Annabelle Chih/Getty Images News

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) reported a 54% gain in revenue y/y for the first two months of Q3, and most likely this momentum will continue into September. TSMC benefited from a number of product launches that aligned in the quarter, but more importantly, it gained market share. Nvidia (NVDA) returned to TSMC for its Ada Lovelace RTX 40 series graphics cards. TSMC now makes everyone’s graphics processing units (GPUs), including Intel’s (INTC) newly launched ARC series. TSMC will continue to grow despite macro headwinds because it stands at the apex of a fundamental shift in the semiconductor industry from integrated device manufacturers like Intel to fabless semiconductor companies like Apple (AAPL), Nvidia, and Advanced Micro Devices (AMD).

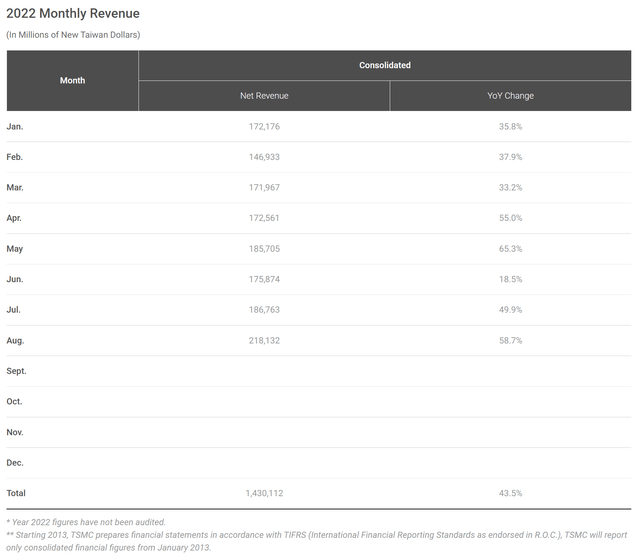

TSMC’s revenue for the first two months of Q3 is up 54% y/y

TSMC reports its revenue in NTD on a monthly basis and will typically report all three months of the quarter prior to the earnings report. This gives investors a pretty good idea of what to expect with the major uncertainty being the effective exchange rate with USD. Many of TSMC’s customers, such as Apple, pay in USD, so TSMC benefits from a strong dollar.

TSMC’s report for July and August speaks for itself:

TSMC has benefited from a number of customer launches occurring in the Fall time frame. These include Apple’s early iPhone 14 series launch, Nvidia’s launch of the RTX 40 series, AMD’s launch of the Ryzen 7000 series, and Intel’s launch of the ARC series of gaming graphics cards. All of these required productions starts months in advance of launch at TSMC with production likely continuing through Q3.

The revenue surge in Q3 is therefore somewhat the product of this coincidental timing, and depending on how its customers’ products are received, the revenue gains could very well peter out in Q4. Nevertheless, TSMC picked up important new sources of revenue in the Intel GPUs and Nvidia’s RTX 40 series. Nvidia had returned to TSMC for the 40 series after giving production of the RTX 30 series to Samsung (OTCPK:SSNLF).

A semiconductor slump? It depends where you look

After the past couple of years of semiconductor shortages, some decline in demand was probably inevitable. During its Q2 conference call, TSMC CEO C. C. Wei noted the softening of demand in consumer electronics and resultant high inventory levels. At the same time, Wei claimed that the inventory correction was not yet affecting TSMC as wafer demand overall exceeded TSMC’s ability to supply.

TSMC guided to a revenue gain of 35% for Q3 in USD at the midpoint of the guidance range, and it appears that TSMC will easily beat that. Even if revenue declines sequentially in Q4, TSMC’s full year revenue growth will probably meet Wei’s guidance of mid-30s percentage.

For some time, analysts have been beating the drum of the “semiconductor slump”. Citi analyst Christopher Danely took a bearish view of semiconductors, as reported by Asia Fund Managers in August:

Investors contemplating investing in semiconductor companies as an opportunity may want to think again, says an assessment of the sector by Citi analyst Christopher Danely. Recently, Danely observed that the market for semiconductor stocks is looking increasingly gloomy. The Russian invasion of Ukraine has dampened investor sentiment, which has exacerbated due to a likelihood of an economic recession and apprehensions over China invading Taiwan.

“It’s a den of bears out there,” Danely observed, adding that build-ups in semiconductor inventories are creating higher risks and an environment for poor rewards “if you believe a recession is coming.”

The article resonated with Danely’s bearishness, pointing to indicators of slowing semiconductor sales and demand for the month of June:

For instance, the Taiwan Semiconductor Manufacturing Company, the largest chip manufacturer globally, reported a decline in its net revenue for June 2022. On a consolidated basis, TSMC’s revenue for June 2022 was approximately NT$175.87 bn ($5.8 bn), a decrease of 5.3% from May 2022.

But as subsequent monthly revenue shows (see above), the June sequential decrease was not significant. Pointing to sequential changes in revenue almost never is meaningful for companies like TSMC whose major customer, Apple, has very large seasonal variations in revenue due to seasonal product launches like iPhone.

There’s a tendency of corporations, and semiconductor companies are no exception, to attribute downturns to macro forces rather than own up to performance issues. Thus, Intel claimed that its Q2 y/y revenue decline of 22% was mainly driven by the “sudden and rapid decline in economic activity”.

This was despite the fact that everyone knows that AMD is eating Intel’s lunch, as it reported a revenue increase of 70% y/y for Q2. And while Intel guided to a 12-17% y/y revenue decline for Q3, AMD guided to an approximately 55% y/y revenue growth.

While both IDC and Gartner reported declines in PC shipments in Q2, it’s clear that the PC slump was not uniformly distributed. Also, it may have been due in part to anticipation of the new hardware announcements that have now taken place.

At Intel’s Innovation Day keynote, CEO Pat Gelsinger announced Intel 13th Generation Core CPUs in addition to the ARC graphics cards. So, between AMD, Nvidia, and Intel, major refreshes of CPUs and GPUs for PCs have been announced, just in time for the holiday shopping season.

Apple’s Mac revenue did suffer a 10% y/y decline for the June quarter (fiscal Q3) but had been doing very well up to that point. In its fiscal Q3 conference call, Apple put most of the blame for the decline on supply constraints due to the COVID lockdowns in China. Up until fiscal Q3, Apple Silicon had been propelling Mac revenue growth with Mac revenue in the fiscal first half growing by about 20% y/y.

iPhone revenue in fiscal Q3 was roughly flat but can be expected to grow y/y for fiscal Q4 due to the early iPhone launch. Apple will likely set a revenue record for the quarter. iPhone revenue will likely decline y/y in the December quarter due to the early September launch.

In this context, Bloomberg’s report Apple Ditches iPhone Production Increase After Demand Falters should not come as any great shock:

The Cupertino, California-based electronics maker has told suppliers to pull back from efforts to increase assembly of the iPhone 14 product family by as many as 6 million units in the second half of this year, said the people, asking not to be named as the plans are not public. Instead, the company will aim to produce 90 million handsets for the period, roughly the same level as the prior year and in line with Apple’s original forecast this summer, the people said.

We should perhaps be surprised that Apple is expecting roughly the same unit sales as last year. A decline in unit sales for the December quarter was already baked in.

TSMC has been anticipating a decline in unit sales for smartphones and has said that this will be offset by the increased value of the silicon as Apple and other mobile chip designers build in more AI capability and 5G becomes more pervasive.

Nvidia’s problem appears to be mostly due to the influx of used high-end graphics cards following the Ethereum conversion to “proof-of-stake” verification of transactions, as I detailed in an article on September 16. Nvidia reported 3% y/y revenue growth for its fiscal Q2, ending in July. The steep decline in the Gaming segment of 33% can be expected to worsen in fiscal Q3, where Nvidia guided to a 17% y/y overall revenue decline.

But this is not really a semiconductor slump, and Nvidia’s Data Center segment can be expected to continue growing. The Data Center is now Nvidia’s most important business. Data Center revenue grew by 60% y/y in fiscal Q2.

CEO Jensen Huang spent most of his recent GPU Technology Conference keynote discussing Nvidia’s various data center products, including hardware, software and services. Nvidia’s flagship H100 GPU accelerator for the data center is in production and expected to ship to customers by the end of the year.

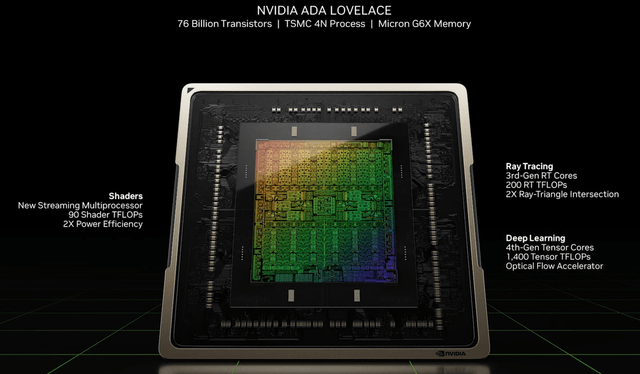

H100 strains the limits of what TSMC can build on its most advanced 5 nm process, with 80 billion transistors. During the keynote, Huang also announced Nvidia’s Ada Lovelace GPUs for consumers that are almost as big at 76 billion transistors on the same TSMC process:

Ada Lovelace GPUs will power Nvidia’s next generation RTX 40 series cards. While there’s been some criticism of Nvidia for the pricing of the cards, they represent the most technically ambitious graphics cards ever to hit the consumer market.

While the RTX 40 series doesn’t feature PCIE 5.0 as I had expected, it provides sufficient performance uplift over the previous generation that it should be largely immune to the impact of used GPU sales. There are no used GPUs that will offer anything close to 40 series ray-tracing performance for games such as Cyberpunk 2077.

N3 process node will cement TSMC’s market share gains

Overall, TSMC is thriving because its customers are thriving. And its customers are thriving in part because they represent a superior business model compared to the traditional integrated device maker (IDM) such as Intel. Leading edge silicon will continue to transition to fabless designers partnering with foundries because that’s the best way to cope with the increasing cost of shrinking integrated circuits.

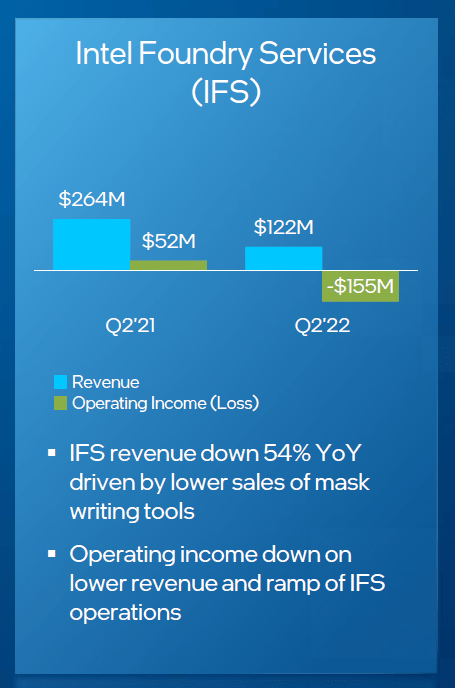

And what of Intel’s foundry ambitions? It’s very hard to take Intel seriously when they show numbers like they showed for Q2:

Intel

This looks to me like a very half-hearted effort, like the last time Intel wanted to get into the foundry business. Intel has two main problems as a foundry, neither of which it has solved. It can’t offer competitive leading node fabrication. And it can’t offer the assurance of non-competition that a pure-play foundry like TSMC can offer.

The next process node after 5 nm is 3 nm, referred to by TSMC as N3. Getting to N3 has been a long, difficult and expensive process, but TSMC should be in full production by the first half of next year. Numerous customers can be expected to embrace N3, with Apple probably first in line.

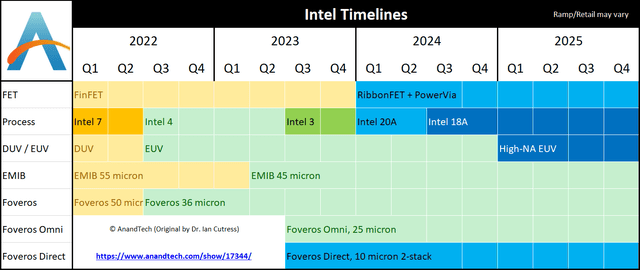

At the same time, Intel will only have its Intel 4 process in production, as shown in this chart from Anandtech:

Although the timeline shows Intel 4 starting up this year, Intel has no chips in production on the node at this time. Intel’s latest consumer chips, Raptor Lake 13th Gen Core, are still fabricated on Intel’s rebranded 10 nm process it now calls Intel 7. Intel’s latest Xeon Chips, dubbed Sapphire Rapids, are also fabricated on Intel 7. Intel’s data center GPU, Ponte Vecchio, also only uses Intel 7 for its most advanced, Intel-fabricated chiplets.

Intel 4 is Intel’s 7 nm process rebranded, and only its first process to use Extreme UV (EUV) lithography. As such, it’s couple of years behind TSMC’s 5 nm process, which was TSMC’s first to make substantial use of EUV. Apple shipped iPhone 12 with A14 Bionic processors built on the 5 nm process in October 2020.

Intel’s timeline shows Intel following up with new process nodes on a faster than Moore’s Law pace, but I’m very skeptical that Intel will be able to do better than get Intel 4 into mass production sometime next year.

Samsung will be TSMC’s main competition on 3 nm. Samsung announced in June that it had started “initial production” on its 3 nm node. Initial production does not appear to mean full mass production, as Samsung stated that it will be for “high performance, low power applications”. Samsung has plans to expand 3nm production to mobile processors.

Samsung’s announcement seemed designed to preempt TSMC, but it’s not clear whether Samsung will have mass production capability to rival TSMC next year. During the period of high GPU demand following the launch of the Ampere RTX 30 series in late 2020, Samsung seemed to strain to increase production, leaving Nvidia unable to meet demand. This almost certainly contributed to Nvidia’s decision to go with TSMC for the RTX 40 series.

Similar problems may have led Qualcomm (QCOM) to give TSMC production of its Snapdragon 8+ Gen 1 processors for premium smartphones, which the company announced in May.

As the N3 node matures and costs come down, I expect TSMC customers to migrate products to the node in the coming years. Apple will adopt it for the 2023 iPhone launch and may use it sooner for other products.

Samsung can be expected to contest the market for 3 nm, but I expect TSMC to win increased market share based on its ability to deliver high volumes of reliable parts that meet customer requirements.

Investor takeaways: buy the “slump”

I’ve been accumulating TSMC since July, and following the Bloomberg report, I couldn’t resist buying some more (along with Apple). For some time (2020-2021), I’ve felt we needed a correction in semiconductors, but we’re well past that now. I consider almost all the companies in the Rethink Technology Portfolio to be undervalued, including TSMC.

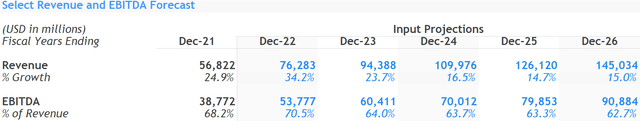

My Discounted Cash Flow model calculates a fair value of $137.40. That’s assuming that revenue growth tapers off substantially after this year, for a CAGR of only about 20%:

I fully expect TSMC to do better than the model. By virtue of its diverse customer base and technology dominance, TSMC is about as recession-resistant as it’s possible to get in semiconductors. Short of nuclear war or Chinese invasion, I don’t see anything threatening TSMC.

And either of those prospects seems increasingly remote. In my opinion, if the Ukraine war has taught us anything, it’s the superiority of Western military technology and tactics. Furthermore, Biden’s commitment to defend Taiwan appears genuine. I believe the US Navy is more than capable of turning back a Chinese invasion attempt.

Would it be better to wait until the markets hit bottom? Sure, but I don’t have a crystal ball to tell me when the bottom will be. I’m okay with buying in the current market environment as long as I’m convinced that the company is trading well below fair value, which TSMC certainly is. I remain long TSMC and rate it a Buy.

Be the first to comment