Denys Yelmanov/iStock via Getty Images

Elevator Pitch

I have a Buy rating for ZIM Integrated Shipping Services’ (NYSE:ZIM) shares. ZIM is an appealing long-term investment candidate given its unique business strategy. More importantly, ZIM’s generous dividends will enable investors to be patient and wait out the current uncertainty associated with freight rates and the near-term financial performance of shipping companies in general. ZIM is a good dividend stock which rates well on criteria like dividend safety, dividend payout, and dividend yield.

ZIM Stock Key Metrics

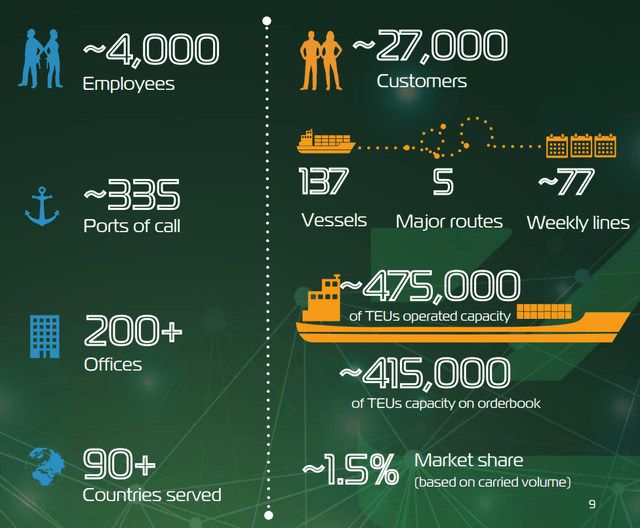

ZIM refers to itself as “a global container liner shipping company” in the company’s FY 2021 20-F filing, and the key statistics relating to the company are presented in the chart below.

ZIM’s Key Numbers At A Glance

ZIM’s May 2022 Investor Presentation Slides

Apart from the figures highlighted above, investors should also pay close attention to ZIM’s share price performance metrics and its key Q1 2022 operating metric (freight rate).

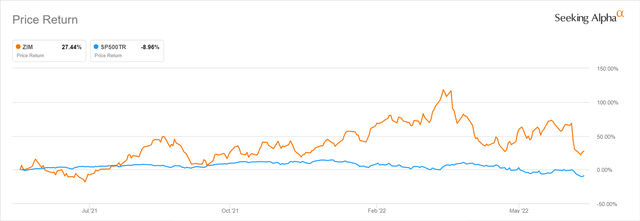

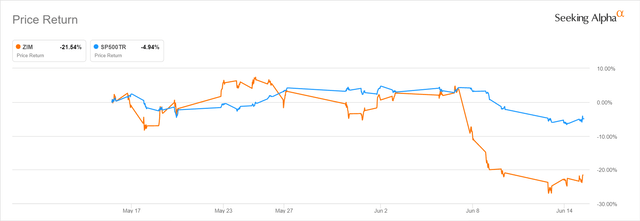

ZIM’s stock (+27.4%) has outperformed the market (-9.0%) by a wide margin in the last one year, but its share price performance in the past month has been disappointing in both absolute and relative terms. In the last month, ZIM’s shares dropped by -21.5% as compared to a -5.0% decline for the S&P 500 in the same period.

ZIM’s One-Year Historical Share Price Chart

ZIM’s Stock Price Performance In The Past One Month

Specifically, ZIM saw a sharp -15% fall in its stock price from $68.52 as of June 7, 2022 to $58.46 as of June 8, 2022, before closing even lower at $51.74 as of June 15, 2022. A June 8, 2022 Seeking Alpha News article had attributed this to a recent bearish JPMorgan (JPM) sell-side analyst report. In the report, the JPM analysts noted that they “anticipate a slowdown in freight traffic will hurt the (shipping) sector and singled out the company (ZIM Integrated Shipping Services) as a stock that will underperform.”

Earlier, ZIM disclosed the company’s Q1 2022 performance on May 18, 2022 prior to trading hours. Notably, the company’s average freight rate per TEU expanded by 6% QoQ and +100% YoY to $3,848 in the first quarter of the current year.

In terms of future expectations, ZIM noted at the Bank of America (BAC) Transportation, Airlines & Industrials Conference on May 19, 2022 that it is “still taking a conservative view that the market might start to normalize towards the second half of the year and that the spot rates might cool off a little bit.” At the company’s most recent quarterly earnings call on May 18, 2022, ZIM also highlighted that “the supply-driven balance reverses in 2023 when more significant newbuild deliveries” are expected to come onstream.

The company’s management comments are aligned with the sell-side’s consensus financial estimates. Based on S&P Capital IQ data, ZIM’s topline expansion is forecasted to moderate from +169% in 2021 to +26% in 2022, and the company is projected to deliver negative revenue growth of -31% and -11% for 2023 and 2024, respectively.

It is inevitable that freight rates will normalize in time to come and ZIM will eventually see slower growth going forward. This implies that a further correction in ZIM’s share price (as it did in the past one month) in the near term won’t be a surprise. As such, it is important that ZIM’s shareholders are sufficiently rewarded with dividends to wait out the volatility in the company’s share price in the short term. I will focus on ZIM’s dividends in the next two sections of the current article.

What Should Investors Know About ZIM’s Dividend?

Investors should know a couple of things about ZIM’s dividend in considering whether it is a good dividend stock.

Firstly, ZIM has the intention to return a significant percentage of its excess capital to the company’s shareholders, and this is evidenced by its relatively healthy dividend payout ratio.

At its Q4 2021 investor briefing on March 9, 2022, ZIM stressed that “our dividend policy says that we will distribute between 30% and 50% of our annual net income in dividends.” According to the sell-side’s consensus financial projects obtained from S&P Capital IQ, ZIM is expected to pay out dividends per share of $17.25 and $7.04 for FY 2022 and FY 2023, respectively. The company’s 2022 and 2023 dividends in turn represent 40% and 50% of its normalized earnings for this year and next year, respectively. This is in line with ZIM’s stated dividend policy.

Secondly, ZIM’s forward dividend yields are very attractive.

ZIM offers a consensus forward next twelve months’ dividend yield of 29.4% as per S&P Capital IQ data. The stock also boasts consensus forward fiscal 2023 and 2024 dividend yields of 14.1% and 8.7%, respectively, at the time of writing.

Even if the 25% withholding tax (assuming shareholder is not a tax resident in a country that has a tax treaty with Israel and not entitled to a lower withholding tax rate) is taken into consideration, ZIM’s adjusted dividend yields are still very high. Specifically, ZIM will still provide appealing (albeit reduced) consensus forward dividend yields (adjusted for 25% withholding tax) of 22.1%, 10.6%, and 6.5%, for the next twelve months, FY 2023, and FY 2024, respectively.

Thirdly, ZIM’s future dividends are reasonably safe.

One key factor is ZIM’s expected dividend payout in the 30-50% range as discussed above which is neither too low nor too high. Another key factor is ZIM’s strong financial position which should provide support for the company’s future dividends. ZIM had a net cash balance of $779 million as of March 31, 2022 which is equivalent to roughly 13% of its market capitalization.

In summary, ZIM should impress dividend-focused investors with its reasonable dividend payout ratio, high dividend yields, and the safety of its dividends.

How Often Does ZIM Stock Pay A Dividend?

The frequency of dividend payments is an important factor to consider for investors who rely on dividends for regular income.

At its Q4 2021 earnings briefing, ZIM had emphasized that its priority is “delivering on our dividend commitment, not only in terms of absolute numbers (dividend yield) but also in terms of frequency of payments, as they will be paid quarterly.”

Also, the company’s dividend policy is to distribute 30-50% of its earnings as dividends for the full year, including both interim and final dividends.

While it is common for companies to pay out a greater proportion of their full-year dividends at the end of the fiscal year (final dividend), ZIM had noted at its recent first-quarter investor call that the company will still maintain its interim quarterly dividend payout ratio at a reasonable 20%. This ensures that ZIM’s shareholders will receive decent income or dividends on a quarterly basis throughout the year.

Is ZIM A Good Long-Term Investment?

The shipping business, like any other cyclical industry, will have its ups and downs. In that respect, a good long-term investment in the shipping industry is a company with the right strategy to navigate across different cycles.

There are three key aspects of ZIM’s strategy which I am positive on.

The first is ZIM’s strategy to focus on niche areas of the shipping market. On its investor relations website, the company mentioned that it “strives to increase and sustain profitability by selectively competing in niche trade lanes where the market is underserved.” Specifically, ZIM disclosed that it has “a sizeable market share” in the “Transpacific, Cross Atlantic, Cross Suez, Intra-Asia and Latin America” trades. In other words, ZIM picks the spots where it competes in. This is not that much different from former CEO Jack Welch’s goal for General Electric (GE) to be either first or second in the markets it participates in.

The second is ZIM’s actions to lower its dependence on the spot market. By having the majority of the company’s vessels on long-term charters, fluctuations in spot rates will not impact the company to a large extent in the short term. At the Bank of America Transportation, Airlines & Industrials Conference on May 19, 2022, ZIM revealed that only a mere “11 of those (137 vessels in total) that will come up for renewal between now and the end of the year.”

The third is ZIM’s focus on asset-light businesses within the company. In its FY 2021 20-F filing, ZIM noted that it runs “several logistics subsidiaries” which “are asset-light and provide services such as land transportation, custom brokerage, LCL (Less-than-container Load), project cargo and air freight services.” Most companies perform poorly in shipping down-cycles because of high asset intensity and the effects of negative operating leverage. In contrast, ZIM stressed in its 2021 shareholder letter that its “asset-light model” gives it a “flexible cost structure and operational efficiency.”

Is ZIM Stock A Buy, Sell, Or Hold?

ZIM stock is a Buy. I like the company’s dividend policy, and its long-term business strategy as well. As such, I am bullish on ZIM in the long run, notwithstanding short-term volatility in its share price.

Be the first to comment