bunhill

Introduction

As I’m sure nearly all Intel (NASDAQ:INTC) shareholders know, Intel recently had a pretty disastrous earnings report. Since I’m an Intel shareholder, I know that I certainly noticed! This article is going to be about a topic I don’t write about much: When to sell a loser. And whether Intel meets those standards, yet.

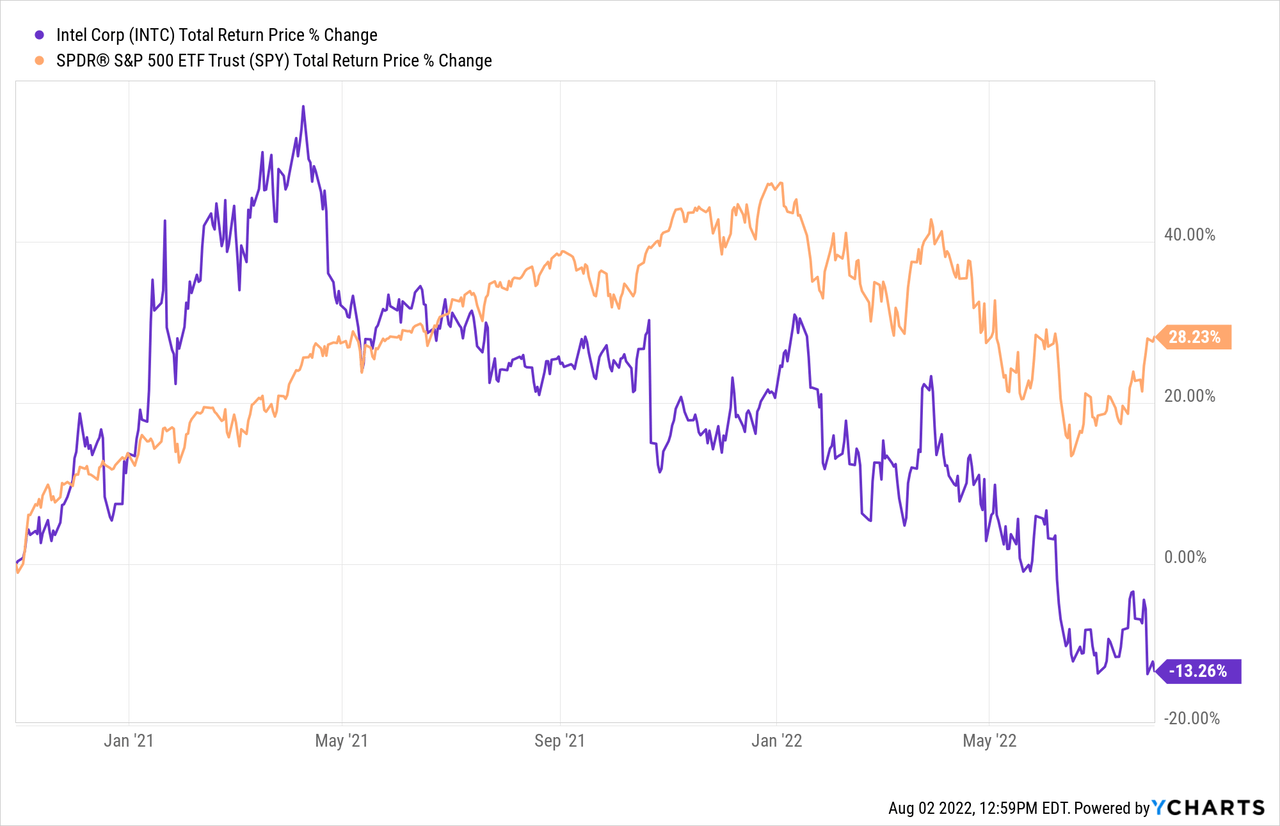

I first bought and wrote about Intel in my October 29th, 2020 article “Intel’s Long-Term Risk/Reward Looks Good. I’m A Buyer Here“. Here are Intel’s total returns compared to the S&P 500 since that article was published.

While Intel initially experienced a hopeful +50% price spike, those hopes were dashed as Intel reported increasingly poor results over the past six quarters. Now, my Intel position is negative while the S&P 500 is up +28%, and that’s obviously not what I want to see.

I did write a follow-up Intel article on March 30th of this year that focused on whether Intel was a good dividend stock titled “Is Intel a Good Dividend Stock? Probably Not At Today’s Price“. In that article, I was pretty bearish on Intel as a dividend stock:

But, from the perspective of a dividend investor, 21 years is simply too long to wait in order to earn one’s money back on an investment. Too many things can go wrong over a time period that long, and that means the time-risk is very high for an individual stock. Semiconductors is a very competitive industry that changes rapidly. This isn’t a consumer staple stock. Additionally, while most dividend stocks are extremely expensive (and therefore very risky) in my view, there are a few alternatives that currently make more sense than Intel from a dividend perspective. For these reasons, I do not view Intel as a good dividend investment right now, even though I do remain long the stock from a total return perspective after having purchased it at a lower price.

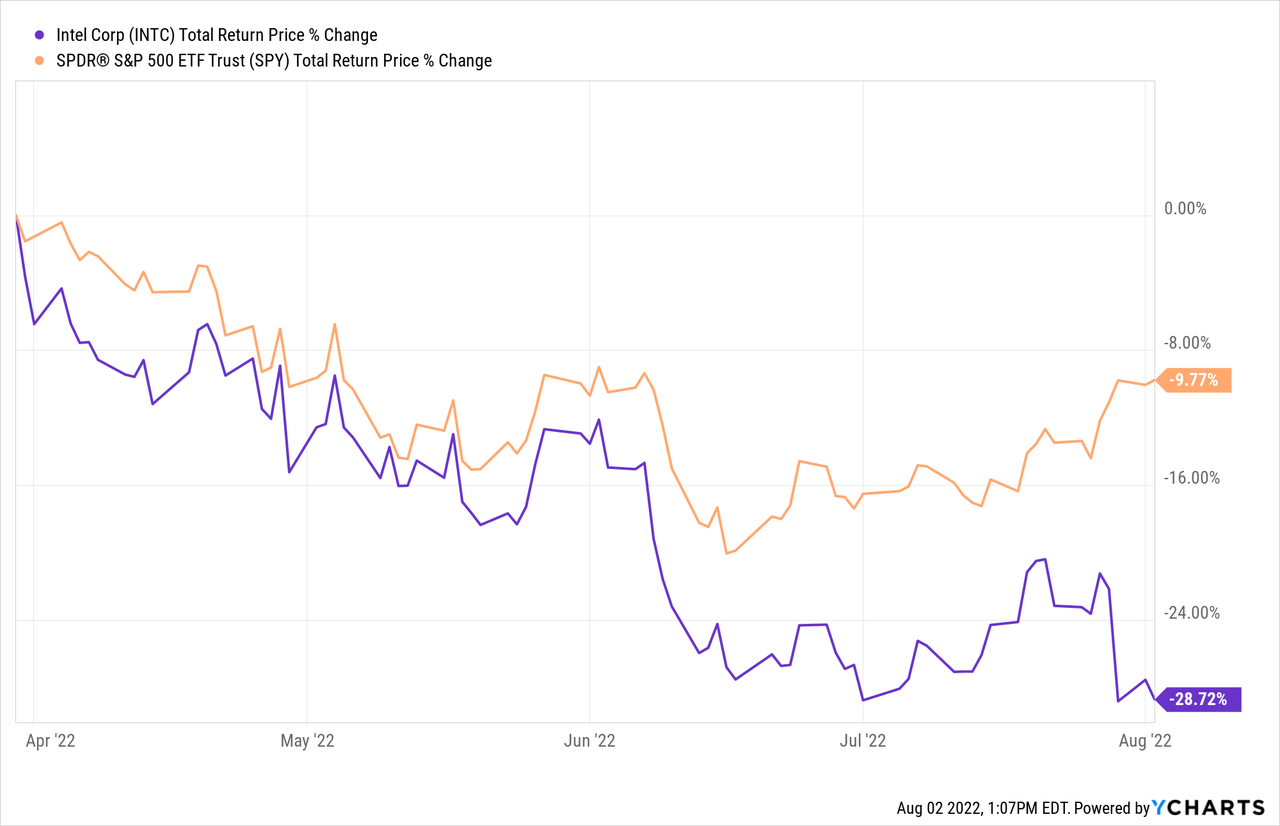

Since that warning to dividend investors article, Intel has performed very poorly:

Intel is down nearly -30% since then, 3x as much as the S&P 500. So, I think I got that call right for dividend investors.

Intel is a fairly complicated investment, and there are lots of nuances a writer could go into. I’m going to try to do two things in this article. The first is I’m going to try to keep things as simple as possible, boiling everything down to the metrics I care most about as an Intel shareholder. That will exclude a lot of things other investors probably care about. Fortunately, there are lots of articles written on Intel, so if someone cares about those other things, there is probably someone else out there writing about them.

The second is that I’m going to be writing this article specifically from my perspective (unlike my dividend article, which was from the perspective of a dividend investor). I often have a unique way of valuing stocks and I also often have a different portfolio strategy than many readers, so I think explaining the context of my purchase of Intel stock and how it fits in with the rest of my portfolio is important in this case. If some readers have a very different approach then they might care about different things. For example, I run an unconcentrated portfolio in which all of my initial weightings are about 1% portfolio weights. Sometimes I might go as high as a 2% weighting, but no higher. In Intel’s case, the initial weighting was 1% and I have neither sold nor added to it since then.

When I bought Intel stock, I knew the first two years were going to be tough, but I also felt I was buying at a reasonably good valuation. I think the conclusion of my original article explains the situation well:

Intel is obviously experiencing both competitive pressures and execution issues right now, and it’s probably not a stock for investors with an investing time frame of fewer than two years. And, it is possible that the short-term issues turn into long-term issues. But, given Intel’s low price and decent earnings, I think there is far less downside risk over the next few years with Intel than there is in the wider market (which remains very expensive), and that there is much greater upside potential over the medium-and-long-term than the market is giving Intel credit for right now.

I’ve found over time that if I follow the general investing parameters I’ve shared in this article that I can achieve an 80% win-rate or better over the medium-term, so my strategy involves making quick decisions and taking small, 1% portfolio-weighted positions. This allows me to invest across multiple industries, effectively spreading my bets around. Generally speaking, I think it’s probably impossible for most investors to have a knowledge edge on a well-followed stock like Intel so I don’t try to pretend that I know more than the market about the business or the stock. What I try to do is adopt a strategy and time frame that fewer market participants are using. My assessment right now is that the people selling Intel stock are mostly using time frames that are less than two years, while mine is three years and beyond. This leaves open the possibility that we could both be right. The market could be right about the short-term potential of Intel and I could be right about the medium and long-term. That’s the bet I’m ultimately placing here, along with the idea that Intel is likely to at some point return to its historical earnings growth rate of 6-7% even if the next couple of years are rough ones for the company.

So, I was going into the Intel purchase with my eyes very open about the near-term risks. But I was also buying at a very low valuation at the time.

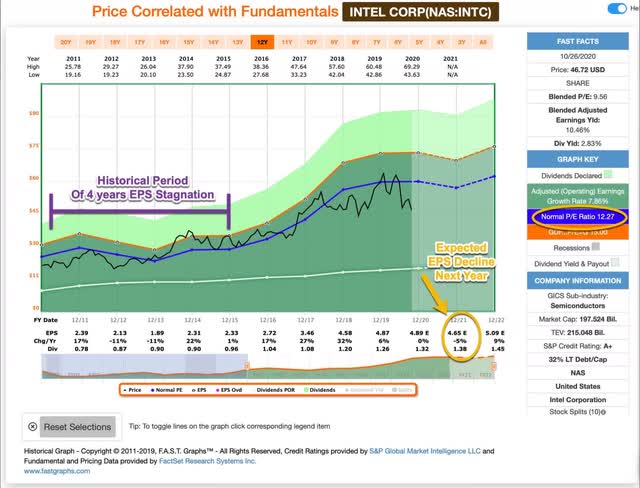

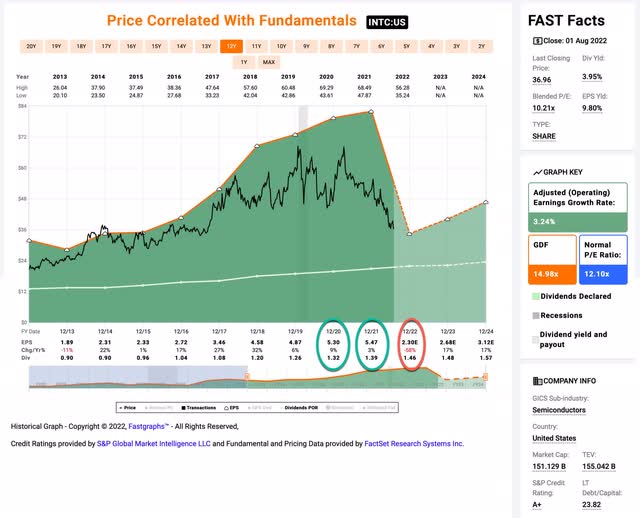

FAST Graphs

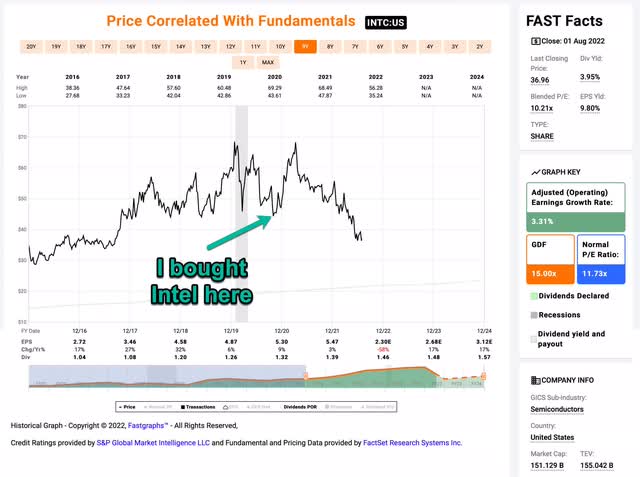

When I purchased Intel I paid a price that had only been experienced a couple of times since 2017. Because I tried to buy with a margin of safety, I’m only down about -13% right now, when nearly everyone else who purchased Intel stock over the last five years is down more than that. I often get criticized in my articles for demanding low prices before I buy a stock, but we get to see the importance of doing so in this example when things don’t go as planned or are worse than expected. And there is no doubt about it that things haven’t gone as expected. Look at the two FAST Graphs below. The first is from my original article in October of 2020 and the second is current. Pay special attention to this year’s earnings estimates from two years ago and what they are today.

FAST Graphs

Above is a copy of a FAST Graph I posted in the 2020 Intel article. Notice what EPS expectations were for 2020, 2021, and especially 2022. 2020 was expected to be $4.89, 2021 $4.65, and 2020, $5.09. So, total collective earnings for these three years were expected to be $14.63 per share.

FAST Graphs

In the above FAST Graph, I’ve highlighted the three years in question, with this year’s returns being current estimates. 2020 came in at $5.30 per share, which was above estimates, 2021 came in at $5.47 per share which was above the $4.65 estimate when I bought Intel, so that was all good. But this year, after two quarters, estimates are down to only $2.30, less than half of the expected $5.09. The total collective earnings from these three years are now expected to be $13.07, which is less than expected when I bought in 2020.

If earnings actually do drop over 50% this year, using my classification methods, that would move Intel from a moderately cyclical business category to a deeply cyclical business category. Because of this potentially huge change, I don’t think Intel is investable right now for new investors unless analysts turn out to be too negative and we also see earnings growth start to rebound in 2023. So, for new money, Intel is an “avoid” for me right now.

For those of us who already own the stock, the question now becomes, whether it is now time to sell.

When to potentially sell Intel

In my original Intel article, because I knew it was risky, especially over the near term, I wrote an entire section about what I planned to do if I was wrong about Intel and why it would be difficult over the first couple of years to know how the investment would turn out. I don’t think things have gotten any easier since then. Intel’s earnings actually did better than expected in 2021, so that pushed out the potential decline an entire year. Now we are staring in the face of another recession potentially in 2023.

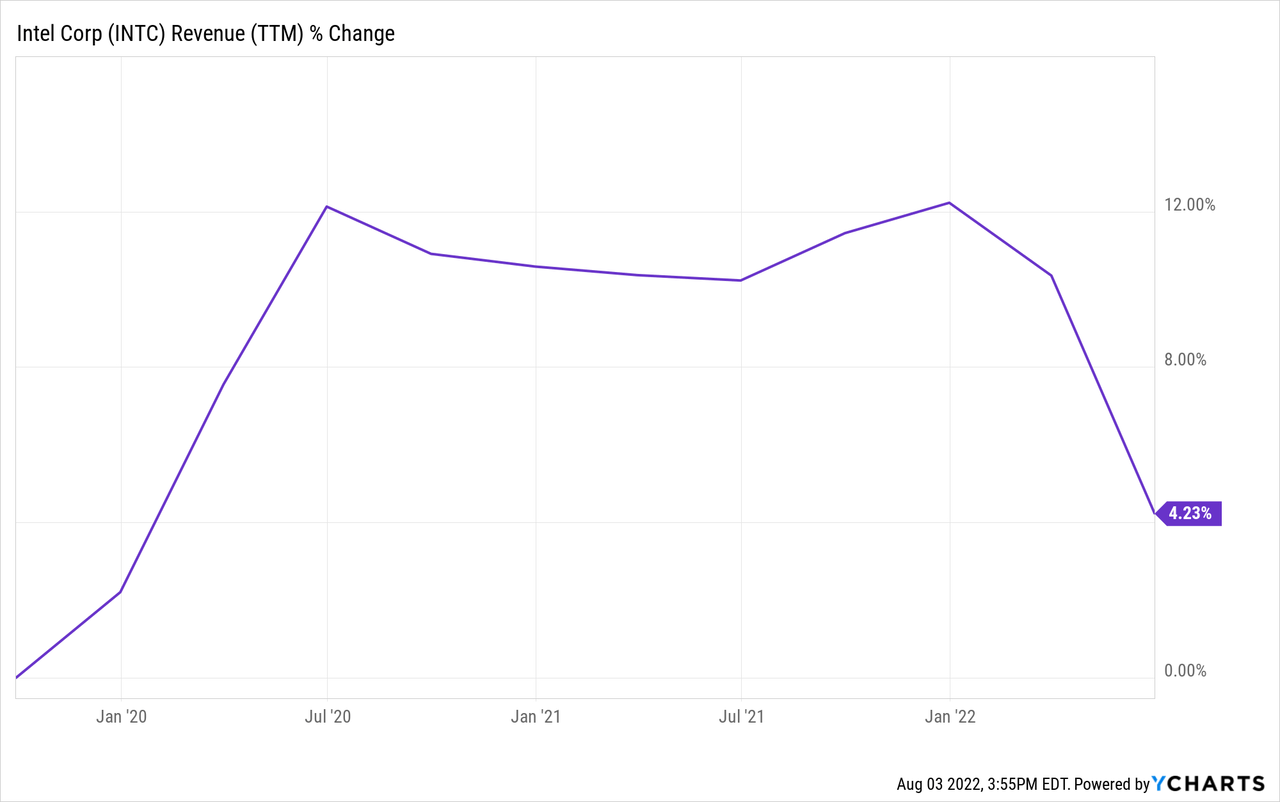

My standard go-to metric for identifying secular decliners, like, say IBM (IBM), is to look at the 3-year cumulative revenue growth. My rule is that if the 3-year revenue is negative and we are not in a recession, then that is the sign of a secular decliner and I almost always sell the stock.

As we can see, the 3-year revenue trend for INTC is still positive, so it has not triggered a sell for me, yet. However, looking at the current trend, we can see that if it continues, in one or two quarters, it could turn negative. And I think if we were mid-economic cycle then that would probably be enough for me to sell. But what complicates things is that we might be in a wider recession in two or three quarters.

During recessions, it’s not unusual for 3-year revenue to turn negative for marginal businesses. (For the really great businesses it’s often just a bump in the road.) And just because revenue dips for a year, doesn’t necessarily spell doom for the business. Now, if it’s 2015 and the economy is doing fine, but a stock like IBM’s revenue is falling for three years in a row, then that’s a clear sell signal to me.

To make things more difficult, Congress did manage to pass the CHIPs act and I think we are going to see more incentives to reshore chip manufacturing in the US, so this should be a long-term tailwind if Intel can get their act together at some point over the next couple of years.

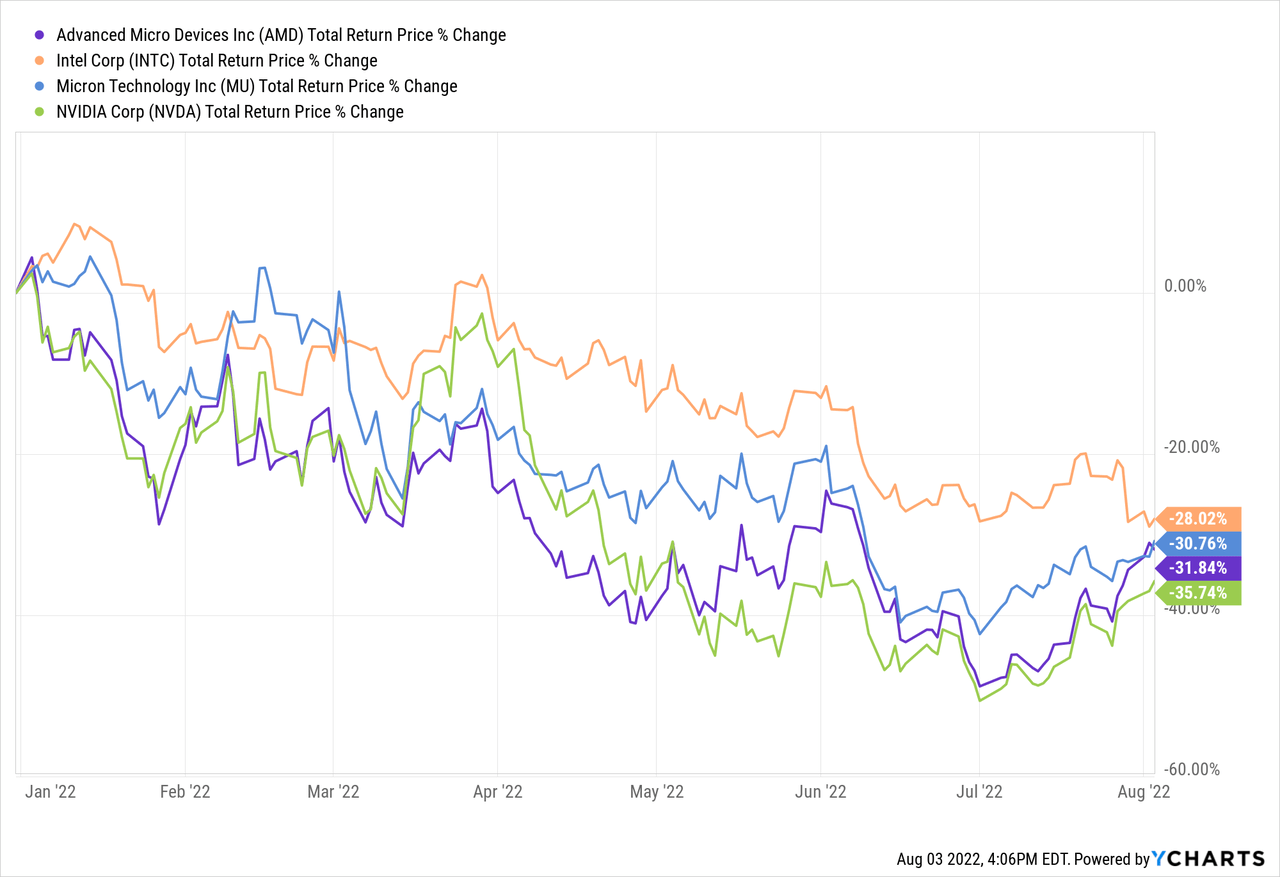

Putting this all together, I don’t think Intel is a clear sell, yet. And if we have a recession in early 2023, which I think is a pretty high probability right now, it won’t be totally clear if INTC’s potential revenue decline at that point is all their fault, or part of the macroeconomy. So it might still be a difficult sell decision at that point. Fortunately for me, I took profits last year or in January of this year in all my other semiconductor stocks like Microchip Technology (MCHP) and Silicon Motion Technology (SIMO), so Intel has been my only exposure to the industry this year. And the truth is, Intel has actually outperformed most big semiconductor stocks I track year-to-date by a little bit:

Right now I have plenty of cash to buy these semiconductor stocks if they get a little cheaper, but it’s possible they could experience a very deep dive during a recession scenario, so what I might do if I eventually run out of cash is to rotate out of Intel, which carries high execution risk, and into one of these other semi stocks if they do fall way off their highs in a deep recession. It might be possible to upgrade the business while at the same time getting a stock that has more upside potential whenever the next upcycle occurs.

Conclusion

The risks for Intel were known when I bought the stock in October of 2020, but they took an extra year to show up in earnings. Intel is certainly fundamentally weak, and on the verge of meeting my sell threshold, but it’s not quite there yet and the stock price does reflect most of the near-term risks. It’s actually been surprisingly more defensive this year than some other semiconductor stocks even though it has obviously performed poorly. I will continue to hold it for the next six months and then reevaluate it at that point in time to see where it stands, whether we are in a recession or not, and how it looks relative to some of its peers. If Intel does manage a turnaround over the next three years or so, the gains could be quite big and a double from today’s price would be a very reasonable expectation. So, the potential reward is at least out there. Much of the rest of the market remains expensive and doesn’t have the same reward potential, which makes it a little easier to be patient with Intel… at least for now.

Be the first to comment