koto_feja

ITM Power (OTCPK:ITMPF) kicked off its latest earnings call covering the results for the year ended 30 April 2022 with an overview of the macro picture. And aptly so, because the energy markets are in such extraordinary flux that alternative solutions such as green hydrogen have once again come into the central spotlight.

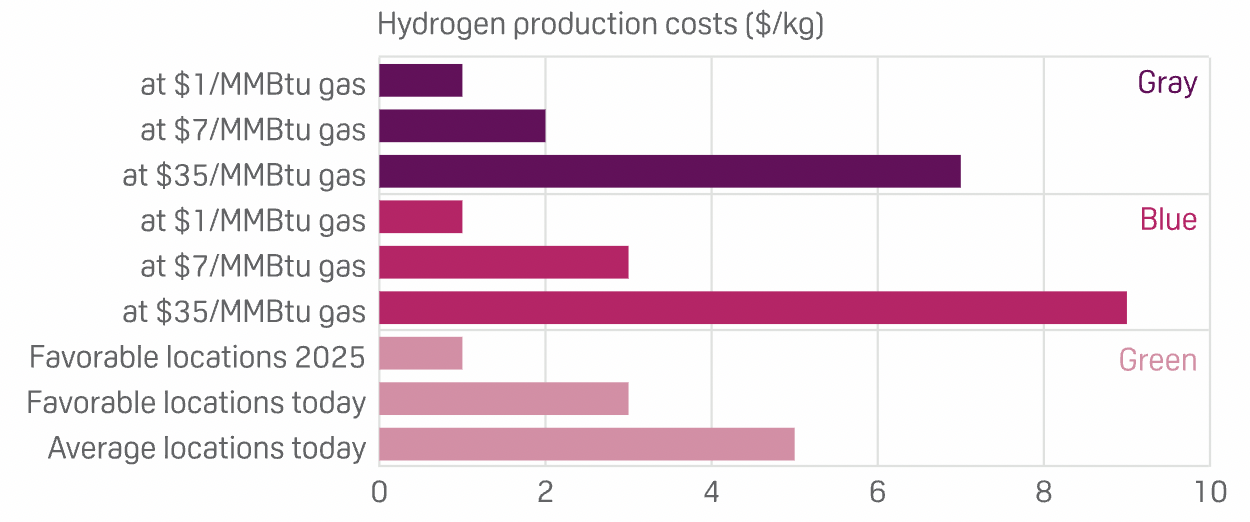

According to outgoing CEO Graham Cooley, record high natural gas prices have allowed green hydrogen to overcome one of its main limitations: uncompetitive production costs. Green hydrogen has for the first time reached parity with industrial hydrogen (also referred to as gray or blue hydrogen). And it is likely that this parity will be maintained, even if and when gas prices normalize. Green hydrogen became cheaper to produce in certain “favorable locations” with abundant, low-cost renewable resources as early as the beginning of this year. By July, LNG was more expensive than green hydrogen in eight European countries.

S&P Global Commodity Insights

For ITM Power, the current momentum in energy markets is a boon. Yet the benefits are not immediately apparent because other structural impediments persist. In addition to renewables capacity, policy in the way of producer subsidies and demand-side incentives is a key factor in enabling green hydrogen. Both the EU and the UK where ITM Power is active have enacted policies in support of green hydrogen. Many of them, however, are experiencing implementation delays — which is problematic for companies like ITM Power that rely heavily on government grants.

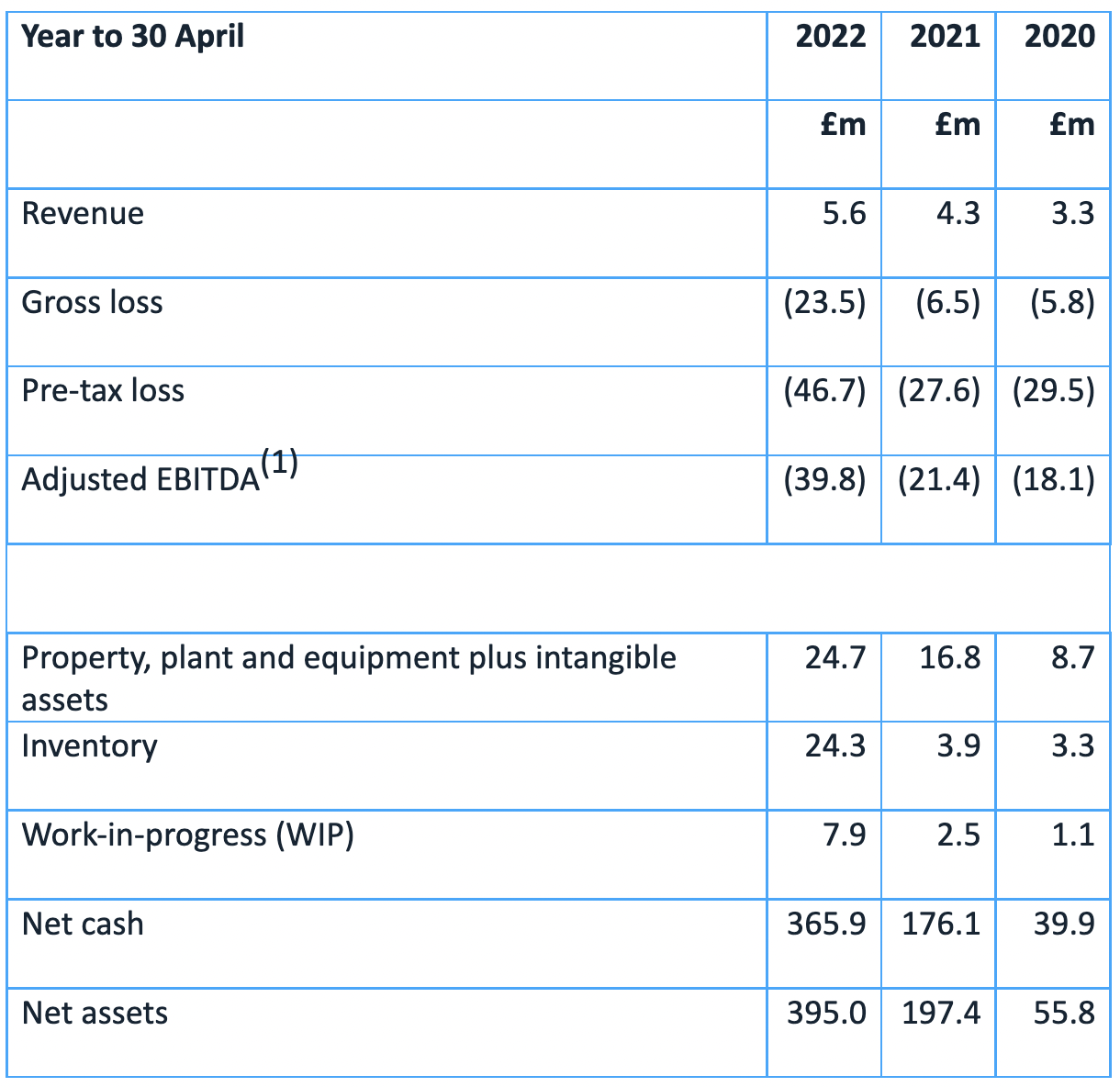

Financials

The company’s last quarter was marked by another delay, of operational type — missed mid-2022 deadline for completing the production of a large electrolyzer at Linde’s Leuna site in Germany — which reduced the top line to an apparently disappointing £5.6m for the full year ending 30 April. The guidance for FY2023 has product revenue increasing to a range of £23-28m, given the expected recognition of sales, 24 MW each, to Leuna and Yara Norge, a Norwegian fertilizer company.

FY2022 also resulted in the unusually wide gross loss of £23.5m. Part of it had to do with higher contract provisions because of increased manufacturing costs. More notable is the increased headcount, which the company justifies with greater product development and operational needs (mainly in their gigafactory at Bessemer Park). It remains to be seen whether these investments — which will continue to rise as production scales — will bear fruit in terms of future project deliveries.

ITM Power

The balance sheet is stable following the latest fundraise of £243m in November 2021. Cash burn in FY2022 amounted to £53m but will increase in the current financial year to £110-135m, which would leave the company with a cash runway of less than 3 years. So at least in that time period, further equity dilution should not be a concern.

Product

ITM Power does have some progress to show for all the cash it goes through. First off, the new improved product, MEP 2, introduced and tested at Leuna has entered serial manufacturing. Its working relationship with Linde Engineering on product validation is starting to help with cost management. To reduce lead times, the company is building up an inventory of products made up of 50 MW to 100 MW core stack modules. This new product development strategy should lead to higher efficiency and lower capital expenditure.

In another indication of efforts to run a leaner operation, but also prompted by geopolitics and inflation, ITM Power made a difficult but sensible decision to scale down expansion plans. The previously announced second gigafactory in the UK has been canceled in favor of enlarging the existing asset at Bessemer Park from 1 GW to 1.5 GW. The company will continue scouring international locations for its next factory, as part of an aspiration to reach 5 GW in production capacity (that is no longer targeted to be in place by 2024); government support and renewables are key considerations.

Policy

Today, like 20 years ago, ITM Power’s future profit prospects are still largely policy-driven. In its home country, the climate action has been unambiguous. The original hydrogen strategy was upgraded in April this year, setting an ambition for 10 GW of low carbon hydrogen production capacity by 2030, with at least half assigned to green hydrogen. In practice, however, the implementation has been slow, and the intended benefits are yet to materialize in any significant way, especially for green hydrogen players. At present, blue hydrogen projects in the pipeline across the UK total 13 GW in capacity, whereas green hydrogen projects add to less than 3 GW. Although blue hydrogen is coming under fire because of high gas prices (that are likely to be sustained for years), the new government under Liz Truss may stall the progress for clean technologies.

Britain aside, the recently invigorated European drive towards energy independence may hold more potential for ITM Power. The EU strategy on renewable hydrogen, first adopted in 2020, has been updated with the publication of REPowerEU — a €300b plan to fast-forward the continent’s green transition by 2030 while displacing Russian gas supplies — in May this year. The target now is to produce 10 million mt/year in green hydrogen and import an additional 10 million mt/year by 2030, up from 5.6 million tonnes envisioned earlier. 41 hydrogen technology projects have been approved under the first Important Project of Common European Interest on hydrogen, IPCEI Hy2Tech. In the works is a pan-European partnership for electrolyzer manufacturers and suppliers of components to achieve a combined annual electrolyzer manufacturing capacity of 17.5 GW by 2025.

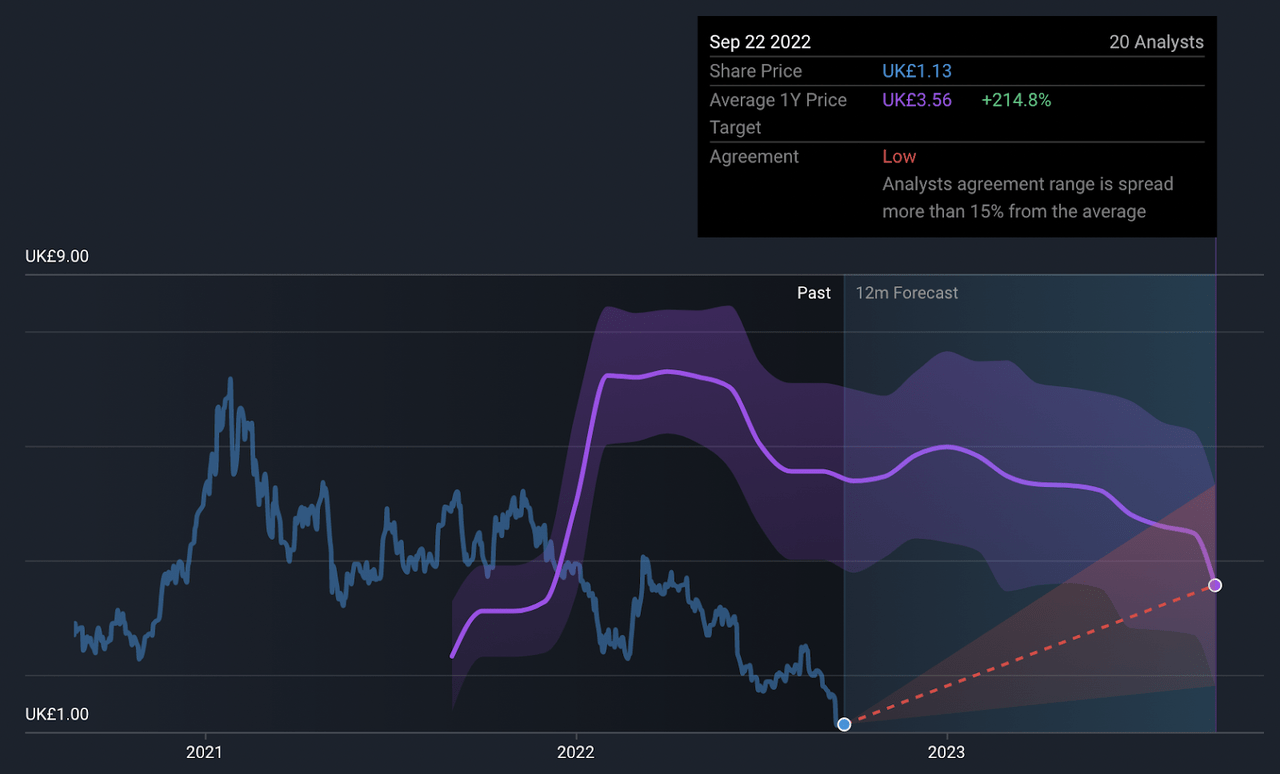

Stock

AIM listed ITM closed at £1.13 on September 21. It is down 72% in the past year and 43% over the last month; market capitalization, as a result, has come down to £674m from a peak of £3.5b reached in January 2021. Even so, the current price is over 100% higher than the level it was trading at (penny stock territory below £1) through most of its life as a public company, dating back to 2004. Given that the company now has something to show for itself — a mature enough technology, a fully operational factory (still the largest of its kind globally) and Linde as a committed partner — there are opinions that the stock is worth more. The average 12-month price target is about £3.56.

Simply Wall Street

Conclusion

Not only does ITM Power have at last something to show for all the time and money invested in it, the critical momentum for green hydrogen seems to be picking up thanks to the confluence of both short and long-term factors. The company’s search for a new chief with experience in international markets is a signal of its unabated growth ambitions. And change is in order if ITM Power is to maintain its leading position in the small but rising industry of electrolyzer manufacturing. But investors in the stock need to be ready for a long wait, during which performance is likely to get worse before it gets better.

Be the first to comment