Joe Raedle/Getty Images News

In this article, I will take the last two recessions and average out some basic valuation ratios for Walt Disney (NYSE:DIS) during each period. I will review the 2007-09 Great Recession period and the original Dot.com Technology Bust span between 2000-03. The idea is we can come up with a fair value target for the stock, if consumer spending slows the economy into a recession during 2022. Disney’s -50% stock slide since early 2021 has already been discounting a recession this year. The question is how much lower can we expect price to decline, before a reversal becomes likely.

I have avoided Disney ownership since January 2021. I wrote an article 17 months ago here explaining how streaming competition would negatively affect the stock’s extended valuation and setting of investor over-optimism. Then again in June of last year here I explained former CEO Bob Iger’s stock sale was a major warning signal that results were failing to meet internal expectations, as inflation rates galloped higher. Of course, few investors understood or agreed with my bearishness as highlighted by the low ratio of likes vs. comments for each article on Seeking Alpha.

SA Article Title – Paul Franke

SA Article Title – Paul Franke

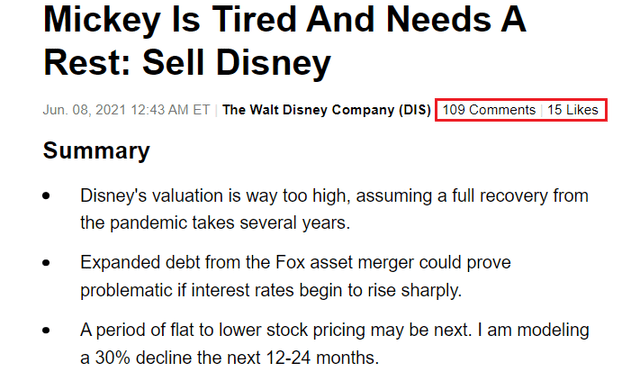

Weak consumer confidence surveys since December have been another reason to stay away from the world’s leading entertainment giant. In my view, near record-low readings during May leave little hope that Disney will “beat” earnings expectations anytime soon. Below is a 60-year chart of the survey-based Michigan Index of Consumer Sentiment, with recessions in grey.

Michigan Consumer Sentiment Survey – 60 Years

Last Two Major Recessions

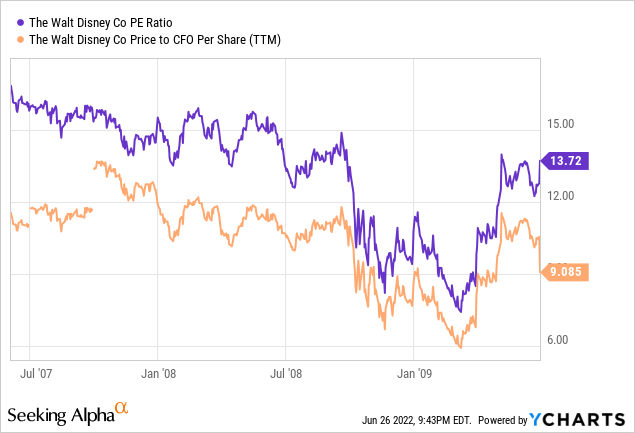

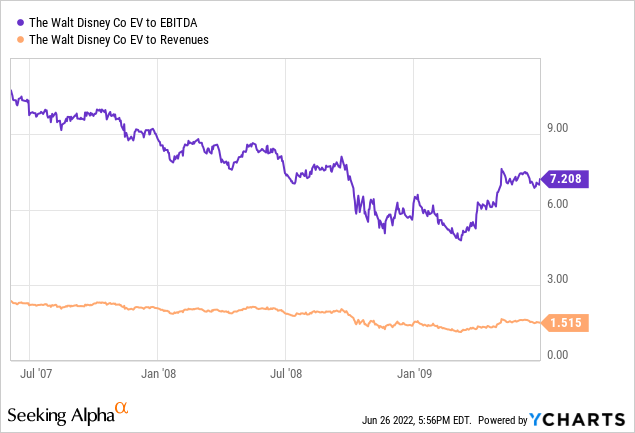

Let’s review how previous economic declines in GDP output over the past several decades affected Disney’s operations and valuation (outside of the pandemic shutdown, which will be part of a look at present conditions). The Great Recession real estate bust and banking crisis was the worst recession I have experienced over 35 years of investing. Disney’s business suffered mightily and did not recover for years. The stats below range from June 2007 to June 2009.

Great Recession

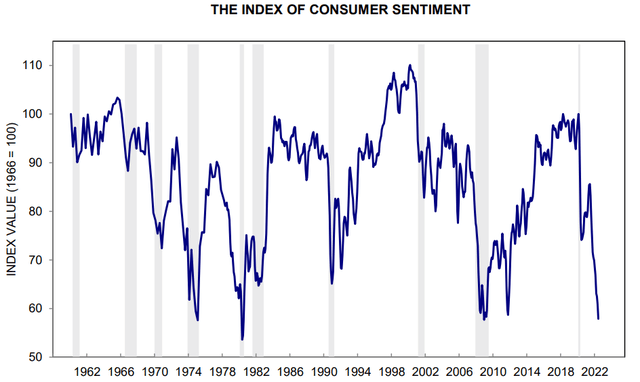

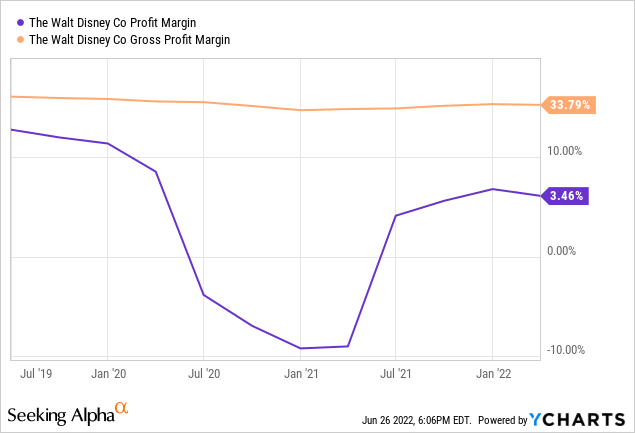

First, let’s review how profit margins fared over the span. Final net margins topped in the middle of 2007, with gross margins peaking in mid-2008 on a spike in oil/gas and other commodity pricing. Overall, both margins declined about 4% during the recession.

YCharts

Disney’s stock quote moved from an overvaluation position to an undervalued one a few years later, as Wall Street sentiment shifted from bullish to bearish predictions for the economy and company results. From the middle of 2007 to early 2009, the share price declined over -50%.

YCharts

Valuations were lower than today at the top in 2007, but higher than previous years. When the stock dropped to a trailing P/E of 12x and cash flow multiple of 8x, I began buying shares in my personal account. EV to trailing EBITDA of 5x and sales of 1.3x were insanely cheap. When we include changing debt levels over the years, EV calculations are very critical to understanding how Wall Street valued the enterprise one economic cycle to the next.

Without doubt, the early 2009 Great Recession bottom was one of the best opportunities to acquire a position for long-term stakeholders over my decades of trading. The stock price rose from $17 to $200+ last year, 12 years after the 2009 bottom, with the accretive help of Bob Iger’s entertainment acquisitions.

YCharts YCharts

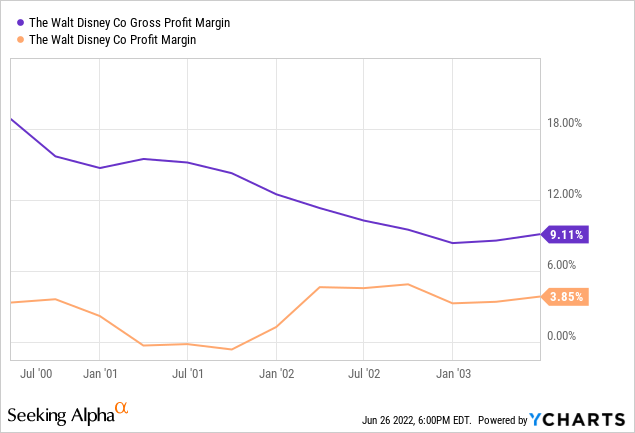

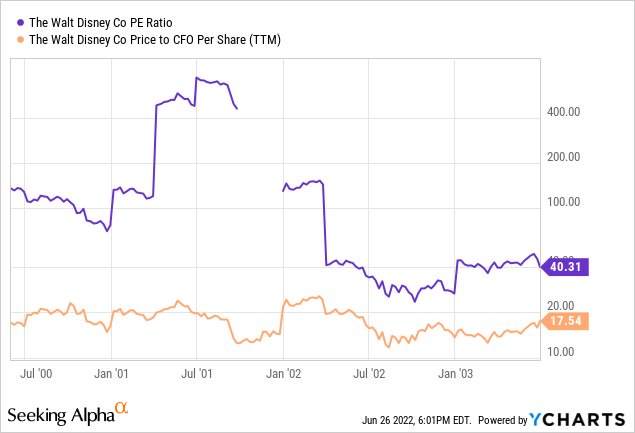

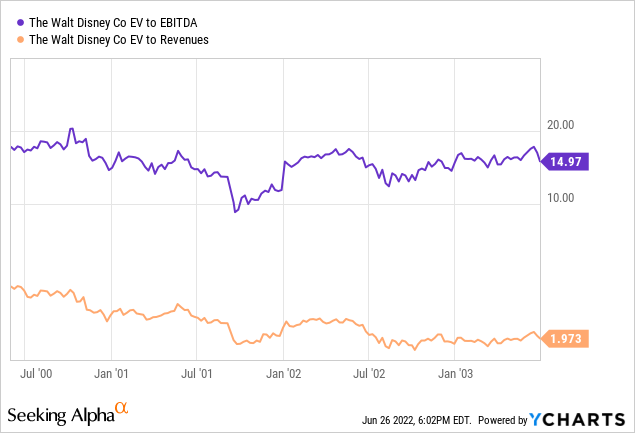

Tech Bust of 2000

The Tech Bubble peak of the year 2000 and subsequent recession is the second recession experience to contemplate. I am reviewing numbers between the summers of 2000 and 2003. Going into this economic downturn, Disney’s margins were struggling mightily, and the company was not growing very fast. Results did get worse during the recession, as gross margins were cut in half. Final margins were low and going nowhere during the Tech Bust.

YCharts

The stock quote fell -65% between the summers of 2000 and 2002. Technology stocks performed far worse, with the NASDAQ 100 index declining an unheard of -80%. Such a decline in a major U.S. equity market index had not taken place since the 1930s Depression era.

YCharts

Valuation numbers did not go as low as the Great Recession experience, largely because consumer spending did not tank as much vs. the early 2000s Tech Bust and recession. In some ways, the current market and economic setup is similar to the Tech Boom peak and overvaluation environment for Disney shareholders. Let’s hope that any recession in consumer spending this year and next is on the milder side like that outcome.

YCharts YCharts

Reasons Downside Still Possible

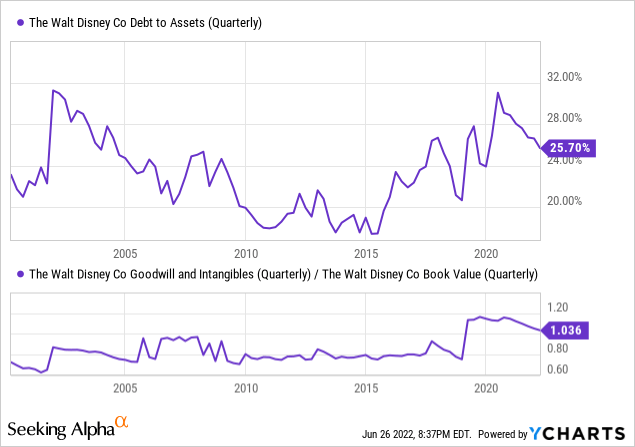

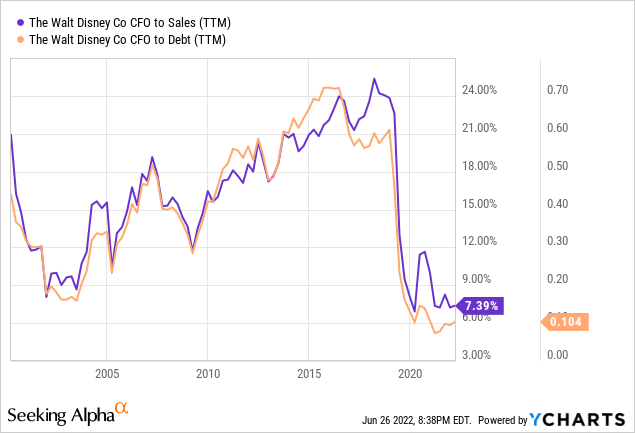

Despite a wicked 50%+ price drop from 2021’s peak, further Disney equity downside cannot be ruled out. In fact, if a major recession is hitting this year, the company is ill-prepared financially to deal with such. I would argue the company may even be on the cusp of losing money from operations if interest rates and labor costs keep rising, while consumers cut back dramatically on entertainment spend.

My point is spiking inflation may require rising interest rates all year to tame it. As interest costs on record consumer, business, and sovereign U.S. debt (in aggregate as a percentage of GDP) zigzag higher and the effects of 8% CPI rises on disposable income slash spending on entertainment of all sorts, Disney may see sales stagnant for the rest of 2022. In addition, costs to run parks/water cruises and film movies/streaming entertainment will not weaken. The honest truth is margins should contract over the next 12-18 months, depending on how badly revenues roll over.

All told, high inflation rates hurt valuations for businesses. Further, Disney’s debt is at all-time high levels today, so rising interest expense will be a huge headwind moving forward. Debt to assets (mostly thin-air goodwill accounting for assets after the Fox media acquisition) and intangibles vs. book value are both unprepared for a deep recession. Essentially, Disney is utilizing the greatest amount of financial leverage I can remember. With the pandemic eviscerating demand for park/cruise and movie entertainment, cash flow as percentage of either sales or debt was already running incredibly light moving into 2022.

YCharts

YCharts

Gross margins are higher than they have been for Disney, which is a plus. However, stagnant to declining sales since 2019, sharply rising variable operating costs, and now increasing interest expense on $50 billion in debt (nearly $100 billion in total liabilities that will have carrying values adjusted for higher interest rates), have and will completely degraded final profit levels for owners.

YCharts

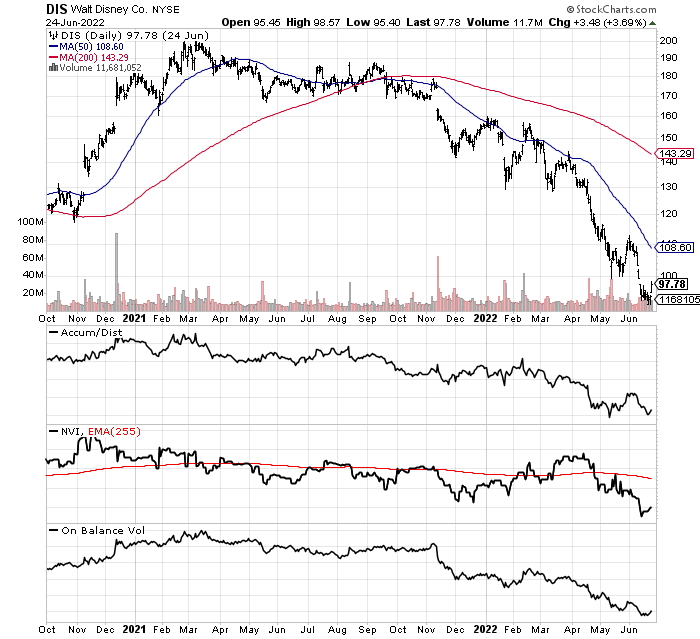

The Disney share price is now -30% lower than three years, before the pandemic appeared. My analysis points to even more trouble for the quote, if consumer spending continues to decelerate in the second half of 2022.

YCharts

YCharts

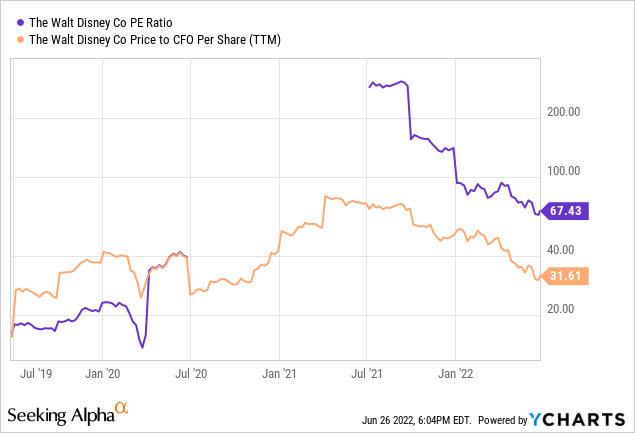

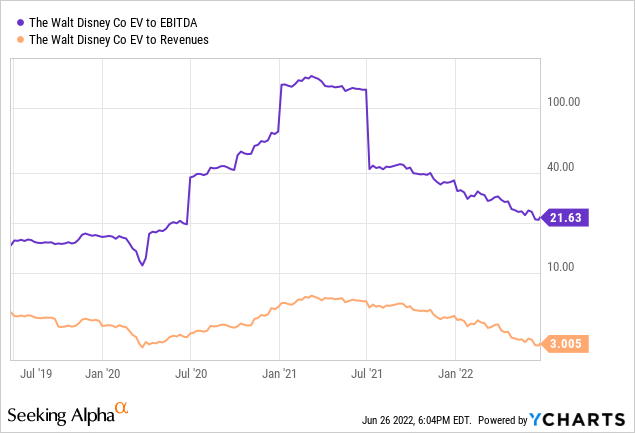

The truly bad news is basic company valuations on P/E, cash flow, and EV (including all of its present debt load) on EBITDA or Revenues remain quite elevated vs. past recession lows. To argue Disney cannot fall yet further in price, because the latest 2021-22 drop of -50% is a whopper to sustain for a blue chip, I would say the math suggests substantial risk remains part of the June equation for investors.

YCharts

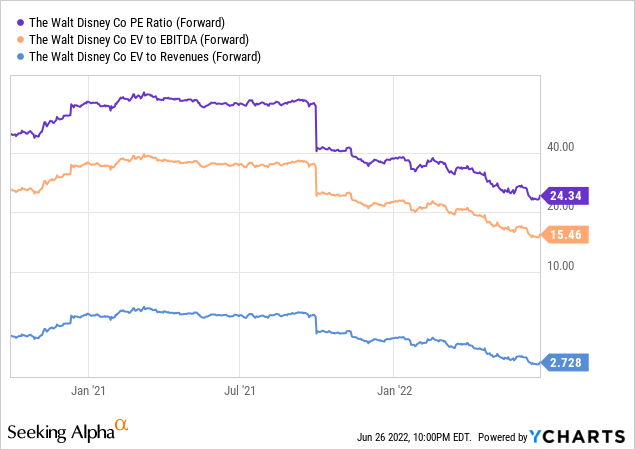

Forward Valuation Comparison

The averages of the last two serious recession for a low-point valuation are:

- Price to Earnings of 15x

- Price to Cash Flow of 9x

- EV to EBITDA of 7x

- EV to Revenues of 1.5x

Given forward 6 to 12-month estimates are roughly DOUBLE the average low points during the past two major recessions, Disney appears to remain quite overvalued in a worst-case economic scenario. Don’t laugh (cry maybe), but further downside of -30% to -40% from $98 a share is still possible. Below is a graph of “rosy” forward estimates by Wall Street analysts that do not assume a deep recession is approaching fast. Note: price to forward cash flow (not pictured) would likely fall to around 20x if the other three valuation measures are hit.

YCharts

Investment Conclusions

When I consider all the valuation possibilities from today, including an optimistic bent of falling inflation and slight economic growth, I remain leery of putting money into Disney around $100 a share. My investment plan is to wait for one more earnings report, which will likely disappoint with weaker guidance for the rest of 2022. The outcome with the best chance in my research is a sub-$90 price is coming by late summer, perhaps even under $80. At that point, long-term investors may begin to nibble and anticipate better days for the company later in 2023.

StockCharts.com

The best-case outcome I can rationally come up with is $120 over the next 12 months. Starting from a relatively high existing valuation today, and assuming a slower economy than anticipated by analysts and investors 4-6 weeks ago, strong upside may be difficult to achieve. The end of the Russia/Ukraine war with a compromise partition of the former Soviet republic would definitely help consumer sentiment, as would a related tank in oil/gas prices. Let’s say management even starts a 2% dividend distribution next week, just for fun. This is the most bullish connect-the-dot scenario I can envision, and represents a bullish potential +25% total return by the summer of 2023.

On the downside, a deep and prolonged recession, which pulls Disney earnings closer to breakeven (or even negative), could dump the stock quote under $60. That’s another -40% of total return losses and price risk, as the company eliminated its dividend to cope with the pandemic cash flow mess on its business operations.

Given this risk/reward analysis, upside outlier potential of +25% vs. downside of -40% is not very encouraging. Trust me, I am a Disney fan… my family has traveled to Disney World in Florida many times and we love all the Pixar and Marvel movies. I would prefer to have a bullish outlook and own shares. Nevertheless, the math still does not make sense, and I will remain on the sidelines.

I rate Disney a Hold for stubborn long-term investors to an Avoid for new investment capital. It may be too late to Sell, if your goal is to own the company for 10 or 20 years. Traders and speculators might sell shares or even short it as a hedge/gamble on recession. I could be persuaded to move Disney into Buy territory on a move well under $90 in the coming months. I’ll try to write a bullish report if and when such plays out. If there’s any good news from me, it’s the fact I am more constructive on Disney at $100 than when it traded closer to $200. I am upgrading my official SA rating from Sell to Hold.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment