Chip Somodevilla/Getty Images News

Introduction

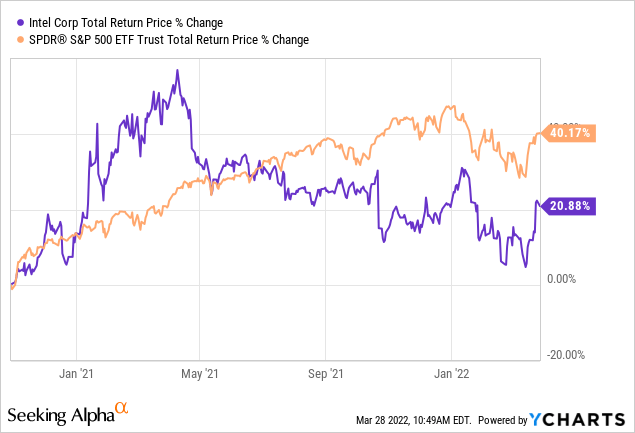

I usually like to begin my articles by reviewing any previous coverage I’ve published on a stock. In Intel’s (NASDAQ:INTC) case, I’ve only written about it one time in the past, soon after I purchased the stock, on October 29th, 2020 with my article “Intel’s Long-Term Risk/Reward Looks Good. I’m A Buyer Here.” Because the stock was very cheap at the time, it has produced good absolute returns, but it has underperformed the S&P 500.

In that article, I analyzed the long-term total return potential for Intel. This article will be different because I will strictly limit the analysis of Intel’s value to its likely performance as a dividend stock. So, this time around, I will assume the stock price will rise enough to offset inflation, whatever that happens to be over the long-term, but I will only consider the actual dividends paid out and the growth of those dividends in this analysis. In that sense, I will be viewing Intel’s stock through the lens of what one might think of as an inflation-protected long-term “equity bond”.

Time Until Payback Analysis

When it comes to the vast majority of individual stocks, risk increases with time. This situation is different for major stock indexes, where the longer one holds a major index like the S&P 500, the more likely is that their investment will succeed and produce positive returns. Many investors do not understand this very important distinction. The reason risk increases with time for individual stocks is because it becomes more difficult to predict the future the farther out in time we go. Predicting Intel’s earnings with some degree of confidence over the next few quarters, for example, is much easier than predicting their earnings 20 years into the future. This fundamental fact of 99% of individual stocks is rarely, if ever, taken into account with traditional analysis like a DCF or dividend discount model, or most other models of dividend valuation. But it should be.

Over the past 5-10 years, because we have had a large number of baby boomers retiring from the workforce, combined with low interest rates on bonds, dividend investing has become very popular. An additional appeal of dividends is that they are relatively easy to understand. The dividend yields are usually clearly posted right along with the stock prices on most financial websites. Theoretically, all an investor needs to do is find a high-quality business, look at the dividend yield and historical dividend growth rate, and after doing a little math, they can estimate their future income from the stock. These factors help explain the huge boom in dividend growth investing over the past decade.

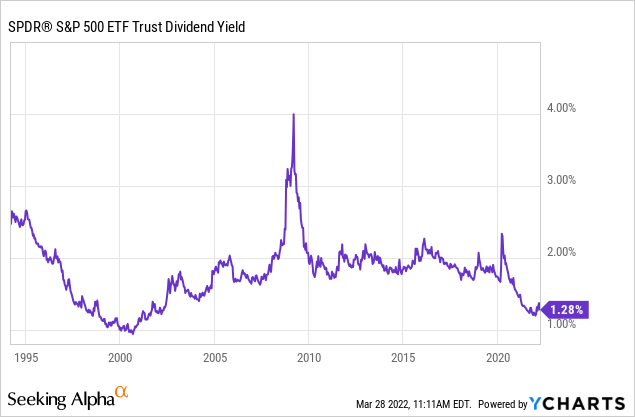

In my view, when it comes to income investing, we have a very popular investing strategy that investors have adopted for good reasons, but for which there is a very big danger that typically goes unacknowledged. That danger is the rising risk of business disruption as time progresses. The central issue here is that as stock prices on dividend stocks rise due to their popularity, the dividend yields fall.

The last time dividend yields on the S&P 500 index ETF (SPY) were this low, was near the dot com bubble in the year 2000. Probably not a great sign for dividend investors.

What I set out to do with the form of analysis I will share in this article is to integrate the time-risk into the analysis. And the way I have done that is to frame the valuation question in terms of how long it is likely to take an investor to earn an amount equal to their investment in a stock back, strictly from dividends and dividend growth over time. In other words, if you invest $100 into a stock, what I want to know is how long it will take to earn $100 back only from the dividends. I call this measurement “Dividend Time Until Payback”.

Whether a dividend stock is a good value or not is then based on how far out an investor thinks they can forecast into the future and what they expect to earn in dividends. The time-risk will be subjective for each investor and might vary from stock to stock. But, my view is that for most reasonably high-quality stocks like those in the S&P 500 index, I can probably do a good job forecasting out 10 years into the future, so if I can earn my money back in that amount of time, then it’s likely to be a good dividend investment including time-risk into the equation. On the high end, other than maybe Berkshire Hathaway, I don’t feel confident predicting the future of any individual stock 20 years into the future or more. So, any dividend stock that looks to take more time than that to pay me back an amount equal to my investment, is too risky for me because the risk of disruption, competition, or changing consumer demand over the course of 20 years is too high. And in between 10 and 20 years, is a range of payback periods where an investor might be able to make the case of making small adjustments for individual circumstances of each business depending on their predictability, but I think it’s fair to say any dividend stock that takes over 15 years to pay back an amount equal to its investment probably isn’t a “buy”, but perhaps, depending on other factors (like prevailing interest rates, inflation expectations, stability of the industry, etc.) individual cases can be made for those stocks that fall in the 11-14 years range.

Putting all this together, I think it’s fair to create a valuation range using dividend time until payback where 10 years or under is a “Buy”, 11-14 years is a fairly valued “Hold”, 15-19 years is a “Hold”, but overvalued, and 20 years and over is perhaps a “Sell” if there are better alternatives that can be found in the market.

Estimating Dividend Yield, and Dividend Growth

In order to estimate how long it would take to earn our investment amount back via dividends, we first need to estimate what the starting dividend yield is, and then also estimate what the dividend growth rate is likely to be. Since most good companies’ dividends often rise year over year, I pull forward dividends expected for the current year rather than use the trailing twelve-month dividends.

If we assume Intel pays out $1.44 in dividends this year, then Intel’s current dividend yield is about 2.84%.

Next, we need to estimate how fast this dividend is likely to grow over time. This requires a little more judgment. Since I am using very long-term projections in most cases, I never want to assume that dividend growth, over the very long term, will exceed earnings growth (because dividends come from earnings). That said, there are situations where if a payout ratio is relatively low, dividend growth can potentially exceed earnings growth for some period of time. So, what I will do, is if the payout ratio is under 50%, and dividends are growing faster than earnings, then I will blend the two growth rates together and use that as our dividend growth rate estimate. But if the payout ratio is above 50%, I will cap dividend growth rate expectations at whatever the earnings growth rate expectation is.

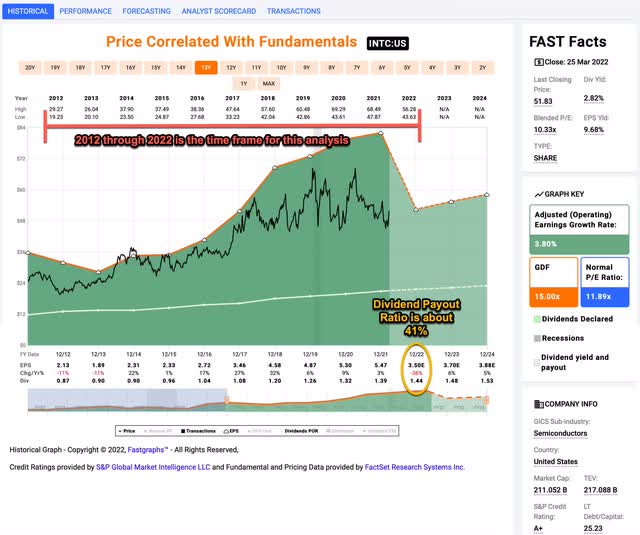

The time frame one chooses to make these estimates can be an important judgment. For Intel, I have chosen the 10-year time frame from 2012 to 2022. This includes a couple of negative earnings growth years in 2012 and 2013 along with the big negative expected year in 2022. So, for my earnings growth expectations, I will include the expectation that drops like these can happen, and I will also control for any buybacks that occurred over this time. (For a full detailed explanation of this process, see my last Intel article where I take readers through the full earnings analysis step-by-step. It’s linked at the beginning of the article.)

Once the time frame is established, we want to determine three things, the earnings growth rate, the dividend growth rate, and the current payout ratio. My estimate for Intel’s earnings growth rate during this time period is about +3.82% (which happens to be right in line with FAST Graphs’ calculation of +3.80%). The dividend growth rate according to FAST Graphs is about +5.92%. Since this is one of those situations where dividend growth has been outpacing earnings growth, we want to examine to see if the current payout ratio is over 50% or not. Using 2022’s expectations the payout ratio is about 41%, so it is under 50%. That means there is room for dividend growth to continue outpacing earnings growth for quite a while if they both stay on their current track. For that reason, I will average the two of these growth rates to give us a rough estimate of the longer-term expected dividend growth rate. When I do that I get an expected long-term dividend growth rate of +4.87%.

Ultimately what I am interested in estimating is how long it would take to earn $100 on a theoretical investment of $100. We can do this by taking the current dividend yield of 2.84% and applying that to $100, which would pay us out $2.84 per year if the dividend never grew. But, we expect the dividend to grow at about +4.87% each year, so we need to take that into account as well. I assume that this money is collected by the investor and not reinvested in the stock and I go ahead and pull the first year’s dividend growth forward. So, at the end of the first year, I assume we would get paid $2.98 on our $100 investment. This process continues for however long it takes to collect $100 worth of dividends and when it crosses that threshold it will be our “Dividend Time Until Payback” as measured in years. Using this method, it will take about 21 years to earn our money back via only dividends with Intel stock.

Viewing this via differing perspectives

In this section, I will examine the findings from several different perspectives. The first perspective is from the risk of making long-term future predictions. And from this perspective, regarding just the dividend prospects, Intel is a “Sell”. Even though Intel has been around and been an industry leader for a very long time, we have seen over the last few years how this can change relatively quickly. In my opinion, trying to predict anything about Intel more than two decades into the future is basically impossible. So, that risk is extremely high for dividend investors in Intel’s case.

That said, if we assume that Intel will be able to pass on inflation during the holding period (which is what I do for this analysis), it will provide better inflation-protected income than long-term bonds which currently average around +2.5% with no inflation protection. (Although Intel’s dividends also come with more risk when we stretch them out over two decades whereas a government bond, if held to maturity, does not have that risk.)

One comparison that I think probably makes sense when it comes to dividend and income stocks is the classic 60/40 portfolio. With a 60/40 portfolio, we get some inflation protection and some growth from the stock portion, but also some yield with the bond portion. In some sense, this is very similar to what an investor is seeking with a dividend-focused portfolio, but it is constructed in a different way. iShares Core Growth Allocation ETF (AOR) is constructed like a 60/40 so it is a pretty good proxy to use to compare against dividend stocks. My estimates are that using the same process I used with Intel, AOR would take about 23 years to earn one’s investment back via the dividends if purchased at today’s price. That’s actually a little bit longer than Intel. So, if an investor did think they could predict Intel out that far, then it is slightly more attractive than a 60/40 proxy like AOR.

Next, we can compare Intel’s dividend payback period to similar stocks in order to compare its relative value to these peers and see how it stacks up. Currently, I track 65 large-cap dividend aristocrats that have a long history of increasing dividends. Intel actually ranks 13th out of the 65 in terms of time until payback. So, it’s actually in the top quintile when it comes to large-cap dividend aristocrats in terms of dividend value. That probably says more about the overvalued nature of this type of stock than it does about Intel as a dividend investment, but relatively speaking, if an investor limits themselves to dividend investing, Intel stock is actually better than most even though it is too expensive for my taste a dividend investment. (As an earnings-based investment, I currently have it as overvalued, but still a “Hold” and remain long the stock.)

Alternative dividend stocks to consider

I’m sure a few readers might be wondering if there are any stocks in the current market that meet my standards for a dividend investment that could pay one their money back in 10 years or less via the dividends that are also a high-quality business. And the answer is, yes, one, Altria (MO). Altria is a great dividend stock, but it does have long-term growth risks so I don’t think it’s very comparable to Intel as a stockholding.

The next closest is T. Rowe Price (TROW). Currently, T. Rowe has a dividend payback time of 13 years if they grow at similar rates as they did from 2015-2022. Ironically, I sold TROW earlier this year because I knew they were subject to big price drawdowns in bear markets and I prefer to avoid those when I can. The stock is not quite a buy based on earnings yet, but for dividend investors who can ignore volatile price movements and have no desire to predict market cycles, TROW is probably the best alternative to Intel as a dividend investment you’re going to find in this market right now. And while TROW’s dividend probably has similar risks that Intel’s does of being cut in any given year, since an investor only has to own TROW for about half the amount of time in order to recoup their original investment, that makes the dividend considerably less risky on the whole.

Conclusion

At this point in time, Intel is basically a turnaround stock, and that turnaround may, or may not, work out. The good news is that their industry has secular tailwinds behind it and Intel also has some deglobalization tailwinds as well as semiconductor reshoring that seems to be on the horizon. They appear to be making the necessary investments for the future and they have a very long history of success. They also have a lot of room, even after their recent earnings declines to continue to pay their dividend. Even in the case of a recession, they will probably be okay near-term. I think it’s still fair to categorize Intel as a high-quality business despite its current challenges.

But, from the perspective of a dividend investor, 21 years is simply too long to wait in order to earn one’s money back on an investment. Too many things can go wrong over a time period that long, and that means the time-risk is very high for an individual stock. Semiconductors is a very competitive industry that changes rapidly. This isn’t a consumer staple stock. Additionally, while most dividend stocks are extremely expensive (and therefore very risky) in my view, there are a few alternatives that currently make more sense than Intel from a dividend perspective. For these reasons, I do not view Intel as a good dividend investment right now, even though I do remain long the stock from a total return perspective after having purchased it at a lower price.

Be the first to comment