FotografiaBasica/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the iShares MSCI United Kingdom ETF (NYSEARCA:EWU) as an investment option at its current market price. The fund’s stated objective is “to track the investment results of an index composed of U.K. equities.” The fund offers exposure to large and mid-sized companies that are based in the United Kingdom.

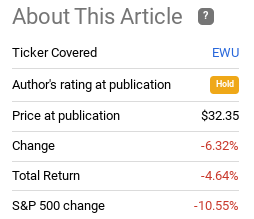

I have held a neutral/hold rating on EWU for a while, which was reiterated during my review a little over two months ago. In hindsight, this outlook has been vindicated because while EWU has seen some losses, they are modest compared to the decline in the S&P 500:

Fund Performance (Seeking Alpha)

Given this performance snapshot, I thought it would be timely to take another look at this option. After review, I continue to see some merit to holding a position in British equities. I picked up EWU as it dropped, so I am hoping it heads higher from here. Yet, there are multiple headwinds on the horizon, so I have to manage expectations by saying that meaningful gains may take a while to materialize. Therefore, I suggest readers consider their risk tolerance, and look to ladder into this option because further downside is very possible.

Consumer Picture in the UK and Europe Is Tight

To begin, I want to talk about some of the reasons for the weakness in EWU, and why I am not extremely “bullish” on this option in the short-term. As noted, EWU has fared better than the S&P 500, so that is a plus. But the fact remains that total return was negative, so it makes sense to take some time discussing why that is.

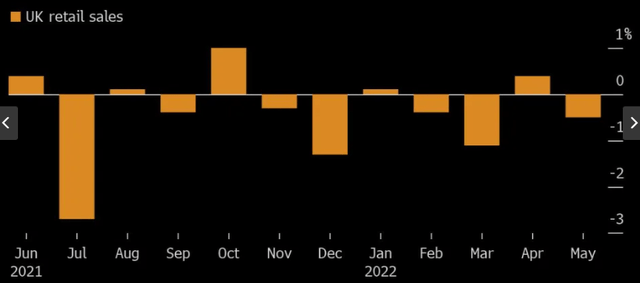

One key reason is the weakness of the British consumer. Similar to the U.S., British households are faced with a tough economic backdrop. Inflation is a major pain point, and sentiment has been hit hard. The result has been a softening of consumer spending, as evidenced by the fact that UK retail sales fell in May, marking the third month where that has happened in 2022:

UK Retail Sales (Monthly) (Yahoo Finance)

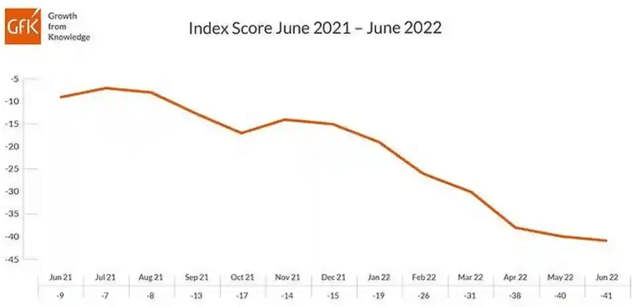

Of course, this is backward looking, but the data is so recent it should give investors some pause. Further, if consumer sentiment is any indication, retail sales are probably not going to shoot higher any time soon. Specifically, this is because sentiment within Britain is falling off a cliff. On a year-over-year basis it is down considerably, but this trend has worryingly accelerated in the short-term, as shown below:

Consumer Confidence (British Consumers) (The Guardian)

My thought here is this is not really surprising. Essential costs are rising, including fuel, utilities, groceries – you name it. Consumers clearly expect these prices to continue to rise, putting at risk a rebound in discretionary spend. As demand for goods and services falls, this will depress business profits and, potentially, GDP, which will limit the upside to a fund like EWU.

Mainland Europe Also Faces Challenges

Digging deeper, my readers will likely remember that I viewed the British economy more favorably than most of Europe because of its proximity (or lack thereof) to Eastern Europe. With the war between Russia and Ukraine continuing, I want to reduce exposure to mainland Europe. Simply, they are most reliant on the supply-chains impacted by this conflict, and they are most at risk if there is an escalation beyond Ukraine’s borders.

The reality is I have opened up positions in a number of developed economies as a hedge against U.S. stocks. Britain and Ireland right now are the two countries I am willing to dive in to, because they are outside the mainland continent and, hopefully, are more sheltered from this conflict.

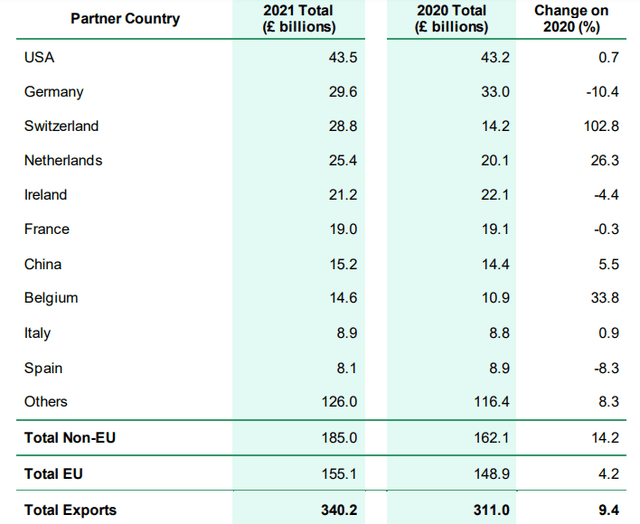

While I stand by this thesis, we should acknowledge that British companies are still dependent on the fortunes of continental Europe. The mid and large-cap companies that make of EWU are international in nature. For British companies, this means a lot of trade with EU-member countries:

United Kingdom’s Trading Partners (U.K. Revenue and Customs)

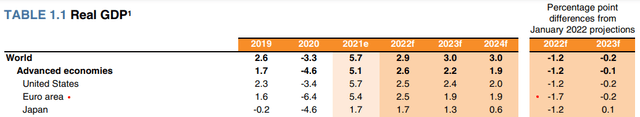

With this in mind, it is concerning that GDP expectations have sharply declined for the EU-area. While macro-headwinds are pressuring all advanced economies, it has not pressured them equally. The EU is expected to grow at a much lower pace:

Expanding on this point, we should understand that Europe is facing many of the same problems as the U.K, and the U.S. for that matter. While the Russia-Ukraine conflict is more unique to central and eastern Europe, inflation is a major pain point on the continent as well. Similar to Britain, important trading partners like Germany are expected to see (and are already seeing) a surge in energy costs, as seen on forward contracts for energy inputs:

Futures Prices For Energy (Germany) (Bloomberg)

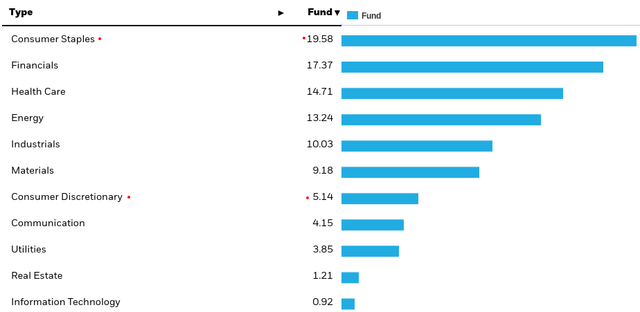

This is just one example, there are many others, and it is pretty consistent in Britain’s other top trading partners, like France, Switzerland, and Belgium. We should also remember that EWU has an overweight exposure to the consumer, as roughly 25% of its underlying holdings are classified as either Consumer Staples or Consumer Discretionary companies:

EWU Sector Weightings (BlackRock)

In short, the reality on the ground in Europe and the nature of EWU’s make-up are signals to be cautious here. While I have a position in the fund, I will only add to it selectively in the months ahead because of this backdrop.

The Dividend Story Is Healthy

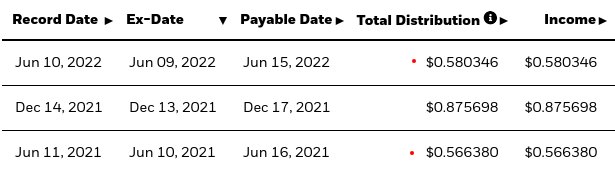

I will now shift to some of the positives. One in particular that I like as a “dividend seeker” is EWU’s dividend. The U.K. in general has been known for a while for offering an above average yield in the large-cap sector. This has been especially true post-Brexit since equity gains have been fairly muted compared to the globe. This has made the dividend stream all the more important, and the first distribution this year showed a reasonable 3% increase from 2021:

EWU Distributions (BlackRock)

This is not the most impressive metric in the world, but it is reasonably healthy. Just as importantly, if we annualize the December 2021 distribution together with the June 2022 distribution, we get a current yield near 4.8%. This is attractive compared to the U.S., as well as most nations at the moment. Therefore, from an income perspective, EWU meets the bill.

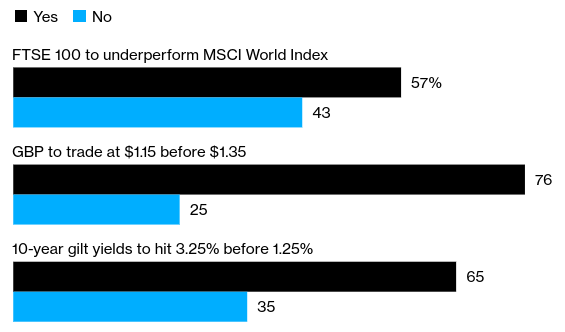

Market Is Pessimistic – Contrarian Play?

My next point is a bit mixed, but some may view it as a negative. But I personally view it as a positive because I am a contrarian by nature. What I am referring to is the overly pessimistic attitude investors have with respect to British equities at this juncture. For support, consider the results of a survey by Bloomberg. The majority of respondents expect British equities to under-perform global equities, along with the expectation that bond yields will spike and the Pound Sterling will weaken:

Outlook For Britain Survey (Bloomberg)

The conclusion I draw here is that the market is fairly pessimistic on the U.K.’s outlook right now – on an economic level and in terms of forward equity performance. While there is certainly support for this view – such as the reasons I laid out at the beginning of this article – this overt pessimism has me considering positions. Personally, these levels don’t exist me a lot, but I will probably be adding to my position if EWU sells weakness in the days ahead. If I see above-average drops and/or a general correction in the coming weeks, then I will certainly be adding. This is because I like to take the contrarian stance. If the market / investors are overly confident that British equities will not perform well, then contrarian logic tells me to take the other approach. Given the responses to Bloomberg’s recent survey on the outlook for Britain, I think we are nearing that buy point.

America’s Productivity Reigns Supreme

My final thought is that I want to emphasize I remain over-weight U.S. equities in my portfolio. To be fair, I am always looking for ways to diversify and smooth out potential volatility – 2022 has been a reminder about how important that is. With the major U.S. indices clawing back some of the year’s losses, it is reminding me how resilient U.S. markets are. Further, investing closer to home makes me more comfortable. So while I have a position in EWU, and other developed markets, readers should recognize I am still bullish on America for the long-term. Do I want 100% exposure to the U.S. economy? No. But I am not “bearish” on the U.S. – that is not why I am buying EWU.

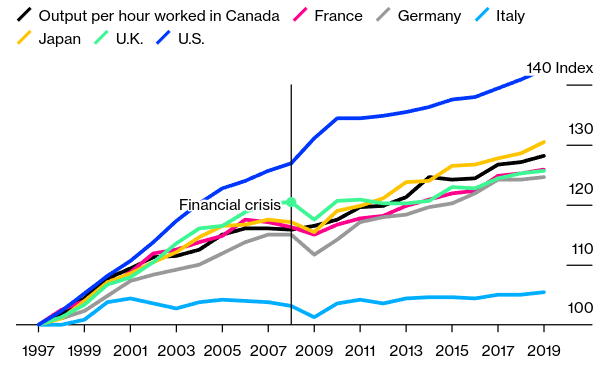

Aside from the domestic bias, investing in American companies gives me exposure to one of the world’s most productive workforces. While developed nations in Europe are not well known for their productivity, America also blows away Canada and Japan as well, in terms of worker output:

Workforce Productivity (Bloomberg)

The good news is British workers are not terribly behind their European peers. The nation falls in the mid-range. (Italy is a notable exception, and not a country I would want much exposure to). But the takeaway for me is that this is another reason why I want the majority of my exposure to be the S&P 500, or American stocks in general. As a country we have a very productive workforce, and that carries through to profits and share prices. The fortunate point here is that Britain is not far behind the globe, just the U.S., but so is everyone else.

Bottom-line

I’ve been patient on EWU for a while, and that outlook has turned out to have made a lot of sense. While the fund has been outperforming the S&P 500, it is still in the red for the year. This is because the world is facing many of the same problems. Britain, just like the U.S., mainland Europe, Asia, and the rest of the globe faces problems from supply shortages, inflation, and uncertainty. The country continues to face weak GDP growth, a tepid consumer, and a workforce whose productivity is rising very slowly.

Yet, an argument can be made for an investment here. The fund has a solid dividend, and year-over-year growth in this regard shows the underlying companies are relatively healthy. Further, I like how Britain is more isolated from the Russia-Ukraine conflict than most of Europe. This way, if the conflict escalates, it will be less impacted as a result. Finally, the market seems very pessimistic on the U.K. as a whole, and that suggests the time could be ripe for a contrarian play.

Ultimately, EWU continues to be a mixed bag. I take this to mean that investors need to stay patient, wait for weakness / down days to buy, and not get too aggressive in the short-term. For me, I will continue holding, and look to add to my position in the coming months if we see either some positive news or an unjustifiable market drop. Therefore, I will keep my rating on EWU as a “hold”, and suggest readers approach the fund selectively at this time.

Be the first to comment