moderation in sales activity in their final mile segment is further reason for heightened awareness on broader demand trends and economic activity.

At 17.4x, JBHT does trade at a discount from their five-year average of 21.5x. And despite trading at a premium to the S&P 500, which currently trades at around 15.9x, the spread is narrower than historical averages.

Though upside exists in the shares, the near-medium term outlook appears challenging, especially with a Q4 that may disappoint depending on the outcome of the holiday season, which appears muted at this point. For long-time investors, JBHT remains fit as a core transportation holding. The road ahead, however, may be too bumpy to add any further to the portfolio cargo.

Be the first to comment