Cylonphoto

Nvidia (NASDAQ:NVDA) has finally dropped to clearly buyable levels in spite of having one of the more attractive growth stories in the market today. NVDA stands to benefit from the ongoing digital transformation and further from the move towards more advanced technologies. This is all while the company is profitable with a net cash balance sheet. Valuation is no longer an issue here – I rate the stock an outright buy for long term investors.

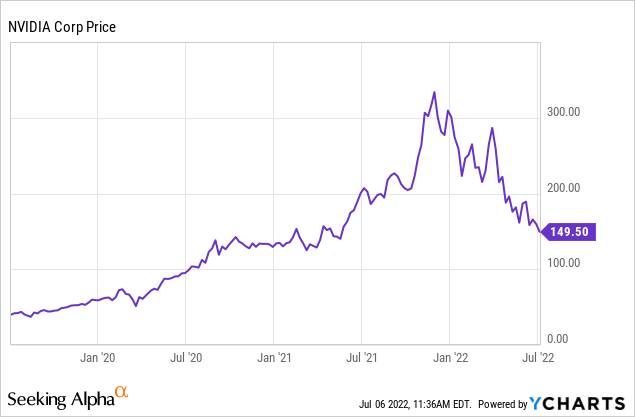

NVDA Stock Price

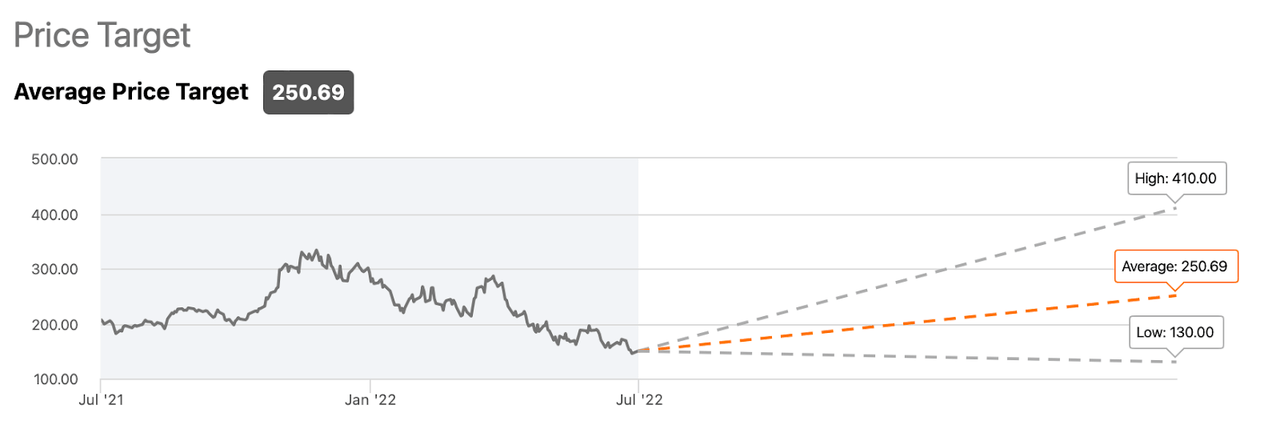

NVDA is now trading below $150 per share, a far way from its $346 all-time high reached in late 2021.

I last covered the stock in March where I was neutral on the stock due to the fact that its valuation was “only” reasonable while the rest of the tech sector had already undergone monumental multiple compression. After a 37% decline since then, NVDA is primed for a rally.

NVDA Stock Key Metrics

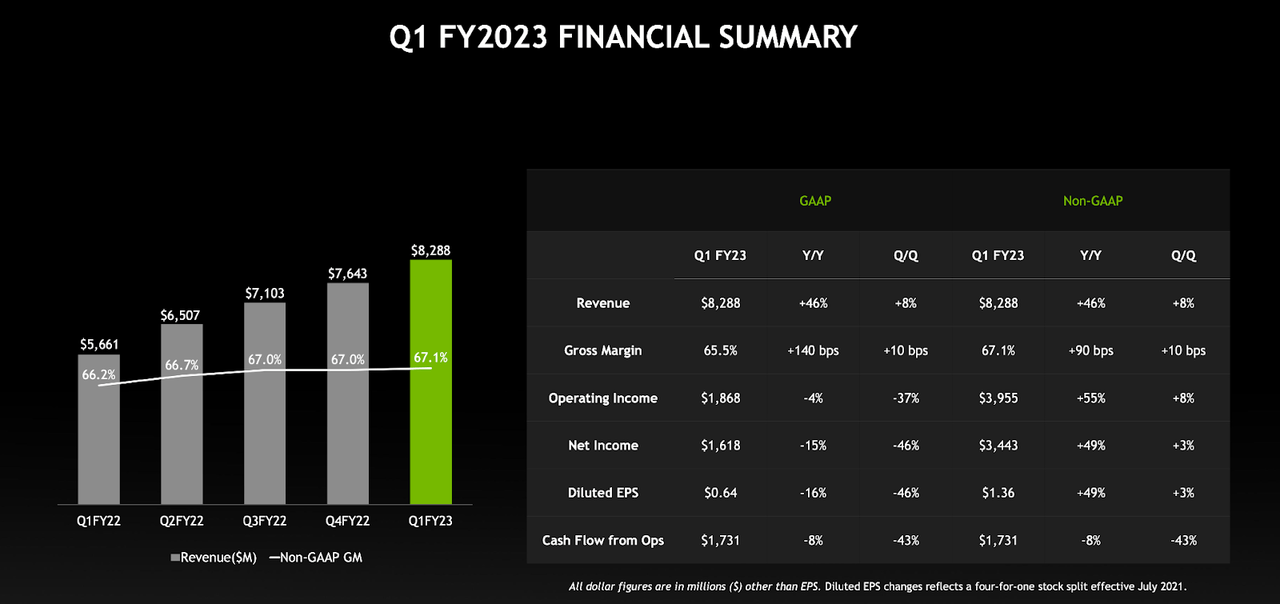

In the latest quarter, NVDA showed strong 46% revenue growth. Net income declined on a GAAP basis by 15% due to $1.35 billion in acquisition termination costs related to its failed acquisition of Arm. Excluding that one-time expense, non-GAAP EPS grew by 49%.

Q1FY23 Slides

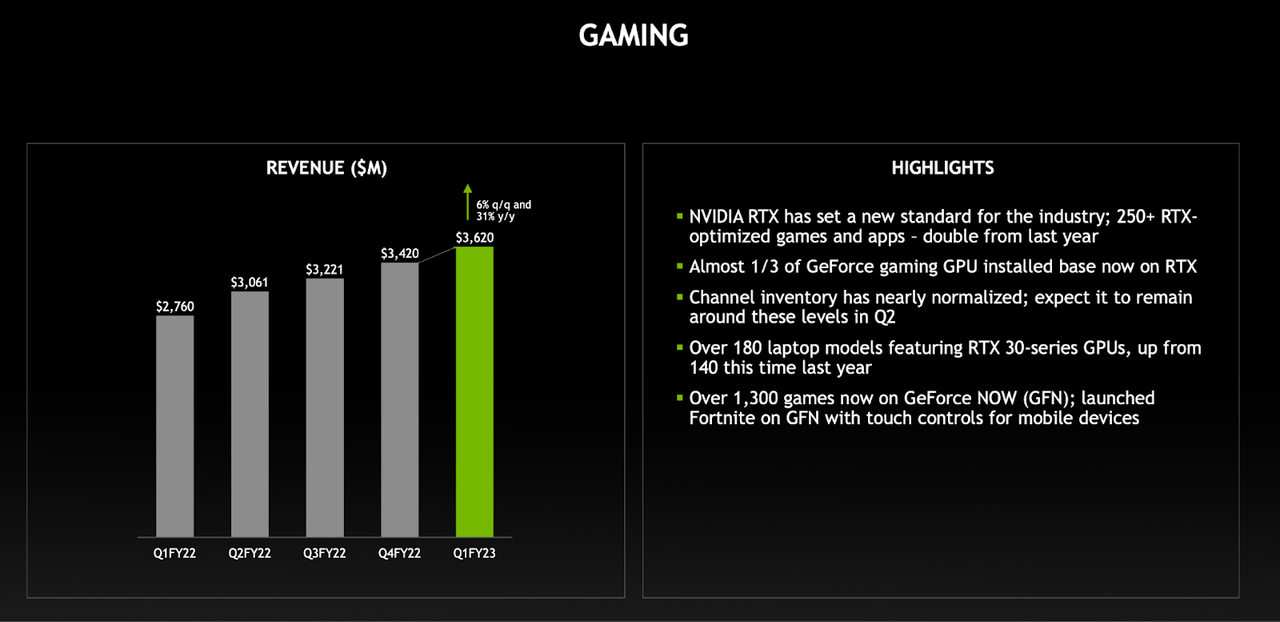

Most investors may know NVDA for its gaming division as that has historically been its profit driver. Gaming revenues grew by 31% year over year.

Q1FY23 Slides

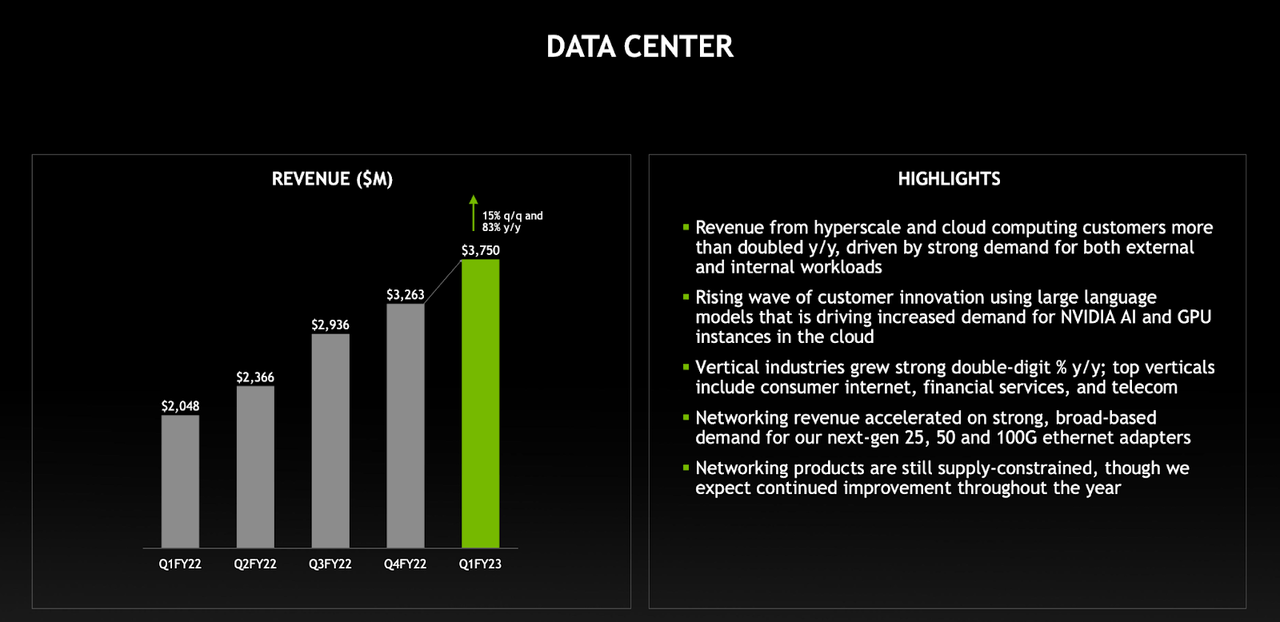

Yet data center revenues have finally eclipsed gaming revenues to become its biggest business line. Data center revenues grew 83% to $3.75 billion.

Q1FY23 Slides

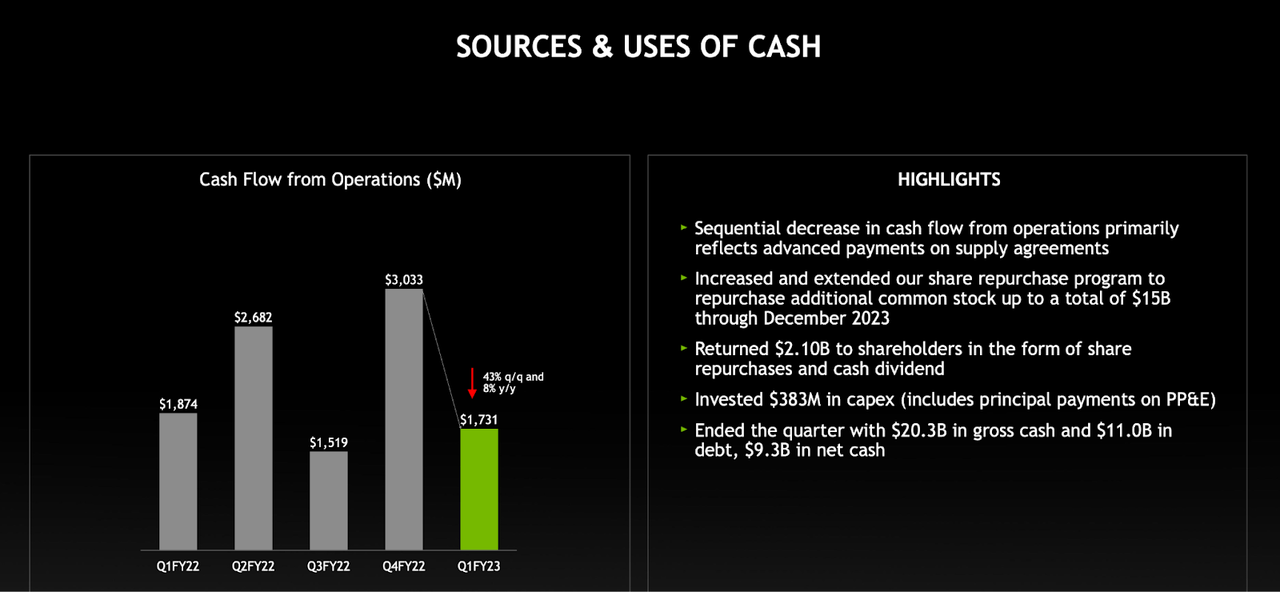

NVDA repurchased $2 billion of stock and paid out $100 million of dividends in the quarter. The company ended the quarter with $20.3 billion of cash versus $11 billion in debt for a net cash position of $9.3 billion.

Q1FY23 Slides

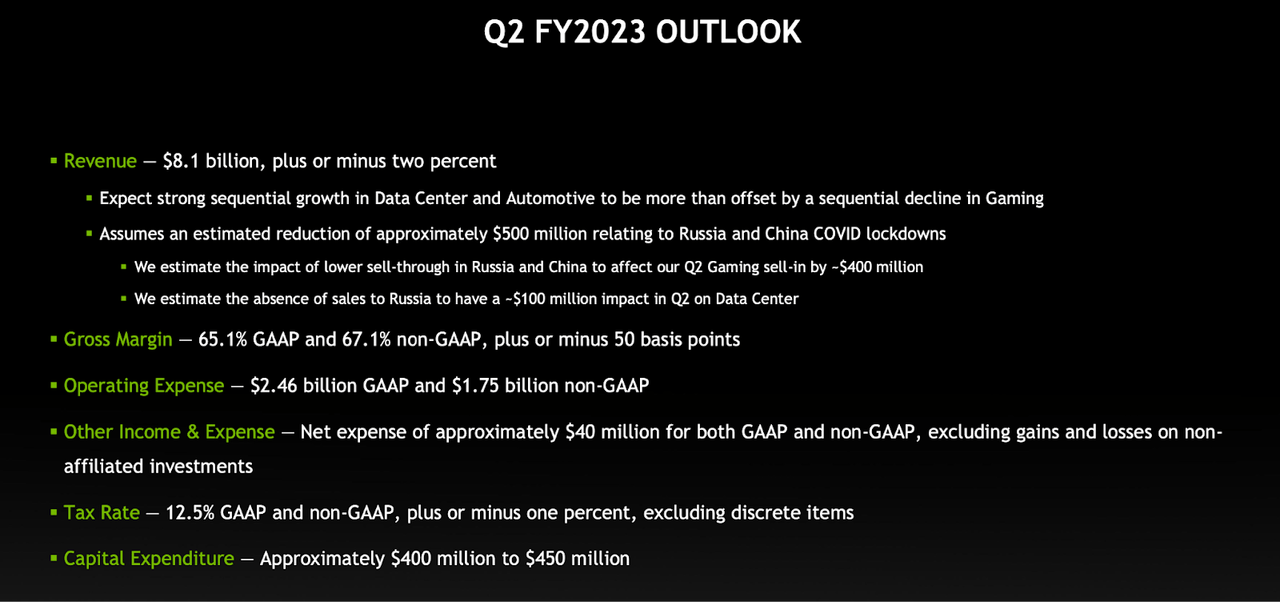

In the next quarter, NVDA expects around $8.1 billion of revenue, representing 24.4% year over year growth. That represents a huge deceleration from the 46% growth of the latest quarter, but should not be too surprising considering that NVDA is passing over tough comparables.

Q1FY23 Slides

Why Is NVDA Stock Dropping?

I suspect that NVDA’s stock is dropping for two primary reasons. First, some investors may have been hoping for a more upbeat outlook in spite of the tough comps. Second, the odds of an economic recession are looking higher by the day, which may negatively impact NVDA’s growth trajectory at least in the near term.

How Does NVDA’s Momentum Compare To Competitors?

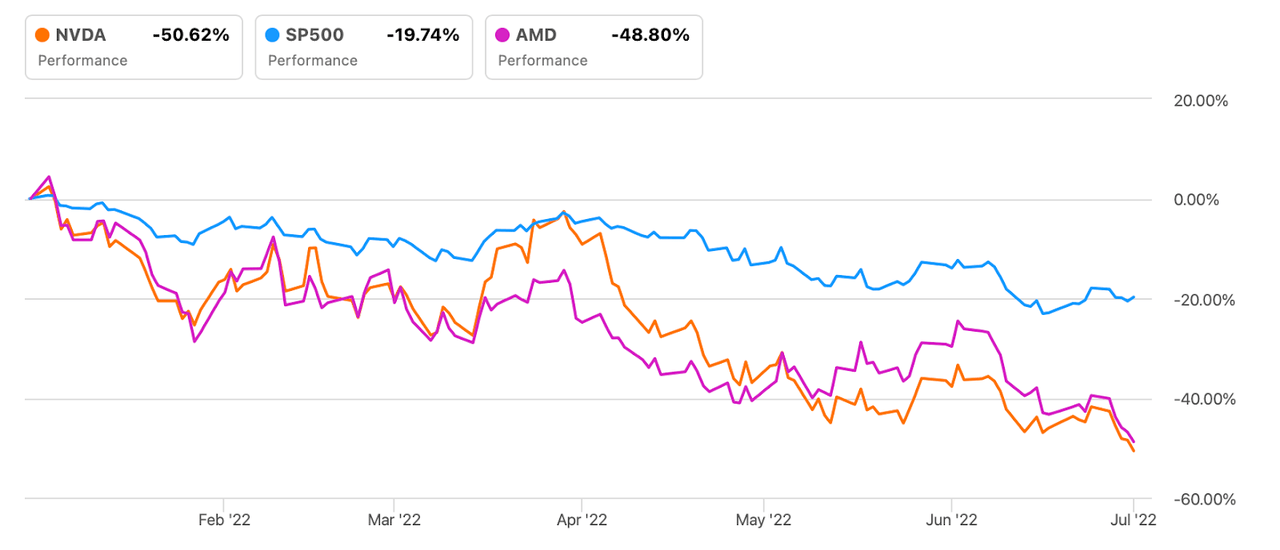

For much of 2022, NVDA performed more like an average stock in the broader market but has since fallen like other tech stocks. Both NVDA and peer AMD (AMD) have fallen by a similar amount this year.

Seeking Alpha

Is Nvidia Undervalued Now?

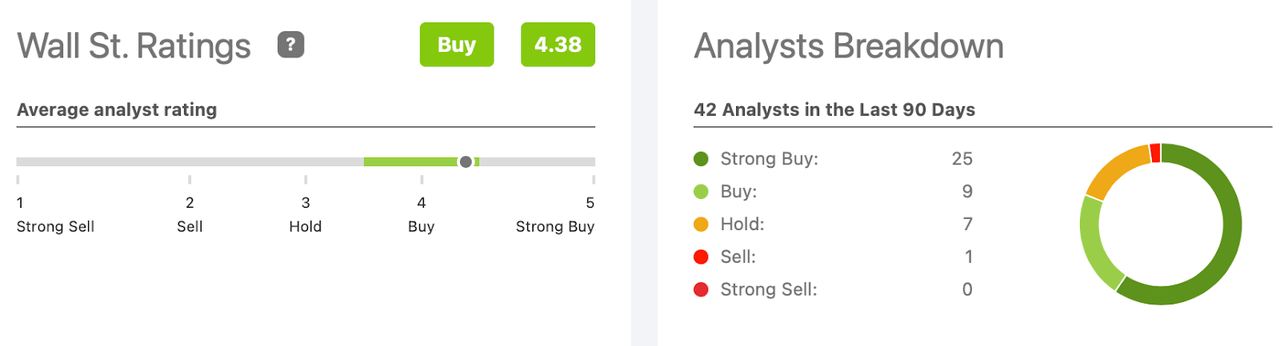

Wall Street analysts have an average rating of 4.38 out of 5 which falls in the “buy” range.

Seeking Alpha

The average price target is $250 per share, representing 66% potential upside.

Seeking Alpha

What Is The Future Outlook?

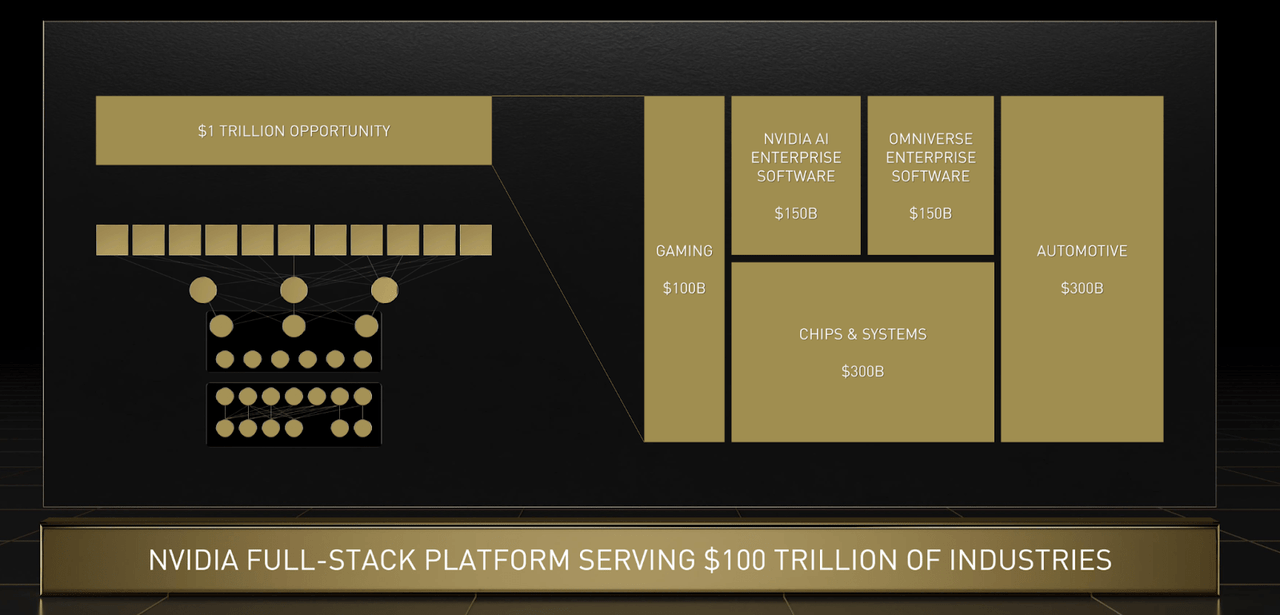

The thing about NVDA is that its outlook is so bright that there is a wide fair value range. NVDA is addressing a $1 trillion opportunity – there is no future digital world without NVDA.

Q1FY23 Slides

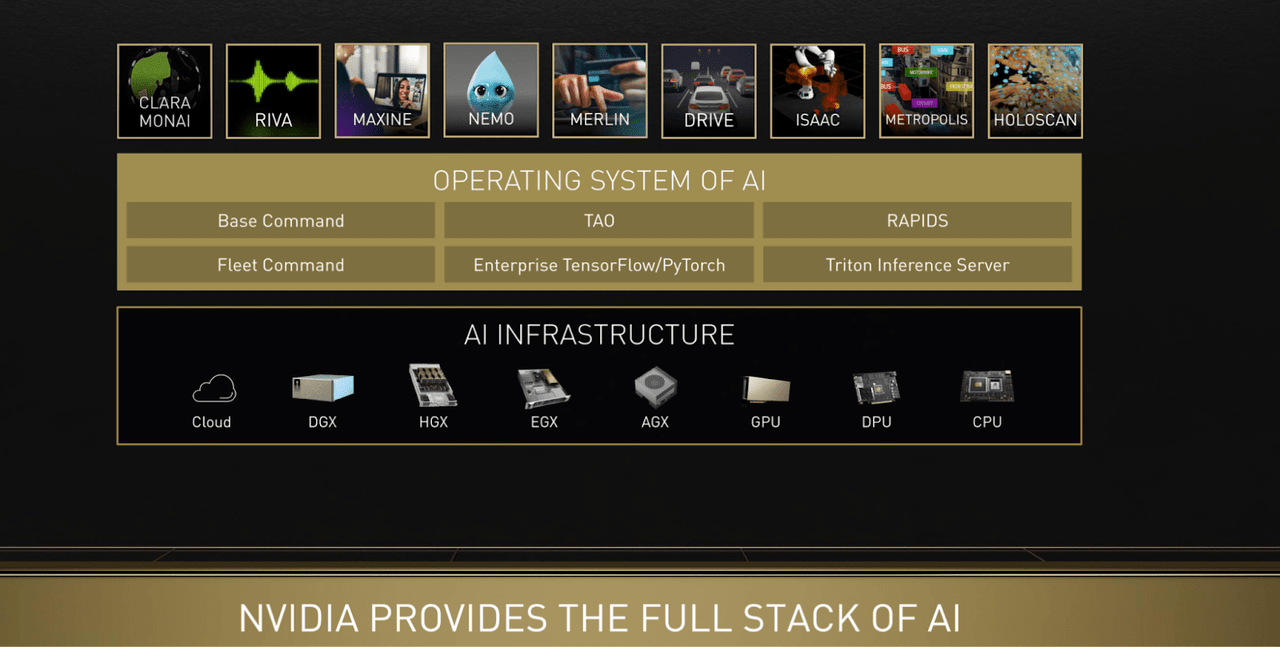

This isn’t just about the ongoing move to everything IoT – digital is getting more advanced with trends like artificial intelligence.

Q1FY23 Slides

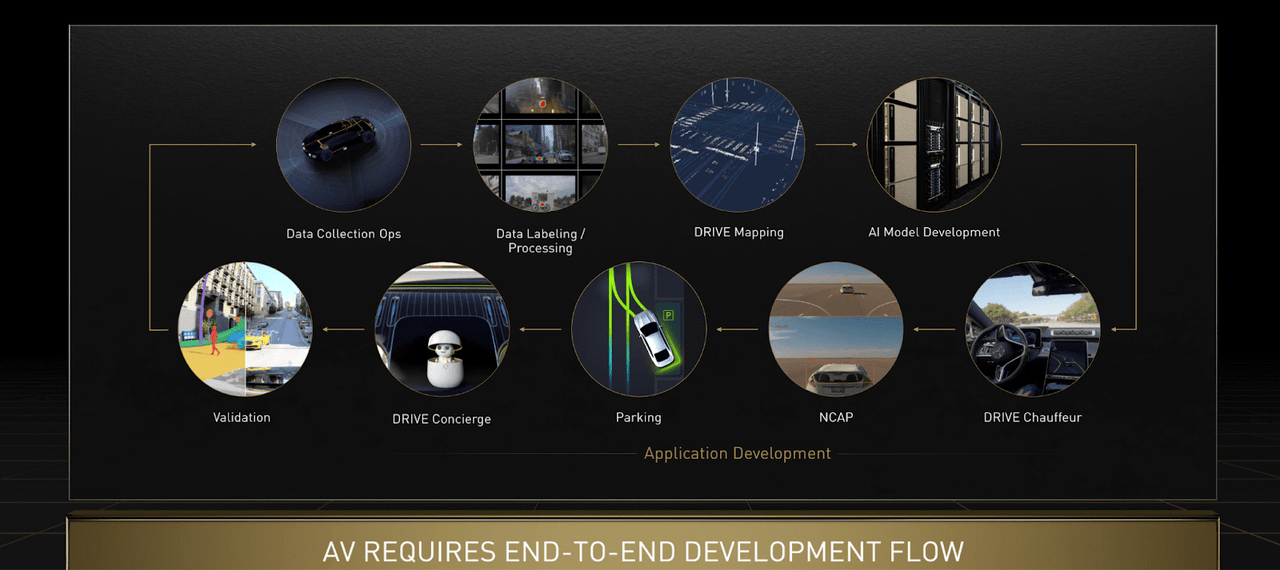

Over the long term, autonomous vehicles will also require the use of NVDA’s chips.

Q1FY23 Slides

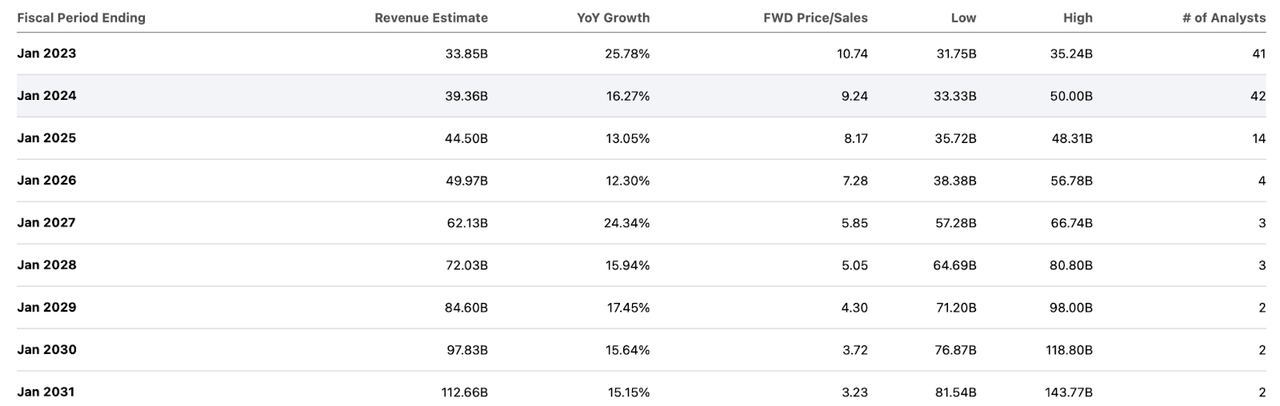

Unless one thinks that the future will be less technologically advanced than today, NVDA has growth for as far as the eye can see – and farther. This helps to explain why consensus estimates call for double digit revenue growth for the next decade.

Seeking Alpha

The trick with NVDA stock is making sure we are not paying too much of a premium for what is undoubtedly a very attractive investment story.

Is NVDA Stock A Buy, Sell, Or Hold?

At recent prices, NVDA is trading at only 34x 2021 earnings and 28x forward earnings. Against a 15% long term revenue growth projection, I could see earnings growing at 20% or higher. NVDA deserves a 2x price to earnings growth ratio (‘PEG ratio’) due to the implied clarity of future growth. That places its fair value at around 40x earnings, representing a stock price of $215 per share. That represents 43% potential upside over the next 12 months. The key risks here are mainly long term. I am not so concerned about near term economic risks due to NVDA being quite profitable and having a net cash balance sheet. The longer term risk is if NVDA fails to stave off competition, at which point it might lose pricing power and face margin compression. The current stock price is attractive against the thesis where NVDA maintains a market leading position, but the valuation has considerable downside if NVDA becomes a commoditized operator. With more and more developers working on various NVDA platforms, I’d argue that its moat is becoming stronger over time. I rate the stock a buy as 43% potential upside should be enough to trounce the broader market.

Be the first to comment