Andy Feng/iStock Editorial via Getty Images

Article Thesis

NIO Inc. (NYSE:NIO) is one of China’s major electric vehicle companies that recently reported better-than-expected results. The company has been hurt by lockdowns in China in the near term, but the longer-term growth outlook is very solid thanks to a strong brand and the introduction of new models. Compared to many other EV companies, NIO is trading at a rather inexpensive valuation today.

Recap

I have covered NIO a couple of times in the past, including an article from last December. When NIO was trading in the $40s and $50s during the EV bubble in early and mid-2021, I thought shares were too expensive to warrant a buy rating, but I became more bullish over time as NIO started to drop to a more reasonable valuation. In this report, we’ll look at recent earnings and the macro factors that impact NIO that have emerged since my last article, such as lockdowns in China, inflation, and increasing recession risk.

Did NIO Beat Estimates?

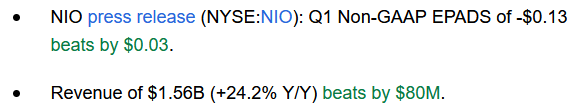

NIO Inc. did in fact manage to beat estimates on both lines, as shown in the following snippet from Seeking Alpha:

Seeking Alpha

The profit beat by $0.03 per share was nice, but not overly meaningful, and NIO still isn’t profitable yet. The revenue beat of more than 5% was a pleasant surprise, as NIO managed to perform better than analysts had estimated, despite the lockdowns in China that hurt its ability to build and sell vehicles. The 24% growth rate is low compared to the growth NIO has delivered in the past, but when we consider the lockdown-related headwinds, the results weren’t too bad.

It should be noted that current estimates see NIO’s revenue growth slowing down to just 10% for the second quarter, as shown here on Seeking Alpha. This can be attributed to the larger negative impact from lockdowns during the current quarter, compared to the less pronounced impact in Q1. Still, revenue growth, even at a low pace, is a positive considering the circumstances. During the second half of the year, growth will accelerate to 63% and 123% for Q3 and Q4, respectively, if the analyst community is correct. The lowish revenue growth in Q1 and Q2 should thus not be overinterpreted, as it is macro-headwind driven and not caused by company-specific items.

Delving into the company’s earnings call, there are some noteworthy subjects, I believe. First, management notes that while production was severely impacted in April and May, things are getting back to normal in June. With a bit of a lag between a car being produced and it being sold, I do believe that there is a high likelihood that deliveries will be more or less back to normal levels in July. This is why I believe that the ramp-up in sales in the second half of the year that many Wall Street analysts expect is realistic. Another important subject that was broached is commodity price inflation. Rising commodity prices, e.g. for nickel, lithium, and copper, are an issue for EV manufacturers. Nevertheless, NIO managed to achieve an 18% vehicle gross margin during the quarter, which is pretty solid when we consider that NIO is not yet very large. If Tesla’s (TSLA) performance is a guide, margins should expand over time, as the company is able to source parts and material more efficiently, for example. Since NIO’s customers aren’t very price-sensitive, NIO also seems to be in a position where it can demand above-average margins in the long run. With margins close to the 20% level already, NIO could, like Tesla, become a pretty profitable automobile manufacturer with increasing scale and once its revenue generation is scaled up.

NIO Stock Key Metrics

NIO Inc. is forecasted to generate revenues of $9.1 billion this year, which would be 60% more than the revenue the company generated last year – despite the slowish growth in H1, caused by Shanghai lockdowns. In 2023, NIO is forecasted to generate revenues of $15.6 billion, which represents a forecasted 72% revenue increase versus the current year.

This is a highly compelling growth rate, as long as the company manages to actually deliver on the analyst consensus estimate. When we look at how the company has fared in the past, relative to estimates, it seems quite likely that the company will be able to at least match what Wall Street is forecasting today, as NIO has missed revenue estimates just thrice in the last 14 quarters, with 11 revenue beats in that time frame.

NIO’s revenue growth will be driven by several factors. First, the company benefits from a strong EV market growth rate in its home market, China. Favorable regulation and legislation make an increasing number of Chinese consumers acquire EVs, and NIO is able to capitalize on that demand thanks to its strong brand. NIO’s cars are seen as high-quality items that are highly sought after by those that have the financial means to acquire them. An ongoing buildout of charging and battery-swapping stations, service centers, and sales centers helps NIO drive business growth in its home market.

International growth will be another driver for revenue increases in the foreseeable future. NIO first entered Norway in Europe, but since then, additional markets were added to NIO’s international roster. By the end of 2022, the company will also sell some of its models in Germany, the Netherlands, Sweden, and Denmark, which have a combined population of well above 100 million. By 2025, NIO plans to sell its vehicles in at least 25 markets, which showcases the company’s aggressive international expansion plans. In Western markets, non-established foreign ICE auto companies have traditionally not done too well. But in the EV market, where legacy players are less powerful and where many young companies are operating successfully, this does not seem to be the case to a similar degree, which is good news for Chinese EV players such as NIO and its peers such as XPeng (XPEV) and Li Auto (LI).

NIO will also be growing its market share thanks to the introduction of new models. Its lineup is already pretty solid, with a range of sedans and SUVs, but NIO continually adds new models to broaden its market potential and to add new potential buyers. A couple of days ago, NIO launched its most recent EV, the ES7, which is a medium-to-large-sized SUV, priced at $70,000 and up, depending on battery size and extras. NIO plans to introduce a brand aimed at more mass-market-type vehicles eventually, which could expand its market potential and sales significantly. Tesla, for example, experienced rapid growth when it introduced its more mass-market-appealing Model 3. A similar success is not guaranteed for NIO, but as long as the company manages to deliver quality vehicles that are fitting its buyers’ tastes, the introduction of somewhat less-premium vehicles under their own brand could be a huge success.

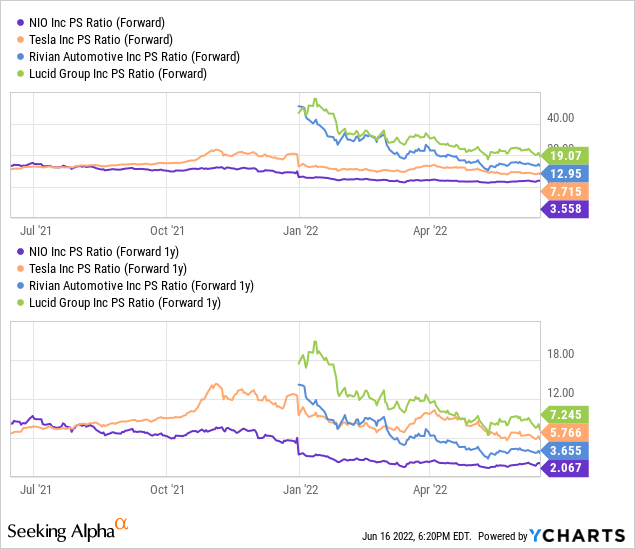

Business growth alone naturally doesn’t make a company a great buy. Other things have to be considered as well, such as a stock’s valuation. On that front, NIO looks like a very solid pick, I believe – at least when compared to its peers.

Compared to other EV pureplays that are active in the premium space, NIO seems quite inexpensive: At 3.6x this year’s revenue, shares are trading at a 50%+ discount compared to Tesla, and they are even cheaper when compared to US-based Rivian (RIVN) and Lucid (LCID). The same holds true when we look at 2023’s numbers – NIO, again, is the least expensive among these four companies by far. When we consider the problems Rivian and Lucid are experiencing in scaling up production, this discount seems quite surprising. I do believe that NIO is a significantly better value today, compared to Lucid and Rivian. Tesla is profitable, unlike NIO, RIVN, and LCID, which is a reason for some to prefer Tesla. But its growth is way lower than that of NIO, as Tesla is forecasted to grow its revenue by 33% next year, versus 70%+ for NIO. The combination of (way) stronger growth and a significantly lower valuation makes me favor NIO over Tesla.

Is NIO Stock Expected To Go Up?

Markets are experiencing turmoil today, and that has also impacted NIO. With interest rates rising and many investors seeking to reduce risk/exposure, NIO’s stock price could continue to struggle. That being said, Wall Street analysts have a consensus price target of $36 on NIO, which is almost twice the current share price. For those that put a lot of value in analyst price targets, NIO could be an attractive buy today.

Is NIO A Good Long-Term Investment?

It’s not possible to say who will rule the EV market in five or 10 years. But NIO is one of the companies with a solid long-term outlook, I believe. Its brand is strong, it is doing well in its home market, and Chinese policies are aimed at bolstering the country’s EV manufacturers, which should come in handy in the long run. International expansion plans and an attractive model line-up should help NIO compete versus both legacy players and other EV pureplays. From a valuation perspective, NIO looks better than many other EV pureplays, although it should be noted that shares are not cheap when compared to how legacy auto companies are valued.

Is NIO Stock A Buy, Sell, Or Hold?

I do believe that NIO is one of the most attractive EV pureplays today, thanks to its rather inexpensive valuation and strong forecasted growth. The company is not profitable yet, but has been expanding its margins in the recent past and reported lower-than-expected losses for the most recent quarter, despite commodity price headwinds.

If NIO can continue to grow its business at an attractive pace, profitability will follow eventually, and its below-average valuation could then lead to relative upside potential.

On the other hand, all growth stocks are struggling right now, and buying an auto company when a recession becomes more and more likely may not be great timing. It is very much possible that interest rate worries and risk-off sentiment will result in even better buying opportunities in the future, which is why waiting for a better entry point might pay off.

Be the first to comment