Tast Nawarat

The market has finally started to realize that the Fed cannot keep interest rates at these elevated levels in the context of declining inflation and nominal GDP. The key question is whether a reversal in the hiking cycle is aggressive enough to trigger a recovery in inflation expectations. If this occurs, inflation-linked bonds should perform well in risk-adjusted terms, and the iShares TIPS Bond ETF (NYSEARCA:TIP) should generate strong returns.

The TIP ETF

The TIP tracks the performance of U.S. Treasury inflation-protected securities, with a weighted average maturity of 7.2 years and an effective duration of 6.7 years. The current real yield on the TIP is 1.7.%, which is what investors should expect to receive per year over the long term after inflation, less the fund’s expense fee of 0.19%. However, there is also the potential for significant capital gains if either long-term bond yields fall, or long-term inflation expectations rise. The TIP is the largest inflation-linked bond ETF with USD23.8bn in assets under management, although the fund has lost almost 30% of its assets since they peaked in late-2021, which coincided with the highs in the TIP’s price.

The Race To Reverse The Hikes Is Now On

I have noted in a number of articles that the monetary conditions that currently fail are incredible restrictive and out of line with the fundamentals of the debt-burdened US economy. The Fed is widely expected to hike interest rates a further 25bps at each of its next two meetings, but markets are already of the view that these hikes will be reversed entirely by the end of the year. Just as the Fed eased policy too aggressively in 2020, it has tightened too aggressively over the past year, with rates rising even as inflation expectations have fallen sharply.

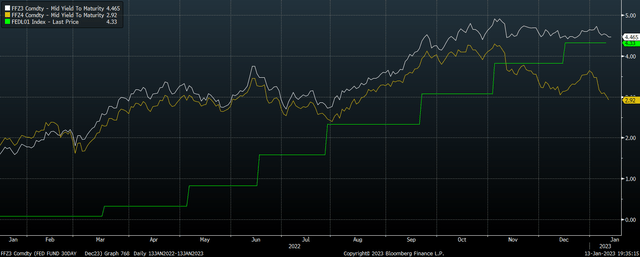

Fed Funds Rate Vs Dec23 and Dec24 Fed Funds Futures Rates (Bloomberg)

If we look at interest rate futures, we can see that the Fed funds rate is expected to be roughly in line with the current level by the end of 2023, and fall to just 2.9% by end-2024. Even as expectations of interest rates has declined sharply in recent weeks, bond yields remain elevated as investors expect rates to bottom out in 2024 before rising once again. However, given how aggressive the Fed has tightened during this cycle, and the extreme level of private and government debt, rates are likely to head much lower over the coming years. Even at 2.9%, the Fed funds rate would still be 65bps above 5-year inflation expectations, which currently sit at 2.25%.

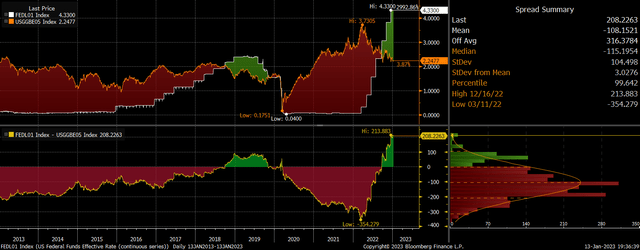

Fed Funds Rate Vs 5-Year Inflation Expectations (Chart)

Considering that the Fed funds rate has been on average 108bps below 5-year breakevens over the past decade, this would still represent tight monetary policy, particularly considering that the real GDP growth outlook has deteriorated over this period. I would not be surprised to see Fed funds expectations fall much more aggressively over the coming months as CPI prints continue to ease, and could easily see us back below 2% in 2024.

How Will Inflation Expectations Respond To Rate Cuts?

If rate expectations continue to decline, then bonds are highly likely to perform well, but the key question for inflation-linked bond funds like the TIP is whether Fed easing will be enough to trigger a reflation in the economy and a rise in inflation expectations. My view is that with US M2 money supply now in absolute contraction, it would take an aggressive reversal in Fed policy to bring about the conditions for a sharp rise in inflation expectations.

However, the high level of public debt in the economy means that nominal GDP will have to grow faster than interest rates to prevent an unsustainable rise in Treasury borrowing costs. While the Fed will continue to talk tough about fighting inflation, it will ensure that it does not let inflation drop below nominal GDP growth on a sustainable basis. I have noted in the past how I believe that structural and cyclical factors will keep real GDP growth below 1% a year over the coming decade, which is likely to act as a ceiling for real bond yields. In this context, the real yield on the TIP of 1.7% is good value and the fund should provide strong returns as real yields move lower.

Be the first to comment