LauriPatterson/iStock via Getty Images

Introduction

It’s time to talk about Mondelez International (NASDAQ:MDLZ), a company I haven’t covered in a long time. There are a few reasons why I’m covering the stock again. First of all, it’s always a good thing to be on top of dividend opportunities in defensive sectors. Moreover, the company is once again at an all-time high, making it worth looking at the reasons that have caused significant outperformance this year. Moreover, I own PepsiCo (PEP), which is one of my favorite dividend stocks in the consumer defensive sector. Adding something similar to my portfolio makes sense for diversification reasons as my portfolio continues to grow.

So, let’s dive into the question: is Mondelez a good dividend stock?

The Power Of Strong Brands

Industries in consumer sectors are more often than not very competitive. This goes for both consumer defensive and consumer-cyclical products. Most of my readers know I’m a very picky investor, having invested almost all of my money in less than 25 individual dividend stocks.

I get even pickier when it comes to consumer stocks. After all, I hate to be dependent on consumer trends, marketing efficiency, and related issues.

However, Mondelez is different. While the snack business is highly competitive, it owns some of the world’s best brands, with very low competition. At least when it comes to taste and brand strength.

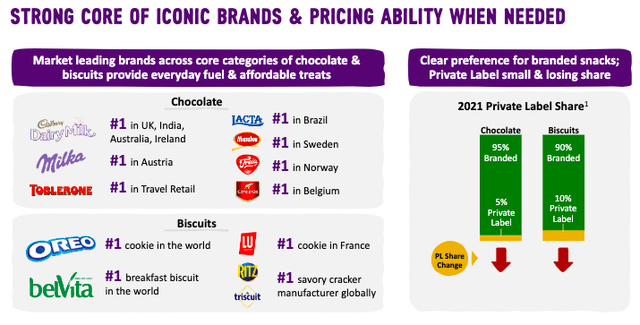

The company owns some of the world’s biggest chocolate and biscuit brands. This includes Milka, Toblerone, Oreo, Lu, and Ritz.

Mondelez International

These brands dominate competition from both branded snacks and private-label alternatives. In this area, private generic brands have a very hard time competing, which is great for MDLZ.

In 2021, the company generated roughly 65% of its revenues in developed markets. During the three years ending 2021, the company generated 2.7% annual compounding revenue growth in developed markets. However, in emerging markets, accounting for 35% of total sales, the company achieved 7.3% annual compounding revenue growth during the same period.

General tailwinds are population growth, middle-class growth in emerging markets (making branded snacks more affordable), as well as post-COVID changes that supported work from home and flexibility, which supports more snacking.

On a long-term basis, MDLZ aims to achieve between 3% and 5% in organic net revenue growth. Organic, meaning excluding acquired growth through M&A.

Fast forward to November 1, when the Chicago-based company reported its 3Q22 earnings. I’m bringing this up because that quarter showed the company’s resilience in a very tough consumer market.

Mondelez achieved 12.1% organic revenue growth. That’s a strong number as the global consumer is in a very tough place due to high inflation and economic uncertainty – I believe most people reading this are also feeling the impact of high inflation.

What’s important here is the revenue growth breakdown. The company hiked prices by 11.4% in the quarter, which accounted for almost 100% of total organic revenue growth.

However, volume/mix also improved by 70 basis points, meaning that real demand was also higher (adjusted for pricing). In emerging markets, volume/mix improved by 800 basis points, which is a blowout number, providing the company with 24.4% organic revenue growth. Developed markets saw a decline of 340 basis points in volume/mix.

According to the company:

Consumers in developed markets continue to prioritize groceries over other forms of spending, and they continue to view our brands as affordable indulgences. Meanwhile, in emerging markets, consumer confidence remains strong with growing demand for our categories and continued loyalty to our iconic brands.

On a full-year basis, the company expects at least 10% organic revenue growth, up from 8%.

Sell-side analysts believe that this is too conservative as the company is tremendously well positioned in this market – despite a challenging environment for consumer stocks.

According to BMO Capital Markets analyst Kenneth Zaslow (reported by Seeking Alpha):

“We would not be surprised if MDLZ were to exceed 10% constant currency EPS growth outlook in F2022, while setting the table for an above-algorithm year in 2023, largely reflecting pricing actions, easing of supply chain constraints, muted demand elasticity, and ongoing growth in Emerging Markets,” he told clients on Wednesday. “We increased our F2022 outlook and maintained our above-consensus outlook for F2023 on our view that demand elasticity will remain muted while its acquisition strategy continues to contribute to incremental growth.”

Long-Term Relative Performance

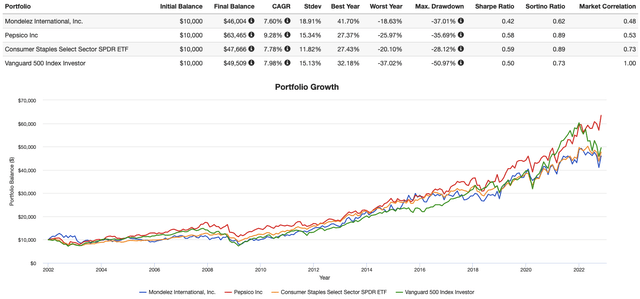

With all of that said, the MDLZ performance isn’t bad. The company has returned 7.6% per year since 2002 (including dividends). Note that MDLZ is a standalone company since 2012, so take this with a grain of salt.

However, the performance isn’t that special. The S&P 500 has returned 8.0% during this period. The consumer staples ETF (XLP) returned 7.8% with a standard deviation of just 11.8%, more than 300 basis points below the S&P 500 standard deviation! PepsiCo returned more than 9% per year, with a standard deviation barely higher than the S&P 500. Hence, MDLZ scores poorly when it comes to the volatility-adjusted performance (Sharpe/Sortino ratios).

Portfolio Visualizer

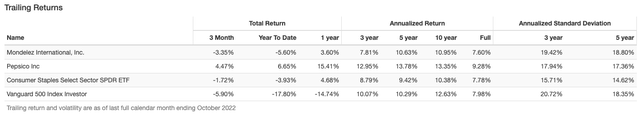

Over the past three, five, and ten years, MDLZ’s performance has moved closer to its peers. Yet, still with a higher standard deviation.

Portfolio Visualizer

So, what about the dividend?

The MDLZ Dividend

Mondelez doesn’t have a very long dividend history as the company was established in 2012, when Kraft Foods was renamed Mondelez after spinning off the grocery business, now known as Kraft Heinz (KHC).

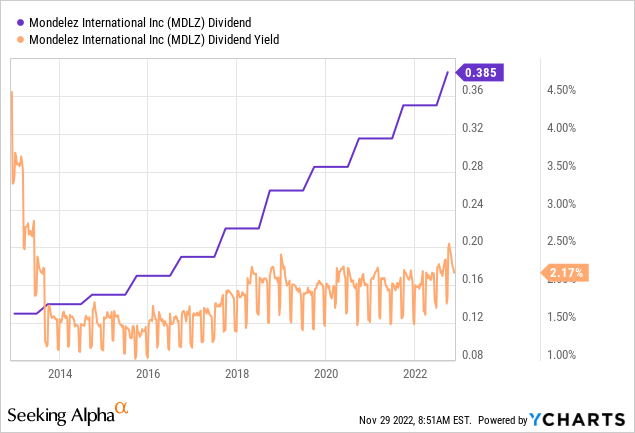

Mondelez investors currently receive a $0.385 per share per quarter dividend. That’s $1.54 per year or 2.3% of the current stock price.

As the graph below shows (note that the yield hasn’t been updated), MDLZ has never been a high-yielding consumer staple stock as it usually yields somewhere close to 2.0%.

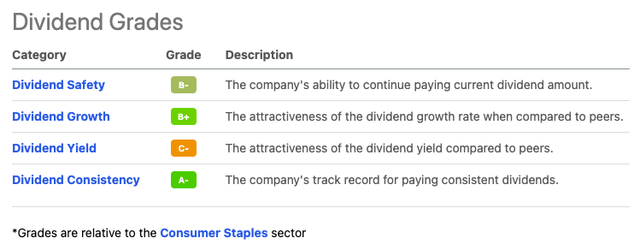

When looking at the dividend scorecard below, we see that the yield is indeed a weak spot. At least when compared to the consumer staples sector, which consists of mainly mature businesses that tend to have higher yields.

Seeking Alpha

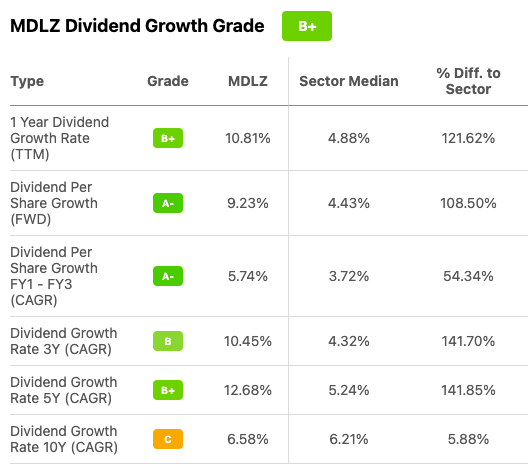

The good news is that it doesn’t matter too much. The company scores relatively high on dividend growth. Over the past ten years, the average annual dividend growth rate was 6.6%. That number improved to 12.7% over the past five years. Both numbers beat the sector median as the screenshot below shows.

Seeking Alpha

These are the latest hikes:

- July 2022: +10.0%

- July 2021: +11.1%

- July 2020: +10.5%

- July 2019: +9.6%

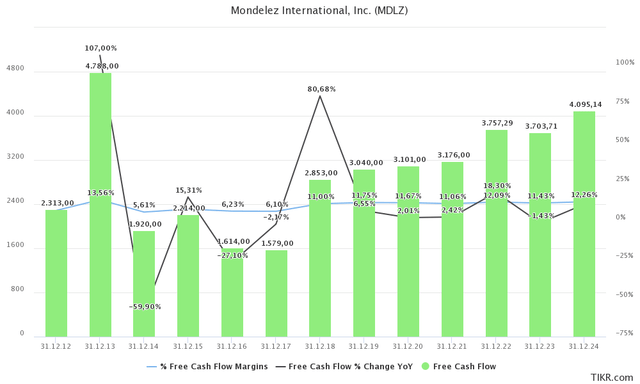

It is no surprise that MDLZ shareholders are benefiting from stronger dividend growth as the company has done a tremendous job growing free cash flow. The free cash flow margin has come up from the 5-6% range prior to 2018 to currently more than 11% on a consistent basis. Moreover, free cash flow has been growing by double digits per year since 2018. This provided a healthy basis for higher dividend growth.

TIKR.com

The company’s dividend is its third capital allocation priority. Investments in organic growth are the biggest priority. This includes digital channels, advertising, capabilities, and related. The second priority is M&A to remain competitive. The balance sheet comes after the dividend, which makes sense given that MDLZ has a healthy balance sheet.

MDLZ has close to $20 billion in net debt (gross debt minus cash). That’s roughly 3.0x EBITDA. The company has an A3 credit rating, which is truly fantastic. The interest coverage ratio is 12.6x.

With that said, $3.7 billion in free cash flow is roughly 4.1% of the company’s $90.3 billion market cap. This implies that there’s a lot of upside for the dividend to grow. However, 4.1% is not that high. Especially after the recent market sell-off, a lot of good dividend stocks offer free cash flow yields of more than 6-7%.

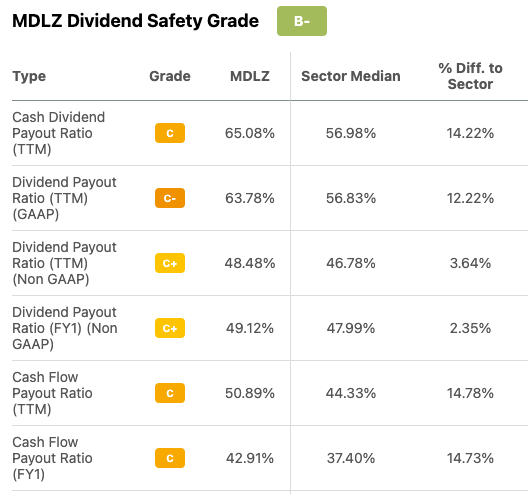

The company’s GAAP dividend payout ratio is 48%. That’s roughly 100 basis points above the sector median. Hence, despite paying a lower dividend and being a dividend growth stock (instead of a high-yielding stock), the company doesn’t score that well when it comes to (the) payout ratio(s).

Seeking Alpha

So, what about the valuation?

Valuation

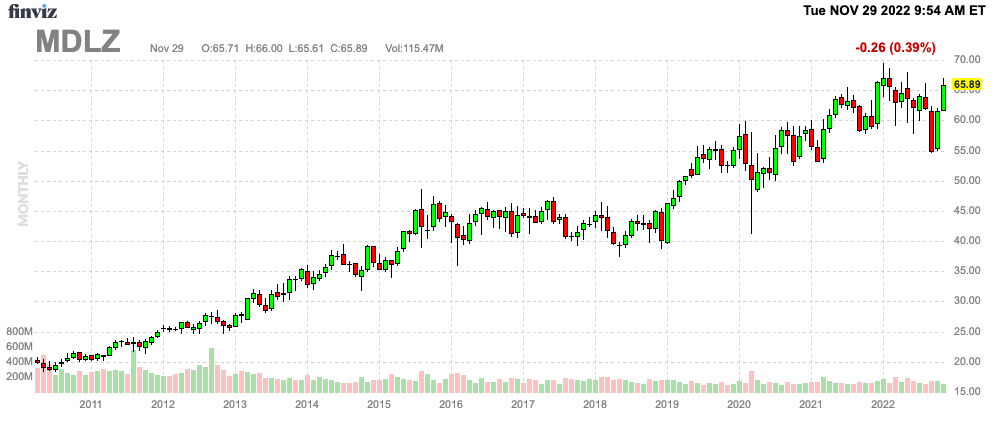

MDLZ shares are flat on a year-to-date basis and just 5.5% below their 52-week high. That’s a decent performance given the stock market’s struggles this year. Investors have found refuge in a company that has strong pricing power and brand awareness to withstand ongoing economic difficulties. Moreover, with slowly easing agriculture commodity prices (lower inflation growth rate), margins are set to remain in an upward trajectory.

FINVIZ

Unfortunately, for investors who aren’t invested yet, it’s never fun when a stock barely offers a discount.

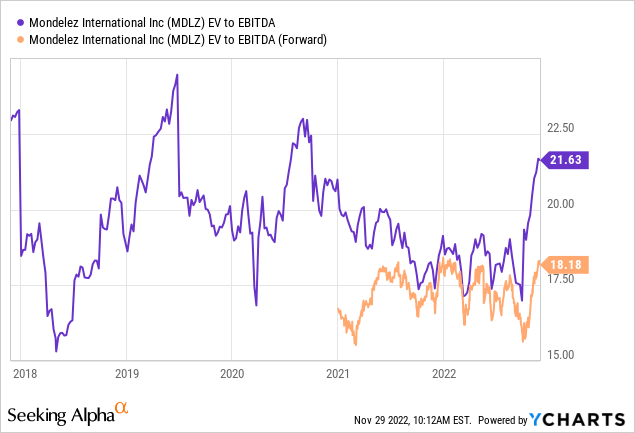

The company is currently trading at an enterprise value of $110.0 billion, consisting of its $90.3 billion market cap and $19.7 billion in expected 2023 net debt.

That’s an implied EV/EBITDA multiple of 17.5x. This is by no means a low valuation, especially considering that the free cash flow yield is barely above 4.0% as we calculated in this article. Sometimes, cash cows trade at elevated EV/EBITDA multiples as long as the FCF yield is high. MDLZ has a high multiple and a somewhat low FCF yield. That’s not a recipe for a great entry, in my humble opinion.

So, is MDLZ a good dividend stock?

Is MDLZ A Good Dividend Stock?

Yes. But…

Yes because MDLZ has all the qualities to offer a great long-term investment vehicle to investors that provides steadily rising dividends, a rock-solid business model capable of satisfying growth, a healthy balance sheet, and pricing power (inflation).

Unfortunately, the stock’s valuation isn’t attractive. Investors have found refuge in MDLZ this year, pushing the valuation to lofty levels. Moreover, the free cash flow yield isn’t that attractive. The same goes for its dividend yield, which isn’t that high.

Moreover, alternative investments have offered slightly higher returns. Often with less volatility. This includes the period (after 2018) where MDLZ started to improve its free cash flow growth and margin.

So, here’s the thing. I think that MDLZ is a good dividend stock. Yet, I wouldn’t buy it unless it were to drop by 10-15%.

(Dis)agree? Let me know in the comments!

Be the first to comment