Torsten Asmus

Inflation-linked bonds have been a major casualty of the ongoing rise in interest rate expectations. The Fed’s hiking cycle has not only led to a rise in bond yields across the entire yield curve, but it has also helped cause a substantial drop in inflation expectations over the past few months. As a result, demand for fixed income securities and the demand for inflation protection have both fallen sharply.

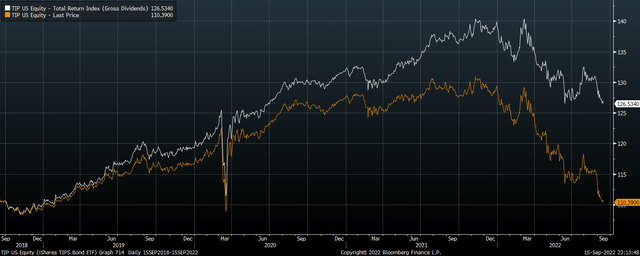

As holders of the iShares TIPS Bond ETF (NYSEARCA:TIP) receive income payments tied to the CPI, in total return terms the ETF has still outperformed most of the world’s stock markets this year, but capital losses have seen holders lose around 10% since the start of the year. Going forward, I expect to see the combination of capital gains and still-elevated inflation drive double-digit nominal gains over the next 12 months.

TIP ETF. Real and Nominal Returns (Bloomberg)

The TIP ETF

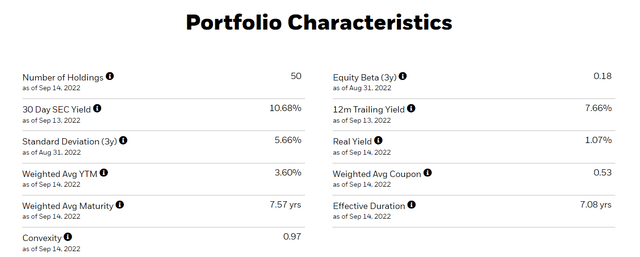

The ETF tracks the performance of U.S. Treasury inflation-protected securities, with a weighted average maturity of 7.6 years and an effective duration of 7.1 years. The current real yield on the TIP is 1.1%, which is what investors should expect to receive per year over the long term after inflation. To be clear, on a trailing basis real bond yields are deeply negative reflecting the surge in inflation, but bond markets expect the recent inflation surge to be temporary. The 1.1% TIP yield reflects expectations that inflation will average around 2.5% over the next 7-8 years.

TIP returns are generated in two ways. Firstly, the ETF pays income payments linked to the consumer price index. Secondly, the price of the ETF fluctuates in response to changes in expected real interest rates. This is where I believe the bulk of the returns will come from over the next few years. If, for instance, investors expect inflation to stabilize above 2.5% but that the Fed will be forced to keep interest rates at relatively low levels due to economic weakness, the TIP will see significant capital gains. While there are of course risks of capital losses in the event that the opposite occurs, I believe the balance of risks is tilted to the upside as explained below.

The Fundamental Drivers Of Real Bond Yields

Over the long term, the real yield that investors receive in inflation-linked bonds is driven by two factors. The first is the expected rate of real GDP growth. The weaker the outlook for economic activity growth, the more attractive it becomes to lock in real yields. As I argued here, the combination of structural factors such as slowing working-age population growth, and policy-driven factors such as rising government involvement in the economy, suggest that long-term real GDP growth is likely to be below 1%, which is below the current yield on the TIP ETF. The second driver of real bond yields is Federal Reserve policy, which can cause real bond yields to fluctuate significantly above or below real GDP growth. The current political pressure on the Fed to bring down inflation has seen inflation-linked bond yields surge higher even as the economy has weakened. In less than a year, real yields have risen by around 300 basis points, and are now significantly above their long-term average.

The Higher Yields Go, The More They Will Ultimately Fall

The problem the Fed now has is that the higher real bond yields rise, the more economic weakness that is likely to result due to the extreme level of debt in the economy. Once the economic damage caused by the sharp rise in interest rates becomes clear, and headline inflation pressures ease, we are likely to see a significant change in policy stance by the Fed. My contention is that such a reversal will not only cause bond yields to fall, but it will also cause long-term inflation expectations to rise as upside pressure on the dollar fades. Both of these forces would be beneficial to TIP holders. The last time real yields were at current levels in 2018, a reversal in Fed policy caused the TIP to rise by around 20% over the next two years.

Summary

Inflation-linked bonds have been hit from all sides over the past few months, with the TIP ETF suffering significant losses. However, with real yields now above their long-term average and the rate of real GDP growth, the risk-reward outlook is highly positive. Even the slightest signal that headline inflation pressures are easing, or that economic weakness is intensifying, would likely cause a downside reversal in yields and significant capital gains in the TIP.

Be the first to comment