kanawatvector

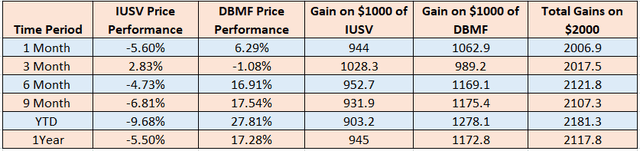

The market can be pretty cruel at times, even for value investors who choose their stocks with due diligence by giving key consideration to factors like profitability and cash flow. Hence, the iShares Core S&P U.S. Value ETF (NASDAQ:IUSV) which as its very name suggests provides exposure to companies that are undervalued relative to the broader market been down by more than 5% during the last year as shown in the blue chart below.

Comparison of Price Performances: IUSV and DBMF (seekingalpha.com)

On the other hand, the iMGP DBi Managed Futures Strategy ETF (NYSEARCA:DBMF) is up by more than 15% and as seen by the trajectory of the orange chart moves in the opposite direction to the blue one. This price action is referred to as an inverse correlation, which this thesis makes use of to make an investment case for hedging IUSV with DBMF.

First, I provide some insights into the iShares ETF, together with the reasons it needs to be hedged.

IUSV, a Value ETF

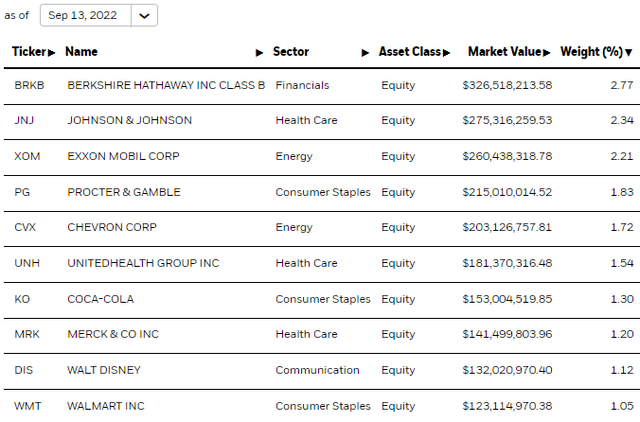

The iShares ETF or its more popular peer SPDR Portfolio S&P 500 Value ETF (SPYV) provides exposure to a broad range of U.S stocks, which, according to their fund managers are deemed to be undervalued relative to comparable companies. For illustration purposes, IUSV’s top ten holdings by weight, out of the total of 741 are shown in the table below.

IUSV Top Ten Holdings (blackrock.com)

Many choose this ETF because of its low fees of only 0.04% plus the fact that it provides dividends at a yield of 2.16%, paid on a quarterly basis. This is not much when considering that there are many 4-5% yielders out there, but for those who do not have time to go through the lengthy selection process necessitated by value stocks, the ETF option is better than parking your money in a bank to earn less than 1% interest rates on savings.

However, this is a market like no other, with the inflation level reaching record highs and the Federal Reserve using both interest rate and quantitative tightening to drain liquidity out of the monetary system. In these circumstances, the buy-and-hold strategies which have held up so well for the last ten years may not be sufficient to protect one’s portfolio against downsides. To make my point is IUSV’s chart above, which, after holding up until February this year, has started to pursue a net downtrend from March. This is also the case for other value ETFs when looking at their six-month performances.

Now, in my quest to find portfolio hedging mechanisms, I recently covered the Direxion Auspice Broad Commodity Strategy ETF (COM) which, by the way, has suffered much less than value ETFs during the last month. With this thesis, I evolve towards futures contracts, namely through DBMF.

The rationale for Hedging with a futures ETF

This is a managed futures ETF that was launched in May 2019 and its issuer Dynamic Beta investments (“DBi”) has grown the underlying fund into becoming one with $653 million of assets under management.

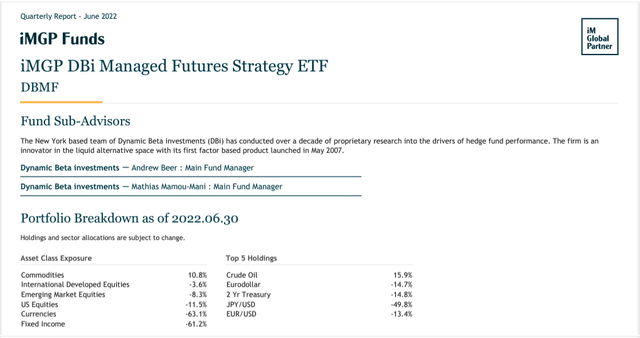

Its objective is to look for diversification across a number of asset classes, namely commodities, equities, currencies, and fixed income as shown in the extract below. DBMF also trades currency pairs through highly liquid U.S-based future contracts.

Key Facts and holdings (imgpfunds.com)

In addition to providing protection, the ETF also seeks long-term capital appreciation by tracking the largest commodity trading advisor hedge funds by asset size. Moreover, as shown by the top five holdings above, the strategy consisting of being long crude oil and the U.S. dollar, while shorting treasuries seems to be working well. In fact, it is working so well that despite the current high inflation environment, it has delivered more than 27% gains since the start of 2022, while IUSV is down by nearly three times as much.

On the cautionary side, as shown by the three-year performance chart below which includes the Spring 2020 market crash, DBMF in blue has underperformed IUSV during certain periods of time. These were the periods that the vast majority of investors have been perceiving as “normal” market conditions since 2008/2009, with deflation, low-interest rates, and a monetary system flush with liquidity. These were the best financial conditions for risk assets like equities and even bonds, but, conversely, not for DBMF.

Therefore, this is an ETF for “abnormal” circumstances and as such, it performs best when the most improbable scenarios occur, with high inflation just being one of them. In other words, it becomes useful when you need it the most (like during the March 2020 market crash) and this is the reason for which I recommend it as a portfolio hedging strategy to be used with value stocks.

On the other hand, if inflation happens to moderate, Russia sends more natural gas to Europe, or there is a deflationary scenario involving a general decrease in price levels, DBMF may suffer from a downside. Such an event may also happen if the Federal Reserve suddenly turns dovish in case recession fears start to outweigh inflation concerns.

Therefore, there are risks when using DBMF for hedging.

The Risks

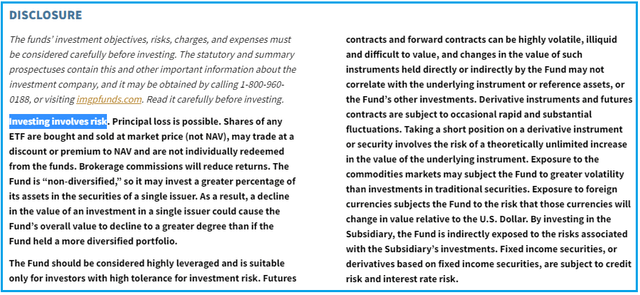

DBMF’s futures contracts are about being long and short across commodity, fixed income, currency, and equities. These financial instruments are used to anticipate future variations of an underlying asset like currency, stock, commodity, etc. This implies that the fund managers buy or sell a determined quantity of the assets, on a given date with an expiry time, and at a price known in advance. Thus, futures can be viewed as speculative, especially when associated with hedge funds.

Disclosure from the fund managers (imgpfunds.com)

Moreover, for those who are used to trading stocks at a bid and ask price, a futures contract is somewhat different as it constitutes more of a firm commitment, to be executed on its due date by both parties at an agreed price.

This can become a complicated strategy to implement for an individual investor as it entails the use of predictive models, having to be highly dynamic in the management of the portfolio, and using tactical positioning. In the case of DBMF, it uses an optimized portfolio turnover strategy through weekly rebalancing, with the fund managers at DBi also adopting some of the practices used by hedge fund managers. However, prior to doing so, they have “conducted over a decade of proprietary research into the drivers of hedge fund performance”.

The results seem to be impressive as, during the first half of 2022, the ETF outperformed the SG CTA Index by 4.46%, and by 5.75% during Q2-2022 alone. For investors, the SG CTA benchmarks the daily performance of major commodity trading advisors (“CTAS”).

Another factor that has helped is the usage of the most liquid US-based futures contracts with low transaction costs. For DBMF, the fund managers charge 0.95% as fees.

However, in line with the adage that past performance does not guarantee future results, it is important to assess what lies ahead.

Discussing the Outlook

This has been a year of drastic changes, as emerging from years of low-interest rates, the market is now facing the realities of higher CPI (consumer price index) numbers, with Tuesday marking a day of reckoning for many who thought that inflation had already peaked.

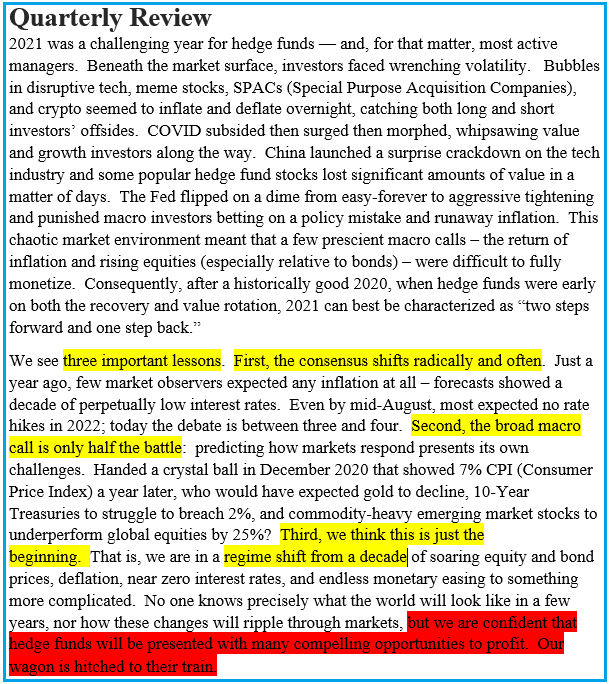

While some would like the Fed to raise interest rates by 100 basis points to tame inflation, others are warning that with the Fed rates approaching 4.5%, the market could drop by 20%. To look for guidance and rely on a strategy that has worked up till now, I consult DBi’s review for the quarter which ended in June (Q2). For this matter, the fund managers mention that “consensus shifts radically and often” as highlighted in yellow below. Their second and third points predict more upheavals in a monetary regime that has shifted drastically.

Quarterly Review (imgpfunds.com)

More importantly, as highlighted in red above, in light of all these changes, I appreciate the confidence of the fund managers, namely in “hitching their wagon to the train” of change. Therefore, the outlook is for more upheavals to come, but, DBi seems to be synchronized to these and ready to act accordingly.

Concluding with Hedging in Action

Consequently, despite its year-to-date performance of over 27%, DBMF is a buy. It offers dividends too paid on an annual basis, with the last one paid on Dec 31 2021 at a yield of 10.56%. However, as seen by the non-uniform yield history, this is no dividend ETF as it primarily looks for capital appreciation and not income.

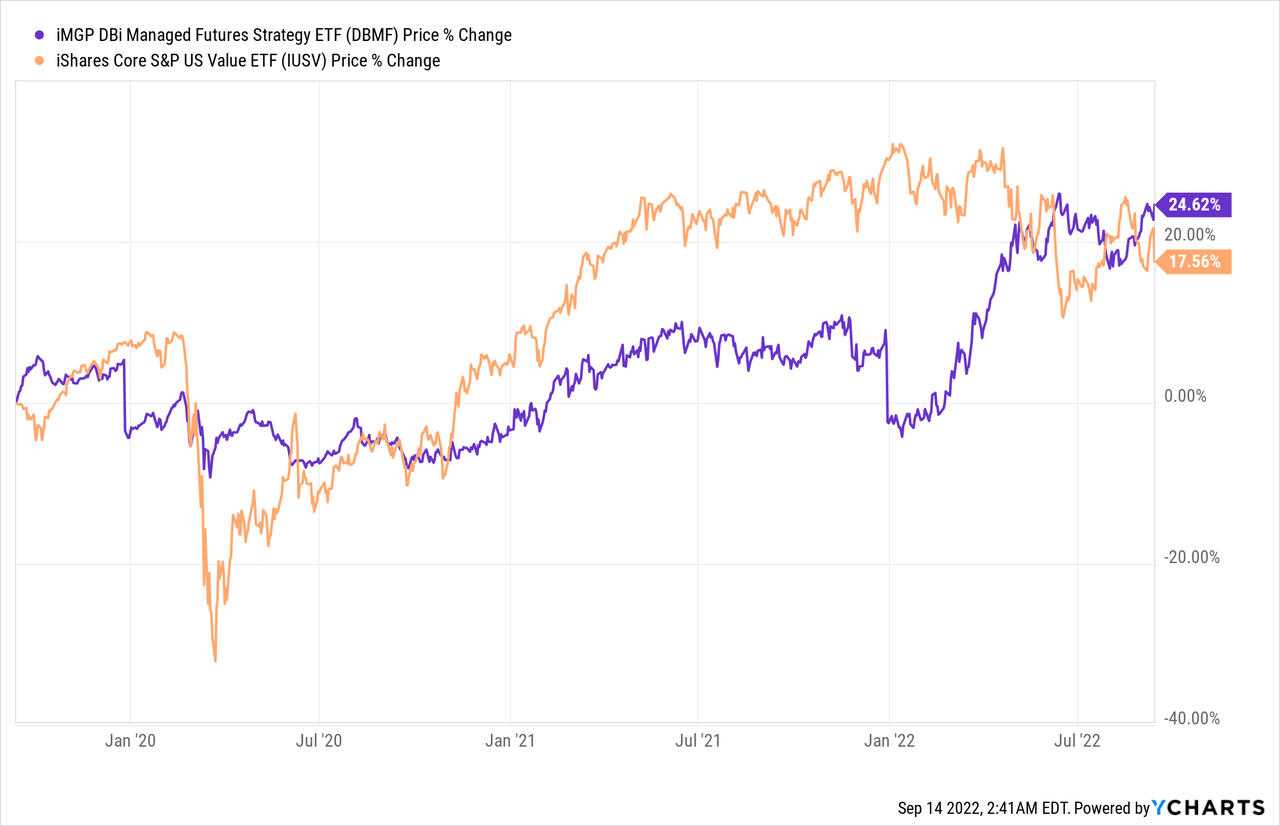

Coming back to my objective with this thesis, the table below shows the performance of a total of $2000 invested equally in IUSV and DBMF. Now, this hedging strategy delivers more than $2000 which makes it a successful one, and this, even when the futures ETF underperformed during the 3-month period.

Table built using data from (seekingalpha.com)

In this respect, I have chosen IUSV more as a representative of large- and mid-capitalization U.S. equities than the ETF to own. Consequently, investors can hold on to their value stocks, while adding shares of DBMF. This is also my intent as I do not wish to sell at a loss in view of forthcoming market pains, but, instead, look to boost the performance of my portfolio through DBMF.

Finally, in addition to cushioning IUSV, DBMF constitutes a useful alternative investment and can be used to diversify away from the classical 60:40 portfolio, while at the same time getting exposure to the commodity space. Judging by its 17% six-months gain, the futures ETF could reach $38.5 by June 2023 based on its current share price of $32.87. As for IUSV, it is better to wait for the dust to settle before buying.

Be the first to comment