Dan Kitwood

Over the last few months, we have written several articles outlining our views of banks in general. We explained the relationship that you, as a depositor, have with your bank is in line with a debtor/creditor relationship. This places you in a precarious position should the bank encounter financial or liquidity issues. Moreover, we also outlined why reliance on the FDIC may not be wholly advisable. And, finally, we explained that the next time there is a financial meltdown, your deposits may be turned into equity to assist the bank in reorganizing.

So, at the end of the day, it behooves you, as a depositor, to seek out the strongest banks you can find, and to avoid banks which have questionable stability.

While we outlined in our last articles the potential pitfalls we foresee with regard to various banks in the foreseeable future, we have not provided you with a deeper understanding as to why we see the larger banks as having questionable stability. Over the coming months, we intend to publish articles outlining our views on this matter.

First, we want to explain the process with which we review the stability of a bank.

We focus on 4 main categories which are crucial to any bank’s operating performance. These are: 1) Balance Sheet Strength; 2) Margins & Cost Efficiency; 3) Asset Quality; 4) Capital & Profitability. Each of these 4 categories is divided into 5 subcategories, and then a score ranging from 1-5 is assigned for each of these 20 sub-categories:

- If a bank looks much better than the peer group in the sub-category, it receives a score of 5.

- If a bank looks better than the peer group in the sub-category, it receives a score of 4.

- If a bank looks in-line with the peer group in the sub-category, it receives a score of 3.

- If a bank looks worse than the peer group in the sub-category, it receives a score of 2.

- If a bank looks much worse than the peer group in the sub-category, it receives a score of 1.

Afterwards, we add up all the scores to get our total rating score. To make our analysis objective and straightforward, all the scores are equally weighted. As a result, an ideal bank gets 100 points, an average one 60 points, and a bad one 20 points.

If you would like to read more detail on our process for evaluating a bank, feel free to read it here.

But, there are also certain “gate-keeping” issues which a bank must overcome before we even score that particular bank. And, many banks present “red flags,” which cause us to shy away from even considering them in our ranking system.

As mentioned before, it is difficult to overestimate the importance of a deeper analysis when it comes to choosing a really strong and safe bank. There are quite a lot of red flags to which many retail depositors may not pay attention, especially in a stable market environment. However, those red flags are likely to lead to major issues in a volatile environment. Below we highlight some of the key issues that we are currently seeing when we take a closer look at Credit Suisse.

Over the past several weeks, there has been a lot of discussion, especially in the social media and various forums, about an imminent collapse of Credit Suisse (CS). The sharp increase in the bank’s CDS, which have almost reached the level of the 2008-2009 crisis, has only intensified these concerns. In this article, we would like to take an unbiased view on CS, which is not based on any rumors, but rather on the bank’s financial statements, its current business model and the group’s announced restructuring plans. We will assess both short-term and long-term risks in the current market environment, and will do a stress-test of the bank’s business in a systemic crisis scenario. Moreover, we will show that difficulties at a European bank could lead to major issues for retail clients of U.S. banks.

What are the issues of CS’s business model?

The key issue with CS’s business model is that the bank is in the process of a long-term, and a rather painful, restructuring. The primary reason for this restructuring is CS’s investment banking division, which has quite a risky business model, consumes a lot of the group’s capital, and has relatively low operating efficiency. CS’s investment bank unit generated more than CHF1B of losses for the group in 2Q22, and also was the source of various infamous scandals, with the Archegos case being the most recent one, which led to significant litigation costs for CS.

According to the group, its objective is to transform the investment banking unit into a capital-light, advisory-led banking business, and more focused markets business that complements the growth of the wealth management and Swiss Bank franchises. In addition, CS plans to strengthen its global wealth management franchise, which also requires quite a lot of investments. The question here is, of course, how CS will fund costs of this major restructuring?

One possible option is to do a capital raise, probably through an issue of rights. However, given the bank’s share price has fallen by more than 50% since the beginning of the year, and the stock is trading at very depressed multiples, a capital raise would be highly dilutive for the current shareholders, and would send the share price much lower.

Another possible option, which was reported by the Bloomberg, is to attract “outside money” by doing a spin-off of the group’s investment banking unit. CS is even considering to revive the First Boston brand to make this potential spin-off more attractive for investors. This scenario also seems unlikely, as we believe there is a lack of potential buyers for such an asset with potential further litigation costs, and a capital-heavy low-efficient business model. Moreover, this new entity would operate in a highly competitive U.S. market, and it is unlikely that the First Boston brand alone would help it to establish a sustainable market position.

CS is also discussing sales and divestitures of some of its units, but it is not clear whether those will be enough to fund massive restructuring costs.

Is it a new Lehman-style collapse?

First of all, we would like to mention that most of the discussion in the social media is based upon rumors rather than facts. While these discussions could likely lead to liquidity outflows, particularly to deposit withdrawals, we note that CS has a large share of highly-liquid assets on its balance sheet. As such, mild outflows are very unlikely to create problems for the bank in the current environment.

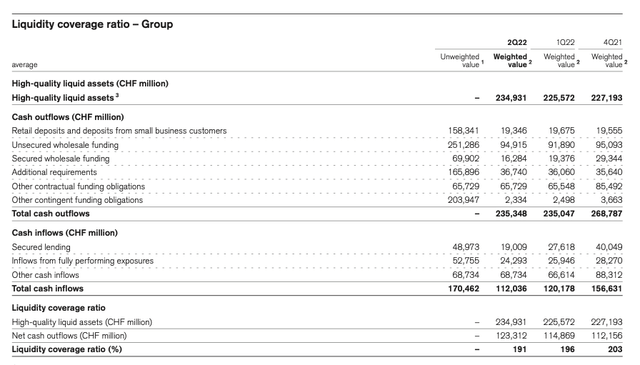

As the table above shows, although the group’s LCR (liquidity coverage ratio) has declined since the beginning of the year, it is still at a strong level of 191%. According to CS, the liquidity pool consisted of CHF141B of cash held at major central banks, primarily the SNB, the ECB and the Fed, and CHF92B market value of securities issued by governments and government agencies, primarily from the U.S. and the UK.

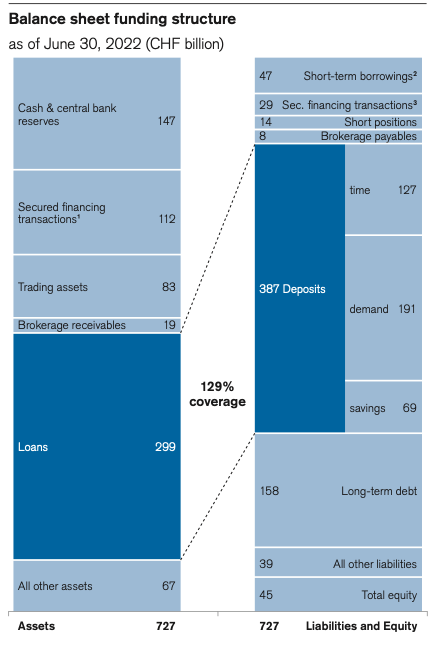

Another positive factor is that CS has a decent loan-to-deposit ratio of 77% or a funding coverage ratio of 129%, which is calculated as total deposits divided by total loans.

Company data

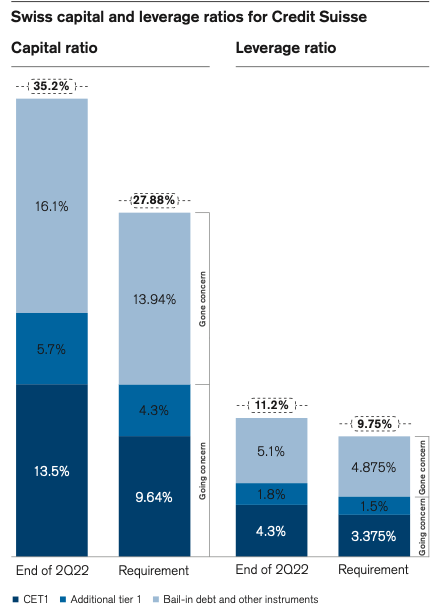

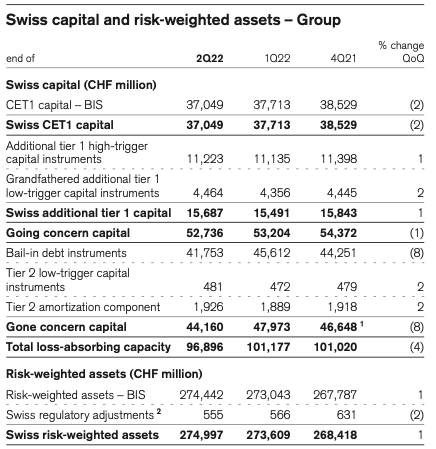

In terms of capital, CS’s ratios are comfortably above the regulatory requirements.

Company data

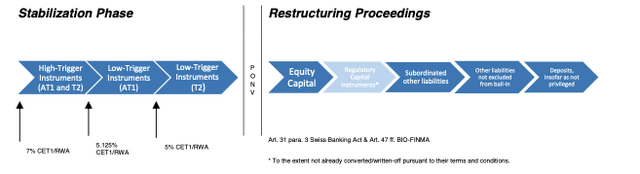

As of 1H22, CS has CHF37B of CET1 capital, and CHF16B of high-trigger and low-trigger AT1 instruments, which are the so-called second stage of loss absorption. That brings total going concern capital to CHF53B. There is also going concern capital, which is the third stage of loss absorption and consists mostly of bail-in debt instruments, which stood at CHF44B as of the end of the second quarter.

Company data

As such, while CS does have a lot of issues even over the short-term perspective, we think that an imminent Lehman-style collapse looks unlikely.

The situation would look much worse even in a mild crisis

While the current global markets are certainly not in a bullish mode, it is hard to say that we are in a crisis environment. But even now we are seeing a spike in CS’s CDS and a sharp fall of the group’s bond prices, including senior ones. If these events were to occur in a systemic crisis environment, CS would likely face even a Lehman moment, in our view. Trust between a bank and its customers and counterparties is a crucial factor, and in a crisis mode, there would be likely a major bank run at CS as customers would quickly withdraw deposits given the bail-in schedule shown below.

Counterparties would close limits on CS, leading to a major spike in funding costs for the group. These events would eat up CS’s liquidity pool rather quickly.

Even more importantly, another of CS’s issue, which is currently largely overlooked, is quality of its corporate book.

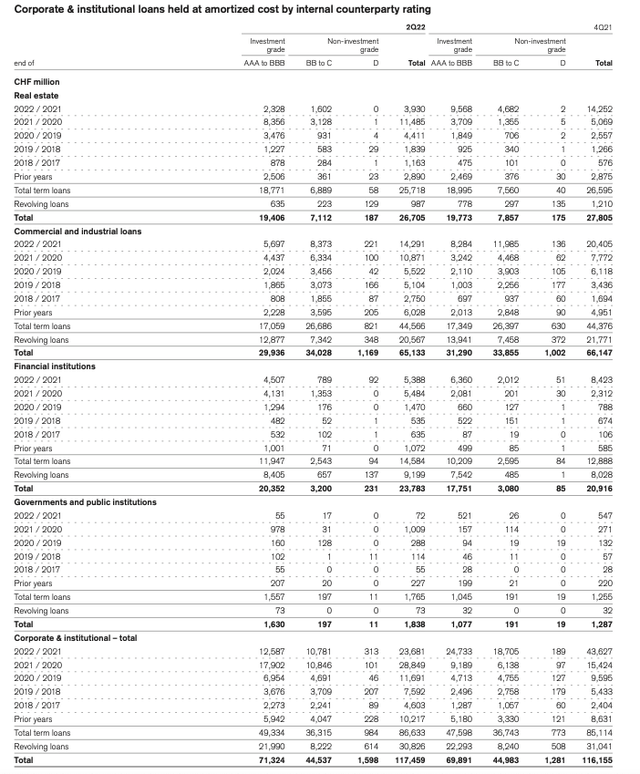

Below is a breakdown of CS’s loan book by counterparty rating. As we can see, exposure to non-investment grade borrowers is higher than exposure to investment grade ones, and correspond to 52% of the bank’s total commercial and industrial credit portfolio. Needless to say, non-investment grade borrowers carry elevated risks even in a stable market environment. In a systemic crisis, even investment grade borrower can easily become default. As such, credit quality of CS’s commercial credit portfolio looks like a concern.

How could it affect U.S. retail depositors?

So how can issues with a European bank affect U.S. retail depositors? In our previous articles on Citigroup, JPMorgan, and Bank of America, we noted that these banks have large amounts of derivatives on both their balance and off-balance sheets.

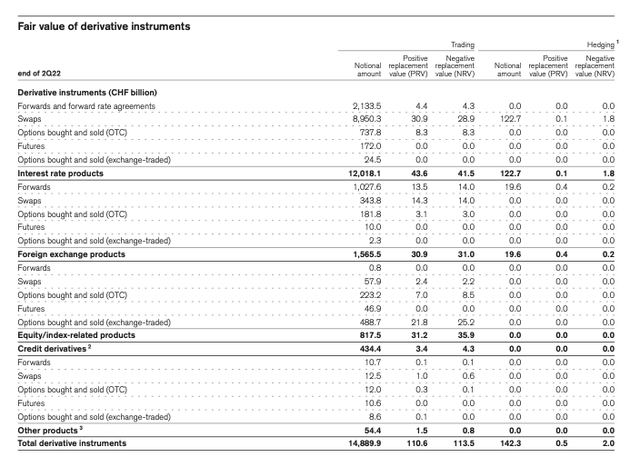

Below is a breakdown of CS’s derivatives.

The table shows that CS’s notional amount of derivatives is CHF15T, which is almost 70% of the total U.S. GDP. Yes, this is notional amount, and after netting it becomes much smaller. However, majority of these derivatives are OTC contracts, which are the riskiest type of derivatives, especially in a recessionary environment when there is a high chance of a counterparty default risk. It is highly likely that CS is among derivative counterparties of large U.S. banks, and in a crisis scenario CS likely would not be able to meet its obligations under these OTC contracts. This would lead to major losses for U.S. banks, and eventually for their retail depositors.

Bottom line

We believe derivatives exposure is one of the key risks for a bank in a volatile environment, since there is a high chance of a counterparty default risk. When we were choosing the Top-15 banks for SaferBankingResearch.com we have excluded banks with exposure to derivatives through either their balance sheets or off-balance sheets. It is hard to overstate the importance of a proper analysis of a bank’s off-balance sheet, given that derivatives are often sitting there.

Housekeeping matters

This article, as well as Saferbankingresearch.com, was a combination of efforts between Avi Gilburt and Renaissance Research, who has been covering U.S., European, LatAm and CEEMEA banking stocks for more than 15 years.

If you would like notifications as to when my new articles are published, please hit the button at the bottom of the page to “Follow” me.

Be the first to comment