AntonioSolano/iStock via Getty Images

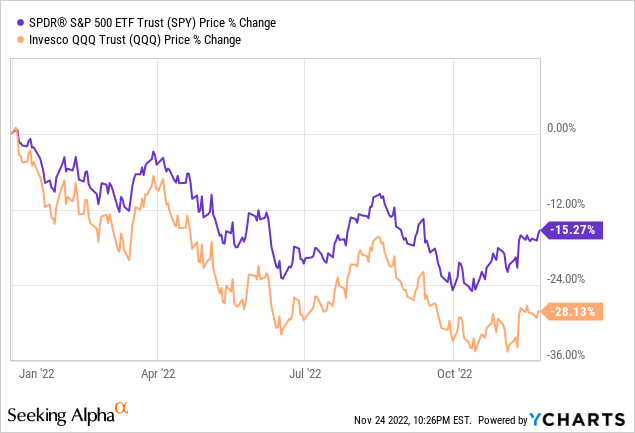

Given the significant macroeconomic and geopolitical uncertainty, there are numerous cyclical stocks on sale. As a clear example of this, the major indexes – such as the S&P 500 (SPY) and the Nasdaq (QQQ) – are down year-to-date:

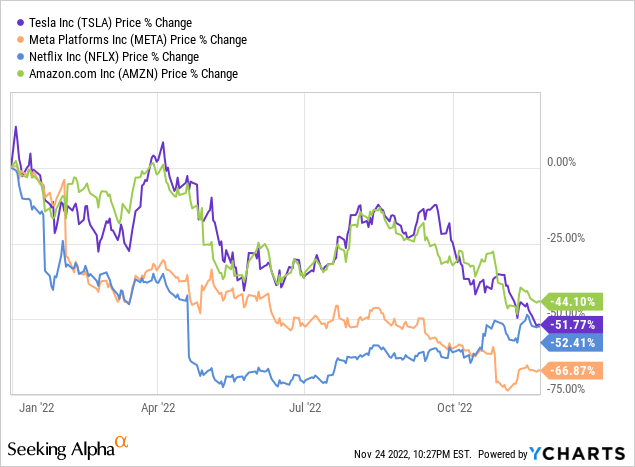

On top of that, most of the stocks that were market leaders over the past decade – such as Meta (META), Tesla (TSLA), Amazon (AMZN), and Netflix (NFLX) – are all down significantly year-to-date:

With inflation and interest rates soaring and the economy leaving numerous clues – such as an inverted yield curve and a declining housing market – that we are on the precipice of a serious recession, these stocks are all taking a beating as investors price in the hit to earnings that will come from steeply declining economic growth. On top of that, the Institute of International Finance recently projected that the global economy will be as weak in 2023 as it was in 2009 in the wake of the financial crisis.

However, there are actually a few deeply discounted stocks that could benefit from the expected coming recession. We share two that we think could in fact double in such a scenario.

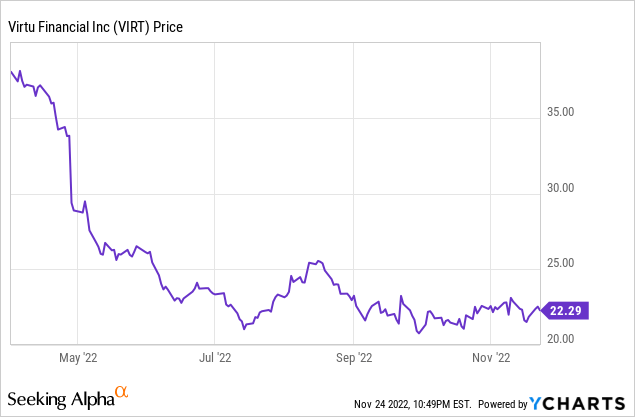

#1. Virtu Financial (VIRT)

VIRT is a market maker and high frequency trader that benefits from spikes in market volatility. While the stock has not experienced a boost from the market pullback this year, this is largely due to two factors: the volatility was very inconsistent and retail investor participation declined sharply from the massive post COVID-19 stock market influx we saw. However, in more traditional, rapid market selloffs, VIRT saw its profits soar and – in the case of 2020 – its stock massively outperformed by soaring 60% even as the SPY pulled back sharply. In the 2008 stock market crash, VIRT saw its profits soar too (it was privately held at the time, so there is no stock performance to track there).

In addition to its diversification benefits, VIRT remains compellingly undervalued. The fist symptom is that, despite substantially reducing its share count over the past few years and successfully advancing numerous growth initiatives in businesses like options, ETFs, and crypto, its share price is near the lower end of its range over that period. Another symptom is that its price to earnings ratio is approximately half of its historical average. On top of that, insiders remain heavily invested in the shares themselves and it is still run by one of its original founders, who clearly has a deep emotional investment in the firm as well. The company is buying back shares hand-over-fist instead of empire building, in a clear statement that they believe in the existing business and that the stock is significantly undervalued.

If we indeed run into a repeat economy of 2009 and/or one of the numerous geopolitical headwinds materialize in the coming months or years which in turn prompt a significant spike in market volatility, VIRT could easily double from current levels. After all, it was trading near $40 per share back in April of this year and it would not surprise us if it returned to those levels in the not-too-distant future:

You can read our recently updated in-depth investment thesis on VIRT here and our exclusive interview with the company here.

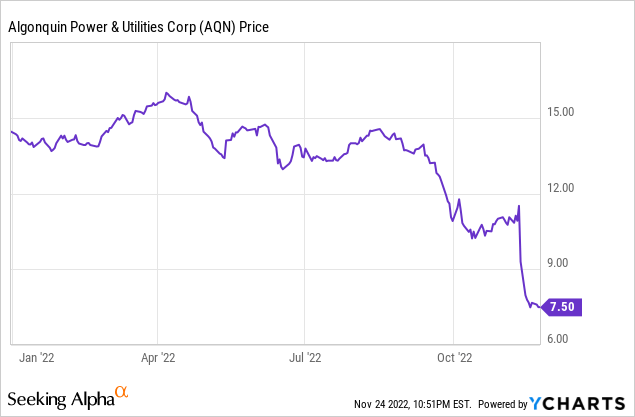

#2. Algonquin Power & Utilities (AQN)

Regulated utility and renewable power producer AQN is currently facing severe headwinds that caused its stock price to plummet and its dividend yield to soar to 9.5% in recent weeks. However, it is important to note that its headwinds are almost exclusively due to high interest rates as the underlying fundamentals of the business remain solid. Adjusted EBITDA increased by 10% year-over-year and adjusted FFO increased by 21% year-over-year, reflecting strong earnings power growth in the business. The long-term growth profile for the business remains intact as it continues to progress towards closing the Kentucky Power acquisition in January 2023 and the company is moving forward with selling renewable assets at attractive valuations in order to raise equity in a much more attractive manner than issuing more shares.

While AQN is meaningfully reducing its fiscal year guidance and will not even fully cover its dividend from an adjusted earnings per share perspective, the coverage is more attractive from an FFO perspective. Management implied on the earnings call that it remains very committed to the dividend and will likely simply slow its growth rate (and likely freeze dividend growth in 2023) moving forward in order to improve the adjusted earnings per share coverage ratio, stating:

[O]bviously, the dividend is a very important part of shareholder value for the company. We have previously stated a target of 80% to 90% payout and there is always going to be, and I think the company has done a nice job talking about this in the past. So, there can be dislocation from year to year on where that target comes in — where it comes in relative to that target.

The balance sheet still has plenty of liquidity and an investment grade credit rating, so it should be able to navigate the next year or two pretty well, though earnings will be suppressed due to elevated interest expense.

Given that it is now trading at a clear discount to peers and its dividend yield exceeds 8% after the latest sell-off while its business model remains recession resistant, we view it as a compelling value that could deliver very attractive total returns via a combination of current income, long-term growth, and significant multiple expansion if/when interest rates decline again. Given that the economy is expected to weaken considerably in 2023, we expect the Federal Reserve to pivot on its policy of interest rate hikes at some point next year. Once it does that, AQN will be able to refinance its floating interest rate debt on longer fixed rate terms which in turn will alleviate just about all of its interest rate headwinds.

At that point, we expect AQN’s stock price to soar back to where it was before interest rate headwinds slammed the stock, which would make it a double from the current share price:

You can read our full investment thesis here and our recent exclusive interview with AQN here.

Investor Takeaway

Most stocks that look cheap today are discounted for a reason: they are poised to take a beating if the severe expected economic slowdown materializes next year. While we think there are some opportunities in cyclical stocks and own a few ourselves, at High Yield Investor we are also positioning our portfolio for the coming recession to continue our streak of massive market outperformance. With holdings like VIRT and AQN, we are positioning our portfolio to soar if volatility spikes and/or interest rates decline in the face of a recession while also holding underlying business models that are well-positioned to weather a recession. On top of that, both stocks are deeply discounted and offer attractive dividend yields, so we see little long-term downside risk even if these upside catalysts take time to materialize. These and other similar bargains are on our shopping list this Black Friday.

Be the first to comment