ssucsy

One stock that we believe is a paradise for traders is Palantir Technologies Inc. (NYSE:PLTR). For investors, it has been a total disaster and it is frustrating to see the lack of any kind of real rebound out of the single-digits. We continue to believe in the company long-term, but the company is not necessarily the stock.

The fact is that it is going to be a long road to real profits. That is why the market hates this stock. Further, the other key metric lines of interest like customer counts, revenues, etc., all seem to be slowing their rate of growth. This was a rapid grower just a year ago. But the world has quickly changed, and all things innovative that do not make a profit have been crushed. Folks, while all manner of financial engineering to show improved ‘cash flow’, and moderate EBITDA movement, the market does not care anymore. It wants to see a clear path to profitability. While the company has worked, or is starting to work, to rein in spending and to reduce the very dilutive stock-based compensation, the Street is assigning little faith.

Right now, even though we have outlined a possible Santa Claus rally into year end, we think that stocks like this are going to contend with heavy tax loss selling. The market as a whole has seen most who wanted to sell already sell, but for a trading stock like this, it creates further negative catalysts. If you are an investor, it is hard to not buy at $6-$7 per share. But $7 per share now is more expensive than $7 per share was just months ago, when you account for more shares, and normalization of growth. That is the problem. We continue to like trading swings on the stock long and short. As investors go, it is going to be a long road.

The path is difficult, but not impossible

Despite what has happened, we continue to like the company long-term, but Palantir stock is just not working right now. On top of the continued dilution, and now the pressure of tax loss harvesting, the company is also facing slowing commercial demand, and governments that will likely reduce spending due to lower tax revenues. Much of the world is already facing or in some cases may be in a recession. The United States has been resilient, but we suspect we see inflation coming down, and the deleterious impacts of increased pressure on consumers and businesses in this more challenging economic climate. With this reality the high level of growth seems to be grinding to a halt, and could stall further in 2023. Potential game-changing names like this that do not make real profit have all been obliterated.

A lot of traders do not realize (or do not care) that Palantir is not a new company. It has been around a long time, but became public in the height of the tech stock mania as we were coming out of COVID. The thing is that stocks like Palantir are indeed often extremely expensive in the early stages. The innovation space is unique. For a long time, the Street could not value them on an earnings basis because there are no or very little earnings. The Street looked to the future based on sales, cash flows, etc. One of the largest reasons stocks like this have been crushed, besides a ‘tough market’ is interest rates. Few have been spared. The concern is that with rates rising, money-losing stocks are out of favor. Debt becomes more expensive, and many companies will suffer. And yet, Palantir has one key advantage. It is still a money loser, though getting there toward sustained breakeven operations, but it has an incredible balance-sheet position.

No debt

For years, Palantir may lose money or hover around breakeven. $7 is a level where we like this name, with all issues baked in. It is speculative, but we like it. Operationally, we are seeing some positive signs, and some negative signs. The company is not bleeding out and losing money hand over first. In fact, Given that there is no debt at all and a ton of cash on hand ($2.4 billion), Palantir is in strong shape to weather any recessionary pressures in 2023. It should not need to borrow any money, so in many ways, the high rate issue, for now, is somewhat moot. Though if their customers rely on debt to fund contracts, then it becomes a bit of a hidden risk. However, the balance sheet is a strength. The weakness is slowing growth.

Slowing growth

One thing that has investors concerned is the slowing growth. The company had been growing like a spreading wildfire. It is still in growth mode, but the pace has stalled. In the recently reported quarter, performance was strong on the top line and actually was ahead of consensus estimates. Total revenue grew 22% year-over-year to $478 million, beating estimates by almost $3 million. That is strong. But those costs continue to weigh, and the cumulative impact of dilution is anchoring earnings potential. This is evidenced by Palantir’s profitability being lower than expected by $0.01 per share, and worse, guidance was less than consensus.

Both of Palantir’s segments, the government and commercial segments, had shown incredible growth over the years. The commercial revenue stream specifically has been growing rapidly, while government results have been slowing for several quarters now. Deceleration of revenue growth is definitely a negative for a company without earnings. That said, U.S. growth is still strong. U.S. revenue rose 31% from last year, and the company grew overall customers by 66% year-over-year. Internationally the story is weaker, and likely reflects the resilience of the U.S. economy still despite global weakness.

Government revenue was still up 20% from a year ago, while U.S. commercial revenue grew 53%. Look this is certainly strong growth. The Street is fickle however, as despite it being strong reported growth, the pace has stalled. But there are positives that we feel are masked to some degree, such as in margins. Gross margin was 77%, very strong, though operating margin a bit lower. Adjusted income from operations, excluding stock-based compensation and related employer payroll taxes was $81 million, representing an adjusted operating margin of 17%. The target is really around 20%. The company lost $62 million in the quarter operationally otherwise. Now, the company likes to boast its cash flow but it does back out a number of key metrics that while as reported they are burning more cash than may be thought, on their adjusted basis, free cash flow was $37 million for the quarter, and the 8th-straight quarter for which this was positive on the adjusted metrics. The company earned $0.01 per share, showing it is teetering around breakeven.

Valuation

On the valuation front, Palantir stock is still expensive, even though shares have been crushed.

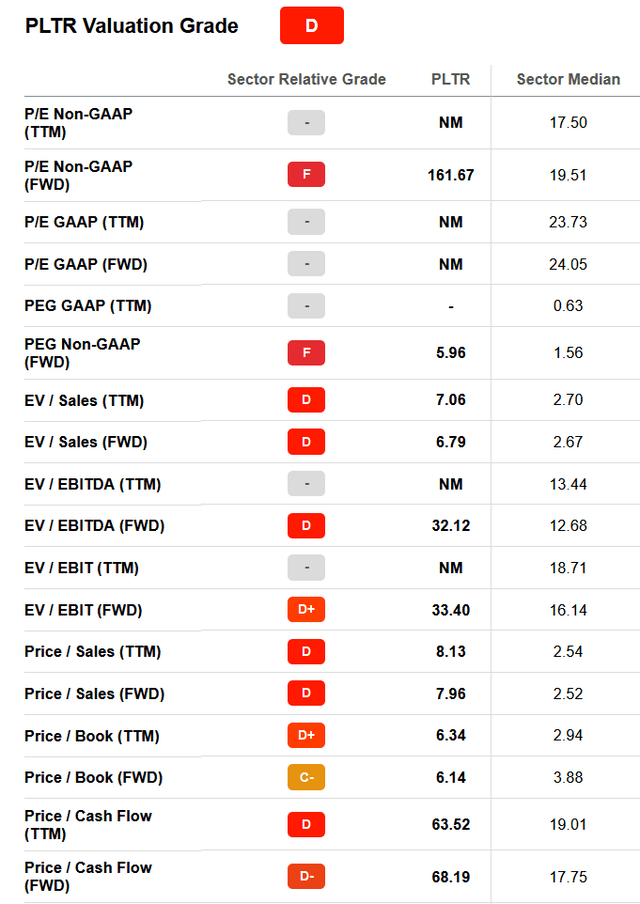

Seeking Alpha PLTR Valuation Grade

Looking at traditional price-to-earnings is foolish, showing a very pricey at 161X. Ultimately, this is what the Street will care about. For now it gets many quarters to show its potential. The Street has doubts, hence a $7 per share price tag. Perhaps the more appropriate measure is the price-to-sales ratio, but not only is this still very high, the market has basically said it is no longer willing to pay for sky high multiples. Keep that in mind. At 8X sales, the valuation has improved dramatically from where it was last year, but this is still high. The price-to-book has been improving and we are watching this as well as EV/EBIT values. Some of this stretched valuation can be justified by the still strong growth metrics.

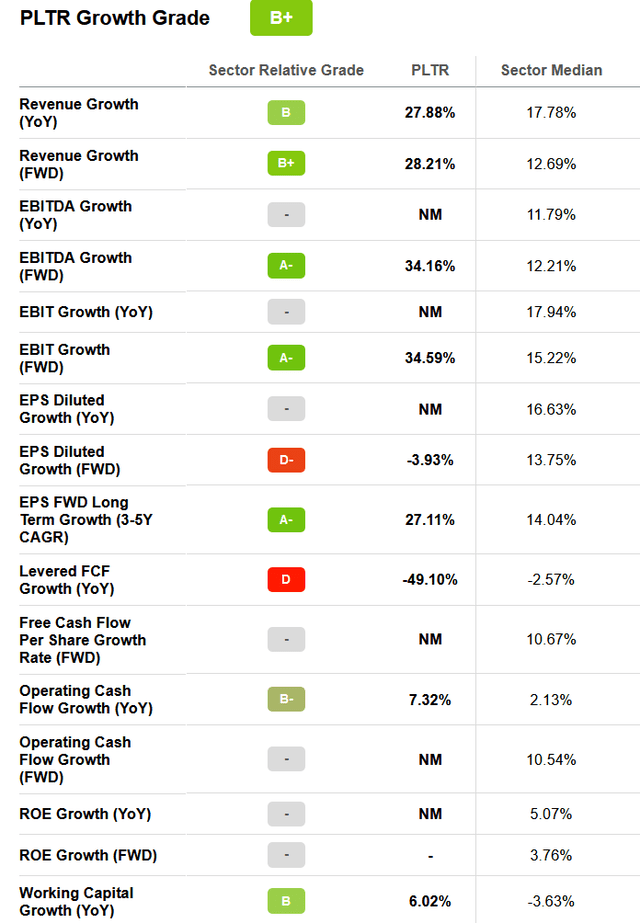

Seeking Alpha PLTR Growth Metrics

So these are still solid grades though down from the past A+ values. The performance is coming down, and that reduction, that slower growth (even though it is still strong), builds in further discounts. Rapid growth has to lead somewhere. That is the mantra.

It is a long road from translating the growth metrics into tangible value, and shareholder returns. This is why the stock is stuck in the mud in the single-digits.

Looking ahead

So as we have been trying to hammer home, the growth concerns are real. The thing is that the Q4 guidance was pretty weak relative to expectations, despite slightly increasing the full-year outlook. For Q4, management guided to a base case of $503-505 million in revenue. This was below consensus of $506 million, but they upped their adjusted income from operations for the year by about 10% to $385 million.

Longer-term, the next few years, we think the company can still deliver 30% annual revenue growth. This will depend on how steep of a recession we get and how companies and governments value Palantir’s AI decision making services. It remains to be seen but we would like to see more work done on margins to boost cash flow and to get to real earnings. Like it or not, this is what the Street wants to see. Margins need to improve and growth must remain to offset stock-based compensation. This is still a problem, and a problem for many similar companies. While Palantir’s technology should help governments and businesses alike operate more efficiently, and therefore more profitably, we could see reduced spending on services like this as recession risks are mounting.

Final thoughts

The growth rate is slowing some, but the growth is strong. Palantir’s valuation is still expensive, but we think the key indicator will be margins. Better margins drive earnings potential. As we head into year end, expect added pressure from tax loss harvesting. We still like trading the stock for when it runs with a hot market on good days, but for now, we think it will be difficult for the stock to advance much past $9-$10 without real movement on its performance on earnings potential. At the same time, should top line growth or customer count trends weaken further, the stock could see another wave lower. All things considered, it’s still a buy at $7, but we think you should have a short-term view for gains. Take quick gains and move them elsewhere to core holdings. Sure, it is fine to own this long-term, we think it has potential, but it is a long road. It is a trading stock.

Be the first to comment