new look casting/iStock via Getty Images

Over the past two months, the rising rate dynamic in the US has triggered a global US dollar liquidity shortage. Most international currency exchange rates have declined to extreme historic lows, causing other global central banks to rally against the Federal Reserve’s hawkish approach. Two weeks ago, the trend became so severe that the British Pound experienced a large flash crash, forcing the Bank of England to pursue a temporary long-term bond purchase program. Days ago, the dollar shortage also caused the Federal Reserve to send over $3B to the Swiss National Bank via a short-term liquidity swap to cover its potential dollar liquidity shortfall. The Bank of Korea also recently agreed to open a swap line, while there is speculation India’s RBI may seek to follow suit amid significant currency deterioration.

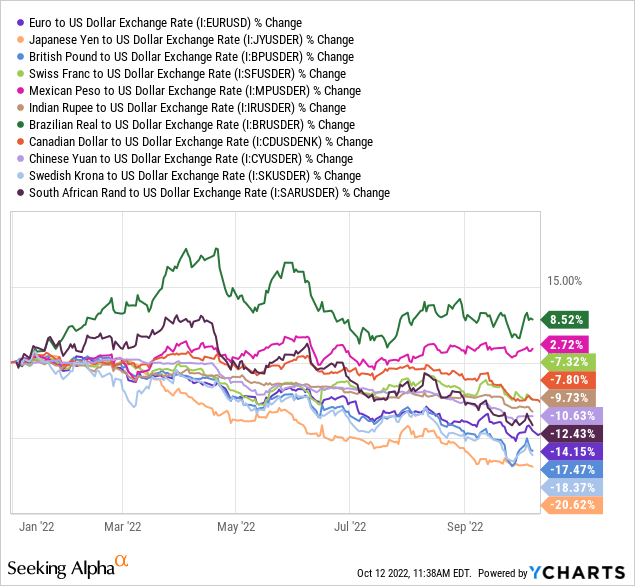

Virtually all significant exchange rates have suffered record declines this year. Interestingly, the only exception is a few Latin American currencies, such as the Brazilian Real and Mexican Peso. See below:

Major currencies, such as the Euro, Yen, and Pound, are resting at the lowest levels in decades. At such an extreme, we may expect the common “mean-reversal” nature of the FX market to kick in and push the US dollar back down. However, this outcome would likely require the Federal Reserve to become far more dovish or its peers to become more hawkish. The latter is possible, but given the above-expected trend in inflation data, I generally doubt the Federal Reserve will become less aggressive soon. Even then, the US dollar shortage crisis may have now become large enough that it is nearly uncontrollable as many emerging market currencies collapse. This situation has occurred in the Turkish Lira and numerous “softly pegged” African currencies, many of which have significant US dollar-denominated debt, exacerbating their exposure to the strong dollar.

The global US dollar shortage has reached a crisis level and is, in my view, the most critical factor in financial markets today. Surprisingly, it has not received much attention from most financial media despite many major central banks and global commercial banks rushing to cover dollar shortfalls. I covered the potential for a mass US dollar short squeeze earlier this year, and it seems we’re now seeing those events play out in full. While I have been generally bullish on inflation-indexed Treasury bonds, I noted the potential for them to continue to decline if the Federal Reserve remained hawkish despite the recessionary economic trend. Real interest rates and the US dollar value are closely linked to the US being among the few countries today with a positive return on inflation-indexed bonds, driving immense demand for US dollars.

I believe we may soon see the US dollar rise even higher as the international FX short squeeze reaches its final wave. However, with this in mind, it seems unlikely the Federal Reserve will become more hawkish than it already is. Inflation-indexed bond funds such as NYSEARCA:TIP still carry some downside risk due to their trend. Still, in my view, they have become a desirable low-risk investment due to their positive exposure to inflation, high real return, and appreciation potential amid the currency shortage.

US Real Interest Rates Are Near Peak Levels

The iShares TIPS Bond ETF (TIP) invests in longer-term inflation-indexed Treasury bonds. These bonds pay the CPI change on any given year, currently around 8-9%, plus a ~1.7% yield – giving a nearly double-digit return on “risk-free” US sovereign debt. Since TIP owns US Treasury bonds, it is also exempt from state and local taxes. The chief risk for TIP is its “duration,” which is the extent to which it declines (or rises) in value given a change in long-term interest rates. Its current duration is ~6.8, meaning it will decline 6.8% if real rates rise 1% higher (and vice versa). As long-term rates have risen quickly this year, TIP’s price has been under pressure.

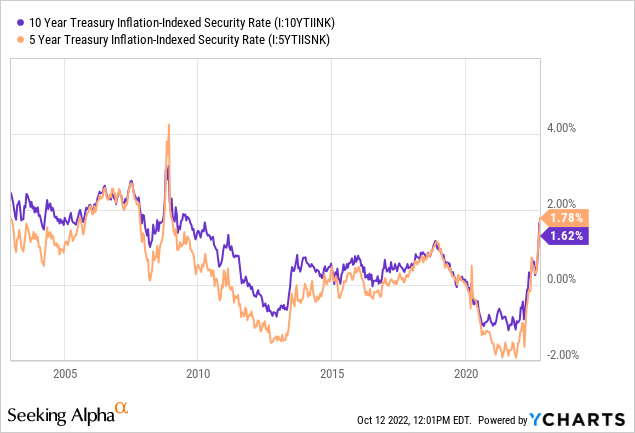

As you can see below, the five and ten-year inflation-indexed Treasury bond rates are the highest they have been in over a decade:

TIP has a weighted-average maturity of around seven years, so its yield is in-between the five and ten-year rates. A rate of 1.7% means TIP pays 1.7% plus whatever the CPI rises. This return differs from a typical Treasury bond that pays around 4% today but is not indexed to inflation, meaning its actual return is generally much lower than TIP’s given today’s 8-9% inflation rate.

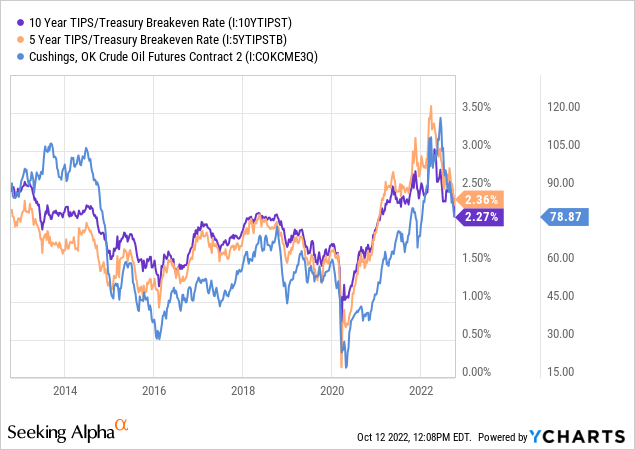

Technically, since inflation-linked Treasuries and “traditional” Treasuries have the same underlying credit risk, the difference in their yields is a gauge of expected long-term inflation (as both should have the same “expected” net return). This “breakeven rate” indicates long-term average inflation – currently around 2.3%. Given PPI and CPI numbers have consistently run above expected levels despite hawkish Federal Reserve policy, I doubt inflation will average 2.3% over the next five years as implied by the five-year breakeven rate. If this proves correct, TIP will deliver a very high “extra” return compared to traditional Treasury bonds, seemingly mispricing inflation risk. Bond’s inflation expectation rate is closely tied to the price of crude oil as it is the most crucial inflation factor (due to the compounding nature of transportation costs in the price of goods). See below:

The supply of crude oil, and most energy commodities, are among the few factors entirely outside the Federal Reserve’s control. For many reasons, I firmly believe the supply of crude oil will become more limited over the coming months (and years). Unless there is a considerable and seemingly unlikely decline in economic activity, I believe US energy prices will continue to rise. This factor is even more prominent in Europe, which has suffered yet another pipeline shutdown, potentially exacerbating the continent’s rising inflation and associated currency weakness. Since Europe and the US share trade and financial networks, higher inflation there will likely mean higher inflation here.

If inflation continues to run hotter than expected, TIP will outperform traditional sovereign bonds, potentially significantly, given how high inflation is. If the CPI continues to rise at an 8-9% pace, then TIP’s total dividend yield would be around 10-11%. Typically, such yields are only found in extremely high-risk emerging market sovereign bonds or ultra-low-grade commercial debt. Even more, I expect inflation-indexed rates (or “real rates”) will stop rising soon as they are at ~12-year highs. More importantly, the currency crisis may become more extreme if US real rates continue to increase. Given the slowing pace of the US economy, it is also possible the Federal Reserve will slow or stop the off-loading of inflation-indexed bonds (end QT, but not restarting QE), potentially improving their value.

Key Risks In Inflation-Linked Bonds

I have had a bullish view on TIP over the last six months, and the fund has declined a bit despite this, as real interest rates have risen despite the slowing economy. Inflation-linked rates are still around 50 bps below their 2000s high range; if they rise that much higher, TIP will decline by an expected 3-4% given its duration. To me, that is minimal downside risk compared to its upside potential, particularly given growing FX market forces that could trigger a reversal in real interest rates.

Of course, as we’ve seen very briefly in 2008 and 2020, a decline in market liquidity can cause an extremely rapid rise in inflation-linked rates. In both instances, the Federal Reserve supplied liquidity to stop an even larger liquidity shortage. Given high inflation, it is not necessarily guaranteed the Federal Reserve will do so again. In reality, I highly doubt we will ever see QE again due to associated hyperinflation risks. That said, as we see in the UK’s sovereign bond market, the Federal Reserve will likely be willing to act as a short-term liquidity supplier to stop a flash crash.

Furthermore, if real interest rates (and “traditional” bond rates) were to experience a rapid 100 bps+ rise (i.e., if Federal Reserve does not step in to supply liquidity), then the US government would likely quickly be forced into default. Default is hypothetically possible because the federal debt is so large that a slight rise in rates would cause the entire budget to go to interest expenses. Hypothetically, TIP and all Treasury debt have no default risk, given the Fed’s monetary authority. Still, if it is a decision between hyperinflation and partial default, the latter may be chosen. In my view, this is a risk that is very hard to quantify, but given the extreme dynamics in international FX markets, it is a risk to consider.

The Bottom Line

In all likelihood, the Federal Reserve will not become so hawkish that it is unwilling to supply liquidity during a liquidity crisis. Considering the developing dollar crisis abroad, I believe this may occur over the coming weeks or months and would likely be a bullish catalyst for TIP. In other words, I am bullish on TIP because Federal Reserve support will become necessary if it continues to fall (causing the dollar to surge higher).

Considering I expect inflation to remain high and potentially rise if OPEC+ continues to reduce oil output, TIP’s yield may be far above that of other Treasury bonds for an extended period. While fewer assets have a “Fed put” today than 2020, inflation-linked bonds appear to be protected. Additionally, TIP offers investors a tax-advantaged return of 1.7% above inflation. In my view, these catalysts make TIP a strong, low-risk, long-term investment with decent potential for a short-term reversal higher.

Be the first to comment