Darren415

Tilray (NASDAQ:TLRY) saw its stock explode higher after President Biden announced plans for cannabis policy reform. While the stock pulled back after reporting earnings, I doubt that the results will matter so much in the near term, as this is a stock that has often traded based on hype and that is likely to remain the case after President Biden’s announcements. While there are understandable justifications for buying TLRY, including its competitive positioning ahead of full-blown legalization in the United States, a consistent reservation has been the exact timeline of that legalization as well as the business fundamentals in the interim. The fundamentals are not as attractive relative to those of US operators, but as long as institutional capital is blocked out of investing in US cannabis stocks, TLRY can continue to be a strong momentum name in the sector.

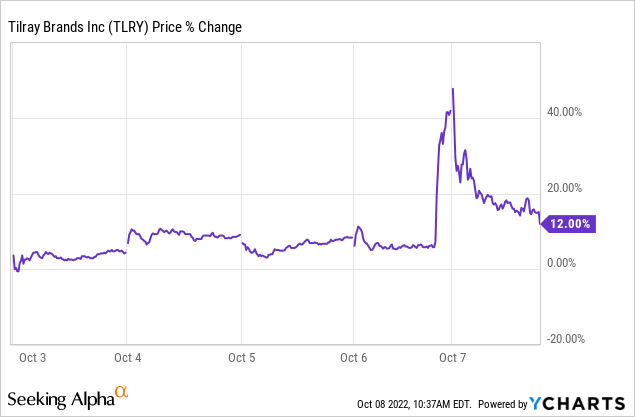

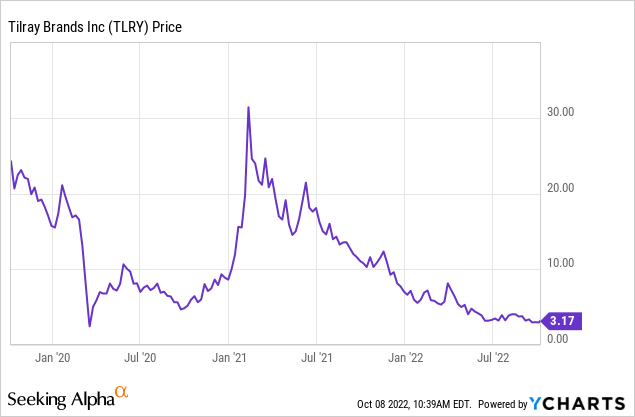

TLRY Stock Price

Despite not having material operations in the United States, the Canadian operator’s stock exploded over 34% higher in the last hour of Thursday’s trading session upon the release of Biden’s groundbreaking announcements.

The stock has since pulled back materially, though it should be noted that even many stocks in the US sector also saw weakness. I suspect that the weakness had more to do with broader market weakness as growth stocks on the whole fell double-digits across the board. In the near term, anything is possible with cannabis stocks like TLRY.

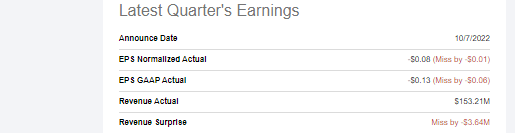

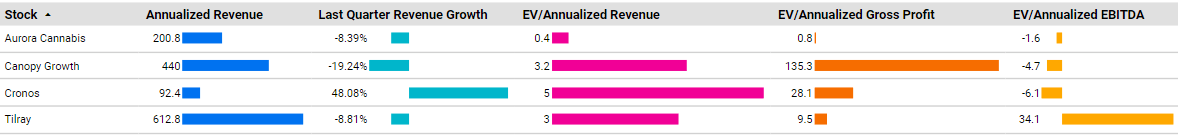

TLRY Stock Key Metrics

I will discuss President Biden’s announcements in just a moment. Let’s start with analyzing the results of the latest quarter. TLRY reported net revenue of $153.2 million, representing a 9% decline year over year. Currency fluctuations did impact results – on a constant currency basis, revenues declined by “only” 1%. I placed “only” in quotes because declining revenues in the cannabis sector should not be expected considering its secular growth drivers. That revenue number slightly underperformed consensus estimates.

Seeking Alpha

Even in spite of revenue weakness, TLRY noted that it maintained top market position in Canada with 8.5% cannabis market share.

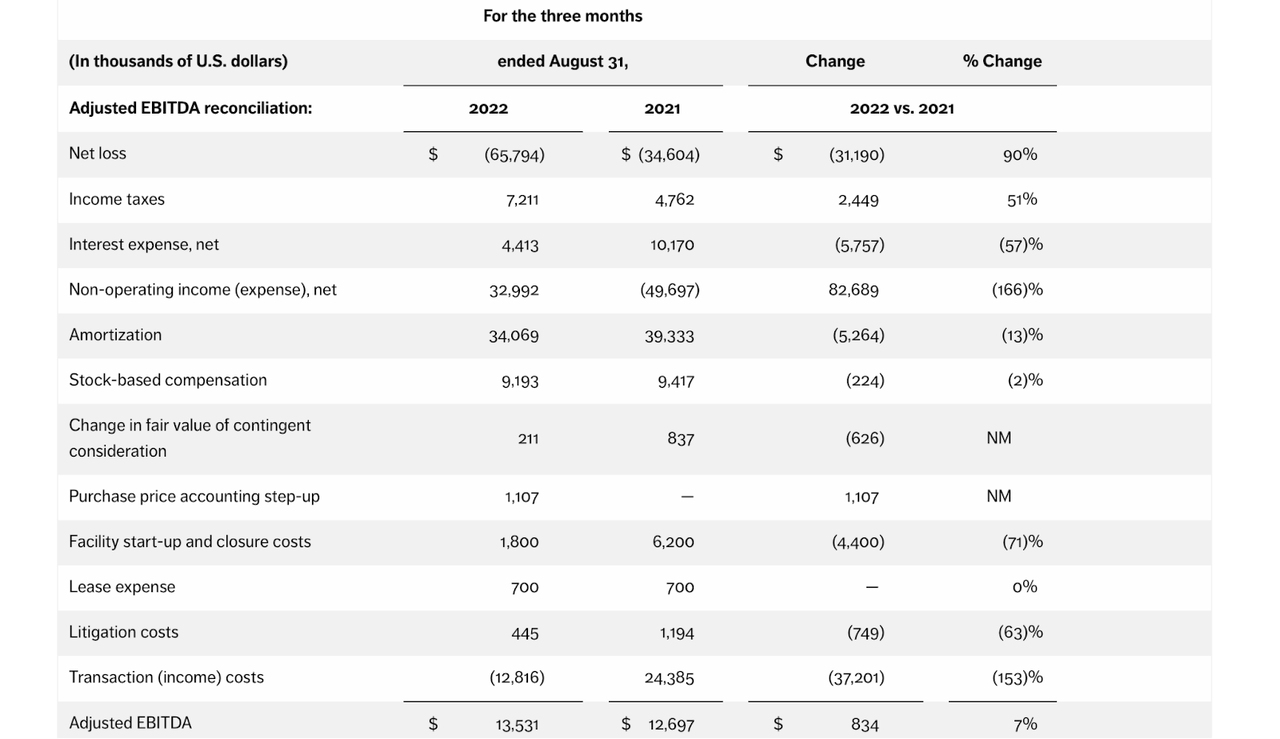

TLRY achieved adjusted EBITDA of $13.5 million, its 14th consecutive quarter of positive adjusted EBITDA and reflecting the fruits of their cost-savings. On the conference call, management noted that they had already achieved $95 million in planned adjusted EBITDA savings this year (this past quarter is the first quarter of fiscal 2023) with $5 million in additional savings slated for the remainder of the year.

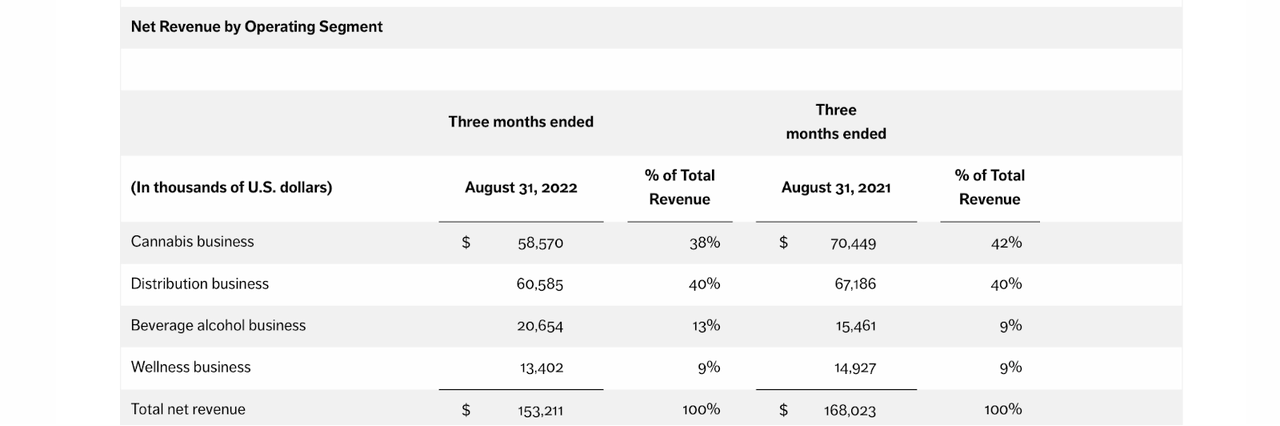

While most investors undoubtedly know TLRY as a cannabis company, the fact remains that on a percentage basis, most of TLRY’s business is not cannabis, with 62% of revenues coming from other sources like alcohol.

FY23 Q2 Press Release

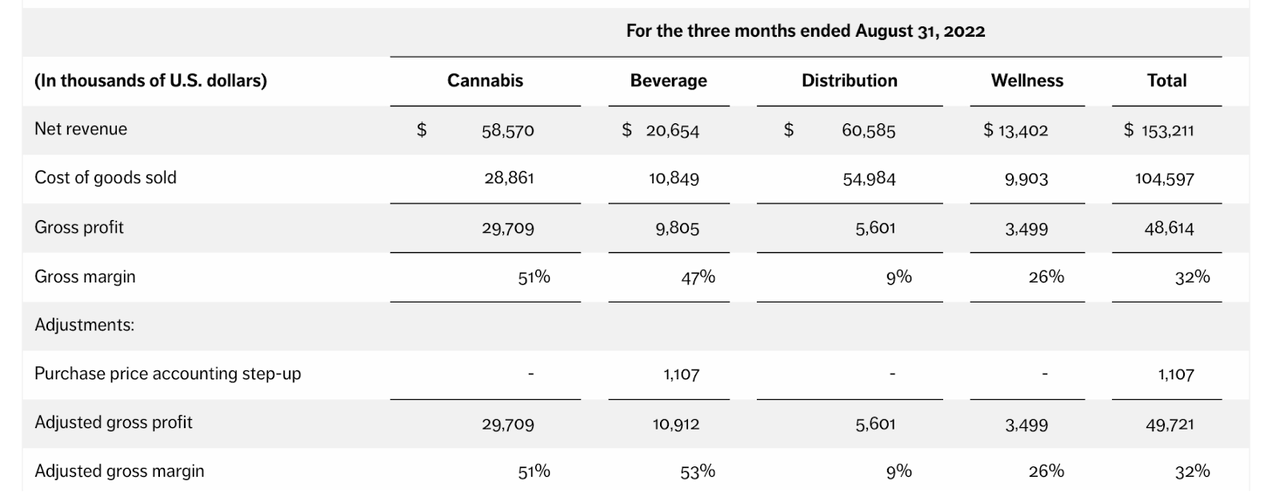

That is important to note because distribution and wellness revenues carry significant lower gross margins and should be considered to be lower value than cannabis revenues.

FY23 Q2 Press Release

Regarding adjusted EBITDA – one could make up their own mind if the figure can be trusted as there are numerous adjustments in that number. I note that after including interest and tax expenses, “adjusted EBDA” was positive.

FY23 Q2 Press Release

Management reaffirmed full-year guidance of up to $80 million in adjusted EBITDA and positive free cash flow. Crucial to that guidance was the drastic steps taken to right size the balance sheet. TLRY ended the quarter with $490.6 million of cash versus $641.1 million of debt, reflecting sequential improvement due to the company raising $129.6 million through its ATM program. 70% of the debt was fixed rate. Not only is management’s guidance crucial to justifying valuation (if anyone is focused on the fundamentals here), but it will also play a role in determining if the company will need to tap capital markets again.

What Has Biden Recently Done With The Marijuana Policy?

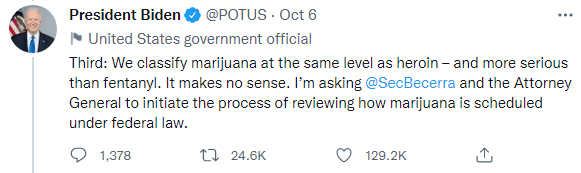

President Biden announced that he would pardon federal criminal offenses related to simple possession of cannabis as well as seek to reschedule the plant.

In isolation, those actions might not mean much as they do not necessarily imply full legalization. That said, it increased hopes for the passage of SAFE Banking because many Democratic senators had previously been against SAFE Banking due to wanting more social equity components. Perhaps if the President can follow through on these promises, then Democratic senators may be more willing to push SAFE Banking through to continue the momentum.

How Will Tilray Be Impacted By This Change?

How does this impact TLRY? The stock has always been a play on legalization of cannabis in the United States. While SAFE Banking falls short of full-blown legalization, one could make the argument that passing SAFE Banking was always the first step before legalization, meaning that these latest developments represent progress toward legalization.

But perhaps some TLRY bulls are reading deeper between the lines. I previously mentioned that President Biden seeks to reschedule cannabis – we can see the exact verbiage below.

Twitter

The note “more serious than fentanyl” has been interpreted to imply that cannabis might be rescheduled as a Schedule 3 drug, considering that fentanyl is a Schedule 2 drug. That would, on the surface, seem to effectively legalize cannabis, but again that is open to wide interpretation.

TLRY stands to benefit from legalization of cannabis due to two main factors. First and foremost, it still owns a portfolio of greenhouses that can produce cannabis cheaply at scale. It has been precisely due to the lack of scale (the Canadian market just is not that big) that has been a thorn in the company’s fundamentals – but all that can change if the company is allowed to export product into the United States market.

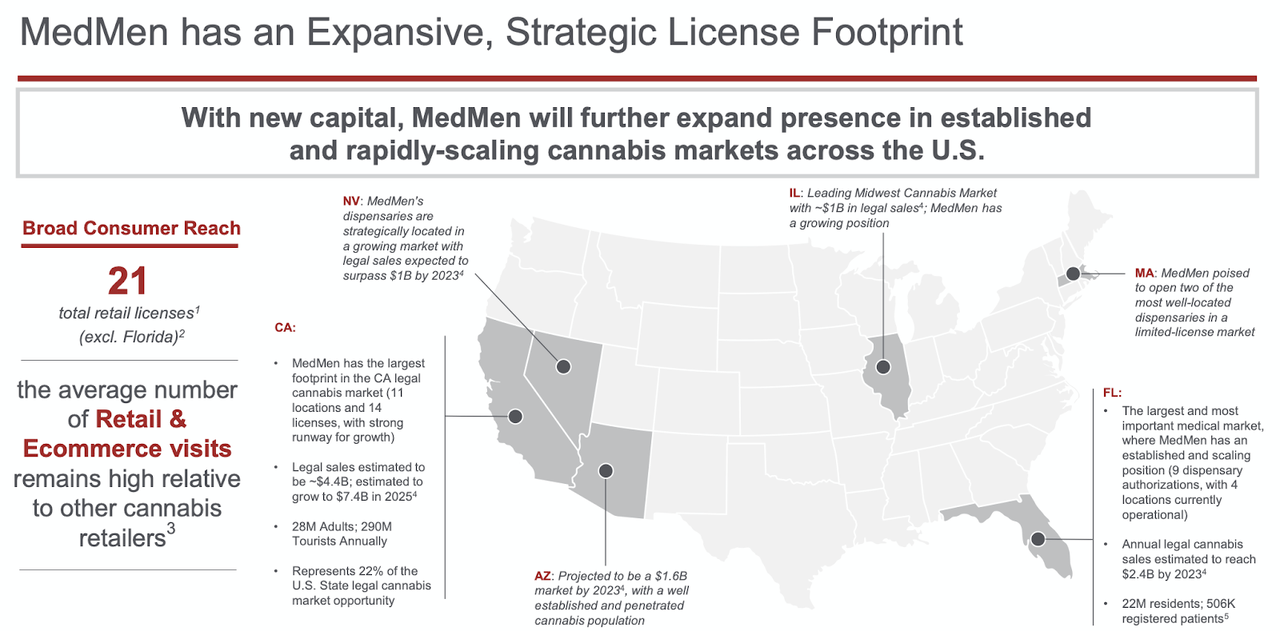

Second, recall that TLRY previously made a $165.7 million investment in the convertible notes of US multi-state operator MedMen (OTCQB:MMNFF) (equivalent to 21% of shares outstanding).

That investment becomes “valid” only upon legalization. MMNFF offers a well-known brand name and exposure to multiple states.

2021 MedMen Presentation

What Is The Long-Term Prediction For TLRY Stock?

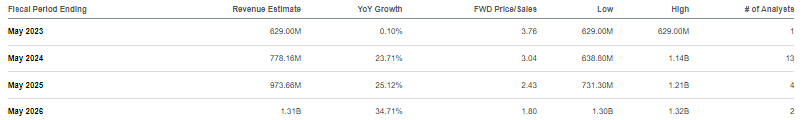

Consensus estimates call for strong 20% to 30% revenue growth after this year.

Seeking Alpha

As longtime investors know, however, consensus estimates have always seemed to be projecting for acceleration in growth rates but that has never quite developed as there has always been setback after setback in the Canadian market. I would not place too much faith in consensus estimates.

Is TLRY Stock A Buy, Sell, or Hold?

TLRY is not too expensive here on a fundamental basis. The stock trades at just around 3x-4x sales. If we assume a 15% long term growth rate, 15% long term net margins, and a 1.5x price-to-earnings growth ratio (‘PEG ratio’), then TLRY might trade at around 3.4x sales, meaning that any forward growth could accrue to shareholder returns – and I note that the cannabis sector is likely to see PEG ratios in far excess of 1.5x.

Among Canadian operators, TLRY is the only big name which is generating positive adjusted EBITDA and the stock trades reasonably as compared to peers.

Cannabis Growth Portfolio

Of course, there’s plenty of risk here considering the ongoing cash burn and stock dilution. But I suspect that most investors just don’t care about the fundamentals here and are focused on hype and momentum. That is an understandable considering that the stock has indeed behaved like a momentum-hype stock in the past.

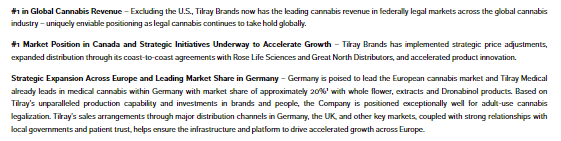

The company arguably also fuels this fire. We can see below that the company calls itself “#1 in Global Cannabis Revenue” but in small print notes that this excludes the United States.

FY23 Q2 Press Release

Further, in spite of the ongoing cash burn, management continues to give off a position of strength, stating that it is in a position to go on the offensive with M&A:

And I think the big thing, which I said in my remarks is this here. Our plan — we have close to $0.5 billion of cash. So, we have abilities to do acquisitions. We have a strong business with lots of growth opportunities in Canada. We have a great infrastructure internationally in both, Portugal and Germany. And with the U.S. today, we’ve acquired businesses within the beer industry, the spirits industry and have a wellness business.

Finally, there is the technical detail that most institutional capital is blocked off from investing in US cannabis stocks due to the plant being illegal on the federal level. That means that if they want to invest in the cannabis sector, then TLRY offers the most liquid way to do so. So there are clear reasons why TLRY is viewed as a momentum-hype stock, and the stock may continue to rise over the next few months as hype builds around potential legalization. I am not a momentum trader but I can appreciate the appeal here.

The risks are numerous. This company is still burning cash, has a long history of burning cash, and has low insider ownership. For instance, CEO Irwin Simon owns only 1.77 million shares yet received $19 million in compensation in 2022 and $13.7 million in compensation in 2021. In my view the management and board of directors seem generously compensated in light of the historic cash burn over the past few years, but that is just my humble opinion. There is high likelihood that hype will eventually fade, and the stock will prove highly volatile – it is unclear how high or low the stock can end up. While I rate TLRY stock a buy, that is purely due to the reasonable valuation and I note that I have no position due to more compelling investment options in the United States.

Be the first to comment