SHansche/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate iShares MSCI United Kingdom Small-Cap ETF (BATS:EWUS) as an investment theme under current market conditions. This is a fund that tracks small-cap U.K. stocks specifically. This differs from the ETF I usually write about to give my outlook on British companies, which is the iShares MSCI United Kingdom ETF (EWU). EWU, by contrast, has a broader focus and includes mostly large and mid-cap companies – not small-caps.

As my readers know, I remain overweight U.S. equities but have been increasing my allocation to non-U.S. developed markets. For the most part I have avoided central Europe, given its proximity to the Russia-Ukraine conflict. While that rules out much of the developed world, I have still found value in places like Canada, Australia, and, notably, the United Kingdom. While Britain itself is part of Europe, its isolation as an island nation allows it to be less exposed to the current military conflict and less at risk if that conflict expands. While there is still more risk inherently than compared to Canada or Australia, it is a risk I am willing to take.

With that in mind, U.K. small caps, and EWUS by extension, has caught my eye. This is primarily because the fund has had a terrible 2022 so far:

Fund Performance (Seeking Alpha)

While that may sound counter-intuitive, the point is that I believe this sell-off is a bit too steep and unjustified. While concerns over the war, domestic economy weakness, and inflation are all reasons to have sold off stocks, a drop in to bear market territory always piques my interest. That doesn’t necessarily mean I am going to buy, but it at least suggests it is an area I should look in to. After doing so with EWUS, I believe a buy case could be made here, and I will explain why in more detail below.

Britain’s Labor Market Is Encouraging

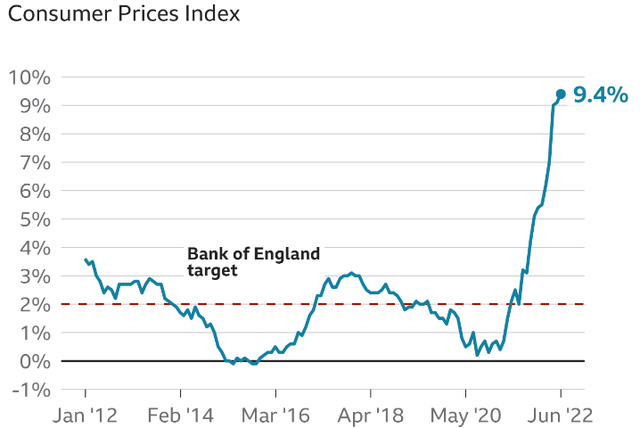

One major pain point for the British economy impacting consumers and businesses alike is inflation. This should ring consistent to American investors, and it forces us to confront the reality that inflation is a global problem. However, it is especially acute in the U.K. where inflation readings are coming in even hotter than in the U.S., and at very high levels historically:

This is particularly important to evaluate when buying EWUS because, as a small-cap fund, it is more sensitive to domestic issues. As opposed to larger British firms that earn a higher share of their revenues and profits outside the country’s borders, small-cap stocks are more reliant on the health of the domestic economy. This helps explain why EWUS has had such a dismal year – the underlying impact of inflation has been pronounced.

However, I see light at the end of the tunnel here. What I mean is that while the news seems bad, it may be about to turn, which is the perfect time to invest. If we wait for inflation to cool and/or the economy to see a broad rebound, equities will have likely already moved. The time to get in is when the macro-environment is pumping out news that has everyone worried, but when there are also signs we could see improvement soon.

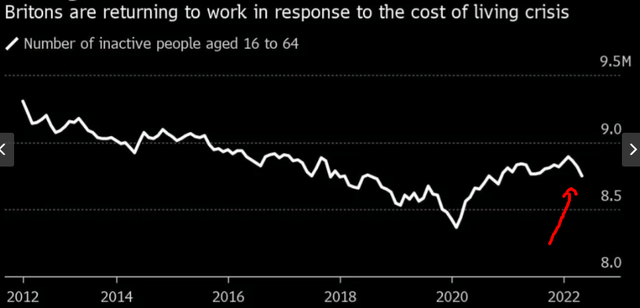

So, what are some of those signs? One of paramount importance is that more British workers are rejoining the labor market. In fact, the labor market is bringing in new entrants at the fastest pace since before the pandemic:

More Britons Joining Labor Market (Yahoo Finance)

I see this as inherently good news for a few reasons. One, it suggests the beginning of a return to normalcy in the labor market. Two, while many Britons may be returning because of the cost of living increases, this could wind up being a self-correcting development. What I mean is, as more people enter the labor market, that should put some downward pressure on wages. That could help alleviate some of the underlying inflation. Two, theoretically with more people working, supply for goods and services should also increase. This, again, should help bring inflation down.

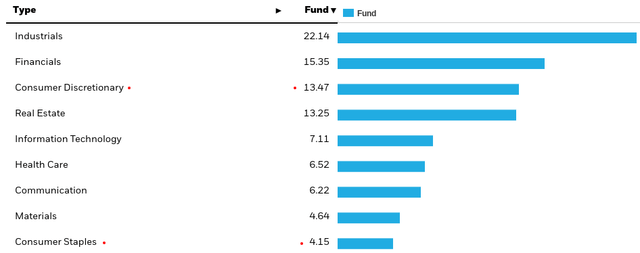

My takeaway from this is it is a win-win for the economy and stocks, especially domestically-oriented small-caps. If more people are working society is more productive. It is also signaling a return to pre-COVID levels in terms of share of adults working, which will normalize supply and wages. Furthermore, if households that currently did not have an income before are now bringing home more dollars, that should boost consumer spending as a whole. This is critical for EWUS’ performance because the fund has about 18% of its assets in consumer-oriented sectors, as shown below:

EWUS’ Sector Weightings (BlackRock)

The conclusion I draw here is that while inflation has been a major sore point, and continues to be right now, I think the headwind is starting to turn the tide. With more people working, consumer spending and sentiment should improve from the dismal levels we have seen recently. This improvement could help drive gains for EWUS.

Dividend Growth Signals Underlying Health

The next point on EWUS is one that is dear to me as a “dividend seeker”. Specifically. this relates to the fund’s dividend, which looks attractive on the surface offering a yield in excess of 5%. While this above-average yield looks enticing, what really has me excited is the year-over-year dividend growth. For example, in June 2022 the distribution paid out by EWUS was markedly higher than what investors saw in June 2021:

| June 2021 Distribution | June 2022 Distribution | YOY Change |

| $.23 | $.44 | 91% |

Source: iShares

My view is this is a very comforting metric. It shows that the underlying health of EWUS’ holdings are strong, on average, and that perhaps the market is mispricing these assets. Clearly, the companies within the portfolio are confident enough to be returning a large amount of cash to shareholders, and that is definitely helpful in an inflationary environment. While I wouldn’t necessarily predict such a large boost for the December distribution as well, any level of growth will help keep the current yield at an attractive level (assuming the current share price is constant). This by itself gets me interested.

Financials Can Benefit From Rate Hiking

While I discussed the consumer holdings earlier, readers probably noticed that “Financials” make up a good bit of EWUS as well. At over 15% total fund assets, this sector’s performance is also critical returns. Fortunately, this is another spot where I think some value exists.

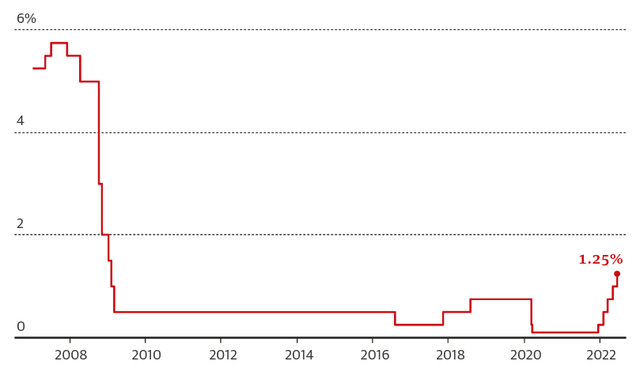

Specifically, Financial companies like banks and lenders can benefit when interest rates rise. The logic is they will pass on more of the increase on their products and services that they charge for, and less on the deposit side. This spread should improve net interest margins, a win for the sector. So far in 2022, that is precisely what is taking place, with the Bank of England pushing rates higher off their historical lows:

Bank of England Benchmark Interest Rate (Bank of England)

While these rates are not “high”, it does mark an improvement for the Financials sector as a whole. Further, there are indications the central bank is not done hiking yet, with a .50 basis point increase on the table for the August meeting, set to take place next week, according to a report from Reuters.

All things considered, this is a positive backdrop for the Financials sector as opposed to other growth-focused areas that have thrived in a low rate environment. To me, this positioning sets the fund up nicely for the second half of the year.

Small-Caps As A Whole Look Cheap

My last point takes a look at the small-cap market more broadly. I personally see some value in the British economy as a whole, and that is beneficial for EWUS. But, just as importantly, I think investors should be looking at small-caps in general right now. Perhaps EWUS is not right for everyone, in the sense they may not want European or British exposure, or perhaps this particular fund make-up is not the sector exposure one wants. But I think it is worth highlighting that small-caps as a sector seem very unloved at the moment, and that is the time to put the contrarian cap on.

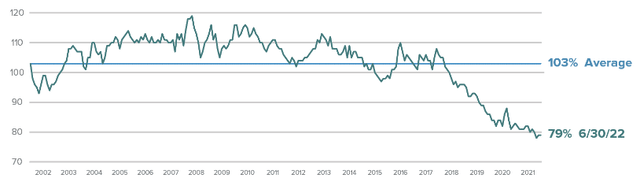

For perspective, consider that the broader index for small-caps (not just British companies) is currently trading at an extremely wide discount to the index for large-caps, as shown below:

Relative Valuations for Small-Caps vs. Large-Caps (S&P Global)

What this is showing is that small-caps have a 20% discount to large-caps, which happens to be their lowest relative valuation in more than 20 years. Perhaps more notably, the average valuation trend is for small-caps to have a premium versus large-caps, so this is quite a divergence.

Does this mean that small-caps are going to just shoot higher? Of course not. Similarly, it doesn’t suggest British small-caps in particular are guaranteed any forward profits. But it does tell me that contrarian investors need to be considering this space more broadly. This is a steep discount relative to their large-cap peers, and history suggests this discount won’t last forever.

Bottom-Line

EWUS has been a losing play in 2022, but I believe a rebound is around the corner. The Bank of England is hiking rates and more Britons are returning to the labor force. These developments should help ease inflation, which has been a major point of contention for British equities big and small. In addition, when looking outside U.S. borders, I want developed markets less exposed to the military conflict in Ukraine. Given that Britain does not share a land border with Europe and has its own currency, I feel more at ease putting my money to work here than in others parts of the continent. Therefore, I will be looking to begin a position in EWUS, and I suggest readers give this fund some consideration at this time.

Be the first to comment