PonyWang/E+ via Getty Images

GameStop Corp. (NYSE:GME) continues to be one of the stranger stocks in the market since the short-squeeze meme rally in early 2021 sent shares briefly near $500. While GME has been extremely volatile, down by more than 40% over the past year, the stock has curiously outperformed the broader market this year with a modest 15% decline thus far. We’re surprised the stock is still trading above $100. That being said, all signs point to more downside in what may be a slow-moving trainwreck in our opinion.

The reality is that the company’s valuation near $10 billion remains perplexing into ballooning losses and a deteriorating operating environment. A big theme for the company last year was its pivot towards digital assets and “Web 3.0” which now appears ill-timed just as the crypto market is crashing. There are plenty of headwinds including weaker consumer spending and poor trends in video game sales that should all come together and send shares lower. We’re bearish and see a significant downside from here.

GameStop Earnings Recap

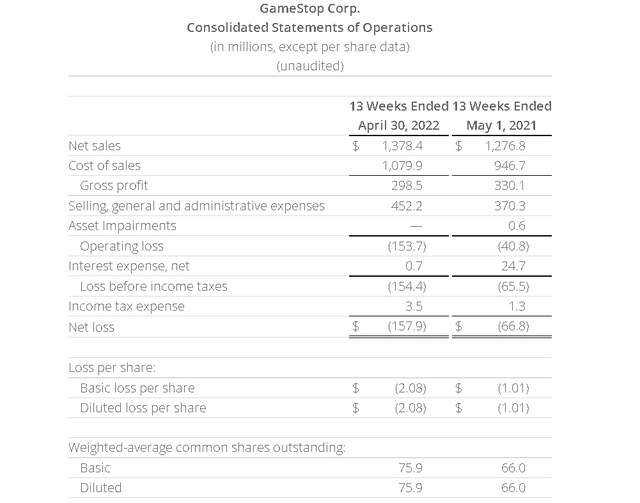

The company reported its Q1 earnings on June 1st with a non-GAAP EPS loss of -$2.08, missing expectations by $0.86. A build-up of inventory explains the spread in earnings against the consensus estimate. Nevertheless, the result here represented a negative net income of -$158 million. There was a jump in expenses with SG&A climbing 22% in large part based on the higher spending as the company continues to invest in technology. The adjusted operating loss at -$154 million widened from -$67 million in the period last year.

Revenue of $1.4 billion climbed by 8% year-over-year but carried a lower gross margin at 21.7% compared to 25.9% in Q1 2021. The trend reflected inflationary cost pressures with freight and supply chain disruptions cited. Management also noted a shift in the product mix towards higher ticket yet lower-margin categories.

Within net revenue, hardware and accessories at $674 million declined by 4% y/y balanced by a more favorable 22% increase in software to $484 million. The smaller collectibles segment led growth with sales up 26% y/y and now represents 16% of the total business.

Operationally, a key development for the company was the launch of its digital asset “GameStop Wallet” allowing users to store, send, receive and use cryptocurrencies and digital assets. The next phase is to enable transactions by users on the upcoming “NFT Marketplace” set to go live in the coming months. While management has been relatively tight in terms of details related to transaction volumes and user figures, recent comments have projected optimism on these initiatives. From the earnings conference call:

We firmly believe that digital assets are core to the future of gaming. Taken together, we believe these investments and initiatives prioritized over the past quarter are positioning us to become a more diversified and technology-centric business.

Finally, we note GameStop ended the quarter with $1.04 billion in cash and equivalents against a small $35 million in long-term debt. The balance sheet is a strong point in the company’s investment profile although the understanding is that recurring losses and negative free cash flow will reduce the cash position at an accelerating pace going forward.

Is GameStop A Good Investment Long-Term?

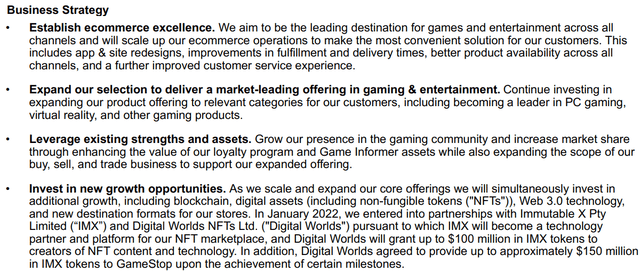

The attraction in GME and its bullish case is that the company can successfully pivot from being essentially a legacy specialty retailer into a digital ecosystem innovator. With a global footprint of over 4,500 stores worldwide including approximately 3,000 in the U.S., the strategy is to leverage its brand recognition into an e-commerce platform while expanding into new product categories related to gaming and entertainment.

On the Web 3.0 side, GameStop is betting that non-fungible tokens as an extension of the “collectibles” category are the next big growth opportunity. In essence, the company is all-in with the GameStop Wallet and upcoming NFT Marketplace.

We mentioned headwinds and they come together to sow some serious doubts that the company will be able to gain traction in any of these areas. First, the macro environment is terrible for retailers and even on the e-commerce side. Record inflation and rising interest rates are seen pressuring consumer spending and that ends up hitting what remains the core business of video game hardware, accessories, and software titles.

The latest data showed that May U.S. retail sales surprised to the downside which already gives a weak signal for current Q2 operating trends. On that point, industry-wide video game sales for May declined by 19% y/y, against what was a stimulus-fueled comparison period in 2021. GameStop management is not providing earnings guidance, but we can say that there is likely a downside to current growth estimates.

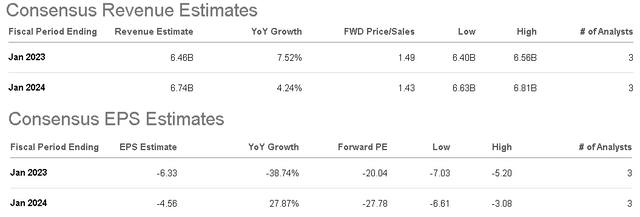

According to consensus, the full-year revenue forecast at $6.5 billion represents a 7.5% increase over last year. For next year, the market expects growth of 4% which is hardly a level to get excited about. By this measure, GME is neither a growth stock while its lack of profitability doesn’t offer much value.

Longer-term, we believe the more structural issues with the brick-and-mortar-based business model dependent on gamers exchanging hardware, and picking up new titles is unsustainable. There is a sense that as the industry continues to move more and more toward downloadable content, the bulk of company store locations become redundant. The pandemic boom for video games sort of gave the company a lifeline but may have only delayed the inevitable.

While GameStop is making an effort to expand online, it faces tough competition from larger e-commerce players that offer similar services. Even with the loyalty program “PowerUp Rewards”, margins can trend lower over time with the high-margin trade-in aspect of the business dissolving. We’re skeptical that the collectibles segment alone can keep the model afloat.

Finally, the push into cryptocurrency wallets and digital assets is launching into terrible sentiment. The price of Bitcoin (BTC-USD) as a benchmark for “crypto” is down nearly 70% from its 2021 high reflecting a broader reset of expectations in the space dragging lower all other cryptocurrencies as well as the market for NFTs.

The setup here is for poor user engagement in GameStop digital initiatives that will likely correspond to large losses over the coming quarters. Web 3.0 may very well be “the future”, but our take is that the future is not now and it probably won’t be from one of GameStop’s platforms.

Is GME Overvalued?

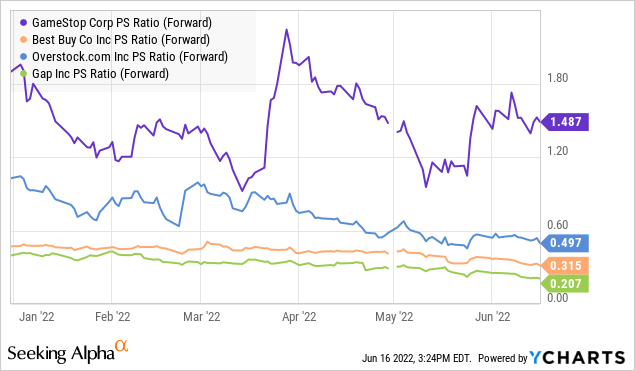

Putting it all together, we believe GameStop makes for a poor long-term investment. The bigger point here is that shares are still materially overvalued by most metrics. Without recurring profitability or even positive cash flows, the metric we are focusing on is the price-to-sales multiple. Typically, retailers with weak or declining growth and negative earnings should trade below 1x sales. In this case, GME at 1.5x stands out among a group of what we would call peers like Best Buy Co., Inc. (BBY) at 0.3x and Overstock.com, Inc. (OSTK), which, in contrast to GME, are both currently profitable.

What’s interesting about Overstock is that as an e-commerce player focusing on home furnishings, the company also has exposure to crypto and digital assets through venture capital investments. We argue that Overstock’s crypto initiatives are more exciting and have a better outlook than what GME is pursuing. Even giving GameStop a benefit of the doubt that it can execute its growth strategy, the valuation premium here remains excessive.

GME Stock Price Forecast

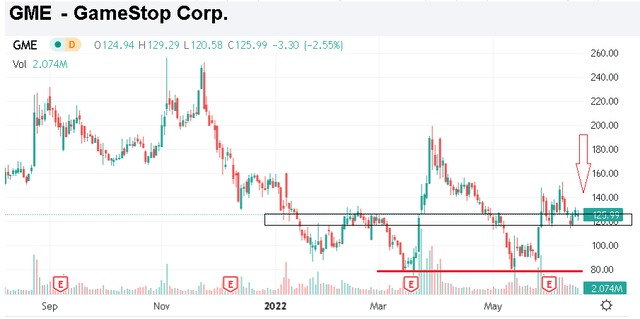

There’s not a lot to get excited about with GME looking at the Q1 financials and the latest operating developments. From the stock chart below, we note that the $120 price level appears to be an area of technical support. A break lower can open the door for a retest down to the year low at around $80.00. To the upside, the bulls will need to see a break above ~$155, for shares to regain positive momentum, we view as unlikely in the current market environment.

Is GME Stock A Buy, Sell, Or Hold?

We rate GME as a sell with a price target of $40 representing a 0.5x multiple on the current full-year consensus sales estimate. Our thinking here is that Overstock.com Inc can represent a benchmark in terms of where GME’s sales multiple would accurately reflect its e-commerce and digital assets ambitions. Shares appear to still be propped up by some lingering 2021 hype, which has only masked what are the deep fundamental challenges.

Beyond sales trends and the gross margins, updates from the company regarding user metrics on its Digital Wallet and NFT marketplace will be key monitoring points going forward. In our view, significant operating and financial weaknesses will ultimately lead to the stock trending lower.

Be the first to comment