Jeenah Moon/Getty Images News

Introduction

The stock of Microsoft Corporation (NASDAQ:MSFT) has lost 30% of its value since it hit lifetime highs over a year ago. Given the steep and prolonged correction, it’s fair to wonder if the stock could now be a rewarding proposition for those looking to re-orient their portfolios ahead of 2023.

I’m not prepared to make definitive judgments either way, as this isn’t a uni-dimensional story; rather, you have multiple potential catalysts that could tilt sentiment one way or the other. Nonetheless, here are some important considerations that may aid potential investors in their positioning with MSFT ahead of the new year.

MSFT Stock Key Metrics

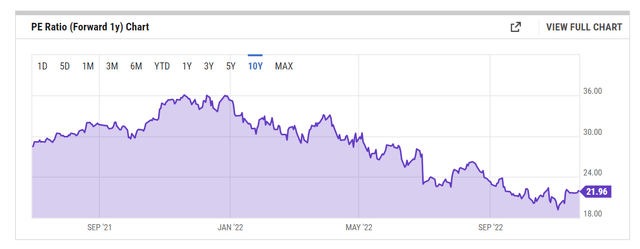

Let’s start with how institutional research views the stock and what this means for forward valuations. Following the management’s conservative commentary on the outlook, we’ve seen a correction in the share price, even as sell-side analysts have trimmed estimates both on the top line and bottom line (over the last 3 months, there have been 36 downward revisions at the EPS level and 39 downward revisions at the revenue level).

The last time I covered MSFT was back in early August, and since then I’ve noticed that the 2024 revenue and EPS estimates have been trimmed by 4.1% and 6.7% respectively. However, during that period, the MSFT stock has corrected by an even greater margin of ~13%, so much so that the valuations look even more enticing.

Just for some perspective, based on the 2024 EPS of $11.16, you’re looking at a forward P/E of less than 22x, which translates to a 24% discount vs the stock’s long-term forward P/E average of 28.7x.

Think about the level of earnings growth you’re getting at that P/E as well. An EPS of $11.16 would represent annual earnings growth of 17%; with a P/E of 22x which translates to a rather low PEG ratio of 1.29x. This is quite the bargain when you consider that historically the forward PEG ratio of MSFT has typically been closer to 2.2x.

What Are Some Catalysts To Watch For In 2023?

Having said all that, investors shouldn’t also dismiss the probability of upward revisions to those consensus estimates, which would only make the forward valuations even more appealing.

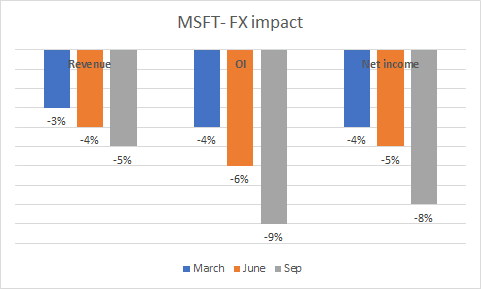

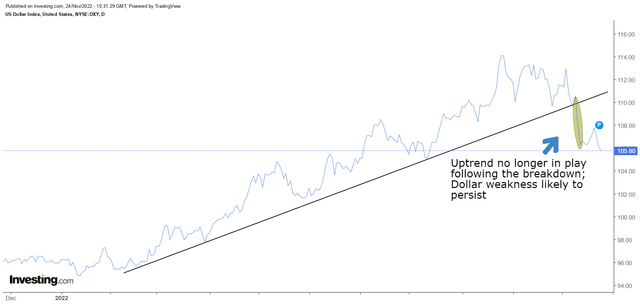

Firstly, there’s the wild card of FX dynamics, which can be a massive swing factor both on the topline and bottom line. The image below highlights how badly MSFT’s revenue, EBIT, and net income has been impacted by the dollar’s strength over the three most recent quarters. The negative impact has only strengthened over every passing quarter, and in the Q1 call MSFT management stated that by the end of this year, FX could have a -5% adverse impact on revenue (200bps worse off than what it was in the Sep quarter).

MSFT Quarterly presentations

I don’t believe the impact will be as brutal; rather I believe we could see upward revisions given the recent movement of the dollar index which has broken down from an 11-month uptrend. Incidentally, when MSFT last published its Q1 results, the dollar index was at 110.95, since then it has corrected even further by ~4.6%.

Then, in the near future, whilst MSFT’s Windows OEM business could continue to be impacted (down 2% and 15% over the last two quarters) by weakness in the broad PC markets, you’d think the low base effect in H2-23 would provide some respite here, even as inventory corrections would likely have normalized by then. Besides, it’s not as though this business is a total washout. Usage growth with the installed base is still resilient enough relative to the pre-pandemic era.

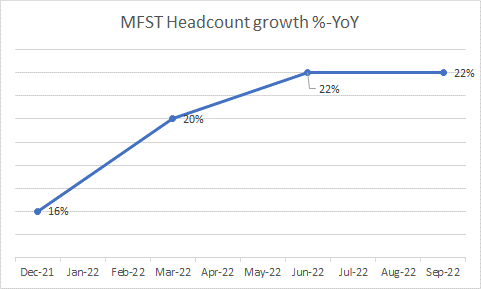

Then, as Microsoft is faced with a more defensive environment, you could also see OPEX pressures fade by the second half of next year. Think about headcount additions where the company has been very aggressive in recent quarters, growing the employee base by over 22%. Going forward, I wouldn’t expect this to be a massive encumbrance on the cost base, as you’ll not only see a slowdown in those hiring rates, but you’re also likely to start seeing increased utilization levels, which could ensure greater dollar drop-through to the bottom line.

Quarterly earnings transcripts

Two other important sources of OPEX pressures in recent quarters have come from the integration of the Nuance and Xandr acquisitions, but by March and June next year, the impact of this should begin to fade as we annualize the acquisition dates. Once again, some more respite for the cost base.

Risks

Azure of course is a vital component of the Microsoft story but this is poised to have an inimical impact on the company’s overall margins, more so as other high-margin pockets such as Windows OEM and Surface go through a slump. It now appears that MSFT’s strategy with Azure in the foreseeable future will likely be oriented around protecting its market share, as it fulfills the optimization requirements of its clients. I’d be curious to see how long this defensive strategy persists.

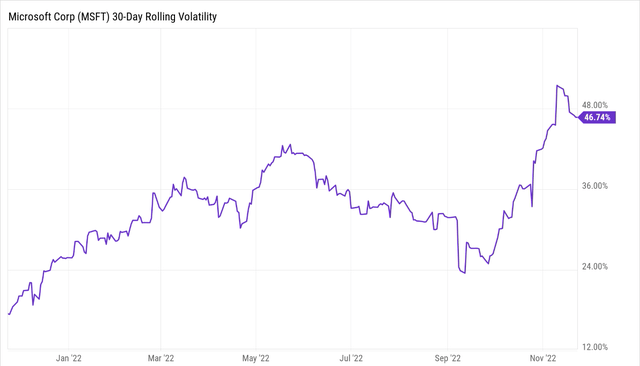

There’s a lot of regulatory uncertainty surrounding the Activision Blizzard acquisition, not just in the major markets of the US, but in Europe, and China as well. So far only the governments of Saudi Arabia and Brazil have approved it, but it still needs to get through 14 other governments across the world. I don’t know if we will see any closure any time soon (one way or the other), but this ambiguity will only likely increase the volatility quotient of the MSFT stock which has surged off late, even as reports regarding the increased regulatory scrutiny has picked up in recent weeks.

If the deal were to get the green light, I can see what a world of good this could do for MSFT’s long-term ambitions in the gaming market; principally, it helps Microsoft address gaps in the high-growth mobile gaming arena, whilst also enhancing the company’s game pass subscription service.

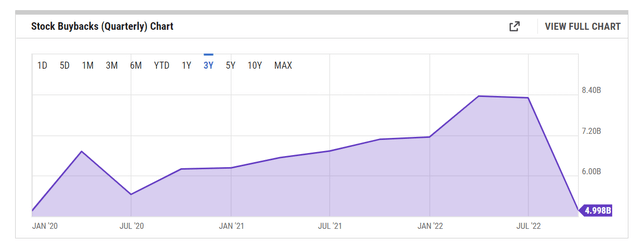

Nonetheless, the integration could add significant pressure to the cost base in the short term, which could be a drag on earnings. Also don’t forget the huge cash outlay of close to $69bn! This could make MSFT more parsimonious with its distribution objectives, particularly buybacks.

We’ve already seen some defensiveness with the buyback outlay off late. Typically, you’d expect management to engage in more buybacks when the share price drops, but after two successive quarters of spending over $8bn in buybacks, the pace dropped in the Sep quarter quite significantly and was the lowest in 3 years. Might this be a sign of things to come? For the uninitiated, as of Q1-23, the company still had 60% of its $60bn share repurchase program yet to be deployed.

Closing Thoughts- Is MSFT Stock A Buy, Sell, or Hold?

MSFT’s technicals don’t fill me with a great deal of confidence, and that’s what’s driving my HOLD rating on the stock.

The chart above shows how overbought the MSFT stock looks relative to alternatives from the Nasdaq; despite a correction from mid-2022 levels, the relative strength ratio is still 35% higher than the mid-point of its long-term range.

Meanwhile, on the weekly chart, the stock has been trending in the shape of a fairly consistent descending channel, and currently, the risk-reward for a long position does not look great as it is not too far away from the upper boundary of the channel. I reckon the more suitable entry point would be at levels of $220-$200, closer to the lower boundary of the channel.

Be the first to comment