Brandon Bell/Getty Images News

Introduction

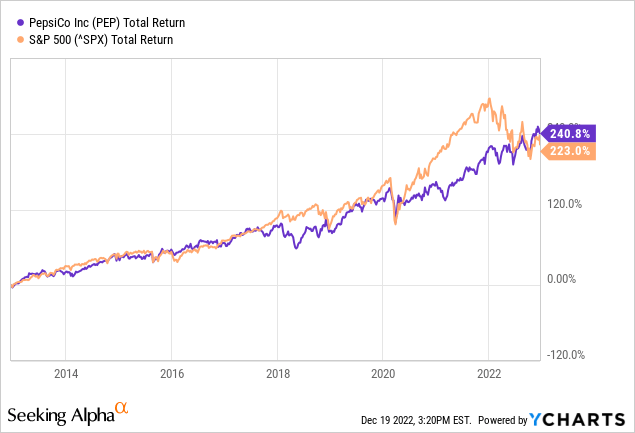

PepsiCo, Inc. (NASDAQ:PEP) is the parent company of well-known brands such as Lay’s, Pepsi, Tropicana, Quaker and the like. The share price rose in line with the S&P 500 (SP500), it brought about a 13% average return over the past decade. The stock is still rising strongly, while the S&P500 and the Nasdaq are in a declining market.

It is also noteworthy that the stock’s volatility is very low. PepsiCo’s beta is 0.59 (5-year monthly basis), which means the stock trades with lower volatility than the general market.

The consumer staples sector is a defensive sector. Companies like PepsiCo can pass on higher raw material costs due to inflation in their products. This allows them to maintain their profit margins. PepsiCo seems like the perfect stock, but its valuation is too high to justify its growth. Which would investors rather choose: PepsiCo with a fiscal 2024 forward earnings yield of 3.7% (rising 8% on average over the next few years), or a government bond with 5% yield?

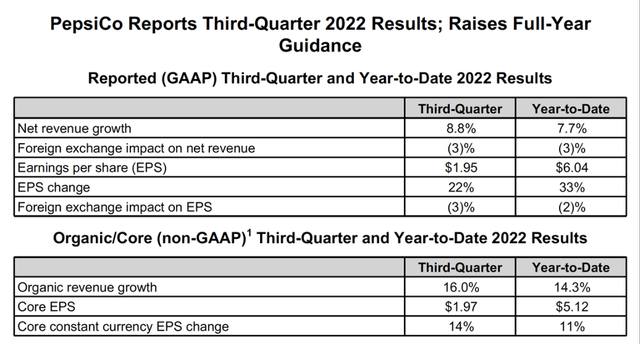

Third Quarter Earnings Were Strong

PepsiCo, Inc. third-quarter results were strong, with net sales growth of 8.8% year-over-year, and earnings per change increased 22% over the same period.

Financial highlights (PepsiCo’s third quarter 2022 results)

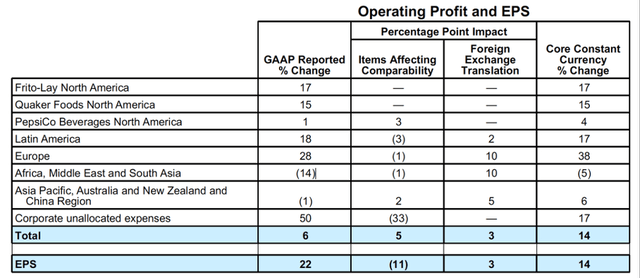

Revenues in North America grew strongly. Frito-Lay sales increased 20%, Quaker Foods sales increased 15%, and PepsiCo sales increased 4% in North America. The increase in revenue was mainly due to price increases, while volumes fell 2% and 4%, respectively. PepsiCo beverage volumes were up 1% in North America.

Revenues in Latin America also rose sharply, by 20%, as convenience food and beverage volumes increased 3% and 7%, respectively. Volumes in Europe declined the most of any region, while revenues were up 1% and operating income was up 28%.

Operating profit and EPS (Pepsi’s 3Q22 results)

PepsiCo raised its full-year results to 12% organic sales growth and 10% core earnings per share growth at constant currency.

On Dec. 5, Pepsi announced that it will reduce its workforce by hundreds to simplify the organization and operate more efficiently, affecting its headquarters in Chicago and Plano, Texas. The workforce reduction could be the beginning of more layoffs to follow. This would result in lower costs and increased profits in the short term.

Dividends, Share Repurchases and Debt Maturities

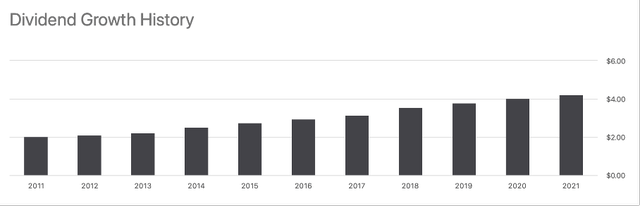

PepsiCo’s management is very shareholder-friendly, as the dividend has been growing steadily for years. Over the past ten years, the dividend per share has increased an average of 7.7% per year. Currently, the dividend is listed at $4.60, representing a dividend yield of 2.6%.

PepsiCo’s dividend growth history (PepsiCo’s Ticker Page on Seeking Alpha)

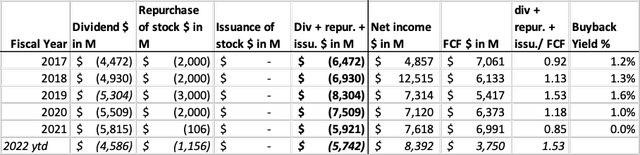

The increase in dividends per share is mainly due to share repurchases, as free cash flow has remained roughly flat over the past 4 years.

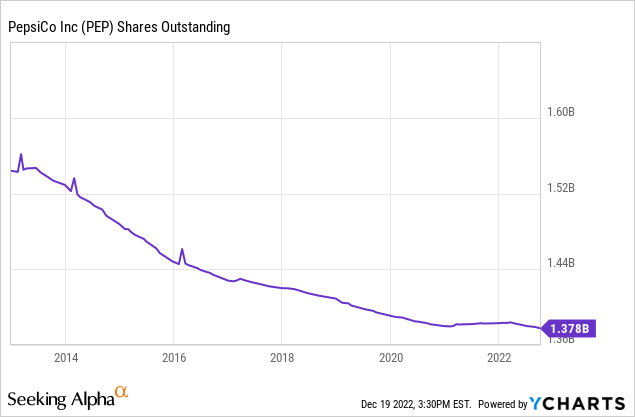

The significant share repurchase program led to a reduction in shares outstanding from 1.5 billion in 2013 to 1.4 billion today (an average reduction of 1% per year).

PepsiCo partially finances its dividend distribution plus share repurchases with cash on its balance sheet. PepsiCo returns cash generously to shareholders. Between 2018 and 2020, it returned more cash to shareholders than came in in free cash flow. Currently, the company has returned 53% more cash to investors than it generated in free cash flow. This is not sustainable for the long term as net debt increases.

PepsiCo’s cash flow highlights (SEC and author’s own calculation)

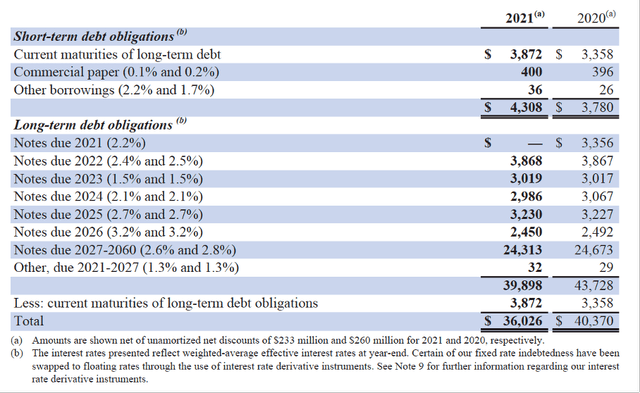

In 2017, net debt was $28.7B. Currently, net debt increased to $32.9B. Looking at the debt maturities, we see that the company has a lot of debt outstanding between 2027 and 2060. That is far in the future. This is good news as the Fed aims to raise interest rates to 5%; newly issued bonds have higher coupon rates.

Through 2027, PepsiCo has a total of about $11.7 billion in debt outstanding (assuming the debt maturing in 2022 is already paid off). The debt will either be refinanced at a higher interest rate or PepsiCo will proceed without refinancing.

I expect PepsiCo will not refinance its debt, but will reduce the size of its share buybacks, which affects dividend per share growth. Still, PepsiCo continues to grow strongly in sales and earnings, so I don’t expect any short-term problems with their dividend per share growth.

The table below shows PepsiCo’s outstanding debt maturities as of January 2022.

PepsiCo’s debt maturities (2021 annual report)

Valuation Looks Expensive

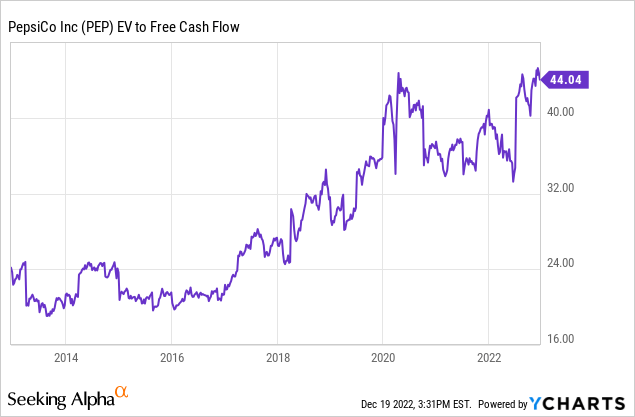

Finally, we come to the stock’s valuation. Since PepsiCo distributes dividends and has a robust share repurchase program, I choose the EV to Free Cash Flow (“FCF”). The chart shows a shockingly high EV/FCF ratio of 44, nearly an all-time high over the past 10 years.

Yet this is not meaningful; The Coca-Cola Company (KO) had an EV to FCF ratio that was also 44 in 2018. Shortly thereafter, the stock fell about 15%, after which it recovered. Coca Cola’s EV to FCF ratio fell to 22 early this year; Coca Cola’s free cash flow has increased 85% from 2018 to date.

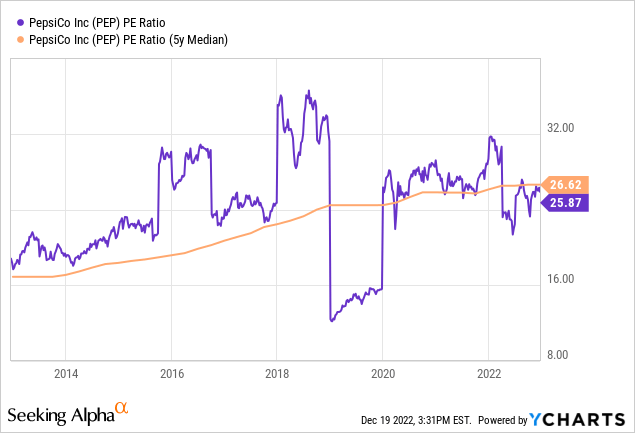

Another way to gain insight in the stock’s valuation is to chart the P/E ratio. PepsiCo’s GAAP PE ratio is 26 and is slightly below the 5-year average of 27. The stock is more expensively valued than the S&P500, with a P/E ratio of 21. Still, revenue and earnings expectations for the coming years are strong.

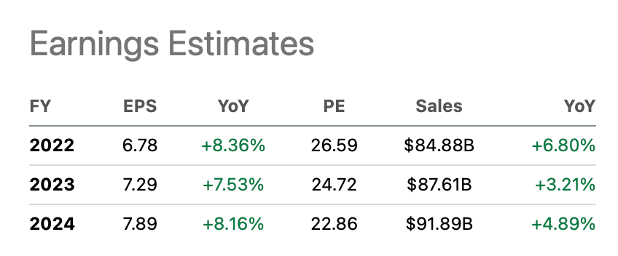

18 analysts on the Seeking Alpha PepsiCo ticker page have raised their earnings estimates for the coming years. Revenues are expected to increase by an average of 4% per year and earnings per share by an average of 8%. These are strong growth figures.

The forward P/E ratio quotes 22.9 for fiscal year 2024. If we multiply the 5-year average P/E ratio of 27 by the earnings per share for fiscal year 2024 of $7.89, we arrive at a share price of $213. The current share price is $181, giving an average annual growth rate of 8.5%. Added to that is the dividend yield of 2.6%, bringing the total pre-tax return to 11.1% annually.

PepsiCo’s earnings estimates (Seeking Alpha PEP ticker page)

The expected total return of 11.1% may sound rosy, but the P/E ratio of 27 for fiscal year 2024 is extremely high. The earnings yield is the inverse of the P/E ratio (=3.7%). The problem is that the Fed aims to raise interest rates to 5%. What would investors rather choose: PepsiCo with a fiscal 2024 forward earnings yield of 3.7% (rising 8% on average over the next few years), or a government bond with 5% yield? The stock currently seems very expensively valued and is a hold.

Conclusion

PepsiCo is the parent company of well-known brands such as Lay’s, Pepsi, Tropicana, Quaker and the like. The stock is a low-beta stock, meaning its volatility is lower than that of the general market.

The company showed strong revenue and earnings per share growth of 8.8% and 22% in the third quarter of 2022. Companies like PepsiCo can pass on higher raw material costs due to inflation in their products. The company raised its full-year outlook and announced cost-cutting measures to improve short-term profitability.

PepsiCo distributes dividends and repurchases shares. Dividends per share have increased an average of 7.7% annually over the past decade. PepsiCo finances dividend distribution plus share repurchases partly with cash on its balance sheet. That is not sustainable in the long run, because the debt pile is growing. The Fed aims to raise interest rates, so I expect PepsiCo to reduce the amount of share repurchases in the near future.

The valuation of the stock seems expensive when looking at the ratio of EV to free cash flow and the P/E ratio. 18 analysts have revised upward earnings estimates for the next few years. If we multiply expected earnings per share for fiscal year 2024 by PepsiCo’s 5-year average P/E ratio (and include dividends), we arrive at an annual pre-tax return of 11.1%. But PepsiCo’s average P/E ratio of 27 is quite high, especially as the Fed seeks to hike interest rates to 5%. Investors could choose: PepsiCo with a fiscal 2024 forward earnings yield of 3.7% (rising 8% on average over the next few years), or a government bond with a 5% yield? PepsiCo, Inc. stock currently appears expensively valued and is a hold.

Be the first to comment