dima_sidelnikov/iStock via Getty Images

Dear readers/followers,

In this article, we’re going to be taking an introductory look at The Honest Company (NASDAQ:HNST). The business, founded by celebrity Jessica Alba, is a play on clean, effective, ESG, and sustainable consumer products – specifically babycare and skin care.

Typically when investing in these sorts of businesses, I would stay far, far away from anything that’s not one of the established giants, knowing fully well the difficulty of making a name for yourself here. Several local/Scandinavian market geniuses and semi-celebrities tried making their own line of skin products or childcare products. While some flew high for a few months or even a year, all of them usually ultimately met the same fate and crashed to earth.

HNST has some history – let’s see if It can be different.

Honest Company – A Look From a Value Perspective

So, when looking at a company like this, and specifically this company, there are a few things that we need to consider, and need to understand. HNST isn’t an upstart or a freshly-started business, it’s been around for quite a while.

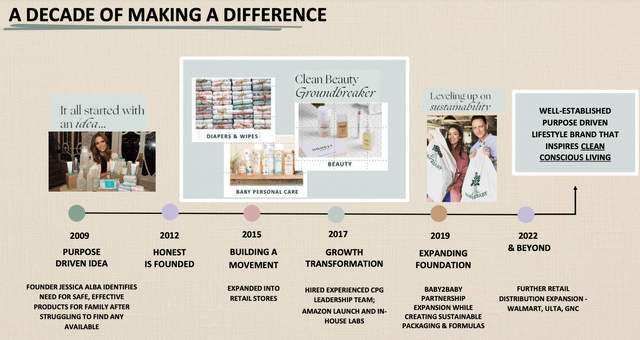

While it IPO’ed during the frothy zero-interest rate period, which sent the company down to earth quickly after, we do have at least a decade of history to fall back on.

Honest Company has, by all appearances, good products. I base this off consumer reviews and having a female friend who uses their lineup, as well as several young mothers who use it for their newborns. The products are appealing and seem to be on the forefront when we look at things like toxicology and safety, as well as zero animal testing, owing to rigorous testing that’s perhaps more at home at a giant like L’Oreal (OTCPK:LRLCY) than a small, up-and-coming company like HNST.

So, the company fulfills one of the primary requirements for a working consumer staples business – it has objectively good products, at what I would argue are market-competitive prices. The company’s products are not excessively expensive than other premium-tier skincare products, even if they are definitely higher-priced than what you would find in the budget bin – both for the skincare as well as for the baby products.

The company employs its own R&D facilities, 3 of them, but outsources the manufacturing and logistics side of the operations to third-party partners that it manages through strict auditory requirements. These operations are located in US, Mexico, and China. The fact that it does operate its own R&D is impressive, as is the scale of its “hand” in things. It, of course, doesn’t do everything on its own, but an impressive portion compared to other similar, celebrity-led companies which tend to be more along the line of slapping a celebrity label on a no-name product.

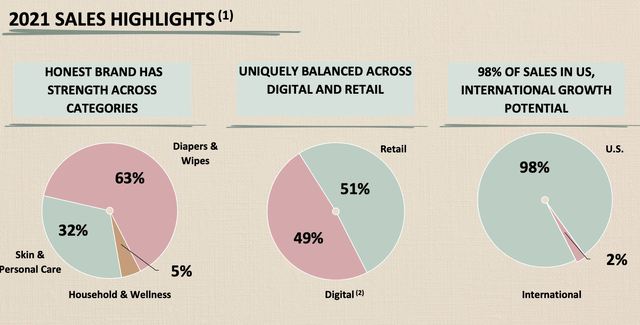

The company’s sales split is, surprisingly, not weighted toward beauty, but towards baby. Non-US sales, such as the buys here in Sweden, are an extreme rarity, because the brand has almost no sales here, even if it does exist.

Its marketing, like many celebrity-oriented products, makes full use of the modern omnichannel marketing approach and sales method. Honest has a long-standing relationship with Target (TGT) and is expanding to Walmart (WMT), Ulta (ULTA), and GNC. The company also, of course, has a digital sales channel. However, the interesting trend is that the company’s sales have tended to go the other way – and really balancing toward a 50/50 retail split. For a company in this stage of growth, that’s exactly what we want to see.

Still, there are a lot of elusive and ethereal “content” and “influencer”-led marketing videos, with so-called dynamic communities counting out 50+ million followers on Social media. The problem with this approach, in my experience, as this is exactly what many of those aforementioned failing brands did, is that it gets more expensive to convert leads to sales – every year.

The company has succeeded in bringing its products to retailers – many locations, in fact. But it continues to focus on things like TAM and Total market sizes, spouting numbers like $130B worth of total market size, and $17B of clean/natural, which has been growing far quicker than the conventional market. All of this is absolutely true – but the same problem exists as with all other growth companies focusing strictly on TAM – it doesn’t mean you’re going to get any of it.

Also, I may be a bit biased, but I don’t have all that much confidence in a rich content-led marketing strategy to try and push a company like this forward in this sort of environment – especially when you don’t control your own manufacturing.

While the product side of the company seems to be working fine – because the company is selling more product, and each of its products seems to garner interest from consumers, what doesn’t seem to be working as well is the thing that needs to be working.

Namely, the finances.

To cut through the noise, the absolute best thing you can do is to start pulling 10-k’s. They’ll tell you what the company’s C-suite doesn’t maybe want to share with you.

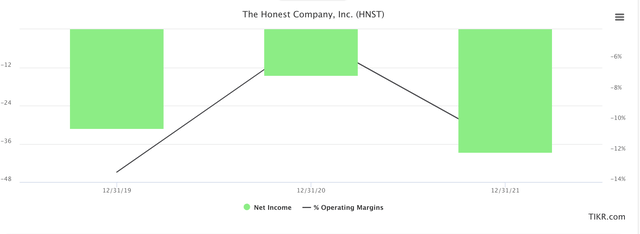

In this case, they spell a history of somewhat declining (on an LTM basis) gross margins or GMs in the 30%-range. This in itself isn’t terrible, but we need to move from COGS to SG&A, R&D/total operating expenses down to actual operating income.

And this is where the egg sort of cracks.

The company is spending far, far more in operating expenses than it currently generates in gross profit, leading to a significantly negative bottom line. The degree of its negative operating profit as a percentage has even increased – it’s down to negative 14.6% for the LTM basis, compared to “only” negative 4.5% when it was close to breaking even during COVID-19. Interest expense is only a small part of that, actually – so I wouldn’t put this company in the box of not being able to manage its interest expense.

Like I expected when looking at the company’s marketing model, most of the expenses, and also the expenses that are increasing or keeping very solid as a too-high percentage of revenue, is SG&A, which includes marketing expenses.

The company has operated at a negative net income ranging from negative $30M down to negative $45M for the LTM period.

Granted, this is a short period that we have info for, but it still doesn’t look great. That’s not even mentioning that things like inflation and expenses hit smaller companies harder than larger ones because larger companies have the advantage of scale and being able to cut back more effectively than smaller companies do.

So, good products don’t help if your margins don’t work. And HSNT doesn’t currently work.

In order to work, we need a turnaround plan. And what is the company’s turnaround plan? Because here is the quote from the current management.

That said, we recognize the headwinds in the marketplace, inflationary pressures across the supply chain remain an issue. Customer acquisition costs remain elevated. The digital channel remains challenged and retailers are increasingly focused on managing their working capital by reducing weeks of supply.

(Source: HNST 3Q22)

And your resilient consumer trends don’t help you if it costs you $1.10 to sell a product for $1 – because it means you’re not making a profit. And given that the company, both in presentations and earnings calls, do not speak on any specific rationale beyond trying to grow its presence and market share to make things more effective, this leads me to believe that there is very little the company truly can do to combat the current across-the-chain pressures that every company is facing.

I mean, they could start using substandard and different ingredients – but not if it wants to retain its company identity.

The only possibility I see is that scale eventually allows the company to sell more products to retailers, increase efficiencies, and work its manufacturing and logistics side to leverage that scale and cost side. Unfortunately, this is to be done in an environment fraught with pressures from inflation, increased costs, and what the company also admits – increased CAC (Customer Acquisition Costs).

What you see in Honest company is a very good description of why I, when it comes to beauty and care products, only invest in companies that own every step of their chain, such as L’Oreal, Essity (OTCPK:ESSYY), or others. And I’m not even saying that these companies are doing particularly well. But what I am saying is that these companies, at the very least, can protect their positive margins and deliver profits to shareholders.

There’s very little visibility when HNST company would be able to start doing the same, let alone start rewarding shareholders in some way.

So while I thoroughly respect Mrs. Alba and I think she has a great product, my thesis and valuation perspective is going to be oriented around what it needs to be looking at – namely when we can expect to start seeing a profit from HNST.

Honest Company Valuation

For its size, and again probably due to its celebrity image, the company actually has analysts following the business. The issue is that these 6-8 analysts from S&P Global have done an absolutely horrid job of forecasting any sort of reasonable valuation for the company with any sort of accuracy.

Street targets started out at around $14.7 on average at the same time last year, and have declined since. Analysts have always forecasted an upside of around 40-70% for the business, and the current average PT for HNST is not even 30% of what It was a year ago, coming in at $4.38/share. But how are we supposed to have any confidence in that?

3 out of 6 analysts are t a “BUY” – but there were 7 analysts at a “BUY” around a year back, and those recommendations have lost around 70% of their investment at this point.

Multiples are not flattering either – at least not when considering the company’s actual results. Even at a 1x sales multiple, the problem is that the company generates a negative bottom line, and I don’t see a current path to profitability. If that had been the case, SG&A and operating expenses would have been decreasing as a % of revenue. The fact that they do not mean the company is not currently scaling well.

Peers in the business trade around at 4-5x Sales, such as L’Oreal. The issue is that these companies deserve their premium – they’re world-leading beauty conglomerates, making HNST look like a drop in the ocean. Comparing the two is a nonsensical exercise.

Look, the issue is that the company needs positive margins and actual profit. L’Oreal, as an example, generates a positive operating margin, not gross margin, of over 19%. That leaves plenty for the bottom line. For baby products, we can look at Essity, which is also up there at around 11-14% historically. Both of these businesses have a yield, and both of them are good investments at the right price. Essity is even cheap right now.

To those that say that’s not comparable – of course, it is. You can invest $10,000 into L’Oreal, or $10,000 into HNST. That’s 10k of your hard-earned dollars into either A or B, generating revenue, income, and profit for you. And as it looks now, company B has no real mark at when it expects to break even.

A year ago or so, this would have been forgiven to a higher degree – but with the world, as it is now, costs being as they are, I would be extremely hesitant at all times, to invest in any company that is not bringing at least a positive bottom line to the table.

if you invest knowing that, you’re basically lending them your capital for free.

You should have good reasons for doing so. Positive or bullish theses on this company focus far too much on technical analysis or on hopeful forward scenarios where the company can turn things around.

I want more clarity of a turnaround before accepting any thesis in such a business. I at least want someone saying “This year X is when we expect to break even”. That hasn’t happened here.

For that reason, I’m “out”. Because of that, I would assign the company a SOTP valuation of around $1.1/share, which is the estimated, 0.8x value of its assets less liabilities/debt – though if we do get that far down, there might be other issues to the company.

Thesis

Here is my introductory thesis for Honest Company:

- My thesis going into HNST is “HOLD”, and not buy. If you hold the company, you obviously hope for a long-term turnaround, and selling at a loss is not something I do unless I’ve lost confidence in the business.

- The company has great products and processes, but lacks the profitability that would make the company even remotely interesting to me at this time.

- My PT comes to an impaired sum-of-the-parts valuation for the cash/equivalents and net PP&E on its books, and i value it at $1.1/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment