All_About_Najmi

I appreciate all my readers. Let me make that clear.

Even those who leave comments essentially aligning me with global dictators. I still appreciate their feedback. Or at least I appreciate their right to give me feedback.

Sometimes, that has to suffice.

But out of my many readers who I appreciate, there are some who really stand out. And as of September 26, “Ote” falls into that elite category after this comment:

Looks to me like REITs are short-term getting hammered for rising interest rates. Causing fear of debt interest rates higher over time. Plus fear in general. I know higher debt cost offset somewhat by rising rents. My thinking: Look through current tightening cycle. Current Fed actions likely will drive recession, thus driving lower short and mid-term interest rates.

Also, Fed can’t let long rates get too high as devil’s bargain required to service huge national debt at low rates. Long-term REITs are an excellent hedge against inflation. I am still holding cash looking for real bargain prices on these three recommended blue-chip REITs, plus others. Getting closer. I can hardly wait to load up.

Thanks to Ote, I’m writing another Cash Is King article.

The first time I wrote any such thing, it was because of the 2020 crash. And today, despite the very different reasons, we’re looking at similar volatility.

(Remember, the pandemic was a health-related issue and the current selloff is an economic issue)

Which means you could be experiencing similar levels of fear.

Which means it’s time to remember what matters.

The Bears Are Roaring

Before I go any further, if you want to read the article Ote left his comment on, you can click here. Its title: “Let’s Go Shake the Magic 8 Ball.”

Pretty catchy, right?

But its point is even more enticing: to make you money even in this kind of crazy market.

I can’t tell you exactly where the major indices are while you read this. All I can do is cite how, as of Tuesday at noon, the S&P 500 was down 23% year-to-date. The Nasdaq had lost 31%. And the Dow had dropped its own 20% by Monday’s close.

So each one of them had hit official bear market territory, giving carnivores everywhere room to roar.

One of the most recent teeth-bared headlines I saw was from MoneyWise, and what a doozy it was! “‘Biggest Crash in World History’: Robert Kiyosaki Issues Another Dire Warning…“

As one word in there indicates – “another” – this isn’t the first time he’s expressed negative opinions about the stock market this year. The same goes for Carl Icahn, the legendary – very opinionated – activist investor, who told investors recently that “the worst is yet to come.”

He’s preached doom and gloom a few times before too.

Once upon a time, those opinions just weren’t popular. But people and institutions alike are piling onto the idea now.

In the end, they might be proven right. They might be proven wrong.

Or they might end up being somewhat right and somewhat wrong, as so often is the case. After all, Kiyosaki’s prediction is pretty drastic.

But one way or the other, we are in the middle of something less-than-completely-positive. And I want you to be prepared for whatever’s still to come.

Cash Is King Explained Again

As I wrote on March 19, 2020 – back when I first came up with the “Cash Is King” article concept – the first rule of real estate might be “location, location, location.” However…

… a very close second, at least when it comes to REITs [real estate investment trusts] is ‘cash is king.’ In fact, you could even say that rule No. 1 doesn’t work long-term if it doesn’t automatically align itself with rule No. 2.

That’s because REITs pay out so much cash every year. It’s the main reason why investors buy into them in the first place: the dividends they’re designed to faithfully offer.

In order to stay faithful though, they have to have enough cash on hand to cover those shareholder perks.

They also need enough cash to cover everyday business expenses such as salaries, utilities, taxes (although REITs do pay less in that regard by doling out more money to shareholders), and so many other unexpected costs.

This only makes sense. But let me continue quoting myself another minute…

For the record, when I say ‘cash,’ I don’t necessarily mean actual greenbacks being physically held in these companies’ hands. I mean, money that’s not tied up in investments. So funds that are easily available.

It’s true that those funds aren’t growing over time, unlike so many other asset types. But it’s also true that, if things go bad, nothing else works quite as well.

And guess what?

Things have definitely gone bad.

Since, to restate the obvious, we’re not looking at the most optimistic of outlooks right now…

After all, this selloff appears to be a deeper correction without the allure of free money, like we had in 2020.

My opinion on the matter is that earnings expectations will be reset for most S&P constituents in Q3-22, so perhaps there will be a little bit more pain…

And it’s in this phase, that cash is king, and the purpose for this article is to provide readers with a shopping list because we are now all bargain shoppers seeking to focus on the highest quality properties in the world.

It’s no time to be cute right now, only world-class REITs!

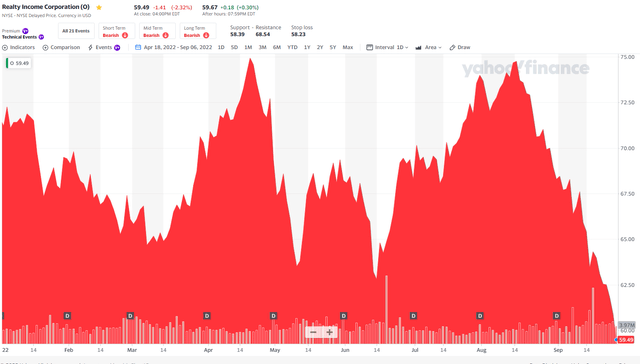

Cash Is King Pick #1: Realty Income (O)

O is an A-rated REIT with a quality score of “100”.

I have written on this REIT so many times it makes my head spin, so if you want to know more about the business model, click here or here.

Now is the time that you want to own a REIT with such a dominating cost of capital advantage, and I can assure you that this REIT is going to be very selective in this environment.

Back of the napkin, O’s cost of capital is ~6.3% and debt cost is ~5.6%, so the WACC is around 5.75%. Even in this environment, it’s important to understand that O could cut off the acquisition spigot and still grow its earnings by around 1.7% per year (annual levered rent growth).

That’s not much growth, but certainly enough to continue to grow the dividend and maintain its Dividend Aristocrat status.

But that’s hardly what I think will happen.

O is set to close on the $1.8 Billion Wynn casino (in Boston) on or before Q4-22, and given the latest STORE Capital (STOR) news, I suspect there could be more M&A activities in the near term for O.

As I pointed out to iREIT members, Spirit Realty (SRC) is the best possible target, given its portfolio composition and ridiculously cheap valuation.

However, M&A is not a catalyst, so I view it as neutral as it relates to valuation.

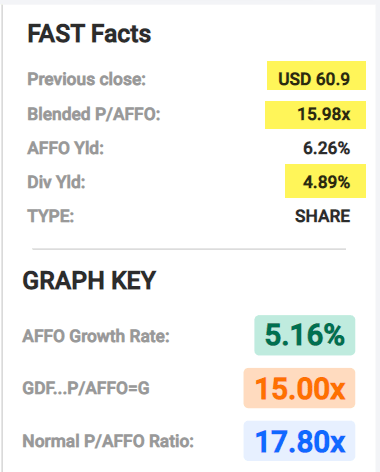

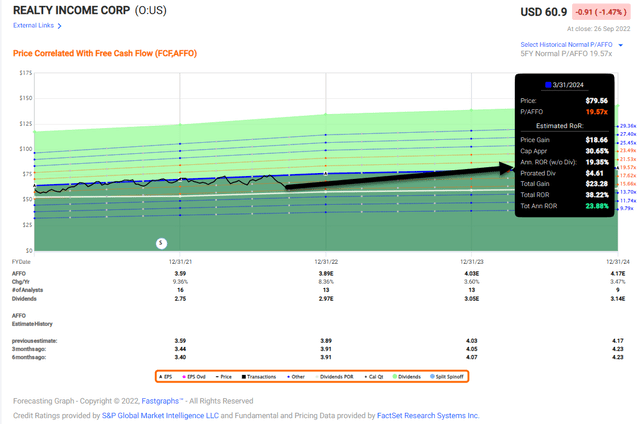

Right now O is trading at $59.49 per share with a P/AFFO multiple of 15.9x, compared with the normal P/AFFO multiple of 17.8x. The dividend yield is 4.9% and well-covered based on the payout ratio of 76%.

FAST Graphs

Shares are now trading at a 15% discount to our buy target, which translates into a Strong Buy pick. O has traditionally outperformed during recessions, and I consider this REIT a perfect pick to ride out the storm.

The company has ample access to liquidity and I’m quite confident that it will only transact accretive opportunities, regardless of market conditions.

Cash Is King Pick #2: Prologis, Inc. (PLD)

PLD is another A-rated REIT with a perfect “100” quality score.

I have also written on this industrial juggernaut on many occasions, so you can get more details here and here.

Once again, in this current setup, it’s important to accumulate shares in the bluest of the blue chips, recognizing that scale and cost of capital have advantages.

Similar to O, PLD has a “fortress” balance sheet – it has +$17 Billion of dry powder across its open-ended ventures with a weighted average interest rate of 1.8% with a weighted average term of 9.7 years.

In addition, PLD has significant embedded leases with mark-to-market that drives tangible earnings growth, so as leases continue to roll to market, the portfolio should see high-single digits net effective SSNOI for several years.

Once more, PLD is perfectly positioned to ride out the storms.

Average occupancy QTD August 2022 is up 10bps vs 2Q22 and up 120bps vs QTD August 2021, as the competition for space continues to put upward pressure on rents.

Despite headwinds related to Amazon (AMZN) and FedEx (FDX), PLD’s updates have remained positive, with rent growth a robust with +52% on new commencements.

Perhaps some negative news from AMZN and FDX (cyclical downturn with other logistics providers) in Q3 and Q4, but we believe the noise is priced into PLD shares.

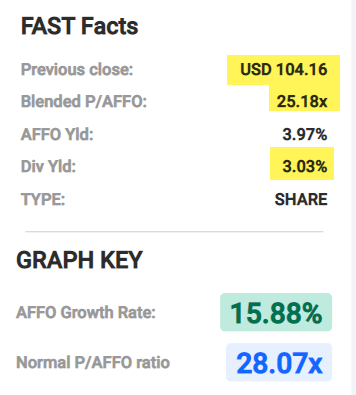

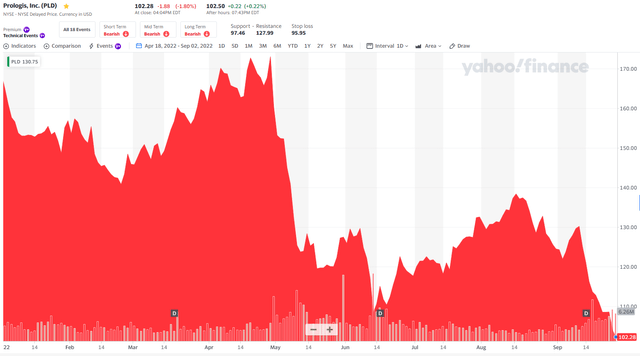

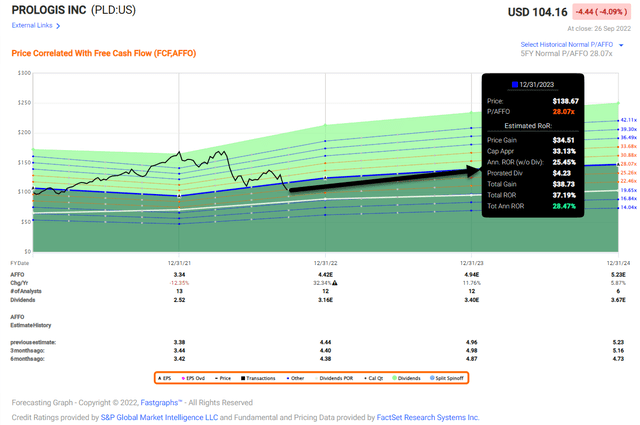

Right now PLD is trading at $102.28 with a P/AFFO of 25.2x, compared with a normal P/AFFO multiple of 28.1x. The dividend yield is 3.0% and well-covered by AFFO per share with a payout ratio of 71%.

FAST Graphs

Shares are now trading at a 30% discount to our buy target, which translates into a Strong Buy. Analysts are forecasting 32% growth in 2022 and 12% growth in 2023.

The Duke Realty (DRE) merger will should close any day will drive year one accretion by ~$275 mm and future accretion of $390 million (mostly from future development). (Once again, perhaps another page for O to consider from PLD’s playbook).

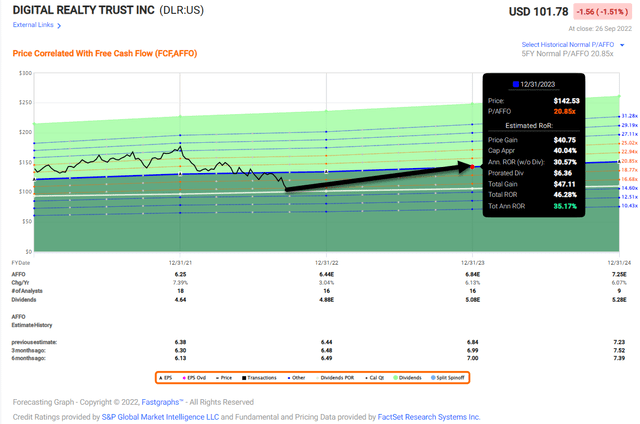

Cash Is King Pick #3: Digital Realty (DLR)

DLR is another very highly rated pick with a quality score of “90”.

I have also covered this data center REIT in significant detail, so you find some of the latest articles here and here.

I’m sure you are starting to see a pattern here with my “cash is king” picks and that common thread is that all three REITs are consolidators.

They have all been able to thrive in various market conditions because of their powerful scale advantages.

DLR’s global portfolio spans over 4,000 customers in 50 different metro areas and the company is the 8th largest publicly traded U.S. REIT.

Their extensive development experience, economies of scale, and process-based approaches to design and construction have provided significant cost savings and added value to their customers.

Another common thread for these three REITs is their balance sheet, and in the case of DLR, the company is rated BBB with a debt maturity profile that’s very well managed, and this gives another level of security for investors.

Dividend safety is also critical to the selection process and DLR has a track record of paying and growing dividends for over 15 years in a row. The payout ratio is ~75% which provides an ample buffer for future dividend increases.

Quite clearly, DLR is both recession-tested and now pandemic-tested, and considering the huge demand in data storage, there appears to be an infinite supply of opportunities.

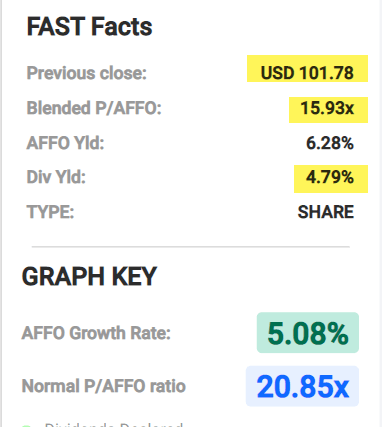

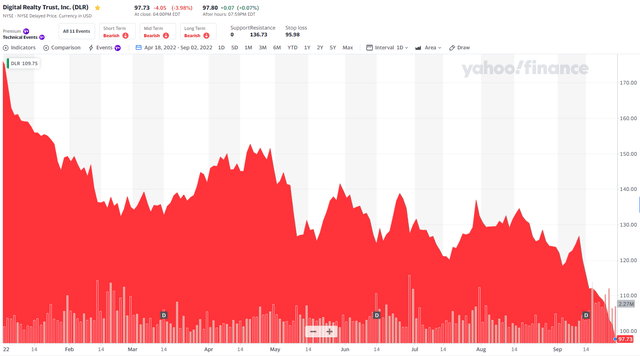

DLR shares are now trading at $97.73 with a P/AFFO multiple of 15.9x, compared with the normal P/AFFO of 20.9x. The dividend yield is 4.8% and the payout ratio is 76% (using AFFO per share).

FAST Graphs

Analysts are forecasting the company to grow AFFO per share by 6% in 2023 and in 2024, which provides added comfort and prospects for enhanced total returns.

We see tremendous competitive advantages that exist with DLR’s largest global platform of multi-tenant data center capacity featuring 170,000+ cross-connects in critical locations with proximity to industry-leading businesses exchanging data in a community of more than 4,300+ customers.

Now Is Not The Time To Be Too Cute

Let me be perfectly clear, Mr. Market always moves faster than reality.

As I said earlier, there are similarities to the Covid-19 selloff, but there are obvious differences, most importantly, the current correction does not have the same allure as the free money cycle we witnessed in 2020.

We’re entering a new phase…

You are going to see me “tighten the hatches” and focus almost exclusively on quality…

Sure, I won’t get the clicks from high-yield articles, but I will get satisfied readers who recognize that now is not the time to be too cute.

As I see it, there are some excellent opportunities to own REITs that I could have never been able to buy.

I plan to load up for my kids and my new grandkid.

I can get stocking stuffers filled up early this year, for a change.

I’ve lived through recessions before, and if there’s one thing that I can promise you about a recession, is that you do not want to own highly levered real estate.

So, you’re now seeing the blue lights flashing… and my guess is that they will be flashing for at least a quarter or two.

Be picky…

Be choosy…

Be smart…

And always focus on quality…

Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down. – Ben Graham

Be the first to comment