Vasko

Thesis

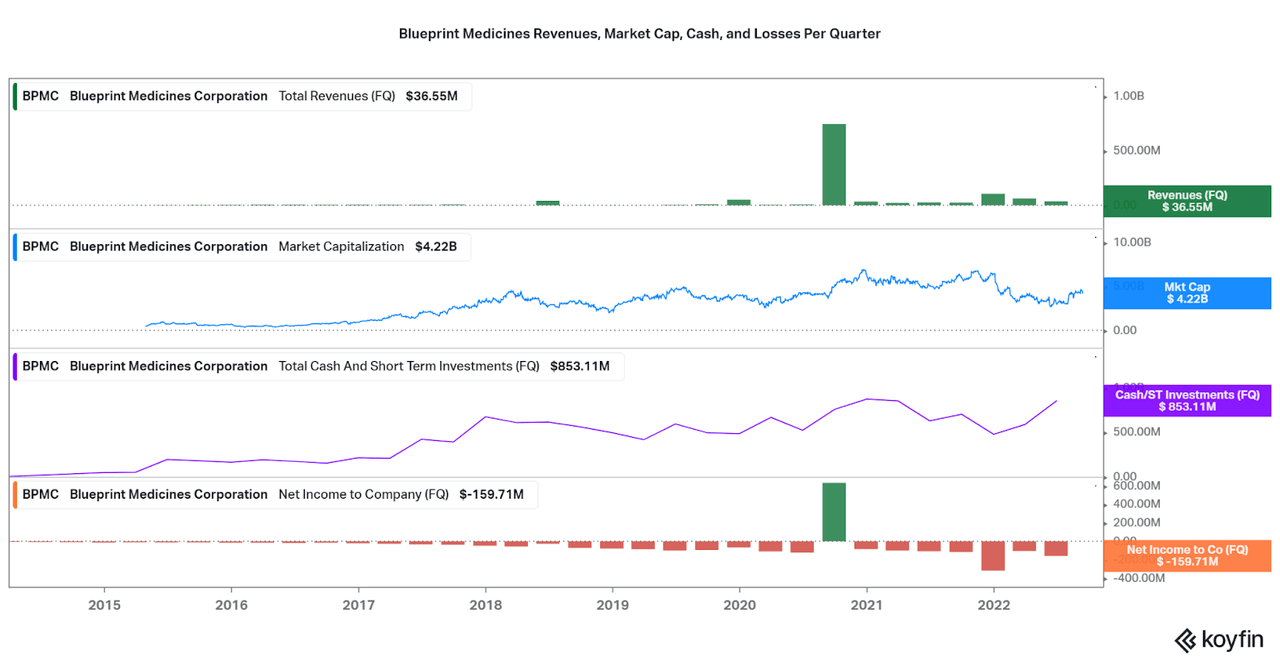

Blueprint Medicines (NASDAQ:BPMC) is taking a unique approach for a younger commercial stage biotech. By selling royalties on all of their approved therapies, the company forgoes yearly revenues from product sales for initial lump sum payments. This approach allows the company to focus on expanding their platform quickly now, while hopefully broadening the platform for steady future cash flows. Although approvals have occurred in 2020 and 2021/22, the company has traded between a $3.0 and $8.0 billion market cap since 2018. I find that the data suggests that Blueprint has taken a focus on long-term success rather than enjoying the success of their current approved drugs, and this creates an opportunity for long-minded investors.

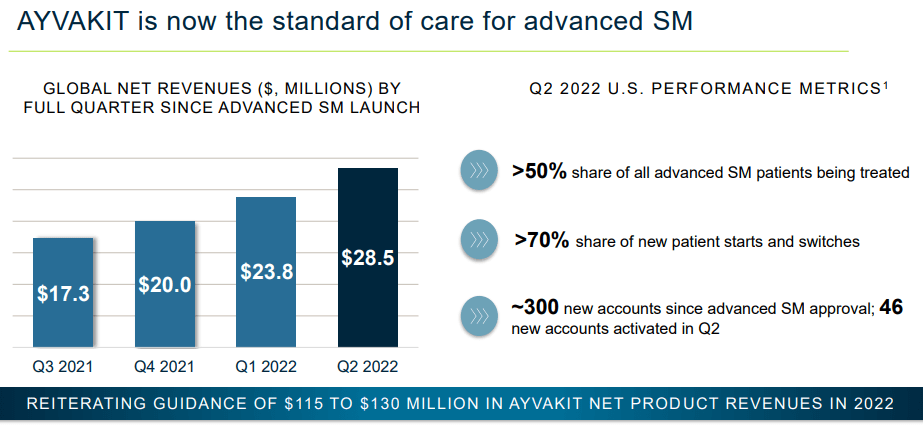

With a focus on genetic mutation-based oncological and hematological therapies, Blueprint has two flagship FDA approved therapies, AYVAKIT and GAVRETO, and future growth will involve expanding the indications of these platforms. This is important because the current indications are relatively niche diseases with limited revenue growth available (GAVRETO revenues are shared with Roche (OTCQX:RHHBY) and AYVAKIT has guidance for ~$130 million in 2022), hence the preference to sell royalties. However, due to positive data and already proven science, I find that there is a higher likelihood that further indications will be approved for AYVAKIT and GAVRETO.

Now that the royalty-funded cash balance is well above $1 billion and average quarterly losses less than $200 million (recent spike in costs can be attributed to initial commercialization), Blueprint is well funded for at least a few more years of R&D. This is important because the company will need to fund trials for expanded indications and expand the narrow-focus pipeline. Thanks to a few mid and early stage trials that are not based on AYVAKIT and GAVRETO, BPMC is becoming more diversified, but this will be a critical factor to watch as the company matures.

BPMC Website Koyfin

Pipeline

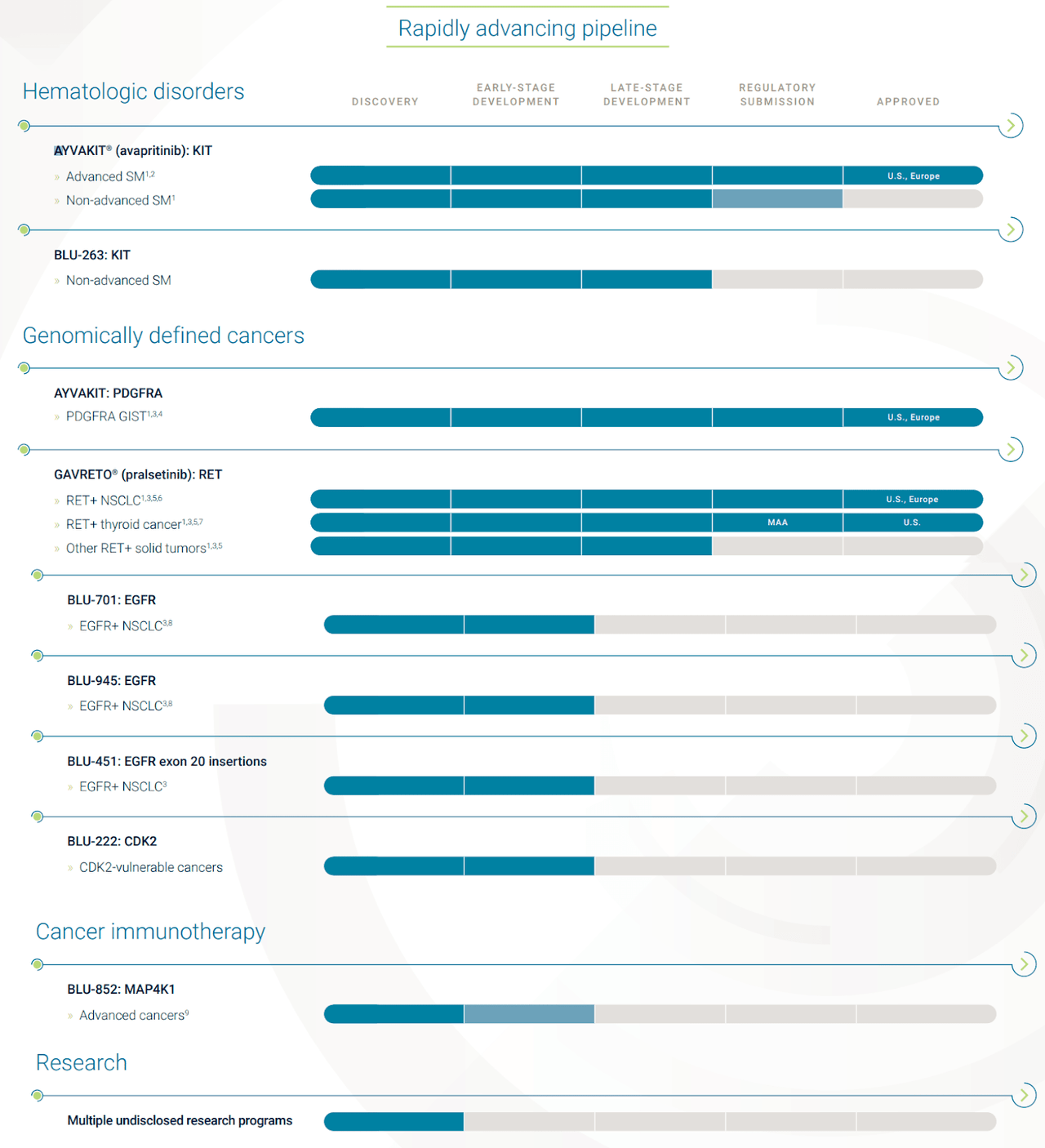

BPMC has an advanced, but narrow pipeline. However, early-stage expansions that have a high probability of succeeding (due to the platform) are good to see. I would personally like to see more.

- Approvals: 2, both expanded into 1 additional indication.

- Late-Stage: 3 trials, 2 for expanded indications and 1 novel therapy (BLU-263).

- Early-Stage: 4 trials, including a few recent acquisitions of varied platforms.

BPMC Website

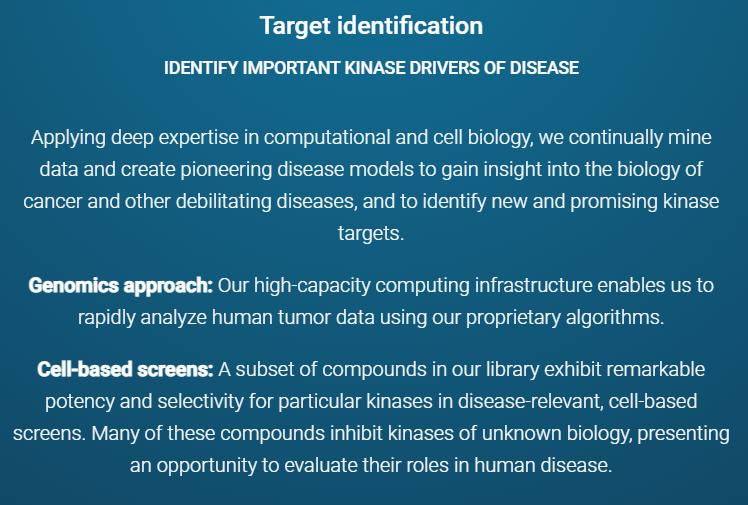

The Science

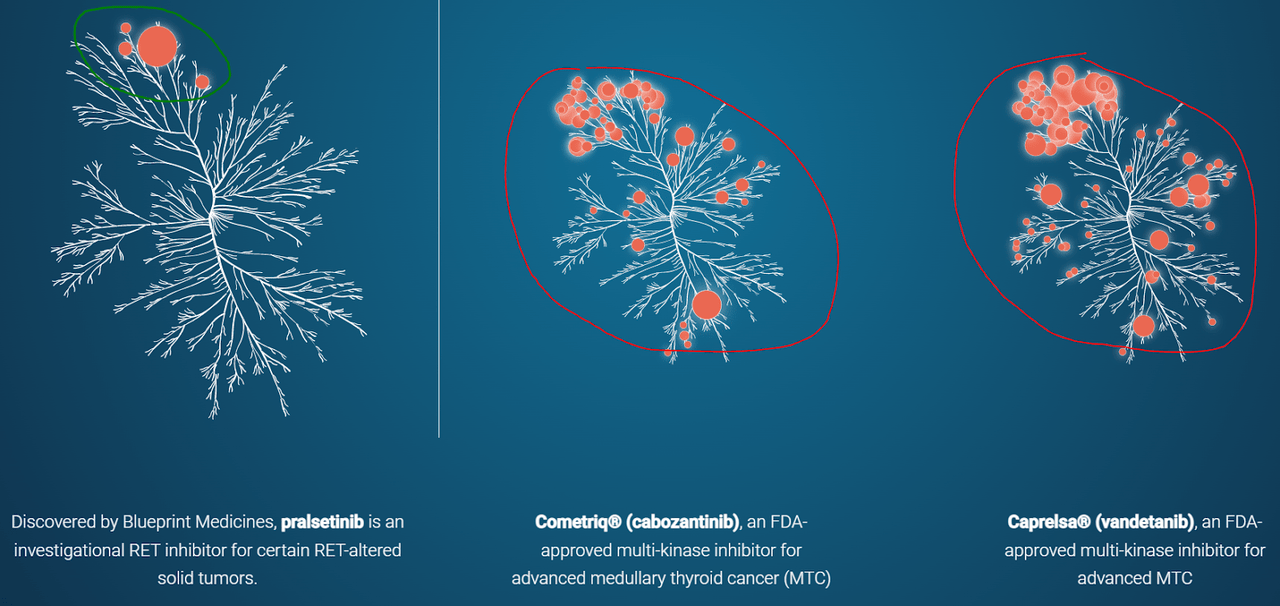

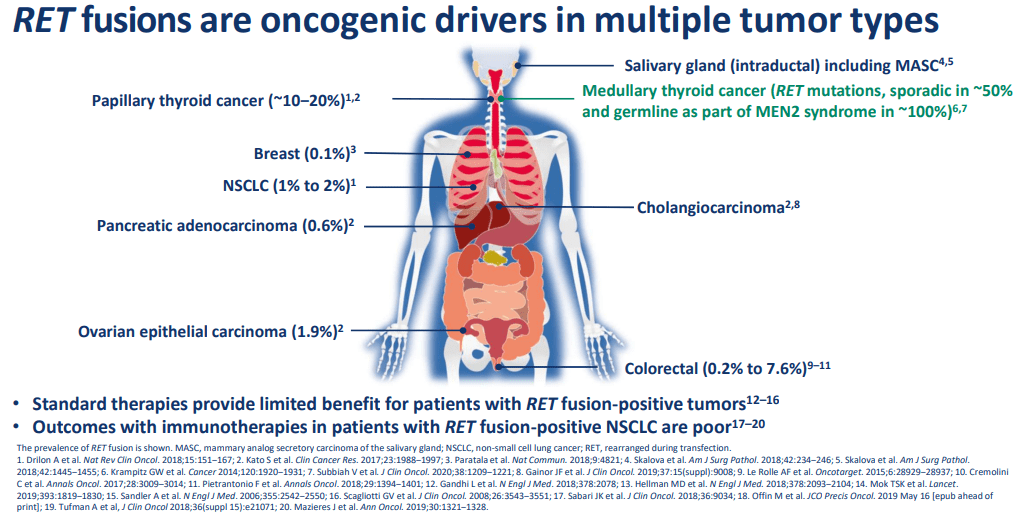

Blueprint’s narrow pipeline is focused on targeting kinase mutations with inhibitors, a fairly common approach. However, Blueprint looks for an advantage with specification on a particular subset of “RET” and “KIT” therapies. While rare in terms of patient numbers, targeting one specific region helps to increase the effectiveness of treatment. As one RET-focused and one KIT-focused therapy have been approved, we can see that Blueprint’s proprietary research is working well. Also, data for expanded indications seem to be successful, increasing the probability of success for late-stage trials.

BPMC Website BPMC 2020 Data Presentation

The success of expanded indications and novel therapies targeting new regions are necessary for continued growth. This is because the initial target populations are not sufficient to drive blockbuster status revenues. As an example, ATVAKIT is only expected to bring in between $115 to $130 million in 2022, far less than current operating costs. If Blueprint wants to become a mature biotech company, as the current valuation suggests, then success across the entire current pipeline is necessary.

2Q22 Investor Presentation

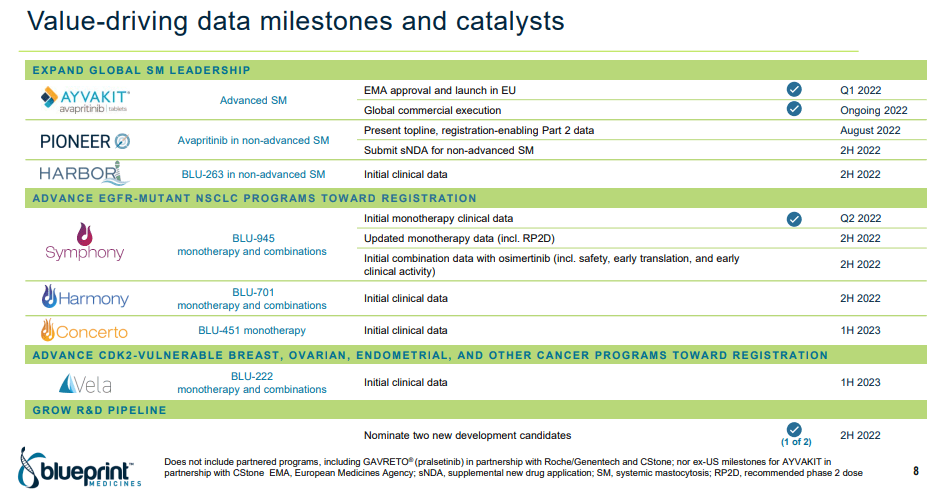

However, Blueprint took an important measure to make sure their pipeline becomes successful. Thanks to the current and expected FDA approvals, Blueprint has a significant expected set of cash flows, and these have been sold to royalty aggregators. In particular, the GAVRETO royalties are being sold to Royalty Pharma (RPRX) and select AYVAKIT royalties are being sold to Sixth Street Partners, totaling over $1.25 billion if all milestones and credit lines are met and utilized. Considering the numerous data points coming up in 2H 22 and early 2023, investors should start to pay attention moving forward.

Most important are:

- The next submission of a sNDA for an AYVAKIT label expansion in the second half.

- Initial clinical data from the next flagship therapy BLU-263 (which has already had royalties sold off).

- And, a wide range of initial data for the next series of platform therapies targeting EGFR-mutations, BLU-945, -701, and -451, all by the end of the year.

Some or most of these data readouts should be met with milestone payments, if successful, further bolstering the company’s strong cash balance.

2Q22 Investor Presentation

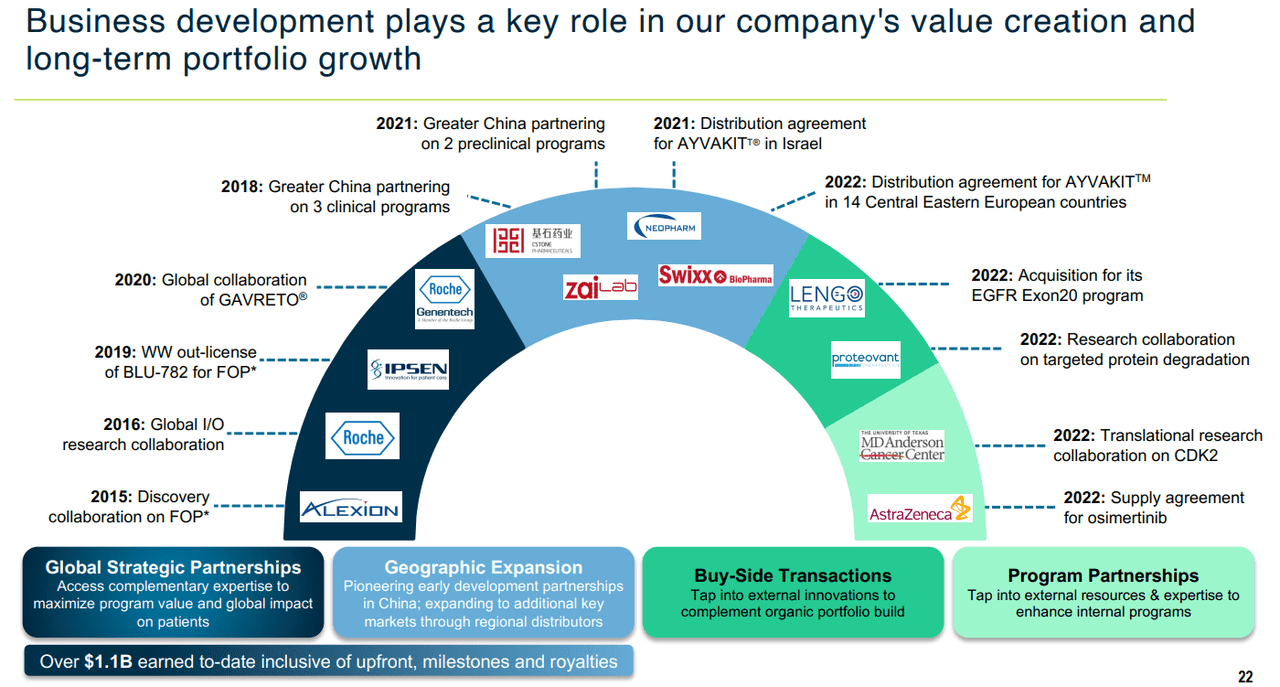

I also see significant value in the partnerships and agreements that BPMC has established over the past decade. These were both important for the first two FDA approvals, and should be a continued factor in allowing commercial success moving forward. At the same time, there are also some murmurings that one of the larger partners may be seen as suitors, particularly after a recent Bristol Myers (BMY) acquisition. Regardless of whether BPMC slowly matures into a large cap or quickly becomes acquired, the upside potential seems fairly positive.

3Q22 Investor Presentation

Conclusion

Blueprint Medicines is a high value early stage biotech company, but with a proven platform, numerous collaborations and partnerships, and increasing shots on goal. As such, I find Blueprint has a higher probability of success in turning into a mature multi-approval biotech company that can lead to earning a status of mature biotech. Therefore, BPMC is well suited for recurring investments over the next few years, but only for long-term oriented investors. Just be wary of both the failure to expand indications and diversify the pipeline as these are the most important criteria of the long-term thesis.

Short-term oriented investors should have some volatility to take advantage of over the next few years, but at some point maturity of the platform may lead to a steady linear growth pattern. Due to the approvals of both AYVAKIT and GAVRETO and relatively advanced clinical trials for expansions, I would hesitate to expect significant downside from current levels. Further upside may also be established in the fact that the RET-based platform is genetic test dependent, and increasing numbers of available patients allows for expanded revenue guidance for current approvals. Therefore, the current high valuation may be supported by investors.

Be the first to comment