franckreporter/iStock via Getty Images

Solid Track record

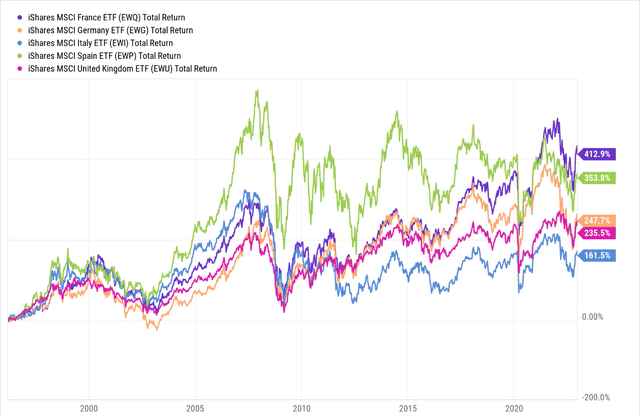

The iShares MSCI France ETF (NYSEARCA:EWQ), a product that focuses on 65 large and mid-sized French companies, has been a long-standing source of alpha for its stakeholders. Since its listing date in March 1996, it has outperformed comparable European alternatives such as the iShares MSCI Germany ETF (EWG), the iShares MSCI Spain ETF (EWP), the iShares MSCI UK ETF (EWU), and the iShares MSCI Italy ETF (EWI), all of whom were incidentally listed on the same date.

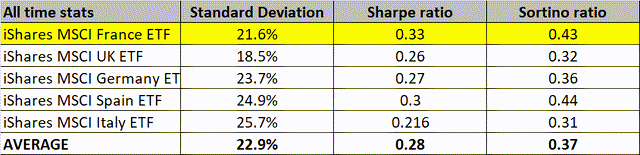

The return differential isn’t the only facet worth applauding. This is a product whose volatility profile has been relatively well controlled. Crucially, it has also demonstrated good competence in mitigating volatility and generating returns. To highlight these qualities, consider the table below which highlights the risk-adjusted return stats of ETFs exposed to some of Europe’s prominent economies.

Firstly, besides the UK option- EWU (18.5%), no other ETF offers a lower volatility profile than EWQ (21.6%). Dabbling with low-volatility products can be quite comforting when you dive into the dicey terrain of international equities. Crucially, despite taking relatively low risk, note that EWQ delivers the highest returns relative to the risk-free rate, as exemplified by the respective Sharpe ratios (0.33x). In addition to that, EWQ also does a fairly commendable job when dealing with harmful volatility, as exemplified by a Sortino ratio of 0.43x. Finally, with the exception of the Spanish option- EWS, which just barely edges it out (0.44x), none of the other ETFs come close to delivering excess returns after downside deviation is accounted for.

An Unappealing Landscape

While EWQ may have come across as a relatively competent international option over the years, it’s difficult to get too excited about this product when you consider the underlying conditions of the French economy.

Just for some context, after impressive real GDP growth of 6.8% in 2021, which was better than the global rate (6%), as well as the rate of advanced economies (5.2%), things have slowed markedly; in the recently concluded quarter, growth only came in at 1%, lower than the 4.2% levels seen in Q2, and even lower than 4.8% levels of Q1. It looks like France could well end up delivering growth of only 2.5% for FY22. Crucially next year, growth will come off in a big way, with an expected figure of only 0.7%, lower than both the global average of 2.7%, and the 1.1% rate for advanced economies.

Slowing growth is just one sub-plot amongst many. Two sectors- consumer discretionary and industrials, dominate the portfolio of EWQ (~42% of total holdings), and the data associated with these segments don’t look too encouraging.

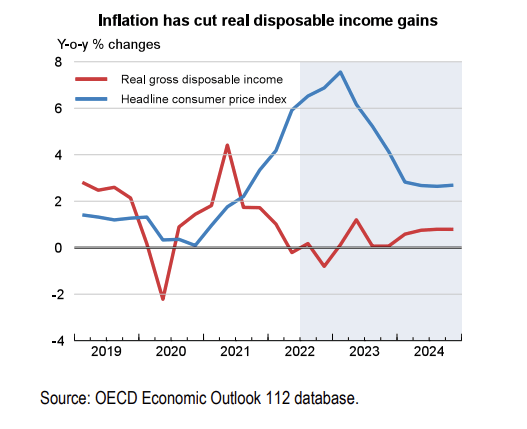

It’s hard to be overly optimistic about discretionary purchases when inflation continues to remain at its highest level in 37 years, eroding disposable income in a big way.

OECD

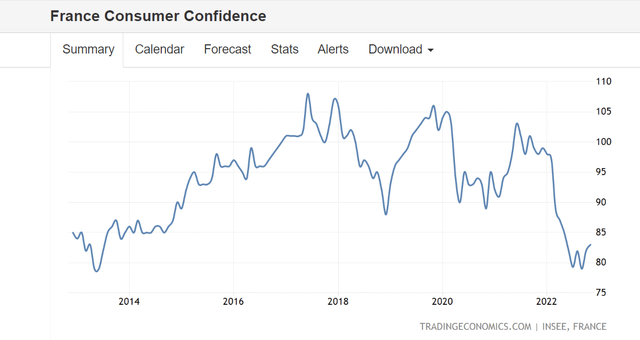

Some may take heart from slowing energy prices, but do consider that the core inflation rate which is less volatile, recently hit record highs of 5.3%. Also note that this year France has implemented some subsidies, fuel price rebates, and energy price controls, all of which are expected to be unwound next year. This could provide another fillip to inflation, even as there will likely be an automatic indexation of the minimum wage which could have an indirect impact on inflation. All in all, the IMF believes that inflation in France will likely only decline in 2025. The French consumer’s propensity to spend does not appear to be in a good way, and this is backed by the consumer confidence numbers which are not far from their lowest point in a decade.

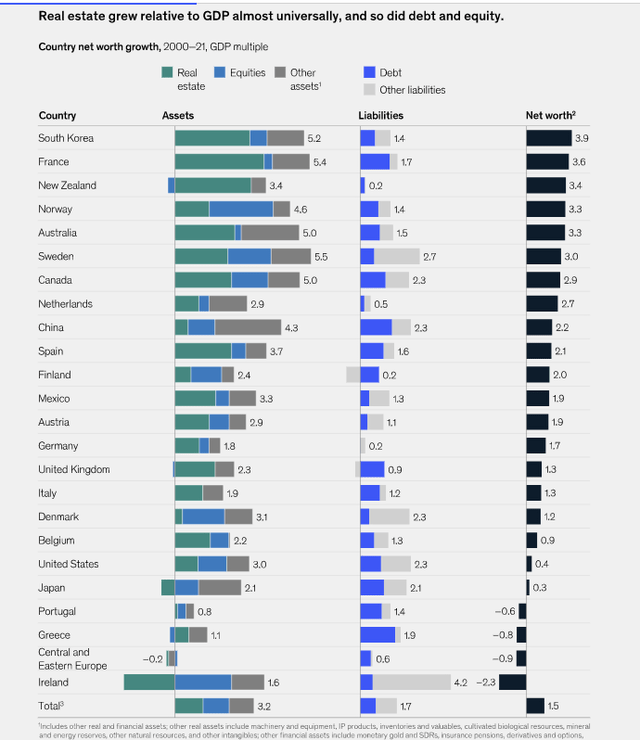

The other risk to note is that in recent years, French households have seen a surge in debt. A study by McKinsey showed that besides China and Greece, France is the other major economy that has seen the fastest growth in debt relative to GDP. With inflation eating into disposable income, and the ECB tightening rates, questions need to be asked about debt servicing capabilities in 2023 and the risk it could have on the financial sector. As you can see from the image below, the real estate market has been a key driver for France over the years, but one does wonder if banks can afford to be lax with their mortgage-related standards in a growing recessionary environment.

A slowing global economy will also leave its mark on capital formation and export orders in France. It’s worth noting that the French manufacturing PMI continues to remain in contraction territory for the fourth successive month. Employment conditions here too don’t look great as there hasn’t been a great deal of incentive to hire, given a flattish backlog. Interestingly enough, in December, factory headcount declined for the first time in close to two years highlighting some of the excesses that probably need to be unwound. Next year, I also don’t believe the French economy will receive the fiscal support it received this year (IMF believes fiscal support in ’21-’22 totaled over 2% of GDP) as the government embarks on a multi-year process of fiscal consolidation. Without ample fiscal aid, it’s difficult to see the French economy flourishing.

Closing Thoughts

The technical and valuation sub-plots of EWQ also don’t come across as overly encouraging.

The chart below highlights how French equities don’t appear to offer a great deal of value against a diversified basket of developed market stocks, as represented by the Vanguard Developed Market ETF (VEA). We can see that this ratio currently looks rather overbought, trading well above the mid-point of the long-term range, and not too far away from the 2009 highs.

Meanwhile, on EWQ’s own monthly chart we can see that the recent price action has been something akin to a bearish head-and-shoulders pattern, implying the growing probability of heightened weakness ahead. Besides if one considers the upper and lower boundaries of the rising wedge pattern, it’s fair to say that the risk-reward is still skewed unfavorably, for those looking at a long position.

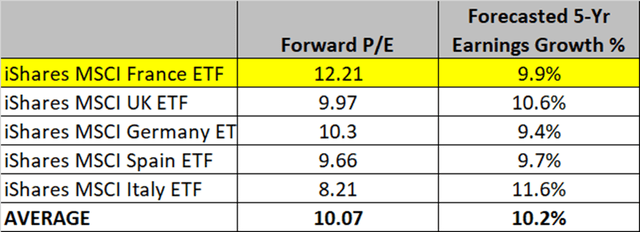

As per YCharts, EWQ also does not offer great value for the long-term earnings potential that it offers. Compared to comparable ETF options from other major European nations, EWQ is the priciest from a forward P/E perspective (12.21x), trading at a 21% premium to the peer set average. Yet it only offers ~10% long-term earnings growth, lagging other options from Italy and UK.

To conclude, there’s not a lot going for the iShares MSCI France ETF, and without coming across as overly flippant, I suspect an investment at this juncture, may well result in a similar “outcome” to that experienced by the French national football team (Les Bleus) at the 2022 World Cup Finals. I believe investors could be better-served fishing elsewhere.

Be the first to comment