William_Potter

Kroger and Albertsons Merger

Move over Walmart (WMT) and Costco (COST)! Kroger (NYSE:KR) is making moves in a merger deal valued near $25B to acquire all of the outstanding shares of Albertsons Companies, Inc. (ACI) for an estimated $34.10 per share. And where Kroger is already the largest supermarket in the nation, technology and the digital landscape have set in motion that it is time for the grocer to evolve, emphasizing an online shopping experience to compete with the likes of Amazon and Walmart’s e-commerce.

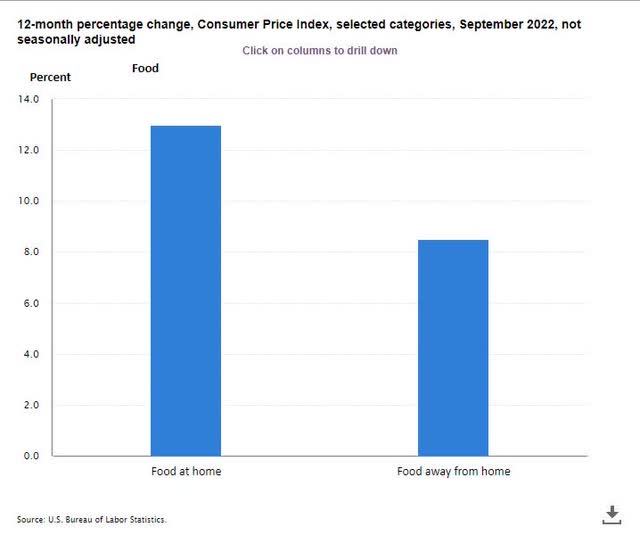

CPI 12-month % Change (U.S. Bureau of Labor Statistics)

If I had to pick a favorite grocer, it would be Kroger, whose long track record of lowering prices set the stage for “blue light specials” in several big box retailers. And consumer staple companies stand to benefit in the current environment where food costs have soared, as illustrated in the above CPI figures. With a massive merger deal that may prove challenging amid antitrust regulations, Kroger could experience more downside than we’ve seen over the last few days before returning to a quant buy rating. While some view an investment now as a risk, others, like Kroger Chairman & CEO Rodney McMullen, see the upside:

“We are bringing together two purpose-driven organizations to deliver superior value to customers, associates, communities, and shareholders…As a combined entity, we will be better positioned to advance Kroger’s successful go-to-market strategy by providing an incredible seamless shopping experience, expanding Our Brands portfolio, and delivering personalized value and savings. We’ll also be able to further enhance technology and innovation, promote healthier lifestyles, extend our health care and pharmacy network and grow our alternative profit businesses. We believe this transaction will lead to faster and more profitable growth and generate greater returns for our shareholders.”

Consumer Staples Stocks for a Bear Market

The markets have been highly volatile, with September substantiating its historically “bad” track record as the worst-performing month of the year. Down 9.34% with a -24.77% YTD return as of September 30, higher-than-expected inflation bagged another nasty S&P 500 performance to end the quarter. But in a down market, consumer staples stocks tend to offer stability, typically generating consistent earnings, regardless of the economy’s health. Why? Because consumer staples are household, in-demand products people need, with brands that function in a non-cyclical manner.

In periods of uncertainty like we’re experiencing, consumer staples can be resilient and less volatile, minimizing investors’ risk. Kroger has been around since 1883, and its stronghold as a retailer and full-service grocer is what has helped its margin growth and improved return on equity (ROE). Kroger’s outlook and desire to focus on advancements like technology and healthcare as a growth strategy is part of why I selected this stock for analysis.

U.S. Sectors Performance (Seeking Alpha Premium)

In addition, the consumer staples sector is inching its way up as one of the better-performing U.S. sectors. While still -12.42 YTD, consumer staples possess the pricing power to fare better than other stocks in this volatile environment. Judging by Kroger’s strategic move, a little risk aids some stocks when the ability to evolve is needed most.

Kroger, ranked a Hold, may benefit as a defensive stock where consumer staples are always in demand. But investors should be cautious when investing in this stock, as there is room for more downside given a merger of this size which can take years to finalize, incurring debt, especially in the volatile high inflationary environment riddled with politics on how best to address rising prices, some of the worst being food costs. With a bit of patience and willingness to take some risk, Kroger’s solid investment characteristics could offer upside as a consideration for a portfolio.

But when you have a fundamentally strong company with a solid track record of acquisitions, and it’s paying a premium for its biggest merger attempt yet that may or may not come to fruition, investors must ask themselves, what level of risk am I willing to take for potential upside – and long term? Let’s dive into the stock.

The Kroger Co. (KR)

-

Market Capitalization: $30.89B

-

Quant Rating: Hold

-

Quant Sector Ranking (as of 10/17/22): 32 out of 193

-

Quant Industry Ranking (as of 10/17/22): 1 out of 16

The Kroger Company operates as one of the largest retailers in the United States, alongside competitors Walmart and Amazon. The biggest traditional grocer in the U.S. with more than 420,000 employees and +2,726 stores under banner names like King Soopers, Safeway, and City Market, Kroger is on a mission for greater scale and capabilities, including better online shopping, in navigating the competition’s e-commerce capabilities.

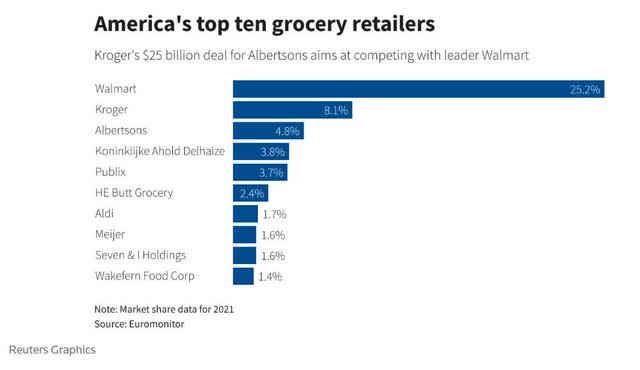

America’s Top 10 Grocery Retailers (Euromonitor, Reuters Graphics)

As you can see from the image above, Kroger is on a mission to compete with the grocery retailer Walmart. With the latest headline news of the Kroger-Albertsons merger deal, the two companies combined will employ over 700,000 people across 5,000 stores nationwide, closing the gap on its rivals. Although there is excitement about the acquisition, much of the excitement is being shifted to analysts’ regulatory concerns that are drawing scrutiny from federal regulators regarding monopolization. Will there be a deal or no deal?

Kroger-Albertsons Anti-Trust Monopoly

The proposed merger of Kroger and Albertsons is being met with skepticism about whether regulators will approve a grocery giant – or, as many call it – monopoly. In the political environment with sky-high food inflation, regulators known to challenge deals have their hands full with this one. Deals like Walgreens’ (WBA) attempt to buy Rite Aid (RAD), Sysco’s attempt to buy U.S. Foods, and Staples’s attempt to buy Office Depot were never finalized, so the biggest risk facing Kroger is the acquisition not coming to fruition.

Where there is some hope regarding large acquisitions, the Federal Trade Commission’s (FTC) attempt to prevent Whole Foods’ purchase of Wild Oats in 2007 failed, and the deal eventually went through. As written by Seeking Alpha News:

“U.S. antitrust regulators have been taking a tougher stance against mergers under the Biden administration, though the Dept. of Justice has suffered legal defeats in recent weeks, including in UnitedHealth’s purchase of Change Healthcare and U.S. Sugar Corp.’s planned acquisition of Imperial Sugar Co., where judges denied the regulator’s efforts to blocks the deals.”

Why are Kroger and Albertsons stocks dropping?

While I tend to steer clear of writing about Hold recommendations and especially stocks that are going through acquisitions, given increased uncertainty, operational and strategic changes, and our quant ratings eventually stopping coverage of the acquired company, I would be remiss not to discuss Albertsons to some degree.

With a market capitalization of $13.99B and ranked Hold, if investors were fortunate enough to hold shares of Albertsons before the announced acquisition, investors tend to benefit from a takeover price once the deal closes. Where it’s not uncommon for the company acquiring to fall, what is unique is both Kroger and Albertsons stocks declined last Friday, with Albertson’s -7.2% and Kroger -5.3%, an indication that shareholders are skeptical about the deal going through. Should it go through, the deal should be accretive in the long term, despite Kroger paying a 30% premium to Albertsons investors. And while Kroger’s past acquisitions have not been of this scale, they have navigated them well. Morningstar analyst Zain Akbari writes:

“Scale is critical to achieving the cost leverage, purchasing power, customer data, and own brand lineup that allow grocers to navigate intense price competition amid an omnichannel shift in an industry with minimal switching costs for shoppers. The $1 billion annual cost synergy target (around 1.5% of Albertsons’ total costs in fiscal 2021, to be realized over four years) seems reasonable, and we foresee revenue synergies (acknowledged but unquantified by management) as private-label, omnichannel, loyalty, and data analytics offerings are optimized. If completed, the deal should boost narrow-moat Kroger’s competitive standing despite Albertsons’ no-moat rating, largely because of scale.”

And if the scale is what we’re looking for, it’s crucial to uncover Kroger’s value and additional underlying metrics.

Kroger Valuation & Momentum

Strong operational growth and price action since the pandemic have resulted in shares of Kroger rallying. Offering a C+ Valuation grade that includes a forward P/E ratio of 11.93x and forward PEG of 0.83x, both metrics showcase that Kroger is discounted relative to its sector. When reviewing the underlying valuation metrics, there are hidden metrics are used in our proprietary algorithm that weigh more heavily than are displayed, hence the C+ rating when the majority of those visible are A’s and B’s.

Kroger Stock Valuation (Seeking Alpha Premium)

Although the stock’s YTD performance is -6.82%, over the last year, the stock is +7.40% with a momentum that outperforms its sector peers quarterly. And despite the deal announcement having resulted in a fall in share price for both companies, with Kroger’s valuation falling more than $2.2B, the merger has quite a bit of headway to make before the deal closes.

Kroger Growth & Profitability

As a long-term investor, it’s crucial to closely examine the characteristics of companies, especially one during a large-scale acquisition. While KR’s D+ growth grade is less than ideal, Kroger’s response to inflation cutting into consumers’ spending habits is to offer more digital coupons, which resulted in an all-time number of downloads, offering personal savings while increasing digital sales.

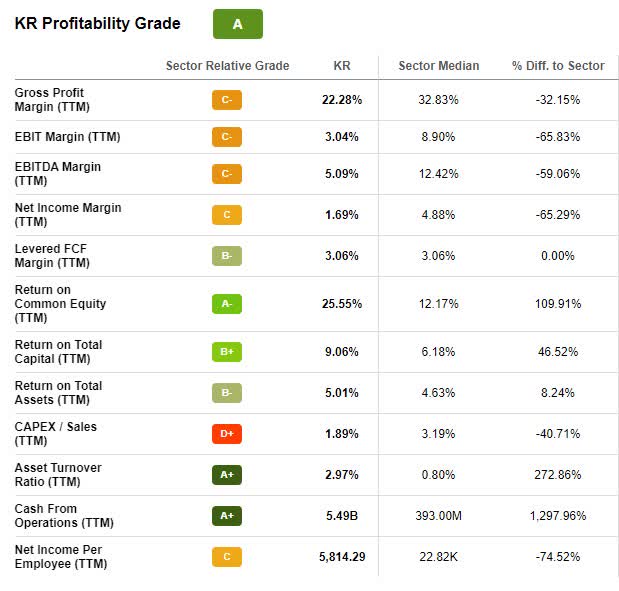

Kroger Stock Profitability (Seeking Alpha Premium)

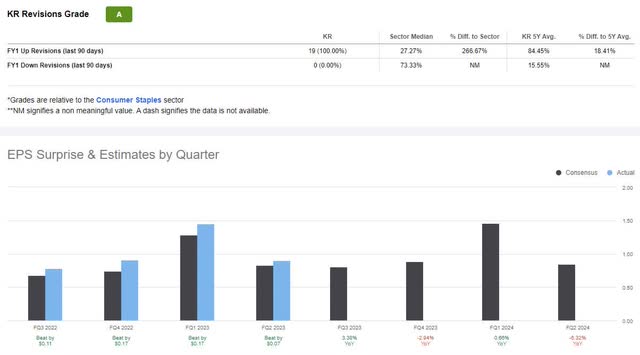

Digital sales increased by 8% in Q2, along with a 34% increase in delivery solutions. Second-quarter earnings beat top-and-bottom-line results with an EPS of $0.90 beating by $0.07 and revenue of $34.64B, a year-over-year increase of 9.33%. Pricing power is a way to drive traffic, and Kroger has managed to capitalize on the ever-changing landscape. With seven consecutive earnings beats, 19 analysts have given FY1 Up revisions in the last 90 days.

Kroger EPS & Revisions (Seeking Alpha Premium)

Strong Q2 results were also driven by:

“increased sales of our fuel, disciplined margin management and strong fuel profitability…Our team is doing an outstanding job navigating the current inflationary environment. We are experiencing the benefits of a multiyear journey in enterprise sourcing that is delivering significant and sustainable savings for Kroger and our customers. Our personalized pricing strategy is enabling us to maximize the reach and effectiveness of our promotional investments to drive loyalty and deliver value for our customers in ways they value most. Together, this has enabled Kroger to improve our price position relative to our key competitors,” said Gary Millerchip, Kroger CFO.

The combination of Kroger-Albertsons has the potential for long-term value. Albertson’s has experienced some setbacks, including debt, over the years but fared well in its 2020 ‘transformational year.’ Paying a premium for this merger may pose additional problems besides monopoly scrutiny and regulators. In this environment, taking on more leverage on the balance sheet could be problematic and eat into margins in this margin-compressed environment, but with its strategic plans to capitalize on tech advances and expansion of new divisions and locations, if the deal goes through, Kroger may be the grocery giant to beat.

Will you bag this grocery giant?

A lot rests on whether or not Kroger will succeed in acquiring Albertsons. The political environment, food costs, and regulatory scrutiny create doubt about its finalization. Whatever occurs in the broader market, investors want safety when buying stocks, whether a rise or fall in the markets.

Consumer staples tend to be resilient in both up and down markets because they are considered defensive investments, and their products are essential to everyday living. With the Fed staying the course to curb inflation and increasing rates, elevated prices are likely to persist. Kroger could very well be the option to consider in the fight against inflation. But it is rated a Hold, and Albertson’s merger is riddled with uncertainty that could send the stock into a downward tailspin, making many investors uneasy about the risk. During periods of uncertainty, consider stocks with solid fundamentals, valuations, and positive growth outlooks that can help you make tactical investment decisions without changing your overall risk level. There are pros and cons to consider if you have an appetite for Kroger. If not, consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you find stocks that achieve diversification into desired sectors you like, including Top Consumer Staple Stocks.

Be the first to comment