jetcityimage

Prior to the market opening on October 25th of this year, the management team at industrial conglomerate General Electric (NYSE:GE) is expected to release financial results covering the third quarter of the company’s 2022 fiscal year. Leading into that time, investors who are either owners of the stock or looking to potentially buy the stock should pay close attention to a variety of metrics that, collectively, should prove to be a good barometer of the company’s fundamental health. Given current economic conditions, it wouldn’t be surprising to see some weakness in some parts of the farm. But so long as the big picture data remains intact, the company still should remain a ‘strong buy’ prospect at this time.

Keep an eye out on debt and cash flows

Nobody will deny that the past few years have been truly transformational for General Electric. Management, for better or worse, has divested of a number of assets aimed at reducing leverage and allowing the company to focus on its core competencies. Unfortunately, this process is not yet complete. This will only be done after two major spin-offs occur, one next year and another in 2024. But in the meantime, management does seem to be focused on continuing to pay down debt.

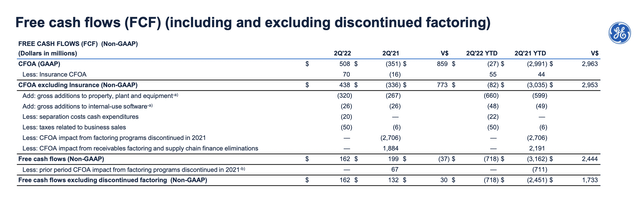

So good is the debt picture for the company that total net leverage as of the end of the company’s second quarter this year came in at $12.58 billion. And this is if we ignore $36.20 billion worth of long-term investment securities that are on its books. Of course, given this inflationary environment, it’s unclear what kind of cash flow the company will generate. In the first half of this year as a whole, the company did generate operating cash flow of $449 million. Though if we were to adjust for changes in working capital, this would have risen to $1.05 billion. Compared to a year earlier though, results were noticeably worse. In the first half of the 2021 fiscal year, operating cash flow was $1.04 billion, while the adjusted figure was just under $1.50 billion. But it’s not even operating cash flow that will determine whether or not the company is able to continue reducing debt or will see a debt increase. A better measure of that would be free cash flow. And in the first half of this year, General Electric reported free cash flow that was negative to the tune of $718 million.

It is possible that the second-half of this year will prove to be more painful for the company. In its second quarter earnings release, for instance, the firm did say that inflationary pressures were already a bit of a problem. Under the Healthcare operations of the company, for instance, operating margins fell by three percentage points. But not every segment of the company suffered in this regard. The real winner in the second quarter of this year happened to be the Aviation segment, with margins rising by 14.7% year over year. The cash flow picture could also be worsened by the fact that management is expecting to push out around $1 billion worth of free cash flow that was originally planned for this year into 2023 due to the timing of working capital dynamics aimed at serving customers and because of orders associated with the Renewable Energy segment.

Watch key segments

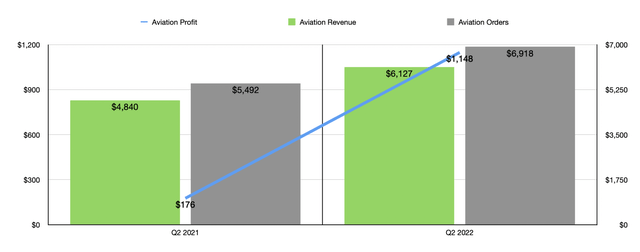

So far, we have taken a rather comprehensive view of the company. But it’s also important for investors to pay attention to particular operating segments. At top of mind for me comes the Aviation segment. This is the true cash cow of the enterprise, even though it has faced some pressure recently. If the most recent data available is any indicator of how this segment will perform, then investors should be rather bullish. In the second quarter of this year, for instance, the unit reported revenue of $6.13 billion and profits of $1.15 billion. This was up from the $4.84 billion in revenue experienced during the second quarter of 2021 and the paltry $176 million in profits experienced the same time that year.

Author – SEC EDGAR Data Author – SEC EDGAR Data

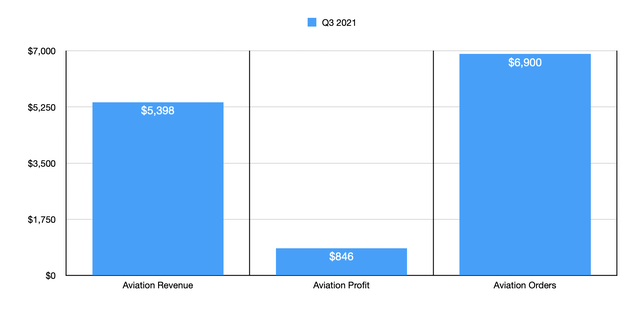

As a leading indicator, orders were also higher, climbing from $5.49 billion in the second quarter of 2021 to $6.92 billion in the second quarter of this year as the decline of COVID-19 has resulted in increased travel across the globe. Investors should definitely be paying attention to revenue, profits, and orders for the segment. For context, segment revenue in the third quarter of 2021 came in at $5.40 billion. Profits were $846 million, while total backlog was $122.75 billion. Any sort of weakening in any of these metrics could prove problematic. But I suspect the company will do just fine on this front.

Author – SEC EDGAR Data Author – SEC EDGAR Data

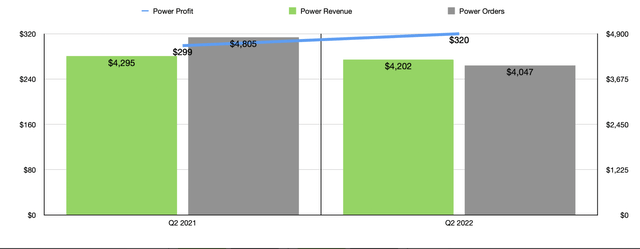

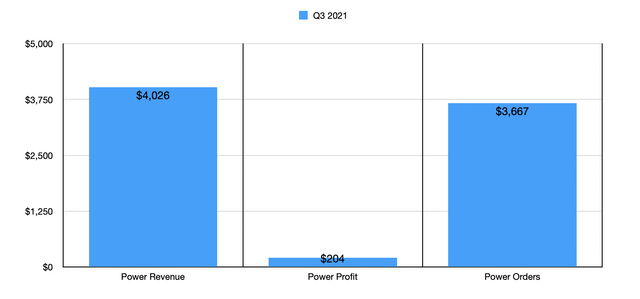

Less certain would be the performance of the company’s Power segment. In the second quarter of this year, that unit generated revenue of $4.20 billion. That was down from the nearly $4.30 billion reported one year earlier. The unit also suffered from a rather significant decline in orders, with the figure dropping from $4.81 billion in the second quarter of 2021 to $4.05 billion the same time this year. At the same time, however, the company did see its profits increase nicely, climbing from $299 million to $320 million. This disparity between revenue and profitability largely has to do with the company’s cost-cutting initiatives. This year, the company hopes to complete at least $4 billion of its $6 billion run rate cost savings program. If this does come to fruition, investors could see bottom line results improve even in areas of the company where revenue might remain flat or decline. But given the inflationary pressures already mentioned, even this might be up in the air in the near term.

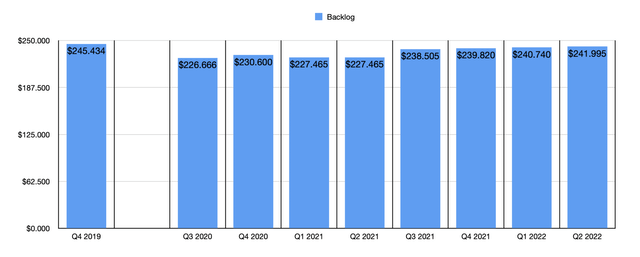

Another important metric that investors should pay attention to is backlog. Every quarter since the second quarter of 2021, management has reported a modest increase in backlog relative to the quarter before it. In the second quarter of this year, for instance, the company had around $242 billion worth. This was up from the $240.74 billion reported in the first quarter of this year. And it compared to the $227.47 billion that the company reported in the second quarter of 2021. If the economy is truly going to weaken, a decline in backlog could occur. And if so, the size of that backlog could go a long way toward determining how painful the near-term picture for the company might be.

Takeaway

In the coming days, we are going to see some interesting movements from General Electric. How the company performs will likely be determined by what data it reveals. Absent something significant taking place though, I don’t believe that the company is likely to experience long-term pain. Any downturn that might take place will likely be short-term in nature. This is because I genuinely believe that the firm is tremendously undervalued at this time. This much has been demonstrated in my most recent article about the company, where I discussed the valuation of the soon-to-be-spun-off healthcare operations of the enterprise. As a standalone entity, I believe it’s worth more than all of what GE is currently trading for. And at the end of the day, it would take a great deal of change for the worse to change my view of that.

Be the first to comment