Justin Sullivan/Getty Images News

Elevator Pitch

My investment rating for Intel Corporation’s (NASDAQ:INTC) shares is a Hold. I predicted that INTC’s stock price wouldn’t be able to rise to $60 this year as per my previous update for Intel published on April 1, 2022. Intel’s share price has subsequently corrected by -22% from $49.83 at the time that my prior article was published to $38.63 as of June 27. The key question now is whether this is time to buy Intel’s shares during the dip, which is the subject of my current article.

Intel is not a good investment candidate deserving of a Buy rating notwithstanding its share price dip. There are signs that INTC might struggle to deliver what it guided for in the long-term as it relates to the company’s outlook for 2025 and beyond. But a Hold, instead of a Sell, rating is appropriate as its low-teens forward P/E multiple is reasonable.

INTC Stock Key Metrics

The key metrics for INTC stock are the company’s Q2 2022 top line and bottom line guidance. Intel’s management guidance for the second quarter of 2022 as disclosed in its Q1 2022 earnings presentation were below market expectations, and INTC’s actual second quarter results might fail to meet its own guidance based on management’s recent commentary at the Bank of America (BAC) Global Technology Brokers Conference on June 7, 2022.

When Intel released its Q1 2022 financial results earlier in late-April 2022, the company outlined expectations for its revenue and earnings per share to decrease by -3% YoY and -49% YoY to $18 billion and $0.70, respectively in Q2 2022. INTC noted in its first quarter results presentation that the “YoY comparisons exclude share-based compensation and gains/losses on equity investments.”

As per S&P Capital IQ data, INTC’s guided Q2 2022 sales and EPS were -2% and -13% lower, respectively as compared to what the sell-side analysts had projected prior to Intel’s Q1 2022 earnings announcement.

Things got worse after Intel participated in the June 7, 2022, BAC Global Technology Brokers Conference, as INTC’s share price fell by -13% from $43.53 as of the date of the conference to close at $37.77 a week later on June 13, 2022. INTC’s comments at the recent Bank of America conference suggest that the company’s second quarter financial performance could be worse than what it guided for in late-April.

At Bank of America’s Global Technology Brokers Conference on June 7, 2022, Intel acknowledged that “the circumstances at this point are much worse than what we had anticipated coming into the (second) quarter (of 2022).” Specifically, a cut in customers’ inventories and a prolonged COVID-19 lockdown in Shanghai, China were among the key headwinds that will hurt INTC’s Q2 2022 financial performance to a greater extent than earlier anticipated.

At the recent conference, the company also noted that the outlook for 2H 2022 has become more uncertain, and it didn’t manage to provide an estimate of the quantitative impact of a more uncertain business environment on the company’s performance for the rest of the year. Notably, INTC highlighted that “it’s gotten a lot noisier than it was even a month ago.”

It is unsurprising that a number of sell-side analysts have reduced their Q2 2022 EPS projection for Intel following the BAC conference, as mentioned in a June 8, 2022, Seeking Alpha News article.

Looking beyond short-term issues, I touch on Intel’s long-term financial expectations in the subsequent section.

What Is The Long-Term Prediction For Intel Stock?

In my April 1, 2022, article for Intel, I had already noted that the company’s “FY 2022-2024 financial performance won’t be good as it enters a significant investment cycle.” In other words, investors have to look forward to INTC’s long-term results, or more specifically how the company will perform in FY 2025 and beyond.

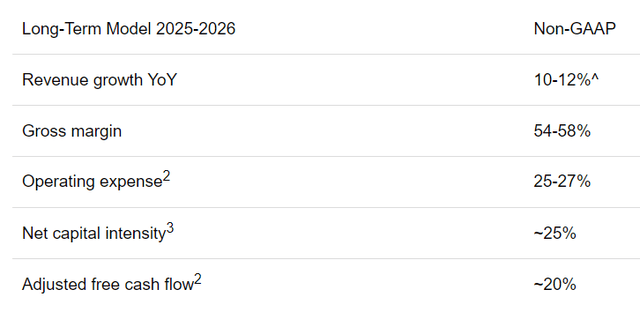

INTC’s CFO David Zinsner emphasized at the recent BAC conference that “looking over the long term, I feel really good about our opportunity to hit the model within the time frame we talked about.” This implies that Intel is sticking to its long-term guidance as detailed at the February 2022 Investor Meeting which is presented below.

Intel’s Management Guidance For FY 2025-2026

INTC’s February 17, 2022 Investor Meeting Press Release

In the next section, I discuss whether Intel is likely to be able to meet its long-term financial goals for fiscal 2025 and 2026.

Is It A Good Idea To Buy Intel Stock During A Dip?

In my opinion, it isn’t a good idea to buy Intel’s stock, despite the fact that its shares have pulled back by -33% in the past year. This is because there are indicators suggesting that Intel has a high probability of failing to achieve its long-term FY 2025-2026 targets.

One key indicator is continued market share losses for INTC.

According to a May 7, 2022, Jefferies (JEF) research report (not publicly available) titled “Semis On Fire”, Intel has lost “200-300bps (basis points) of market share in the data center segment to Advanced Micro Devices (AMD) in the first quarter of 2022. Separately, Mercury Research found that INTC’s share of the x86 CPU market fell from 83.8% as of end-2021 to 81.7% as of March 31, 2021.

Another key indicator is the delay in the production or delivery of Sapphire Rapids.

In mid-February this year, Intel had announced that it “will start initial shipment of Sapphire Rapids for revenue” in March 2022, which it referred to as its “most feature-rich Xeon to date that extends its data center leadership position” in its announcement.

It came as a disappointment that INTC revealed at the recent Bank of America’s Global Technology Brokers Conference that “we are building in more platform and product validation time” for Sapphire Rapids. This points to a delay in the delivery of Sapphire Rapids to the second half of 2022. Notably, this is not the first delay for Sapphire Rapids, which was originally intended to be introduced to the market in 2021. This inevitably raises questions about Intel’s execution, and casts doubts over the company’s ability to meet its long-term goals.

Is INTC Stock A Buy, Sell, Or Hold Now?

For me, INTC stock stays as a Hold for now. A Buy rating isn’t warranted until there are signs that Intel is stemming its market share loss and accelerating its new product launches. But Intel isn’t a Sell either, as its consensus forward next twelve months’ normalized P/E multiple of 11.2 times (as per S&P Capital IQ) isn’t expensive.

Be the first to comment