shaunl/E+ via Getty Images

ZIM Integrated (NYSE:ZIM) is arguably the stock which brought some shine on the often ignored shipping sector. ZIM is a somewhat recent IPO which has delivered stellar returns in its short time as a public company. It has attracted a large following, likely due to the unusually large dividend payments that it has made to shareholders. ZIM has guided to yet another strong year in 2022 and appears to trade astonishingly cheap: I discuss my views on whether the stock is a good buy this year. I explain why readers may want to avoid buying the stock in spite of the possibility of a high dividend payout again in 2022.

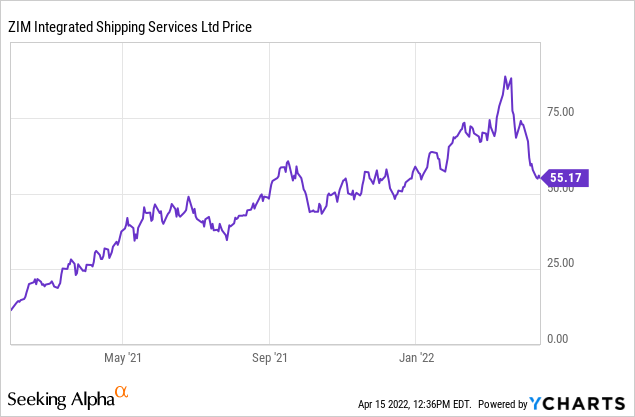

ZIM Stock Price

After coming public at $15 per share in early 2021, the stock peaked at $91 per share and has since fallen back down to around $55 per share.

Even at these lower levels, the stock has still delivered 266% returns in just over a year’s time. What’s next?

ZIM Stock Key Metrics

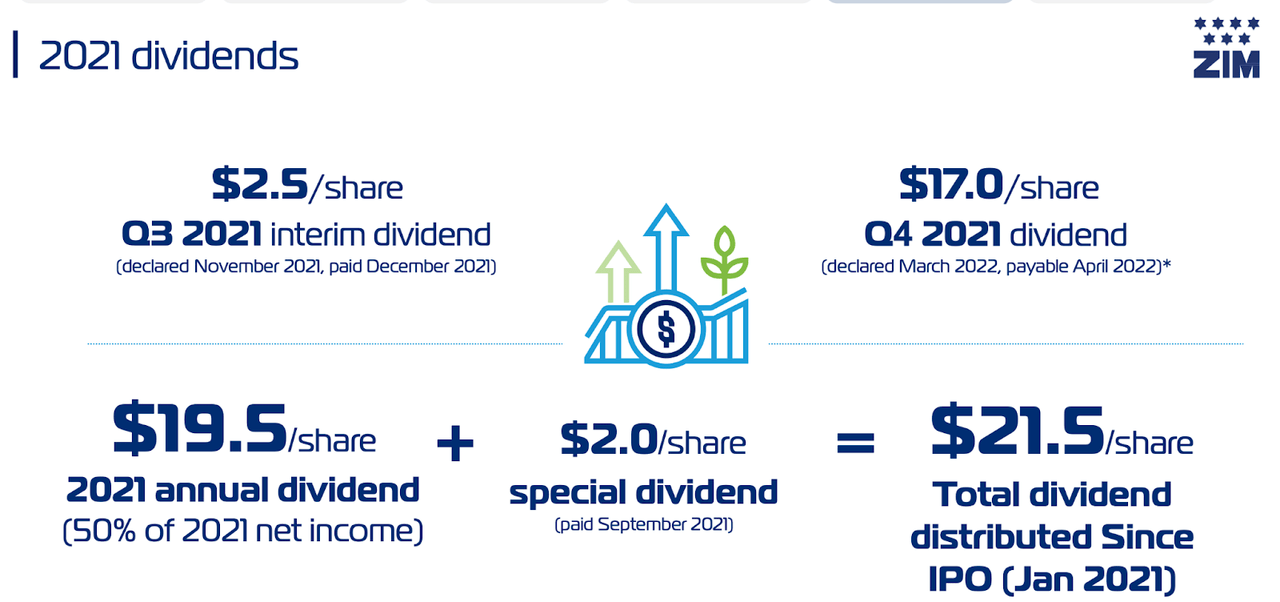

The first key metric which prospective investors likely fixate on is that of the dividend. In addition to a $2 per share special dividend paid in September, ZIM paid $19.5 per share of regular dividends, totaling 50% of full year net income. Together, the $21.5 per share in paid dividends represented 143% of the IPO price.

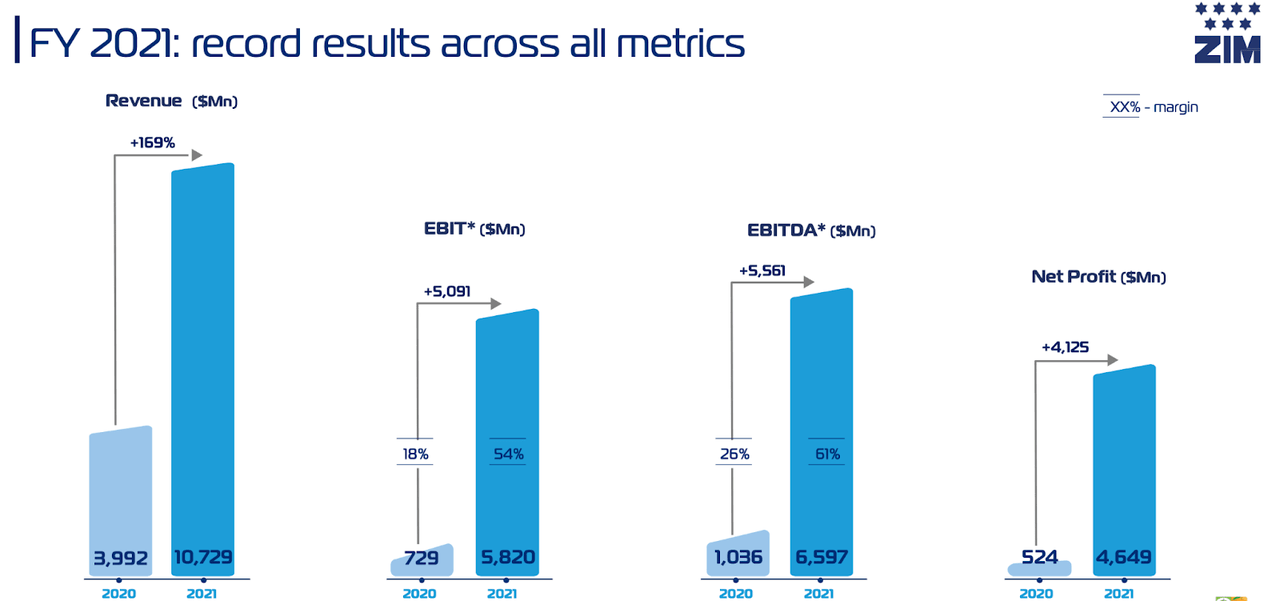

ZIM 2021 Q4 Presentation

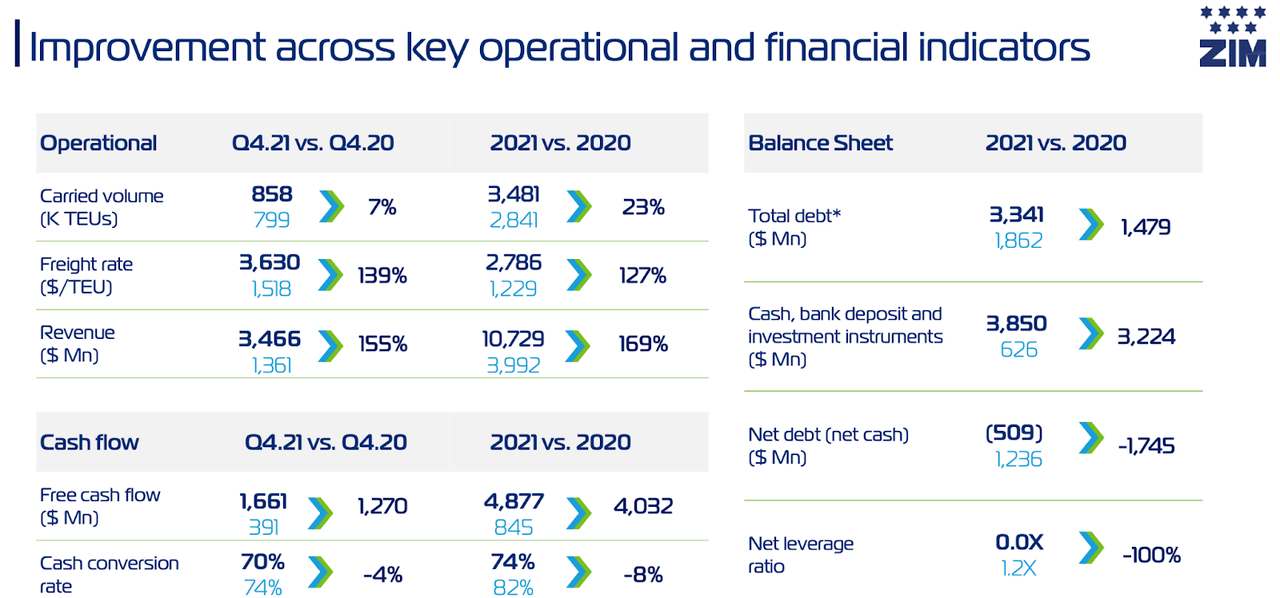

What happened? Due to a combination of soaring demand and held-back supply, freight rates continued to soar in 2021. ZIM realized freight rates of $2,786 per TEU in 2021, representing 127% growth over 2020. While the company only increased carried volume by 23%, the higher freight rate enabled it to increase revenue by 169% and increase net income by 787%.

ZIM 2021 Q4 Presentation

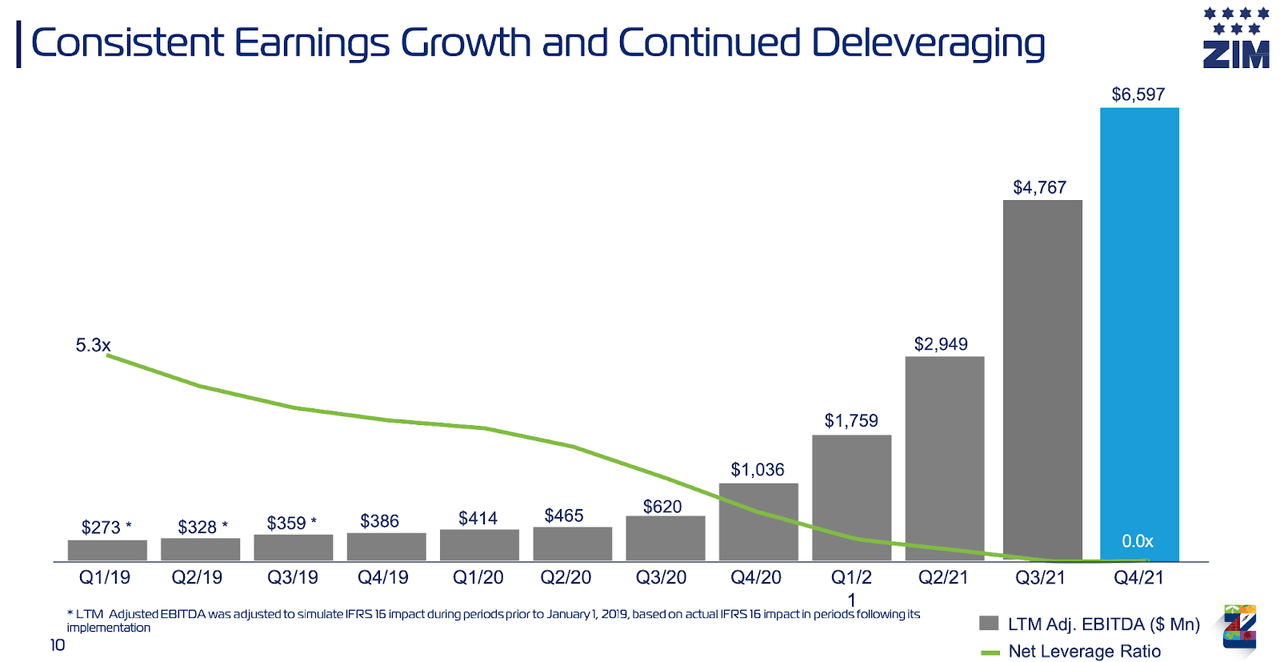

ZIM was able to transform its balance sheet position from a $1.7 billion net debt position to a $509 million net cash position. We can see below that ZIM has reduced its debt to adjusted EBITDA ratio from 5.3x in 2019 down to 0.0x as of the latest quarter. It is quite rare to find a shipping company with a net cash position – I discuss this point later.

ZIM 2021 Q4 Presentation

After generating a 10.9% net margin in 2020 (which already represented an impressive result), ZIM was able to generate a 43% net margin in 2021. Not even the tech company Meta Platforms (FB) generates that kind of profitability.

ZIM 2021 Q4 Presentation

Where Is ZIM Stock Heading In 2022?

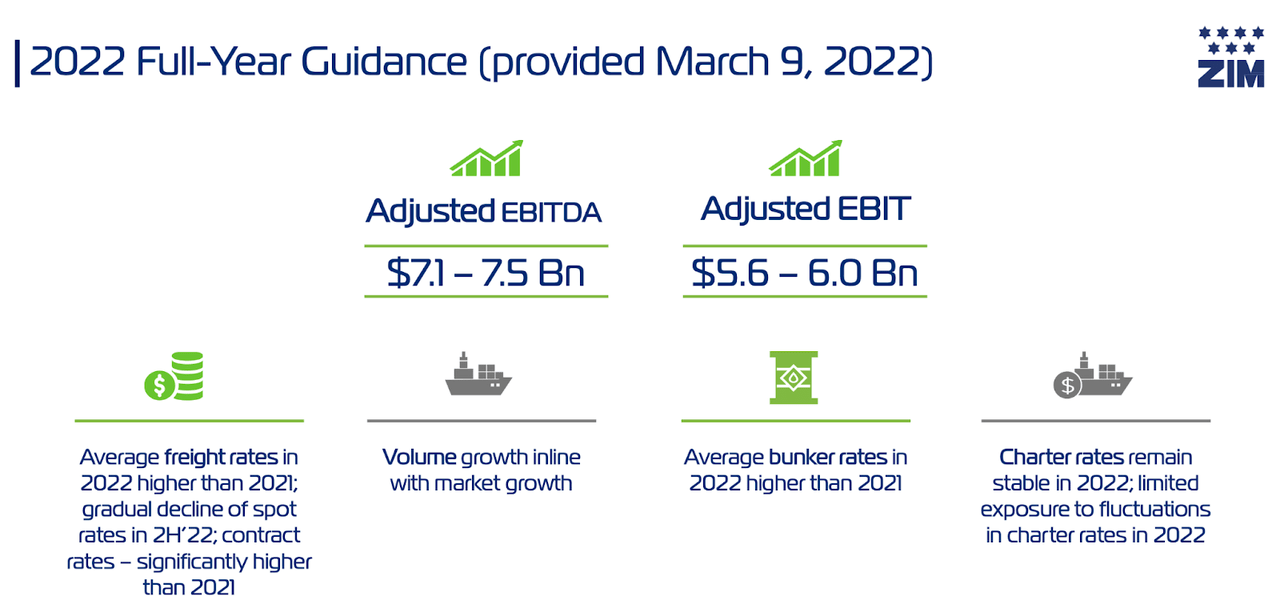

Looking forward, ZIM has guided for up to $7.5 billion of adjusted EBITDA and $6 billion of adjusted EBIT – for comparison, ZIM trades at a $6.7 billion market cap.

ZIM 2021 Q4 Presentation

The company expects to drive that growth due to resilient volumes, higher freight rates, and the fact that it increased its operating capacity by 20% since 2021. I note that adjusted EBIT may be a better metric than adjusted EBITDA as a proxy for free cash flow, because ZIM tends to make significant investments in capital expenditures which exceed the depreciation and amortization cost. Due to ZIM’s net cash balance sheet, the company should not have material interest expenses, making the primary difference between adjusted EBIT and free cash flow being the corporate tax rate.

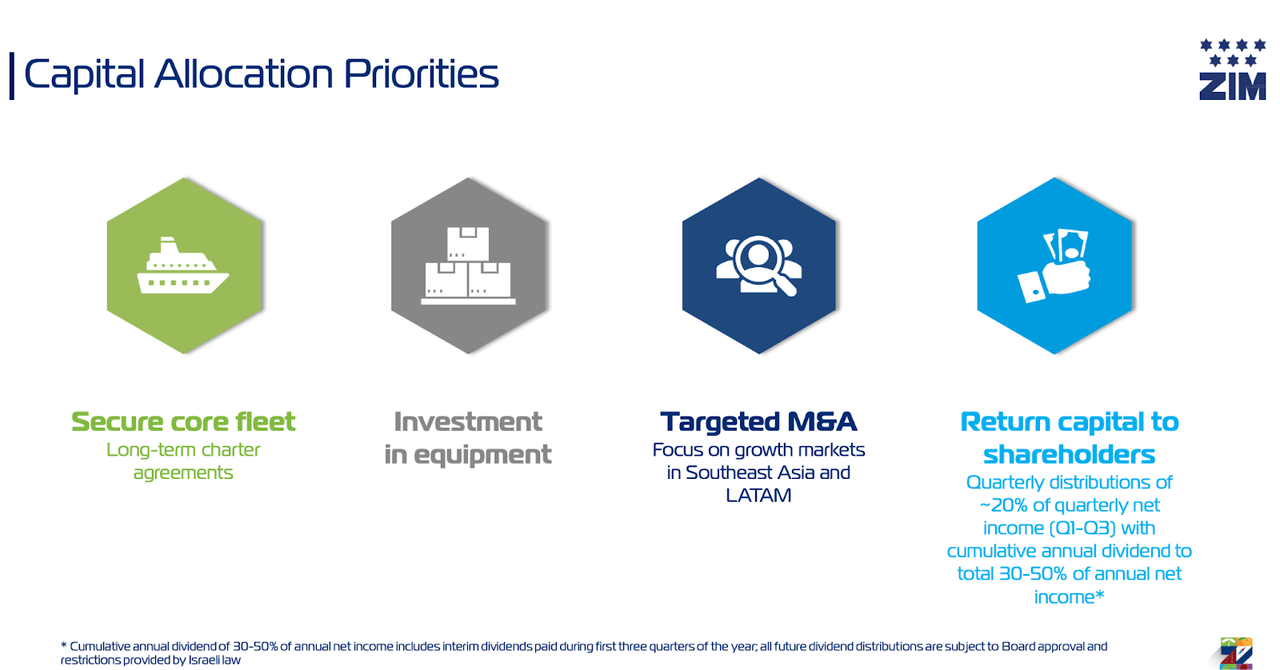

ZIM has outlined its capital allocation priorities as being first to support business growth and second to return capital to shareholders. The company has targeted a dividend payout of 30% to 50% of annual net income.

ZIM 2021 Q4 Presentation

Is ZIM Stock A Good Long-Term Buy?

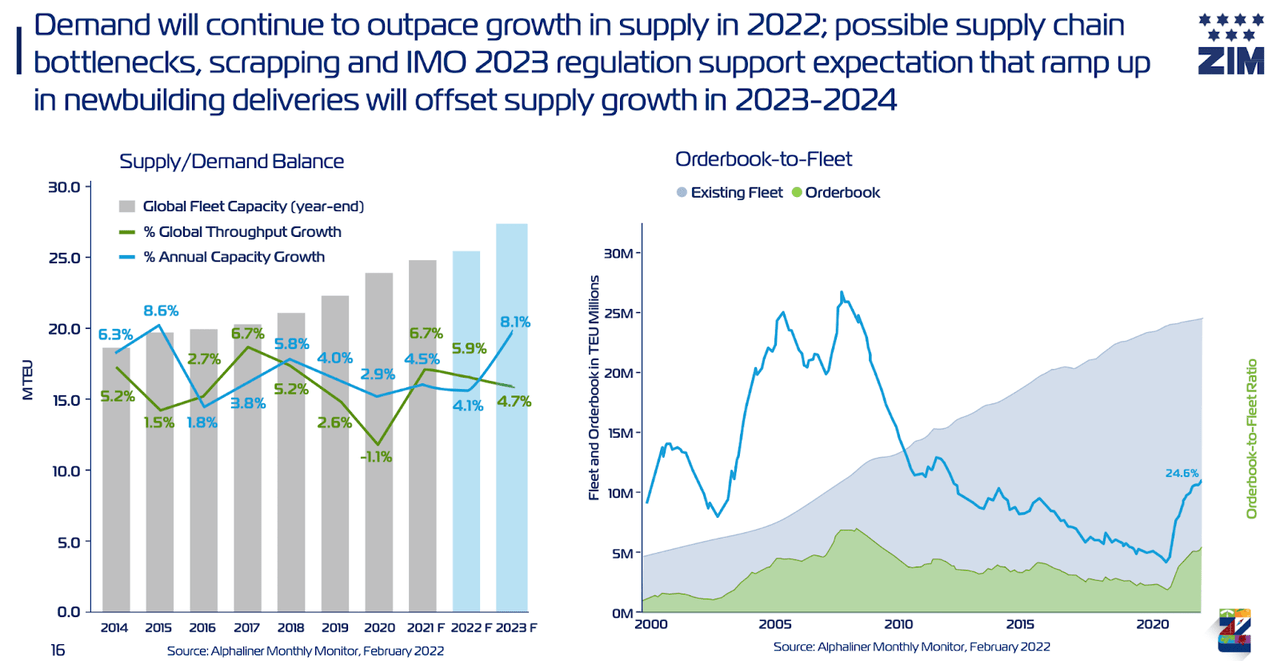

This is a tricky question. ZIM believes that its business should remain strong in the near term, with IMO 2023 expected to be another catalyst. IMO 2023 regulation enforces carbon efficiency, which the company expects to limit supply growth in 2023 and 2024. That argument sounds reasonable, though my personal view is that there may be some delays to IMO 2023 regulation if regulators feel that it is important to prioritize stabilizing the supply-demand imbalance in the near term. I have not seen that view surface anywhere, and note that as a possibility, though it may not be a likely occurrence.

ZIM 2021 Q4 Presentation

There is also the business reality that competition tends to surface where there is great competition. With freight rates at incredible levels of $2,786 per TEU in 2021, I expect competitors to ramp up supply growth and eventually drive that freight rate down. For reference, as disclosed in their financial documents, the average freight rate was $1229, $1009, $973, $995, and $902 for the years 2020, 2019, 2018, 2017, and 2016, respectively.

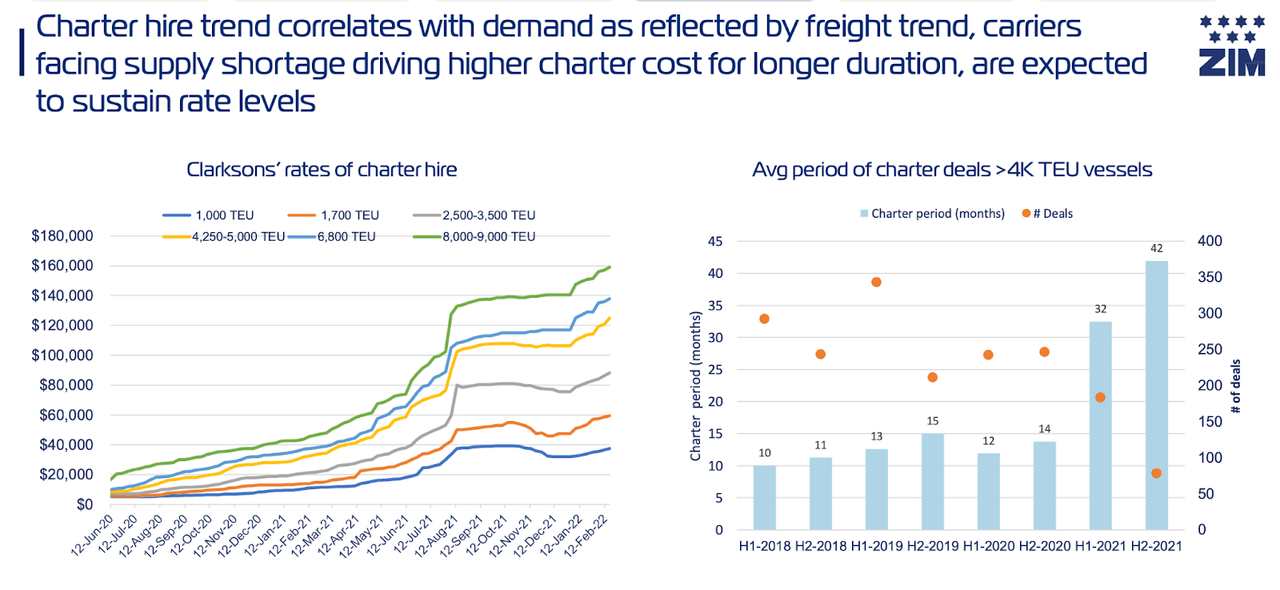

There may also be headwinds to expenses. As we can see below, rates of charter hire have soared over the past 2 years.

ZIM 2021 Q4 Presentation

Rates of charter hire refer to the rate liners like ZIM pay to ship lessors in order to lease the ships (this is how ZIM has an asset-light business model). The vast majority of their operated vessels are chartered and thus subject to fluctuations in charter rates. As noted in their annual report, 81.6% of their chartered-in vessels (based on TEU capacity) were chartered in leases exceeding one year. When these charters come up for renewal, it is possible (likely, rather) that ZIM will need to pay an increased charter rate.

While that may sound menacing, I emphasize that this plays a lesser role on their bottom line than freight rates. Slots purchase and charter hire of vessels accounted for 13.6% of their operating expenses in 2021. The potential risk here is that ZIM enters long-term charter agreements at very high charter rates, and then freight volumes and freight rates crash. This is also a good moment to note that this is why investors should not over-emphasize the net cash position of ZIM, as the debt calculation there does not factor in lease liabilities related to their chartered vessels. ZIM may appear safer than ship lessors like Danaos (DAC) or Global Ship Lease (GSL) because the latter two companies have net debt. However, the leverage is better supported at DAC and GSL because they receive revenues from long-term charter contracts from liners like ZIM, whereas ZIM’s revenues are subject to volatility in freight rates as those contracts are shorter in duration.

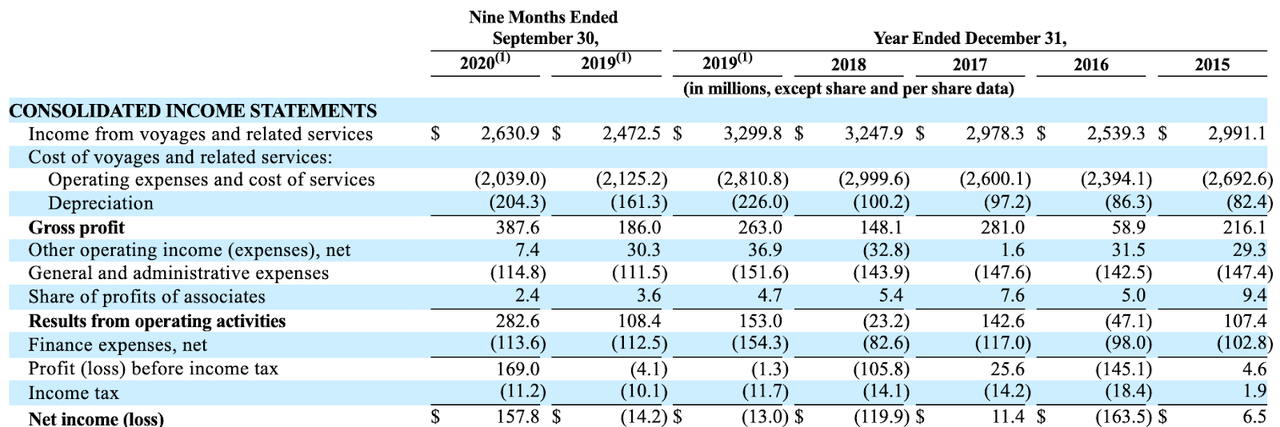

We can see below that pre-pandemic, ZIM struggled to produce positive net income.

ZIM F-1 Filing

I find it reasonable to assume that business should settle back down to pre-pandemic levels as supply catches up to demand, and ZIM’s financial statements may end up looking very similar to pre-pandemic levels. Whereas ZIM would have less interest expenses than before, it may have higher lease obligations due to any long-term charter agreements it signs.

Is ZIM Stock A Buy, Sell, Or Hold?

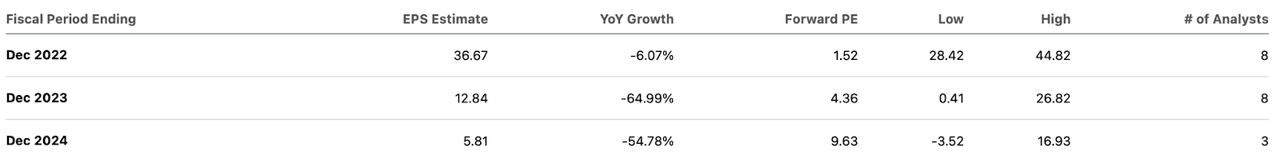

For the stock to work out at these prices, the most obvious thesis is as follows: even if business returns to pre-pandemic levels, how much cash are shareholders getting before then? We can see that ZIM is expected to generate $36.67 in earnings per share this year before seeing earnings quickly compress thereafter.

Seeking Alpha

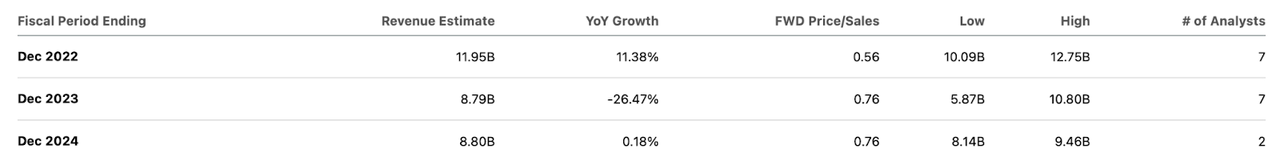

Those estimates appear to be factoring in higher expense costs as well as negative effects of operating leverage, as seen by the slower projected revenue declines.

Seeking Alpha

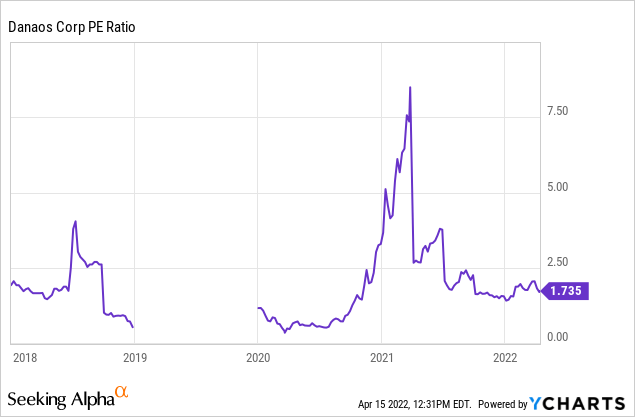

With the stock trading at around $56 per share, shareholders might receive another $18.80 per share of dividends this year and $6.40 per share in dividends next year (assuming a 50% payout of net income). Those dividend payouts are subject to a steep 25% Israeli withholding tax rate but even ignoring that, we arrive at an effective share price of around $30 per share by 2024. I note that I do not give much value to the retained earnings because I expect those earnings to be invested in vessel capacity, which may not realize strong rates of return based on the pre-pandemic business fundamentals. That would place the stock at 5x 2024e earnings, which looks cheap, but I’d argue that it isn’t out of the realm of possibility that the stock would trade at very low earnings multiples of 1x-3x by then (or even lower), especially considering the likelihood that business returns to pre-pandemic levels of negligible earnings. For reference, we can see below that DAC traded at PE ratios lower than 2x prior to the pandemic, and DAC arguably deserves a higher PE ratio than ZIM due to the greater stability of its business model.

The takeaway here is that in spite of the projected 34% dividend yield in 2022 (which seems aggressive), the stock might not be a buy because of the likely multiple compression that will take place as the business environment normalizes.

Instead, the bullish thesis rests on the possibility that ZIM blows out consensus estimates and is able to generate substantially more cash than expected. Because the company charters almost all of its vessels, this subjects it to substantial operating leverage to the upside (and downside), and if freight volumes and/or freight rates continue rising, then ZIM may be able to generate another blowout year, perhaps one even stronger than that seen in 2021. I estimate that ZIM needs to only generate 23% revenue growth over 2021 levels in order to generate full year net income equal to the current market cap. This is a reasonable thesis, though in my view there remains an important risk to consider here, namely that management will not return so much cash to shareholders and may instead prioritize building up capacity. While there is a possibility that such investment may lead to strong returns in 2023 and thereafter, I find it more likely that the shipping sector is running on borrowed time, with freight rates set to collapse back to normalized levels at any time. At current stock prices, the stock needs a huge beat to consensus estimates in order to justify the current valuation – as well as the willingness by management to continue distributing excess cash as dividends. In my base case, I see the stock returning poor returns within two years’ time as multiple compression takes place. Because I expect much of those poor stock returns to be back weighted, I rate the stock a hold instead of sell as the near-term trajectory may still be supported by hopes of strong fundamental performance. I expect shareholders at current prices to realize negative returns over the next few years.

Be the first to comment