Leonid Sorokin

Investment Thesis

Nutrien’s (NYSE:NTR) Q4 guidance took investors by surprise, as the one area where Nutrien struggled to live up to its expectations, was exactly the one area that investors wanted to be positively surprised. Namely, Nutrien’s potash opportunity.

Furthermore, given that high energy costs are negatively impacting Nutrien, investors were expecting/hoping to see Nutrien reaffirming its full-year 2022 EPS guidance of approximately $17 per share, at the midpoint. But here too, investors were disappointed.

For investors that didn’t fully believe that fertilizer supply is extremely constrained around the world, this quarter’s guidance was all the insight they needed to exit this name last week.

But for investors that understand the pushes and pulls of this story, while this guidance was clearly frustrating, all that’s happened is that the bull case has been delayed, rather than destroyed.

What’s Happening Right Now?

Nutrien downwards revised its full-year outlook. We’ll discuss this in more detail momentarily. But before that, I believe that it’s important not to lose sight of the underlying opportunity.

The bear case here is that farmers are pushing back against high potash prices. In fact, for anyone following this space closely, this possibility had already started to gain traction throughout the summer.

NTR Q3 2022

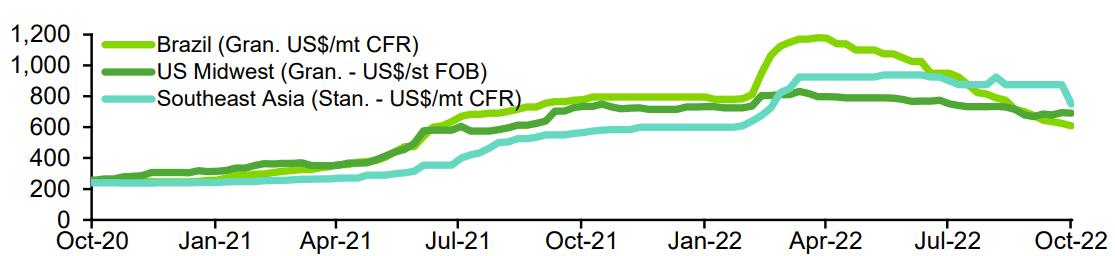

What you can see above is that earlier in 2022, the price of potash jumped higher. Hence, farmers didn’t want to pay higher prices, so they deferred their fertilizer purchases.

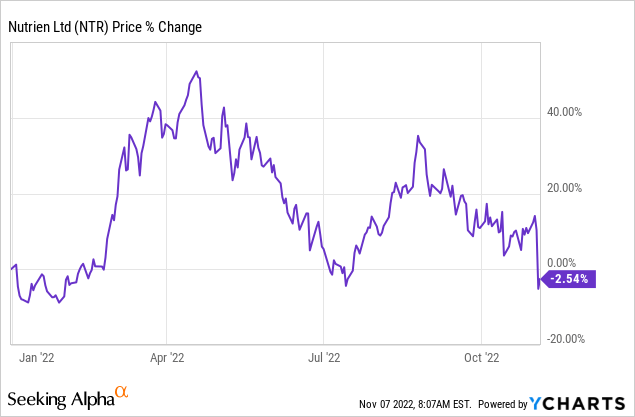

This has now led to inventory levels becoming tight. And if one were to look at Nutrien’s share price it’s nearly as if the whole bull case has broken down:

What you see above is that despite everything that we know, plus all the favorable macro conditions that one could have hoped for, Nutrien’s share price is actually lower than at the start of 2022! That’s just absurd.

Allow me to explain why the potash story is not dead. Farmers are simply going to delay the purchases of their fertilizer or potash products.

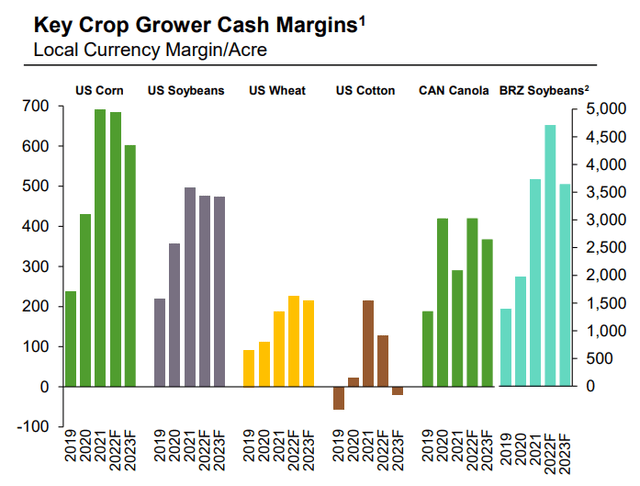

We don’t even need to overcomplicate the investment case by highlighting that crop yields are significantly higher than they’ve been for a while.

In simple terms, if crop prices are high, farmers are incentivized to invest in fertilizers and seeds, to continue farming. And as you can see above, across the board, from corn to soybeans, crop prices are expected to remain elevated into 2023.

Guidance For Q4 is Downwards Revised

As we headed into Q3 earnings, investors expected that Q4 EPS would be approximately $4 per share. That would mean that for 2022 Nutrien was going to print approximately $17 of EPS, and the stock was getting priced at 5x EPS and everyone was happy.

But now, after Nutrien downwards revised its Q4 EPS to approximately $2.80, investors are now suddenly reminded of why investors skew away from investing in fertilizer companies.

It’s not only the poor visibility that plays an issue in terms of volatility. But also, it’s Nutrien’s high operating leverage. When things are going well, revenues grow a little and the EPS line jumps a lot.

And vice-versa. When the topline slows down, and inflationary costs continue to trickle higher, there’s the potential for that EPS growth rate to rapidly compress.

The Bottom Line

Investors are flummoxed. Are we at peak earnings for fertilizer companies? Or what’s going on? I explain that even though investors’ expectations ran ahead of the fundamentals, there’s every reason to believe that these are not peak earnings.

I believe that 2023 will be just as strong as 2022. And if we think about Nutrien as being priced at 5x this year’s EPS, this is what this multiple means in practical terms.

Investors are being asked to pay for 5 years worth of earnings upfront. And if 2023 sees Nutrien’s EPS match 2022, that means that investors are only going to need 3 or 4 highly profitable years, before Nutrien is available basically for free.

But between now and then, investors are going to have to be patient and wait for investors to get positively enthused over Nutrien’s potash prospects.

Be the first to comment