JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Shopify Inc. (NYSE:SHOP) stock saw its worst-ever plunge in recent memory, as it fell more than 70% from its November highs to its March bottom. It easily eclipsed the 50% steep decline during the COVID-19 bear market. However, the stock has staged a remarkable recovery recently. Dip buyers were in a hurry, rushing back into the pandemic favorite.

We believe the worst seems to be over for SHOP’s stock, given the hammering it received. However, we do not encourage investors to hold Shopify stock for the long term. We remain wary of its significant growth premium and weak FCF metrics. Moreover, given the company’s strategic pivot to focus on fulfillment, we think the execution risks could be substantial.

We rate SHOP stock as a Buy. But, we consider the current opportunity as speculative, with a price target of $950, representing an implied upside of 27%.

SHOP Stock Key Metrics

SHOP stock NTM Revenue (TIKR)

SHOP stock NTM EBIT & NTM FCF yield % (TIKR)

Many Shopify investors prefer to view SHOP’s valuation through the lens of its NTM revenue multiples. If we consider that, the stock’s valuation has certainly been crushed. The market has pummeled Shopify stock so severely that its valuation has fallen to just 13.5x NTM revenue. It even reached 10x Revenue at the recent March bottom. Notably, SHOP has been supported reliably along the 10x NTM revenue mark over the last five years.

But, we think Shopify investors were blindsided because they might have disregarded its earnings and FCF multiples. SHOP trades at 209x NTM EBIT. At its November highs, its multiple even reached more than 300x. In addition, its FCF multiple continues to look highly underwhelming, at just 0.15%. Therefore, the argument that Shopify has not been calibrated for earnings and FCF profitability had fallen on deaf ears. That could work if Shopify were operating a highly durable or profitable business model. But, its operating margins and FCF margins have often been on the low side.

Therefore, as it emerged from the pandemic, it started to feel the impact of its pull-forward growth. When the topline momentum started to show strain, investors inevitably turned to value the stock based on its profitability. That was when they realized they had better run before it all came crashing down.

Is Shopify Stock Near A Buying Point?

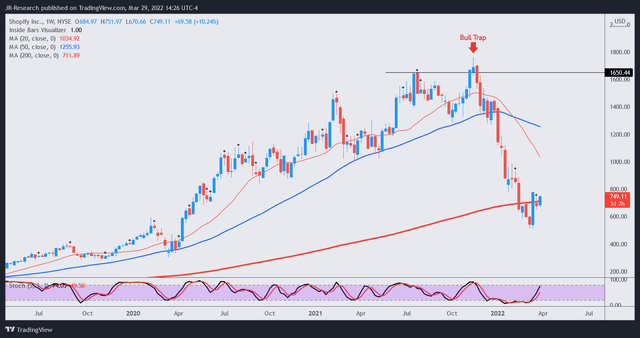

SHOP stock price action (TradingView)

Growth investors often clamor to know whether the current malaise is over. Unfortunately, we don’t think there’s a straightforward case on whether SHOP stock has reached its bottom. Nonetheless, we believe that its recent price action could shed light on a potential bottom.

The 70% waterfall decline was steep. But, it has already recovered about 50% of its losses from its post-FQ4 selldown. Therefore, despite the challenges of building fulfillment centers ahead, SHOP investors seem to have returned to support the stock. Thus, it’s reasonable to assume the sell-off appears to be overdone in the near term.

SHOP stock consensus price targets Vs. stock performance (TIKR)

Furthermore, the Street has also gotten relatively pessimistic over SHOP stock. Shopify stock’s average price targets (PTs) suffered a significant de-rating, given its challenging fulfillment buildout. As a result, SHOP is trading in line with its most conservative PTs. As seen above, we continue to view its average PTs as reliable resistance or take-profit levels.

What Is SHOP’s Long-Term Outlook?

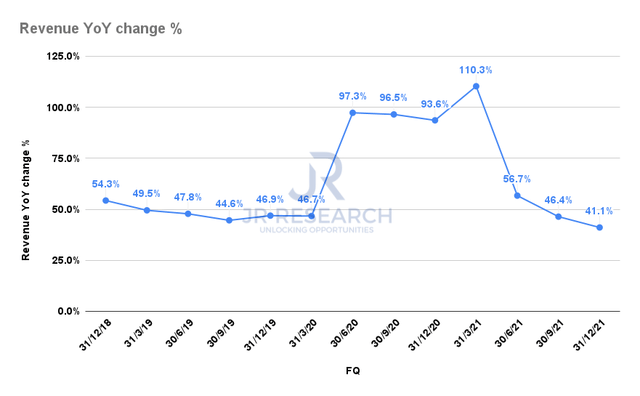

Shopify revenue YoY change % (S&P Capital IQ)

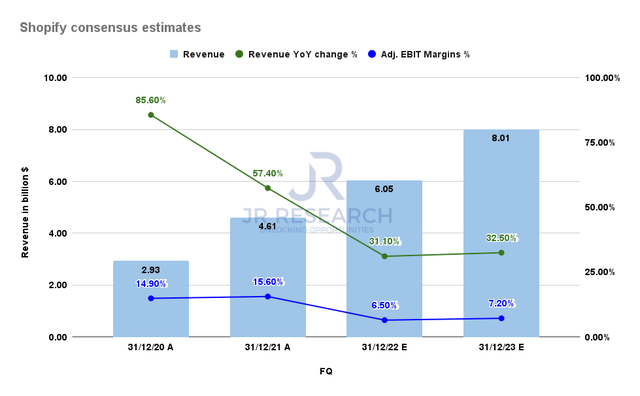

Shopify consensus estimates (S&P Capital IQ)

Shopify investors have been used to phenomenal topline growth over the past three years. It also managed revenue growth of 41% in FQ4, even though growth has consistently decelerated. It’s reasonable to assume that Shopify’s revenue growth would continue to decelerate as e-commerce growth slows. The law of large numbers would eventually catch up with Shopify. As a result, investors could start turning to Shopify’s profitability as a yardstick.

Consensus estimates suggest that Shopify’s revenue growth could slow to about 31-32% over the next two years. Therefore, it’s a marked deceleration from previous years. Notably, management has also telegraphed significant investments, including CapEx spending, to expand its fulfillment footprint.

Therefore, it’s a massive shift from an asset-light model to competing on Amazon’s (AMZN) core competencies. Consequently, the hit to its adjusted EBIT margins could be significant.

Consensus estimates suggest a marked impact on its adjusted EBIT margin in FY22, reaching just 6.5%. It was 15.6% last year. Furthermore, the hit to its FCF margin would also be significant, given its CapEx buildout. Shopify is expected to post an FCF margin of 2.2% against FY21’s 9.8%. The company’s FCF margin in FY23 is also likely to be anemic, reaching 2.7%. The company’s initial phase of CapEx investment is expected to last till FY24.

It’s still too early to understand whether more investments are necessary. We discussed in an earlier article how Amazon took two years to complete its massive CapEx investments. Therefore, it’s a monolithic task that Shopify’s management would need to navigate. And, investors should assume that it’s anything but straightforward.

Is SHOP Stock A Buy, Sell, Or Hold?

We discussed earlier that we think the plunge in SHOP stock looks to be over for now. Despite its growth premium, there’s too much pessimism being baked into its valuation.

However, we consider its ongoing investments over the next three years (at least) to be fraught with significant execution risks. Nevertheless, the company has a robust balance sheet with cash & equivalents of $7.8B. Therefore, we believe it has the wherewithal to finance its $2B in investments through FY24.

However, we remain wary of its embedded growth premium, which we think is significant. Moreover, given the strategic pivot, it has added potential downside risks that need to be considered. Furthermore, we do not think SHOP would be re-rated to its November highs moving forward, given its weak profitability outlook and slower topline growth.

As such, we rate SHOP stock as a speculative Buy, with a target price of $950, implying an upside of 27%.

Be the first to comment