Robert Way

By Valuentum Analysts

At Valuentum, we use discounted cash-flow analysis as the bedrock of our process. However, we also use relative valuation and technical and momentum indicators and blend that into an output called the Valuentum Buying Index rating, or the VBI rating. Each operating company that we follow in our universe is ranked 1 through 10 accordingly on the attractiveness of their valuation and technical/momentum indicators (10 = best).

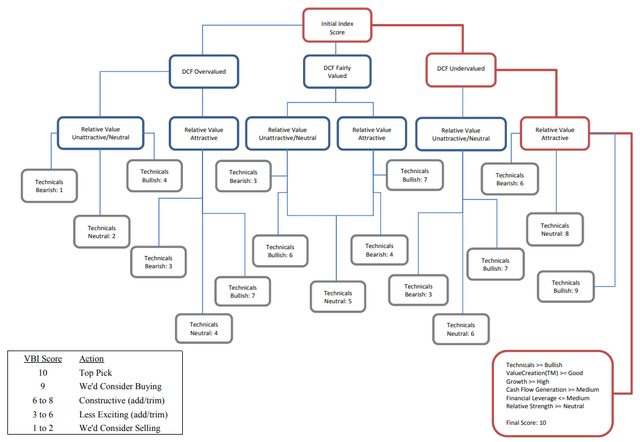

The center of the Venn diagram above, the Valuentum Buying Index (VBI) combines rigorous financial and valuation analysis with an evaluation of a firm’s technicals and momentum indicators to derive a rating between 1 and 10 for each company (10=best). Because the process factors in a technical and momentum assessment after evaluating a firm’s investment merits via a rigorous DCF and relative-value process, the VBI attempts to identify entry and exit points on what we consider to be the most undervalued stocks. (Image Source: Valuentum) The flow chart on how we rank stocks in our coverage universe. (Image Source: Valuentum)

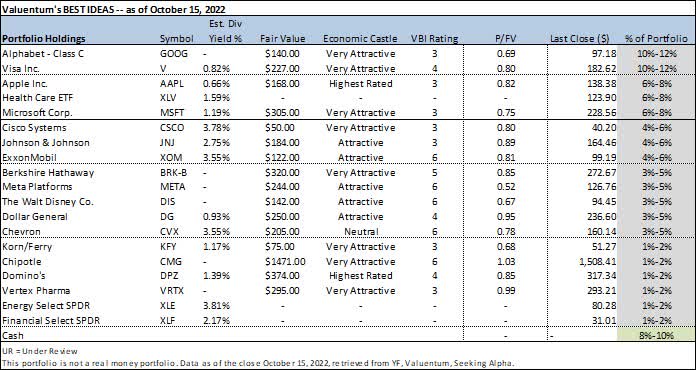

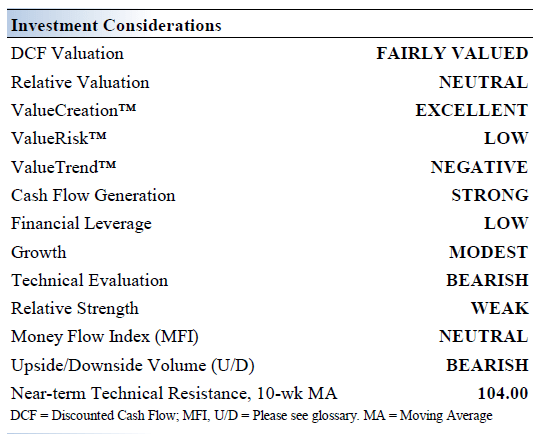

Nike’s (NYSE:NKE) currently registers a 3 on the Valuentum Buying Index on the basis of three of its key investment considerations that we’ll show in a table soon. This rating means we’re constructive on shares, but it also means we’re not as excited as other highly-rated stocks included in the simulated newsletter portfolios. We use the Valuentum Buying Index to source ideas for the simulated Best Ideas Newsletter portfolio, as shown below, for example.

Though other companies may have a similar VBI rating as that of Nike, generally to be considered for inclusion in the simulated Best Ideas Newsletter portfolio, the company must register a high rating first. Other considerations such as strong free cash flow generating capacity, a pristine net-cash rich balance sheet, as well as solid secular growth prospects and portfolio fit are very important, too.

Portfolio information as of published date in top, left corner of table above. The Best Ideas Newsletter portfolio is not a real money portfolio. Past results are not a guarantee of future performance, and actual results may differ from simulated information provided. There is substantial risk associated with investing in financial instruments. (Image Source: Valuentum)

From its namesake to Jordan Brand to Hurley to Converse, Nike is the #1 sports brand period, and we doubt any other company will come close to challenging that anytime soon. Many will try, however. Consumer preferences are still fickle, and the economy may challenge its results, but Nike’s focus on exceeding the athlete’s expectations is second to none. Nike had a nice net cash position on the books at the end of fiscal 2022.

We caution that its share repurchases compete for capital against its dividend program. Importantly for our thesis and for this article, in particular, we want to emphasize that Nike is contending with inflationary and supply chain hurdles and its leaning on its digital sales channels and ample pricing power to offset those headwinds. With the weak economic backdrop clearly stated, let’s now dig more into our fundamental, cash flow and valuation analysis of Nike.

Nike’s Key Investment Considerations

Image Source: Valuentum

Nike focuses its ‘Nike Brand’ product offerings in the following categories: Running, Basketball, Football (Soccer), Men’s Training, Women’s Training, Nike Sportswear (sports-inspired lifestyle products), Action Sports, Gold, and the Jordan Brand. The breadth and depth of its product portfolio have translated into consistently strong results.

Inflationary pressures are a major concern, and while some commodity prices have come in during the past several months, we believe that things have changed fast across the broader economic environment. Here is what we wrote in our October 7 note:

FedEx (FDX) recorded a big miss for the period ending August 31, 2022, earnings released September 16, and while this, itself, isn’t too much to worry about, the package delivery giant also withdrew its guidance for fiscal 2023. Visibility has been significantly reduced. FedEx’s stock has been hammered as a result, and while there are some firm-specific execution issues at FedEx, the implications on the broader economic environment are hard to ignore. Here’s what FedEx CEO Raj Subramaniam had to say in the press release:

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first quarter results are below our expectations. While this performance is disappointing, we are aggressively accelerating cost reduction efforts and evaluating additional measures to enhance productivity, reduce variable costs, and implement structural cost-reduction initiatives. These efforts are aligned with the strategy we outlined in June, and I remain confident in achieving our fiscal year 2025 financial targets.”

Let (us) reiterate what FedEx is saying: Things have deteriorated fast!

Readers have to remember that inflation was a big tailwind to equity returns in 2021. For example, we started getting inflationary readings on the CPI of 5% as early as May 2021, 6% as early as October 2021, and 7% as early as December 2021. The markets rallied through all of this, as we interpreted this as higher prices à higher nominal earnings à higher valuations. However, when we started seeing the food cost inflation in August of this year, that was the straw that broke the camel’s back, so to speak, especially with the rising 10-year Treasury rate as the backdrop.

In June 2017, Nike announced the launch of its Nike Consumer Direct Offense initiative, which aims to grow its digital and direct-to-consumer sales. This strategy has played a key role in supporting Nike’s sales and bottom-line performance in recent years. Digital and D2C sales support Nike’s margins. There is ample room for further upside on this front.

Nike’s immense pricing power is enabling the firm to offset inflationary headwinds seen of late, to a degree. Shifting towards a D2C distribution model and away from a wholesale model supports its margin outlook. Nike is focused on bulking up its digital operations to support its longer term growth trajectory.

We don’t expect any damages to the Nike or Jordan brands in the foreseeable future, but adidas AG (OTCQX:ADDYY) has done well in taking share in US athletic footwear. The gains have not come fully at the expense of Nike, but the strengthening rival is worth watching.

The biggest concerns we have about Nike, however, are the company’s inventory build and exposure to China. We believe the shoe-making giant may have some trouble working through inventory, and the geopolitical situation between the US-China isn’t the best at the moment, and may even escalate. Nike is a big bellwether with respect to Chinese health.

Still, Nike is targeting material revenue growth. The company’s internal long-term financial model indicates high single-digit to low double-digit revenue growth, mid-teens earnings per share growth and expanding returns on capital.

More About Nike’s Margin and Inventory Problems

Nike’s first-quarter fiscal 2023 results, released September 29, weren’t great. Though revenue edged up 10% on a currency-neutral basis, the company’s gross margin tumbled 220 basis points, leading to a 20% decline in earnings per share. Inventories at Nike also increased 44% compared to the same quarter last year.

We don’t think Nike’s margin and inventory situation bodes well for other sports/exercise-related, basketball/gym/tennis shoes and athletic/athleisure apparel names, including the likes of Peloton (PTON), Lululemon (LULU), Under Armour (UA), YETI (YETI), adidas, as well as retailers such as DICK’S Sporting Goods (DKS) and Foot Locker (FL), among others. In particular, here’s what Nike had to say about the pressure on margins:

Gross margin decreased 220 basis points to 44.3 percent, primarily driven by elevated freight and logistics costs, lower margins in our NIKE Direct business driven by higher markdowns, and unfavorable changes in net foreign currency exchange rates, including hedges, partially offset by strategic pricing actions. The overall decrease in margins was primarily driven by North America, which took measures to liquidate excess inventory through NIKE Direct markdowns and wholesale marketplace actions.

Nike is a bellwether for the health of the Chinese market, too. As we outlined in this video here, from our perspective, China’s outlook is bleak, due in part to worsening mortgage market conditions and geopolitical uncertainty stemming from its relations with the U.S., not only as it relates to China-listed ADRs such as Alibaba (BABA) and Baidu (BIDU), but also as it relates to Taiwan (EWT). Here’s what Nike’s CFO Matthew Friend had to say about operations in China on its conference call transcript:

Next, I’ll provide some color around our results in Greater China. In Q1, revenue declined 13% on a currency-neutral basis, and EBIT declined 23% on a reported basis. NIKE Direct declined 2% on a currency-neutral basis with a 5% decline in NIKE Digital. While COVID-related disruption had meaningful impact on store operations and retail traffic, business performance and inventory management are ahead of plan as we continue to proactively recalibrate supply and demand.

Nike’s share price has been roughly cut in half this year, and its fundamental backdrop speaks of a serious impending global recession, in our view. Weak revenue performance, lower gross margins, bloated inventory, and significant troubles in China suggest even tougher times are ahead.

Nike’s Cash Flow Valuation Analysis

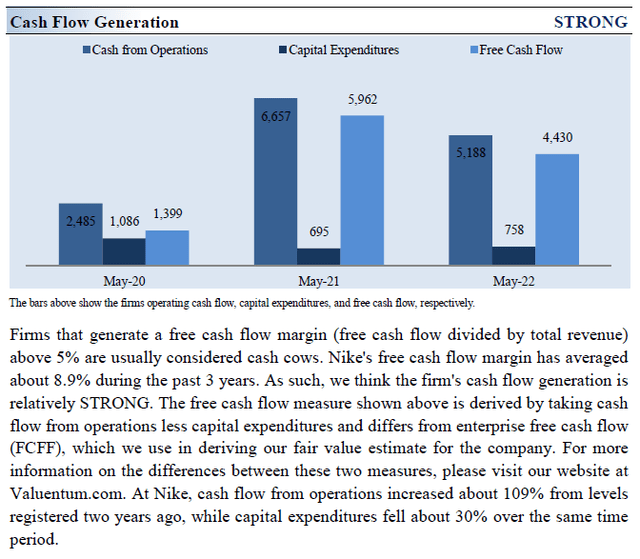

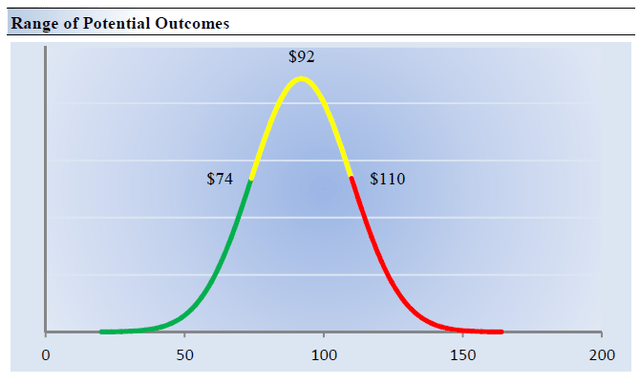

We think Nike is worth $92 per share with a fair value range of $74.00 – $110.00. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk™ rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 6.3% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 6.1%.

Our model reflects a 5-year projected average operating margin of 15.5%, which is above Nike’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 3.6% for the next 15 years and 3% in perpetuity. For Nike, we use a 7.9% weighted average cost of capital to discount future free cash flows.

Nike’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Nike’s fair value at about $92 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Nike. We think the firm is attractive below $74 per share (the green line), but quite expensive above $110 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Very few other companies, if any other, have built such deep, personal connections with the consumer as Nike has, let alone the tremendous brand strength, and its endorsement deal with LeBron James gives it yet another top-notch globally marketable superstar. Nike’s annual free cash flows averaged ~$3.9 billion from fiscal 2020-2022, versus its ~$1.8 billion in dividend obligations in fiscal 2022, and it had a net cash position on the books at the end of fiscal 2022. The sustained strength seen at its digital and direct-to-consumer operations supports Nike’s outlook.

That said, while Nike’s Dividend Cushion ratio is impressive, its yield is relatively modest. The company is a not included in any of the simulated newsletter portfolios, and we’d be cautious on it as well as the broader retailing industry as the U.S. enters what could be a deep recession in 2023. Inventory issues, margin pressures, weakness and China, and a generally squeezed U.S. consumer may continue to weigh on shares.

Be the first to comment