ugurhan

There are a number of good reasons to own the global metals and mining sector. Firstly, the sector is extremely cheap relative to its own history and the broader market. Secondly it should act as a hedge against inflation as has been the case in the past. Thirdly, the sector should benefit from the ongoing boom in renewable energy infrastructure. I am long the iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK), which is a well-diversified fund in terms of both its company and geographic exposure.

The PICK ETF

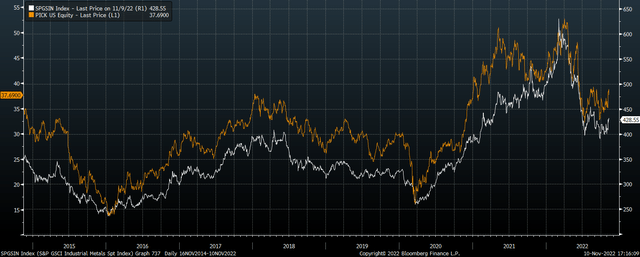

The iShares MSCI Global Metals & Mining Producers ETF seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver. The ETF charges a management fee of 0.39% per year, which is reasonable in the context of the high volatility of the fund. PICK is well diversified in terms of company exposure, with BHP the largest stock in the index with a weighting of 13%, followed by Rio Tinto at 9%. The price of iron ore is therefore a key driver of performance. In fact, the ETF closely tracks the performance of the S&P GSCI Industrial Metals Index, so is ideal for investors looking to benefit from rising metals prices. The ETF also pays an impressive dividend yield of 9.4%.

PICK Vs S&P Metals Price Index (Bloomberg)

Valuations Are At Rock Bottom

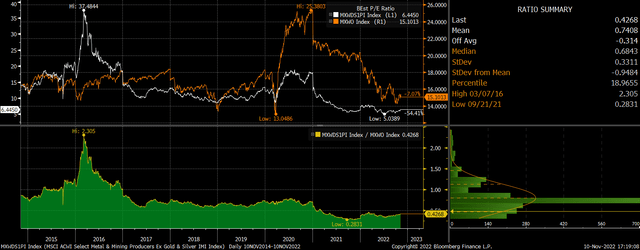

The PICK’s trailing PE ratio sits at just 5.1x, and while earnings are expected to fall over the next 12 months, the forward PE ratio is still just 6.4x. Free cash flow metrics are also strong, with the forward free cash flow yield now at 12.5%. These are extremely impressive valuations relative to the index’s own history and indeed the MSCI World.

PICK Vs MSCI World Forward PE Ratio (Bloomberg)

PICK trades at a 57% discount to the MSCI World on a forward PE ratio, which is close to the largest discount seen over the past decade. If we strip out the impact of profit margins, which are highly volatile in the metals and mining sector, the price-to-sales ratio shows the sector is still deeply undervalued relative to the broader market.

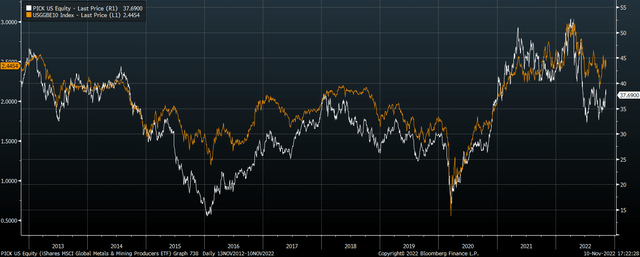

PICK Vs MSCI World Dividend Yield (Bloomberg)

This undervaluation is reflected in the metals and mining sector’s dividend yield, which is 6.3% on a trailing basis and 5.6% on a forward basis, more than double the MSCI World.

The Metals And Mining Sector Is A Good Inflation Hedge

Over the past year the fall in the PICK may have compounded many investors who bought the ETF as an inflation hedge. However, the metals and mining sector is one of the sectors most closely correlated with inflation expectations. This year’s decline in metal prices has had the effect of bringing down long-term U.S. inflation expectations, which peaked in April shortly following the peak in the PICK.

PICK Vs 10-Year U.S. Breakeven Inflation Expectations (Bloomberg)

10-year inflation expectations have shown a strong ability accurately predict long-term actual inflation, and any rise in metals will likely drive inflation higher over the long term, meaning that the PICK should act as good inflation hedge. As this article by GMO details, resource stocks have consistently outperformed the broader market during periods of elevated inflation.

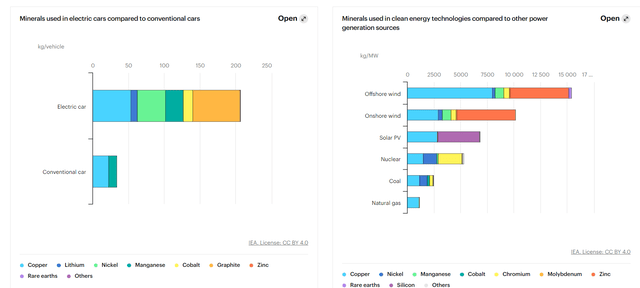

Metals Prices Should Benefit From Green Infrastructure Rollout

Governments around the world are increasingly looking to support the development of renewable infrastructure, which is highly dependent on metals. The charts below from the IEA highlight the huge demand that the transition to renewable energy will place on various metals.

Depressed valuations for metals and mining stocks may reflect investors’ fears over the economic outlook in China, which admittedly is looking increasingly precarious. There is a growing risk that we could see a recession in both China and the U.S. lead to a further decline in metals prices. However, both governments, as well as most of the rest of the world, are likely to respond to any economic contraction and decline in commodity prices by ramping up green energy spending, while central banks will have the green light to engage in more money creation.

Summary

The PICK ETF offers a way to benefit from the continued outperformance of the global metals and mining sector. The sector offers extremely cheap valuations and attractive dividend yields relative to its own history and the broader market, despite its strong track record as an inflation hedge. The sector also stands to benefit from the ongoing boom in renewable energy.

Be the first to comment