(This article was co-produced with Hoya Capital Real Estate)

Ibrahim Akcengiz/E+ via Getty Images

Introduction

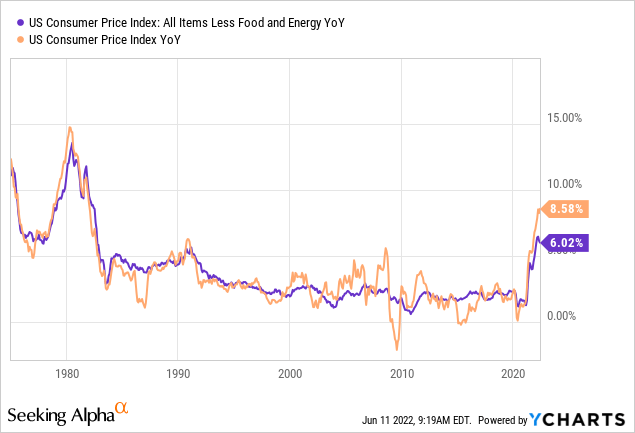

With inflation at 40-year highs, commodity funds are becoming a well-discussed topic on Seeking Alpha. Juan de la Hoz recently reviewed two popular ETFs in PDBC Vs. DBC: Which Is Best For Commodity Bulls? I reviewed two from Aberdeen Asset Management in Aberdeen Offers Both A Short And Long-Dated Commodity ETF. This article reviews the iShares Bloomberg Roll Select Commodity Strategy ETF (NYSEARCA:CMDY).

Understanding The Shares Bloomberg Roll Select Commodity Strategy ETF

Seeking Alpha describes this ETF as:

iShares Bloomberg Roll Select Commodity Strategy ETF is managed by BlackRock Fund Advisors. The fund uses derivatives such as futures contracts to invest in agricultural, energy, precious metals and industrial metals commodities. It seeks to gain exposure to index futures and other commodity investments through a wholly-owned Cayman Islands subsidiary. The fund seeks to track the performance of the Bloomberg Roll Select Commodity Total Return Index. CMDY started in 2018.

iShares lists three benefits for owning CMDY:

iShares.com CMDY

CMDY has $367m in assets and comes with a 28bps expense factor. Like many commodity funds, the stated yield (11.4%) reflects a large payout at the end of 2021. The average yield over the past couple of years is more like 2%.

Understanding The Bloomberg Roll Select Commodity Total Return Index

Bloomberg describes their Commodity family (BCOM) of indices as:

BCOM provides broad-based exposure to commodities, and no single commodity or commodity sector dominates the index. Rather than being driven by micro-economic events affecting one commodity market or sector, the diversified commodity exposure of BCOM potentially reduces volatility in comparison with non-diversified commodity investments.

Source: bloomberg.com/professional/product/indices

The Bloomberg Roll Select Commodity Index aims to control “rolling costs” on the index performance. For each commodity, the index rolls into the Futures contract showing the most backwardation or least contango, selecting from those contracts that settle within nine months. The ETF’s Prospectus explains why that is important and their execution strategy to minimize that cost:

In order to maintain exposure to a futures contract on a particular commodity, an investor must sell the position in the expiring contract and buy a new position in a contract with a later delivery month, which is referred to as “rolling.” If the price for the new futures contract is less than the price of the expiring contract, then the market for the commodity is said to be in “backwardation.” In these markets, roll returns are positive, which is referred to as “positive carry.” The term “contango” is used to describe a market in which the price for a new futures contract is more than the price of the expiring contract. In these markets, roll returns are negative, which is referred to as “negative carry.” The Underlying Index seeks to employ a positive carry strategy that emphasizes commodities and futures contract months with the greatest degree of backwardation and lowest degree of contango, resulting in net gains through positive roll returns.

Source: ishares.com CMDY Prospectus; page S-2

Other features listed in the Index PDF include:

- The index is made up of 23 exchange-traded futures on physical commodities, representing 21 commodities, which are weighted to account for economic significance and market liquidity.

- Commodity weightings are based on production and liquidity, subject to weighting restrictions applied annually, such that no related group of commodities constitutes more than 33% of the index and no single commodity constitutes more than 15%.

- Contract Selection is on the fourth business day of each month. Reweighted and rebalanced annually on a price-percentage basis.

- To avoid the physical delivery of commodities from the underlying futures, the indexes roll from current to subsequent contracts during the roll period defined in the methodology, which typically falls within the 6th-10th business day of each month.

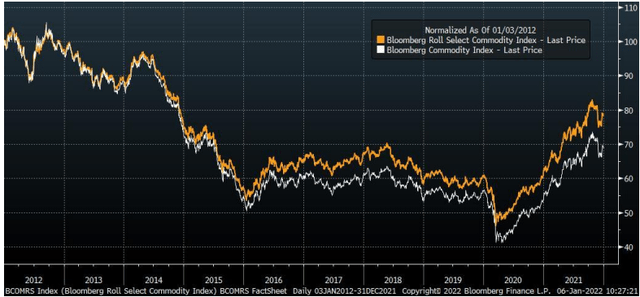

The PDF included two sets of data-points that pre-date the ETF. The first compares the index used by CMDY to the standard Bloomberg Commodity Index. It shows that the roll strategy did add to the return.

assets.bbhub/BCOM-Roll-Select.pdf

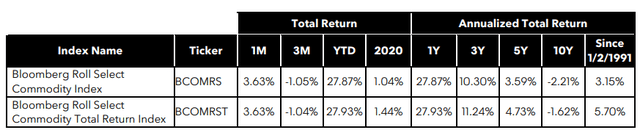

The second gives data on the CMDY Index back to 1991. It shows why commodity funds are best used with timing models. It also shows that distributions since 1991 account for 45% of the return. Data ends on 12/31/21.

assets.bbhub/BCOM-Roll-Select.pdf

Holdings Analysis

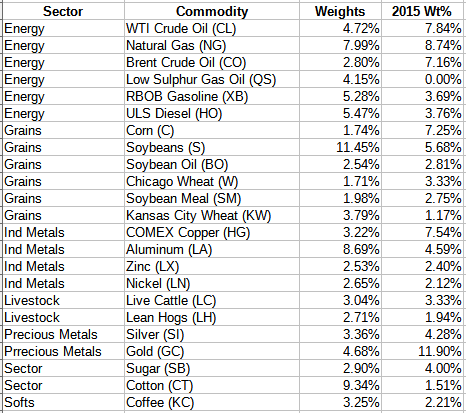

CMDY recently rolled its single Futures position from the June’22 Bloomberg Roll Select Futures, which trade on the CBOE, to the Sept’22 Futures. Currently, they hold 11,920 contracts. The Futures are designed to hold commodities in this allocation:

Bloomberg.com; compiled by Author

Notice that the Futures contract composition has changed since 2015, with Gold taking a smaller slice and Soybeans doubling in weight.

The other positions show they invest their cash across about 50 entities, with T-bills being only 7% of those investments. Most are in corporate paper maturing between now and when the futures expire. The largest two, a BlackRock Money Market fund and a cash collateral account (SGAFT) are 14% of the cash holdings. Overall duration is .07 years, with a YTM of 1.12% on their cash holdings.

Distribution Analysis

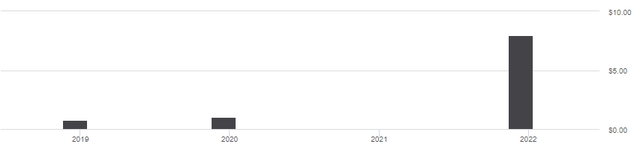

Like many commodity funds, payouts are done at year-end and vary widely each year. Distributions have been 100% from income since inception.

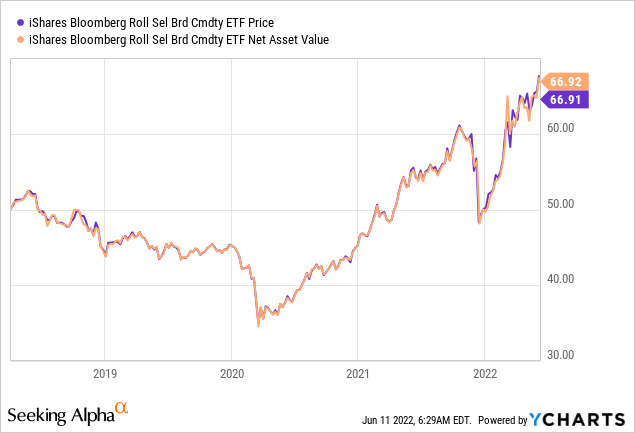

Price And NAV Analysis

The large drop at the start of the year was due to the $7.96 payout that occurred in December. The Total Return chart appears next.

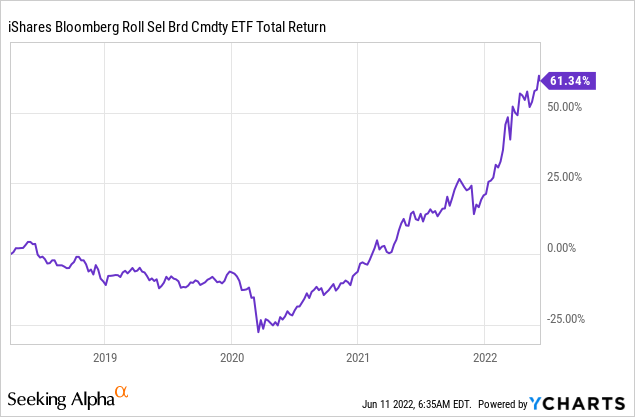

Except for a brief time post-launch, CMDY had investors underwater until early 2021. CMDY is up almost 100% since the 2020 bottom.

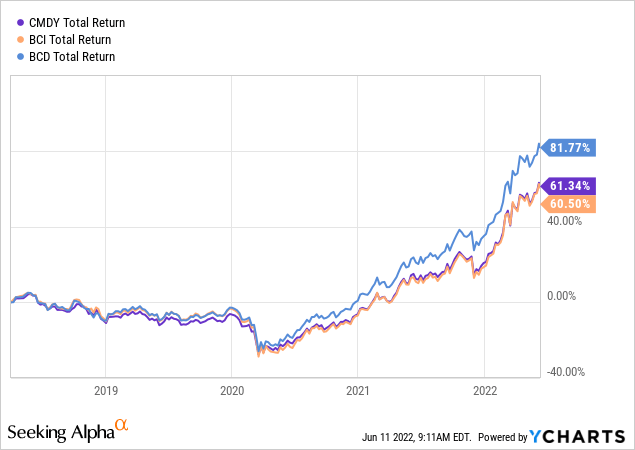

The above chart shows CMDY single Futures strategy matched the Aberdeen Bloomberg All Commodity Strategy K-1 Free ETF (BCI) but trails the Aberdeen Bloomberg All Commodity Longer Dated Strategy K-1 Free ETF (BCD).

Portfolio Strategy

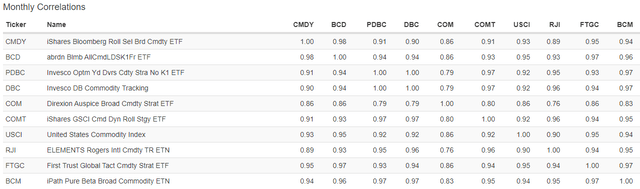

When reviewing Commodity funds, one factor that stands out is their low correlation to US equities, as the next chart will show.

Next, the commodity mix is critical to understand, as fund CAGRs have varied by more than 600bps over the last four years. That is also revealed in the correlations between commodity funds.

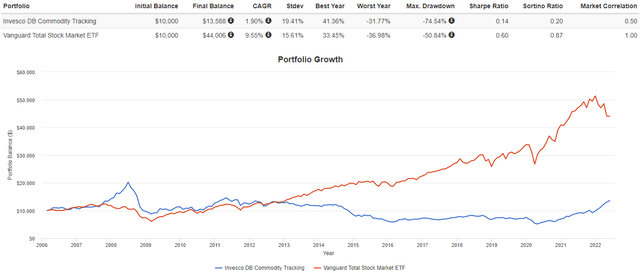

To show timing is critical, the next chart compares the Total Return of the Invesco DB Commodity Index Tracking ETF (DBC) against the Vanguard Total Stock Market ETF (VTI).

It is my observation that Commodity funds work best with timing models, not as a Buy/Hold asset, except for their low-correlation benefits.

For investors wanting a lower risk fund, the Direxion Auspice Broad Commodity Strategy ETF (COM) has the lowest StdDev. For investors okay with the extra risk of Exchange-Trade-Notes, I recently reviewed one of the ETNs available: iPath Bloomberg Commodity Index Total Return ETN Update.

Be the first to comment