Shakeel Sha/iStock Editorial via Getty Images

iShares MSCI Qatar ETT (NASDAQ:QAT) is an exchange-traded fund with exposure to listed companies based in Qatar. The expense ratio is 0.57%, which is quite expensive but about in line with other funds that invest in single countries with less developed equity markets.

The fund had just 32 holdings as of October 31, 2022, although this is about as many as some more traditional developed markets such as Germany (the German DAX index only has 40 constituents, up from 30 in 2021). However, QAT’s net assets under management were only $85 million as of October month-end, illustrating the smaller size and lower popularity of Qatari equities.

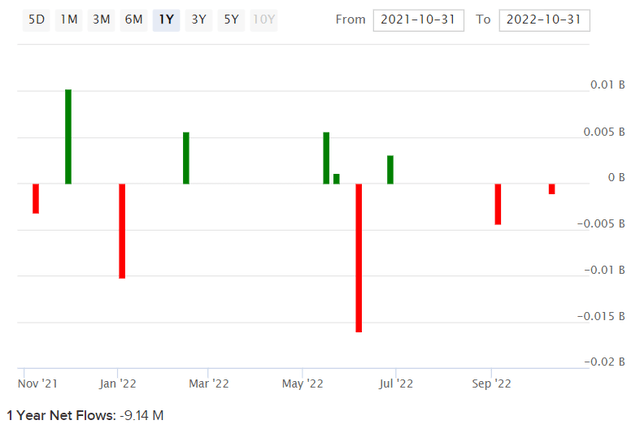

That follows minor net outflows from QAT on an absolute basis, of about -$9.14 million over the past year (illustrated below). Of course, $9 million is a lot relative to QAT’s small AUM of less than $90 million as of recent.

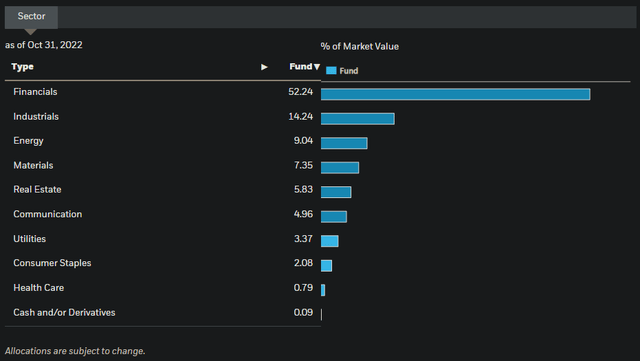

So, QAT is neither popular nor growing in popularity. The fund itself is mostly exposed to domestic Qatari financial companies. Financials represented 52% of the fund as of October 31, 2022, followed by Industrials at 14%, and Energy at 9%. These sector exposures make QAT traditionally quite cyclical. While Qatar will be moving along its own business cycle, you would imagine that this would roughly follow the rest of the world (possibly with some degree of asynchronicity, but mostly synchronised given its high tourism exposure and also energy exposures).

QAT is a cyclical bet on the health of the Qatari economy. A booming global economy is likely to send QAT higher, and vice versa. At the moment, we are in an inflationary environment with credit creation having slowed materially since the peak of 2020/21 during the worst of the COVID-19 pandemic. Monetary stimulus has been reigned back, and so has much of global fiscal stimulus (at least if scaled by GDP). So, the environment has not been favorable for global equities.

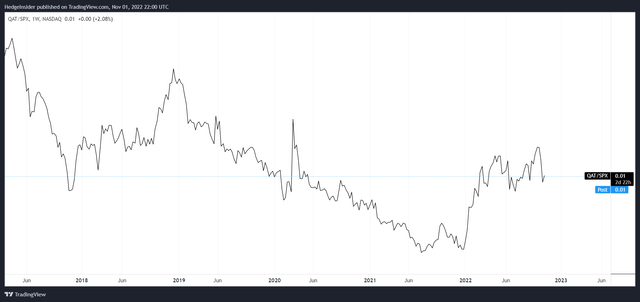

However, QAT has performed fairly well in this environment. While QAT has not been sustainably appreciating, its performance has beaten the S&P 500 U.S. equity index; the QAT/SPX (S&P 500) ratio is illustrated below. While QAT has under-performed in other years and over a longer time frame, the fund has beaten the S&P 500 index this year.

On the other hand, the QAT/SPX is lower than since the fund’s inception in Q2 2014, and the ratio is largely still on a downward trajectory.

Based on Morningstar data as of October 24, 2022, the fund’s forward price/earnings ratio was 12.15x, with a price/book ratio of 1.46x. That implies a forward return on equity of 12%, which is reasonable, but not high. That is to be expected given the fund’s heavy exposure to financial companies which operate in regulated and competitive markets.

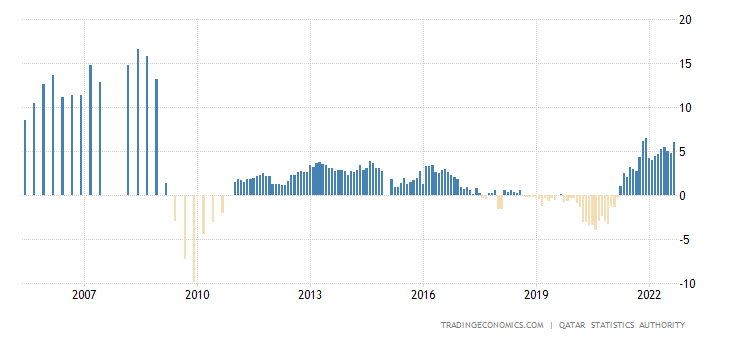

Meanwhile, Qatar’s annual inflation rate is typically between 2-4% over the long run, although in recent times it has been unfavorably volatile.

TradingEconomics.com

Deflation around 2019 was owing largely to rents; rents fell due to various factors including an oversupply of property, a decline in expatriates, and oil price fluctuations (to the downside, leading to lower local transportation costs). Still, over the long run, you could probably assume at least 2% nominal earnings growth. That compares to fairly restrictive monetary policy, you could argue; the local 10-year yield is currently trading at 4.9%. The local central bank rate is currently set to 4.5%, roughly matching current year-over-year inflation (the latter illustrated above).

The local 10-year yield of 4.9% is a fairly high risk-free rate that we would need to consider in valuing QAT. I would not be comfortable assuming more than 2% earnings growth for now. A fair equity risk premium in the western world, particularly for mature markets such as the United States, would be in a range of 4.2-5.5%. While beta is not a perfect measure, we can look at readings of beta (relative volatility) as a proxy for risk; QAT’s five-year beta is about 0.56x, which would suggest lower risk by investing in QAT. This is clearly not a fair approach given nearly chronic under-performance, lesser diversification, and so forth.

Having said that, there is some truth to QAT moving in a fairly stable fashion; when stocks crashed in Q1 2020 across the globe, the S&P 500 index fell by about a third, while QAT “only” fell by about -27%, peak-to-trough. If we apply an ERP of 5.5% to our calculation, and add in our risk-free rate of 4.9% at present, we come to 10.4%. Subtracting 2% growth to perpetuity (an illustrative assumption) takes us to 8.4%. Inverting this gives us a forward price/earnings ratio of 11.90x. That compares to Morningstar’s consensus estimate of 12.15x at present, so very close.

QAT seems like it is probably fairly valued, while its domestic currency is pegged to the U.S. dollar. My rule of thumb for equity funds is that the long-term return tends to converge between the underlying portfolio return on equity and forward earnings yield. In this case, you are looking at a range of circa 8-12%. (N.B. the 30-day SEC yield is currently just over 3%, so a considerable portion of this return should come from dividends.) This is not an unattractive proposition, but if you are investing abroad to capture returns with diversification benefits, I think it makes sense to search for higher-yielding opportunities that also come with FX tailwinds.

Therefore, in summary, I think QAT is likely fairly valued, does not present as an especially attractive diversification opportunity. The lack of popularity in the fund makes sense. But at the same time, it would probably be wrong to take a bearish view; QAT has performed relatively well by not falling this year, and should continue to hold up fairly well.

Be the first to comment