BackyardProduction

Northern Trust (NASDAQ:NTRS) is one of America’s primary three big independent custodian and trust banks. That’s not to say that they’re the only custodian banks out there; firms like JPMorgan (JPM) also have large operations in this field.

However, investors have been drawn to the big three independent custodian and trust banks, namely State Street (STT), Bank of New York Mellon (BK) “BNY Mellon”, and Northern Trust. This type of banking is attractive because it is low-risk and generates profits from managing and safekeeping assets rather than taking much risk on the lending side of the ledger.

All three of the custodian banks listed above fared reasonably well during the financial crisis, and avoided any crushing losses or dilution that would have permanently impaired investors. That makes sense, as these custodian banks aren’t slinging around MBS securities, lending to emerging market countries, or anything exotic like that.

Rather, custodian banking is basic blocking and tackling. Collect assets, provide solid back office and personal relationship services, and charge a reasonable fee for that. With the banking sector, including the custodian banks, in a big sell-off in 2022, let’s check in on Northern Trust specifically.

NTRS Stock Basics

Northern Trust is not the largest custodian bank out there. As per Institutional Investor, BNY Mellon is the largest custodian bank in the world. State Street is #2, followed by JP Morgan at #3. However, Northern Trust is the next largest of the independent banks, and folks commonly think of the State Street, BNY Mellon, and Northern Trust grouping as three close peers.

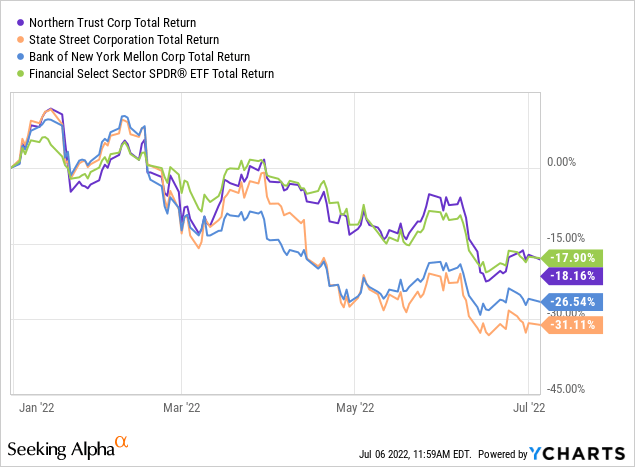

Year-to-date, all three trust banks — like the broader banking sector — have fared poorly:

The Financial Select Sector ETF (XLF) is down 18% year-to-date, as is Northern Trust. Meanwhile, BNY Mellon is down 27% and State Street is off 31%.

At first glance, that might seem surprising. After all, a major piece of income for custodian banks is from net interest income since they invest large sums of money in low-risk securities such as government treasuries. With interest rates moving up sharply in 2022, this should provide a tailwind for the trust banks. And indeed, Northern Trust saw its net interest margin move to its highest point this decade in 2019 amid the last mini-rate hiking cycle. Higher interest rates should offer a similarly beneficial effect this time around.

However, that positive effect has been significantly offset due to falling equity and bond markets. Custodian banks take care of assets and charge fees on them, that’s their primary purpose. With most bond and equity markets down sharply year-to-date, the total amount of assets under management for firms like Northern Trust will be under significant pressure, thus trimming the firm’s potential fee income.

That gives the context to explain the selloff in custodian banks such as Northern Trust this year. With the price coming down, however, the attractiveness of Northern Trust as a dividend stock is increasing. Let’s take a look.

What Is Northern Trust’s Dividend Now?

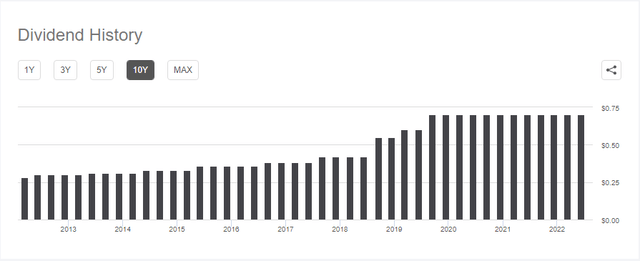

Historically, Northern Trust was a significant dividend growth story. Between 2012 and 2019, the company increased its quarterly dividend from 28 cents to 70 cents. Since 2019, however, Northern Trust has left its dividend stable at 70 cents instead of increasing it:

NTRS Dividend History (Seeking Alpha)

With the dividend at $2.80 annually and the stock ticking down below $100 recently, Northern Trust is now yielding 2.9% on a trailing basis. That’s a solid premium to the financials ETF, which is yielding just 2.1%. However, Northern Trust’s 2.9% trailing dividend does lag BNY Mellon at 3.2% and State Street at 3.6% today. However, a change is coming.

When Will Northern Trust Increase Its Dividend?

After halting dividend growth since 2019, Northern Trust is returning to an increasing dividend policy.

On June 27, Northern Trust announced its Federal Reserve stress test results. The company’s regulatory capital easily met requirements, giving Northern Trust the latitude to engage in additional returns of capital to its shareholders.

As a result, Northern Trust announced a 7% dividend increase, bumping its quarterly payment from 70 cents to 75 cents. This will go into effect for the company’s Q3 dividend payment, which is typically paid on October 1 each year.

With the new higher dividend policy, Northern Trust’s forward dividend yield will jump to 3.2%.

Is NTRS Stock A Buy, Sell, Or Hold?

There are two related questions when deciding whether Northern Trust is a buy or not. The first is whether the custodian banks as a category are worth buying today. The second is whether Northern Trust is the most attractive of the custodian banks or other close peers in particular.

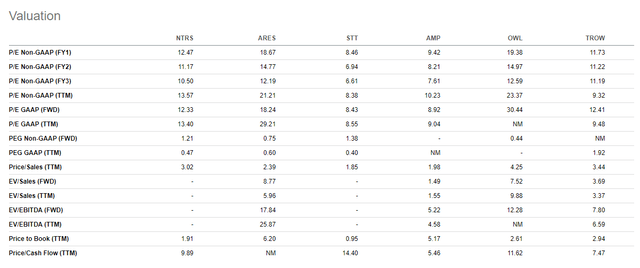

On a valuation basis, Northern Trust slots in as not the most expensive, but certainly not the cheapest of its peers as shown by this Seeking Alpha comparison table:

NTRS Peers Profitability Data (Seeking Alpha)

Northern Trust’s 12.5x P/E, for example, is attractive on its own, but is not particularly cheap given the depressed valuations we see across much of the banking sector today. Similarly, Northern Trust’s 1.9x price/book ratio is below its historical norm, but well above where other too-big-to-fail banks are trading today.

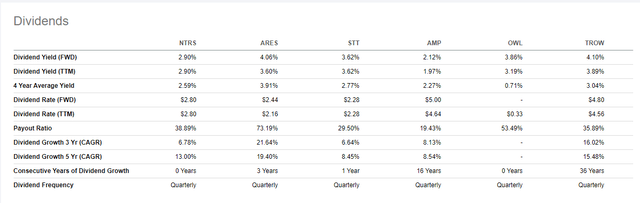

Turning back to income, here is Seeking Alpha’s comparison table for dividends among Northern Trust’s peers:

NTRS Dividend Table (Seeking Alpha)

The 2.9% dividend yield will advance to 3.2% in October with the scheduled dividend hike. Northern Trust’s dividend is safe and well-covered out of earnings. It’s not a bad choice by any means. However, there are arguably more attractive options on offer during the current bear market.

This gets back to the broader question: Is Northern Trust stock a buy today? I’d say it’s a buy, in that all the custodian banks are at attractive prices today. However, I’d view peer State Street as a strong buy, given its lower valuation ratios, bigger year-to-date drop, and greater historical performance. To that last point…

What Is Northern Trust’s Long-Term Forecast?

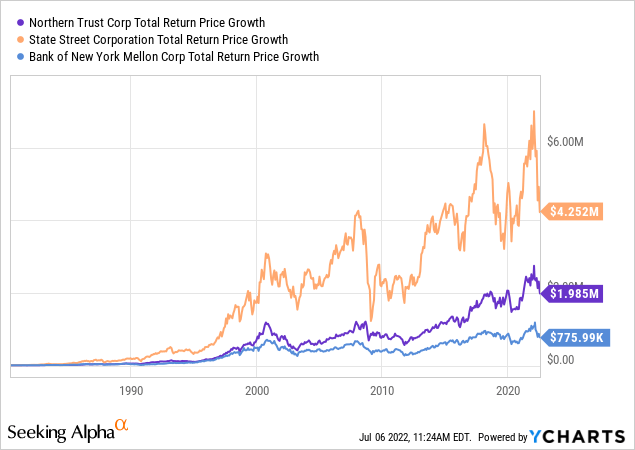

Over the long-term, the trust banks have been tremendous performers. A $10,000 investment in the three primary American trust banks back in 1980 would have performed as followed through to today:

State Street has been the clear winner of the three, but Northern Trust turned $10k into $2 million and even the laggard Bank of New York Mellon turned the same sum into almost $800,000.

The issue, as you can probably see, is that returns have been much less impressive since 2000. The combined forces of lower interest rates and passive low-fee investing have driven down profitability considerably and thus limited these banks’ formerly prodigious ability to deliver shareholder value.

Can Northern Trust recover its former magic? Cost initiatives have helped it outpace State Street and BNY Mellon since the financial crisis. In particular, Northern Trust has gotten its non-interest expense as a percentage of its non-interest income down to 89% compared to 102% in 2011.

Northern Trust has done a great job of making more out of less, delivering improving results even in a low interest rate environment. Add in the pressure from passive investing, and Northern Trust has shown superior operational skill to navigate the past decade while generating considerable shareholder value.

So, there’s a valid case for betting on the management team here and buying at the currently attractive valuation and starting dividend yield. That said, for my own money, I own State Street instead as I see it as both cheaper and better-positioned to thrive over the long-term. That said, I’m bullish on all the custodian banks at current prices, and thus Northern Trust is a reasonable buy here.

Be the first to comment