Justin Paget/DigitalVision via Getty Images

The last time I wrote about Prologis (NYSE:PLD), I did a breakdown of the REIT and explained why the valuation was too rich for me at the time. Since then, shares are down over 30%, which was due to the high valuation and a broader market selloff. Prologis recently finalized terms on the acquisition of Duke Realty (DRE), another large industrial REIT. While the price is certainly more attractive than it was three months ago, I will explain why Prologis will remain on my watchlist for now.

Investment Thesis

Prologis is the largest industrial REIT in the world, with a market cap of $88B. That is poised to grow again in 2022, as they recently announced that they will be acquiring Duke Realty, another industrial REIT with a market cap of $19B. Duke’s portfolio primarily covers the eastern half of the U.S. and will nicely compliment Prologis’ existing real estate portfolio.

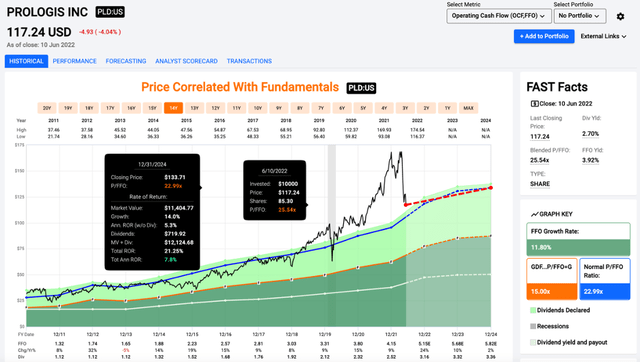

While the acquisition will be a boost for the long-term future of the company, Prologis shares have had a rough 2022 and are down 34% YTD. Shares currently carry a price/FFO of 25.5x, which is still a couple turns above the average multiple over the last decade. Shares will stay on my watchlist for now, but if shares continue to sell off, I will look to buy a starter position.

Some Background on Duke Realty

Prologis has been working to acquire Duke Realty for some time now. Duke’s board rejected the first offer, and they have been going back and forth until both boards approved the most recent offer. Since I haven’t covered Duke before, I think it makes sense to do a brief summary of the REIT and its portfolio before getting into the terms of the acquisition.

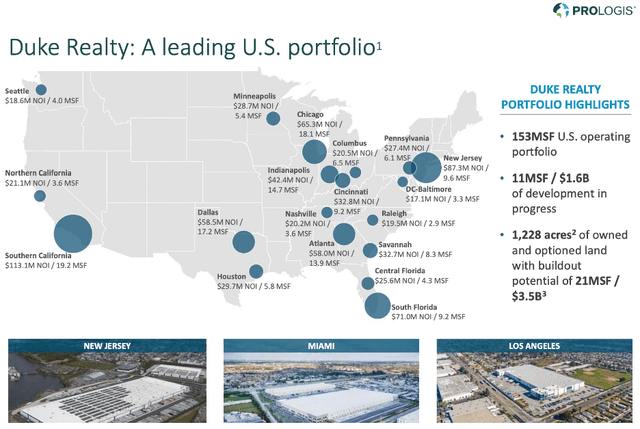

Duke Acquisition Investor Presentation (prologis.com)

Duke has a portfolio spread across the US, with a focus on large coastal markets, like Prologis. They primarily focus on the eastern half of the U.S., but also have a large presence in Southern California. The company has an impressive portfolio that will fit in nicely with Prologis’ existing footprint. While the acquisition terms were a point of contention between the two boards, they reached an agreement on Monday.

Acquisition Terms

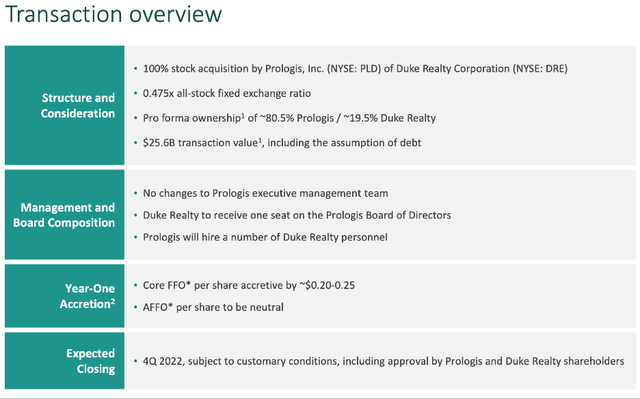

The acquisition is an all-stock deal, with Duke shareholders receiving 0.475 shares of Prologis for each share of Duke. This puts the transaction value at $25.6B (using the 6/10 close price, including assumption of debt). Prologis shareholders will own approximately 80% of the REIT after the transaction, with the remaining 20% going to Duke shareholders.

Acquisition Terms (prologis.com)

Prologis is expecting that the acquisition will be accretive in year one and for several years to come. They are planning to hold onto 94% of the Duke portfolio and the acquisition is expected to close at the end of 2022. While the acquisition is expected to boost FFO in the first year after closing, the valuation is keeping me on the sidelines for now.

Valuation

Prologis has always traded at a premium multiple since the financial blowup in 2008. The company’s average FFO multiple over the last decade is 23x, and the valuation has traded above that average for most of the last three years. Shares currently trade at a price/FFO of 25.5x. This is even after shares lost a third of their value in 2022.

I think somewhere in the low to mid 20s range makes sense for Prologis’ multiple. It has a track record of consistent FFO/share and dividend growth, but I don’t think new investors have a margin of safety. REIT valuation is a little bit of a double-edged sword, and it definitely applies to Prologis. A high valuation means they can issue shares to fund acquisitions at attractive prices but could lead to downside for investors. On the other hand, a low valuation makes issuing shares to fund acquisitions less attractive. The best thing an investor can do is find a fast-growing REIT at or near a fair valuation multiple, which could describe Prologis at a 20x price/FFO, for example.

Conclusion

Prologis investors should be excited about the Duke acquisition. It will add to an already massive real estate portfolio that has significant tailwinds for the coming decade. I think the deal is fair for both sides, and the 800-pound industrial real estate gorilla that is Prologis just got a little bigger. The acquisition should help FFO/share continue to grow, but the valuation is still a little rich at a price/FFO over 25x. Prologis will stay on my watchlist, but I’m going to stay patient on this one. If the valuation gets more attractive in the coming months, I will be prepared to start a small position.

Be the first to comment